8407 bandera rd ste 153. Change of address on motor vehicle records;

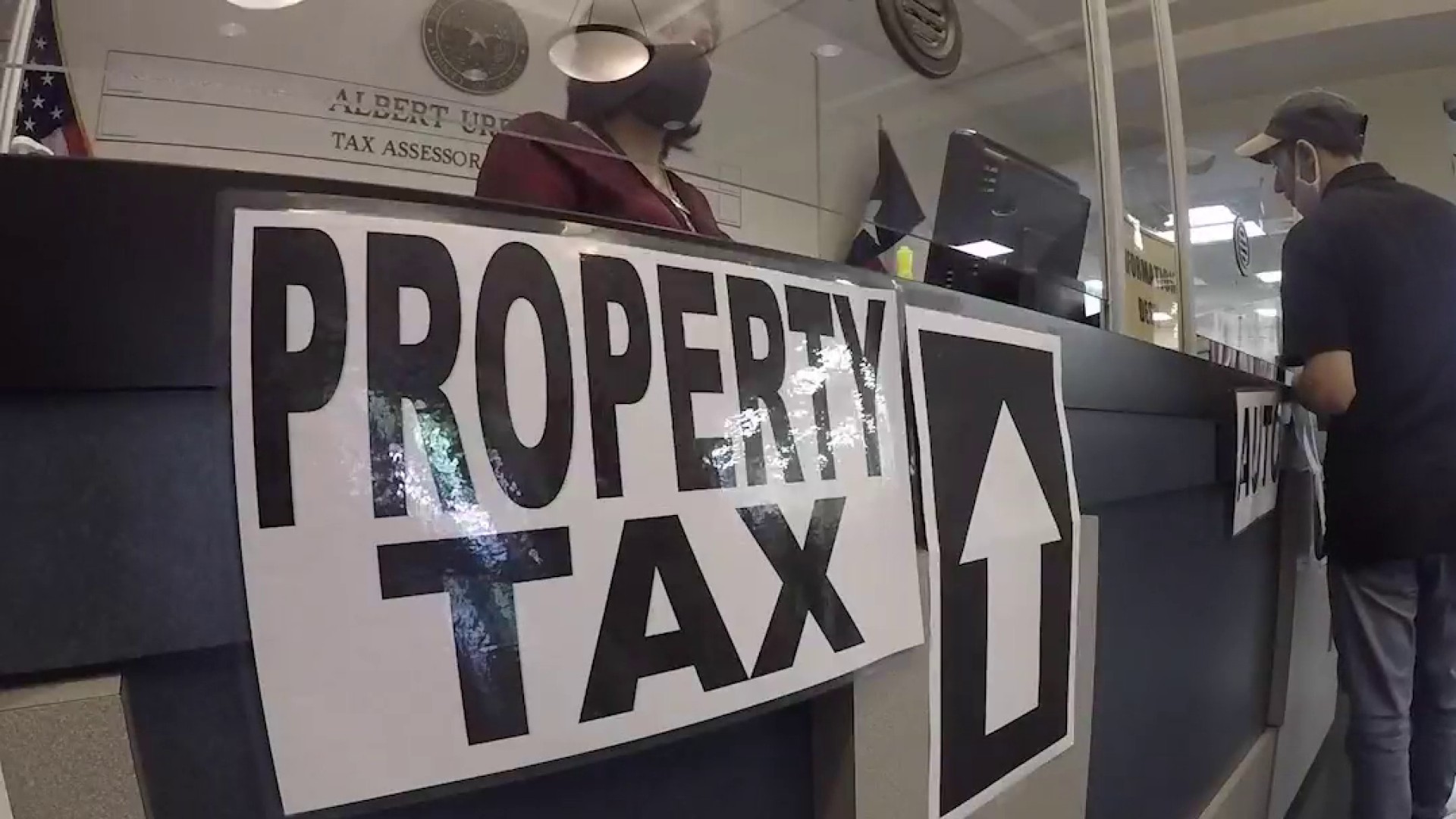

Evictions Property Tax Foreclosures In Bexar County Suspended Due To Covid-19 Concerns San Antonio News San Antonio San Antonio Current

2022 data current as of dec 6 2021 1:22am.

Bexar county tax office san antonio. Bexar appraisal district is responsible for appraising all real and business personal property within bexar county. Prior year data is informational only and does not necessarily replicate the values certified to the tax office. Changing the title to my car was far more easy than i thought.

The bexar county treasurer and tax collector's office is part of the bexar county finance department that encompasses all financial functions of the local government. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. County & parish government government offices.

Registration renewals (license plates and registration stickers) vehicle title transfers; Get reviews, hours, directions, coupons and more for bexar county tax assessor at 3370 nacogdoches rd, san antonio, tx 78217. County & parish government government offices.

The city also collects 1.75 percent for bexar county. This is actually the one on 8407 bandera rd. Address main office 233 n pecos la trinidad vista verde plaza building san antonio, tx 78207 get directions;

County & parish government government offices. 100 dolorosa, san antonio, tx 78205 phone: Bexar county emergency services district #5:

The line was very long before they opened and it was discouraging at first, but once they opened, the line moved fast and mary at. Box 830248 san antonio, tx 78283. The bexar county assessor's office, located in san antonio, texas, determines the value of all taxable property in bexar county, tx.

Search for other county & parish government in san antonio on the real yellow pages®. In the event your registration is expired, you must visit one of our four bexar county tax office locations. 100 dolorosa, san antonio, tx 78205 phone:

Address, phone number, fax number, and hours for bexar county assessor, an assessor office, at n pecos la trinidad, san antonio tx. Address, phone number, and hours for bexar county assessor, an assessor office, at bandera road, san antonio tx. San antonio, tx 78207 mailing address:

The district appraises property according to the texas property tax code and the uniform standards of professional appraisal practices (uspap). The bexar county tax collector, located in san antonio, texas is responsible for financial transactions, including issuing bexar county tax bills, collecting personal and real property tax payments. Click here to register online on txdmv website.

The city of san antonio’s hotel occupancy tax rate is 9 percent, comprised of a 7 percent general occupancy tax and an additional 2 percent for the convention center expansion. Please allow up to 15 days for the processing of your new window sticker (or new plates) by mail.

Bexar County Commissioners Approve 28 Billion Budget After Contentious Debate Tpr

Vintage T-shirt Space Shuttle Sts-1 Columbia Young Crippen 25th Anniversary Lgg Vintage Tshirts Sts 1 Shirts

Municipal Auditorium - New Orleans Louisiana New Orleanian Walter Taney Was One Who Did Not Turn Elvis Away He Arrang Elvis In Concert Elvis Presley Elvis

Debate Over Bexar County Budget Amendments Resume Friday Tpr

Property Tax Information Bexar County Tx - Official Website

Dnk1bq8lj8asum

Pin On Phoenix Arizona

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Bexar County Property Owners Have Until May 17 To Appeal 2021 Property Appraisals Officials Say

Old Land Town Lots Tax Receipts Morris Levy San Antonio Texas Bexar County Bexar County San Antonio San Antonio Texas

Bexar County Commissioners Get First Look At 28 Billion 2022 Budget

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

Promissory Note Sample Real Estate Forms Doctors Note Doctors Note Template Notes Template

Mckinney Kdc To Develop Expansion Of Raytheon Campus The Expanse Construction Campus

Tax Office Mistake May Cost Man His Home Woai

Bexar County Tax Assessor Collector - 30 Reviews - Tax Services - 233 N Pecos La Trinidad San Antonio Tx - Phone Number - Yelp

Houston Skanskas Bank Of America Tower Project Earns Leed Platinum Bank Of America Leed Downtown Houston

Texas Bexar County In Fraud Spotlight Bexar County San Antonio Real Estate County

Bexar County Precinct 1 Justice Of The Peace Court In San Antonio

Comments

Post a Comment