Questions answered every 9 seconds. The florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

You can use capital losses to offset capital gains to lower your tax bill.

Does florida have capital gains tax on stocks. The remaining $71,250 of gains are taxed at the 15% tax rate. When to pay taxes on stock gains and other capital gains. Capital gains taxes are typically calculated quarterly, so you can pay them on each of the following:

Any money earned from investments will be subject to the federal capital gains tax described below, but you won’t owe any money to the sunshine state. How to avoid paying taxes when you sell stock one way to avoid paying taxes on stock sales is. There is currently no florida income tax for individuals and, therefore, no florida capital gains tax for individuals.

For example, if you sold a stock for a $5,000 profit this year, but you sold another stock for a $3,000 loss, you’ll be taxed only on the capital gains of $2,000. Only 18 states levy a capital stock tax, a tax on the net worth of a business. Florida capital gains tax isn’t levied on asset profits.

Your primary residence can help you to reduce the capital gains tax that you will be subject to. And just like interest and dividends, capital gains usually trigger a taxable event. The rates do not stop there.

Florida has no state income tax, which means there is also no capital gains tax at the state level. Individuals pay capital gains taxes to the federal government. Let's say you purchase 100 shares of stock at $50 per share, for a total investment of $5,000.

If you did the opposite, with a loss of $5,000 and a gain of $3,000, your losses would exceed your gains. Ad a tax advisor will answer you now! If you earn money from investments, you’ll still be subject to.

As with other assets such as stocks, capital gains on a home are equal to the difference between the sale price and the seller's basis. If you own a home, you may be wondering how the government taxes profits from home sales. Benefiting from the 1031 exchange

The capital gain tax is triggered only when an asset is sold, not while the asset is held by an investor. April 15 (for q1) june 15 (for q2) Six months later, the price of the stock rises to $65 per share.

You only pay them on realized gains upon sale. Some states have tax preferences for capital gains. The amount that can be excluded stands at $250,000 for an individual and $500,000 for a married couple.

You can maximize this advantage by frequently moving homes. Capital gains taxes on property. Because the tax is paid in good times and bad, businesses often.

These taxes are often levied at a low percentage on the wealth of a firm. This amount increases to $500,000 if you're married. As of 1997, you don't have to pay income taxes on the first $250,000 of capital gain, or profit, from selling your home in florida.

Federal capital gains taxes apply to: The state of florida does not have an income tax for individuals, and therefore, no capital gains tax for individuals. Capital gains are the profits realized from the sale of capital assets such as stocks, bonds, and property.

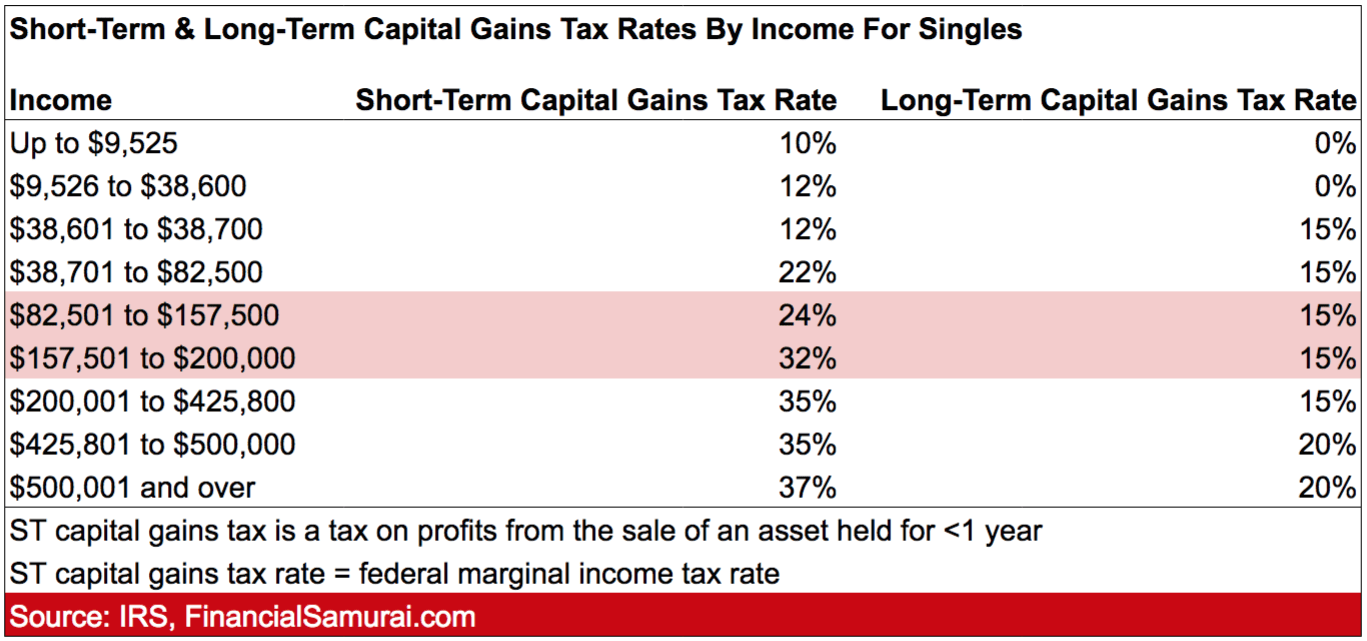

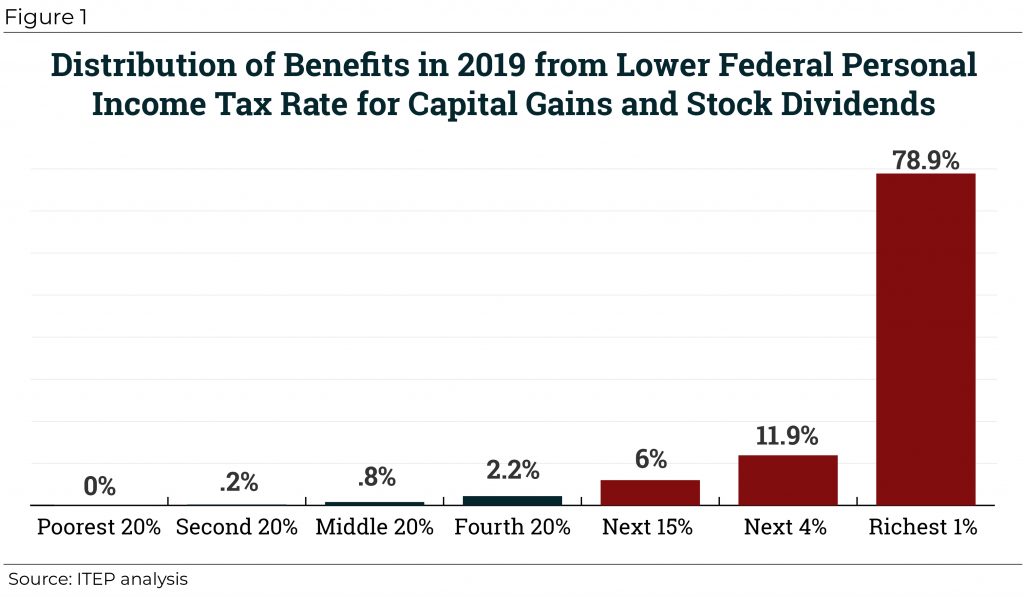

Any amount exceeding these numbers is taxed at 20 percent, which is down from the previous tax amount of 28 percent. Questions answered every 9 seconds. The federal government taxes income generated by wealth, such as capital gains, at lower rates than wages and salaries from work.

Nevada does not have a capital gains tax similar to federal income tax. new hampshire department of revenue administration: Ad a tax advisor will answer you now! Does florida have a capital gains tax?

52 rows ak, fl, nv, nh, sd, tn, tx, wa, and wy have no state capital gains tax. However, when a mutual fund sells shares of its holdings during the year, mutual fund investors could be charged capital gains. Florida does not assess a state income tax, and as such, does not assess a state capital gains tax.

“no capital gains tax in new hampshire.” You sell your entire position for $6,500, producing a $1,500 gain on sale. You get to write off the full value of the stock at the time of donation, and you don't have to pay capital gains taxes on the appreciation.

Overview of florida capital gains tax. (a fund’s capital gains distribution is not taxable if.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

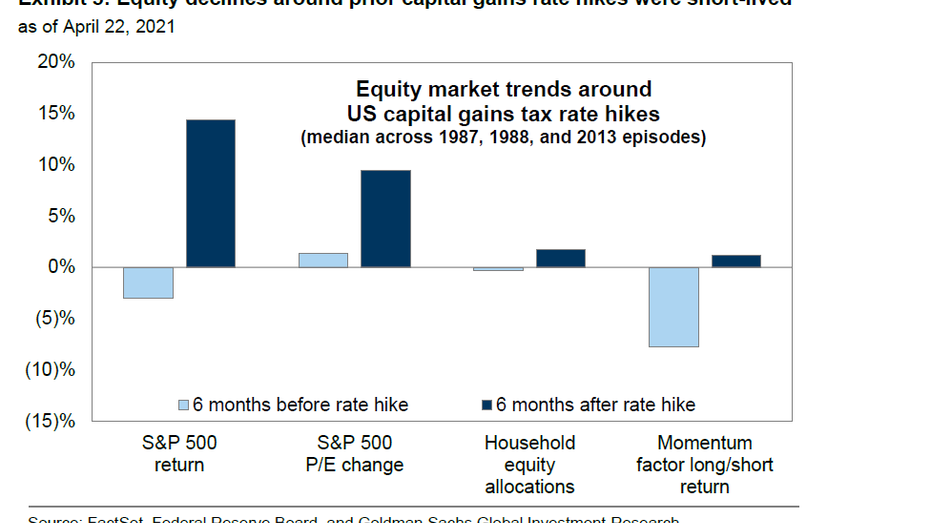

Capital Gains Tax Hikes And Stock Market Performance Fox Business

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Capital Gains Taxes Explained Short-term Capital Gains Vs Long-term Capital Gains - Youtube

Capital Gains Tax In Kentucky What You Need To Know

The States With The Highest Capital Gains Tax Rates The Motley Fool

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax

Income Types Not Subject To Social Security Tax Earn More Efficiently

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

What Is Capital Gains Tax For Stock Options - Secfi

Heres How The Irs Will Tax You On Investment Profits

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How High Are Capital Gains Taxes In Your State Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Comments

Post a Comment