Idaho federal solar tax credit. So altogether, you can save up to $20,000 through the idaho solar tax credit.

Q1 What Is The Product Solarroadway Solar Road Construction Innovation Technology

Federal solar investment tax credit.

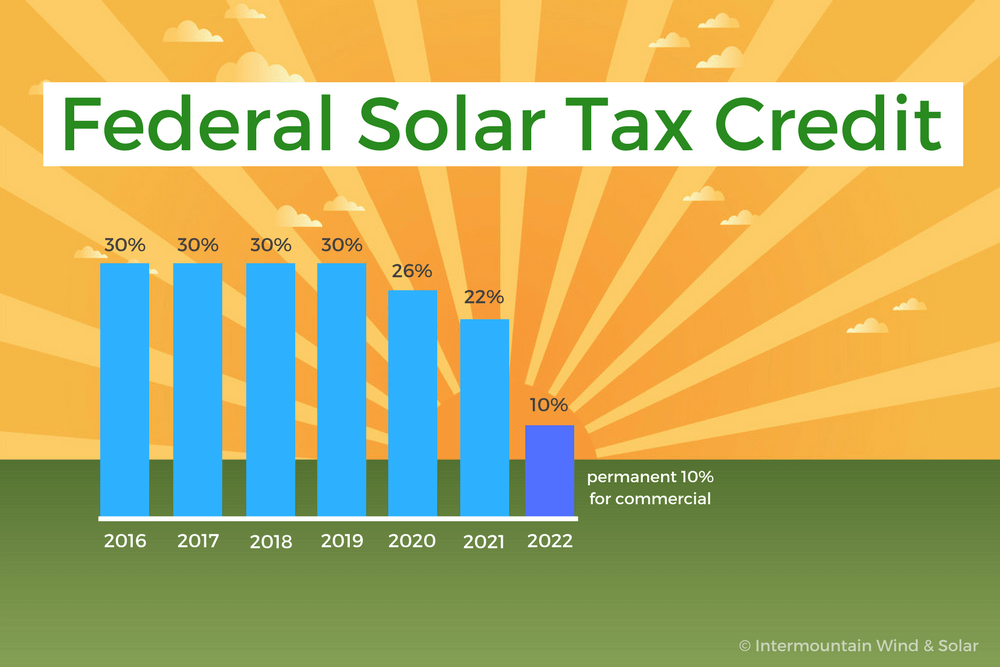

Idaho solar tax credit 2021. It will decrease to 10% for commercial solar energy systems installed in 2022. More recently with the passage of the american rescue plan, the. With the investment tax credit (itc), you can reduce the cost of your pv solar energy system by 26 percent.

May i claim a tax credit if it came with solar pv already installed? Like every other state, new solar panel systems in idaho are eligible to receive the federal solar tax credit of 26%. If you install your photovoltaic system in 2020, the federal tax credit is 26% of the cost of your solar panel system.

You can deduct 40% of the cost of your residential solar energy system from the state taxes you owe. Given a solar panel system size of 5 kilowatts (kw), an average solar installation in ada county, id ranges in cost from $11,305 to $15,295, with the average gross price for solar in ada county, id coming in at $13,300. The 2021 solar tax credit is a 22% federal tax credit for solar energy systems installed before december 31, 2021.

According to the solar energy industries association, these solar tax credits have been hugely successful, with 59% compound annual solar growth since they were enacted. These 20 agreements comply with the public utility regulatory policies act (purpa), which requires utilities like idaho power to buy all energy generated by certain facilities. November 3, 2021 tax credits.

As of 2021, the solar itc is a 26% federal tax credit. There are many options when it comes time to purchase our solar. The federal solar energy tax credit is a tax credit that’s available if you decide to install a solar system.

Buying vs leasing solar panels in idaho. Notable solar installations in idaho. Combined, the projects have a capacity of 52 mw and will generate enough.

As of november 2021, the average solar panel cost in ada county, id is $2.66/w. It is scheduled to come online in december 2022. It also would have paid the credits due to the 2,000 homeowners and businesses on a waiting list who installed solar arrays with the expectation of a.

If your system costs $10,000, you could claim a $2,600 credit on the federal taxes you owe. The idaho solar tax credit is equal to 40% of the costs of a solar system, up to $5,000. In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year (subject to the overall credit limit of $500).

The federal solar tax credit. 30% of the costs of equipment, permits, and installation can be claimed back through your federal tax return. Keep in mind that the itc applies only to those who buy their pv system outright (either with a cash purchase or solar loan), and that you must have enough income for the tax credit be meaningful.

The tax credit will step down to 26% in 2020, then 22% in 2021, then remain permanent at 10% for commercial projects (while the residential credit will phase out). Idaho has the federal solar tax credit After accounting for the 26% federal investment tax credit (itc) and other state and local solar.

After 2022 it expires for home solar energy systems unless congress renews it. Grandview pv solar two is among the largest solar projects in idaho. Idaho also has a state income tax credit equal to 7.4% of the cost of your solar panel installation that can reduce your tax liability if you invest in solar energy for your home or business.

The itc for solar power projects which would have expired in 2020 will now remain at 26% for projects that begin construction in 2021 and 2022, be reduced to 22% in 2023, and decrease to 10% in 2024 for commercial size projects. The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in idaho. Wind projects started in either 2020 or 2021 will qualify for a production tax credit at 60% of the full rate on the electrical output for 10 years.

Installed in 2016, this 108 mw projects generates enough electricity to power nearly 18,000 homes. Solar panel incentives in idaho. Idaho offers a tremendous state tax credit.

This credit is applied on your annual income tax credit. Effective january 1, 2021, the amount of this business tax credit was increased to 70% of qualified wages, including the cost of health benefits, with a max of $7,000 per employee per quarter. Idaho does have a state solar tax credit.

This tax credit is capped at $1,480 but the good news is that it can be combined with the 30% federal solar tax credit. Homeowners who purchase a newly built home with a solar system are eligible for the itc the year they move into the house if they own the. Each year, the maximum deduction is $5,000.

Don’t forget about federal solar incentives! This perk is commonly known as the itc, short for “investment tax credit”. (updated april 27, 2021) a.

We also have an agreement to purchase energy from the 120 mw jackpot solar plant to be built south of twin falls, idaho. Generally, you can claim a tax credit on the expenses related to the new solar pv system that already came installed Forty percent (40%) of the amount that is properly attributable to the construction, reconstruction, remodeling, installation or acquisition of the alternative energy.

A bill recently before the legislature would have doubled the funds available each year from $5 million to $10 million. Oil and gas production tax. Then, for the next three years, you’ll be eligible for a 20 percent state income tax deduction.

Updated march 7, 2021 idaho state tax credit. Solar photovoltaic projects american falls solar i and ii were completed in 2017. (1) an individual taxpayer who installs an alternative energy device to serve a place of residence of the individual taxpayer in the state of idaho may deduct from taxable income the following amounts actually paid or accrued by the individual taxpayer:

Federal itc idaho residents can take advantage of the 26% federal investment tax credit (itc). The first year after installing your home pv system, the idaho solar tax credit allows you to deduct 40 percent of the cost of your photovoltaic power project when you file income taxes.

Solar Tax Exemptions Sales Tax And Property Tax 2021 - Ecowatch

The 10 States Leading Solar Energy Installation In 2021 - Ecowatch

Meadowlark Elementary Installs Panels For Greenhouse Garden - Sheridan Press In 2021 Greenhouse Gardening Greenhouse Solar Design

Infographic House And Household Size Trends - Infographics Archive Infographic Fun Facts House

Pin On Us Regions

How Solar Works Solar Energy Facts Solar Panels Facts Solar

Solar Power Rocks 2013 State Solar Power Rankings - Virginia Ranked 33rd In The Nation With A D Grade While Neighboring States Nc A Solar Power Solar Power

Home Build A Camper Van Van Life Build A Camper

When Does The Federal Solar Tax Credit Expire Iws

The World Geography 10 Unusual Facts About Global Warming Unusual Facts Cattle Factory Farming

Formation Of Natural Emerald Stones - Natural Emeralds - Emerald Gemstone Suppliers In 2021 Geology Earth Science Geology Rocks

Pin By Horizonpwr On Horizonpwrcom Solar Energy Facts Solar Panel Installation Find A Career

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Paul Montoya The Differences Between Wind Power And Solar Power Cowboy State Daily Paul Montoya Writes About The Advantage Of S In 2021 Wind Power Solar Power Solar

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

How Does The Solar Tax Credit Work In Idaho Iws

108kw Ground Mount Idaho Solar Roof Solar Panel Idaho

A Colorado Steel Mill Is Now The Worlds First To Run Almost Entirely On Solar

Camping In Chaco Canyon New Mexico - Cancerroadtrip In 2021 Chacos Canyon Gothic Cathedrals

Comments

Post a Comment