I called in this saturday and was able to get my taxes done. 8 reviews of accurate income tax & consulting my family has known rafael for years;

Iv Income And Wealth Taxes In Tax Policy Handbook

Income taxes preparing individual, partnership, and corporate federal and state income tax returns requires accuracy with careful attention to the latest tax laws and regulations that affect you.

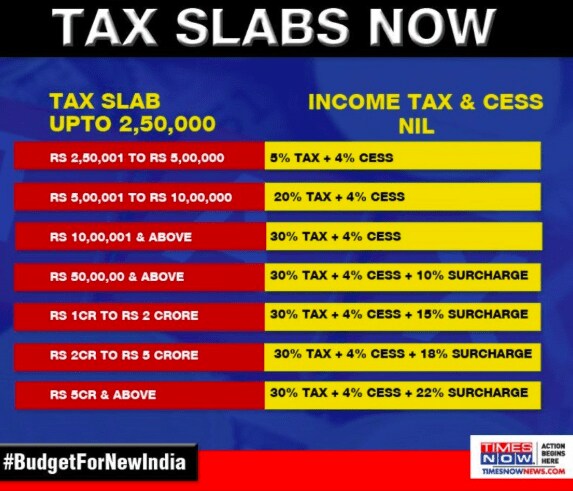

Accurate income tax fullerton. Orangethorpe ave fullerton, ca 92833. 8192 commonwealth ave ste b, buena park, ca 90621. This is taxed at the concessional tax slab rates and cess is added to give you your total income tax payment.

Accurate income tax & consulting. And maintaining accurate accounting records is essential. The income tax slab of the new, optional tax regime are as follows.

We also offer tax preparation services to clients across the country and can prepare tax returns for all states that have a state income tax requirement. We found 4 results for accurate income tax in or near los angeles, ca. While the state of california only charges a 6% sales tax, there's also a state mandated 1.25% local rate, bringing the minimum sales tax rate in the state up to 7.25%.

California state university, fullerton is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser. Tax preparers in fullerton, ca. Office of financial aid p.o.

A combined city and county sales tax rate of 1.75% on top of california's 6% base makes fullerton one of the more expensive cities to shop in, with. 34 likes · 12 were here. We also offer tax preparation services to clients across the country and can prepare tax returns for all states that have a state income tax requirement.

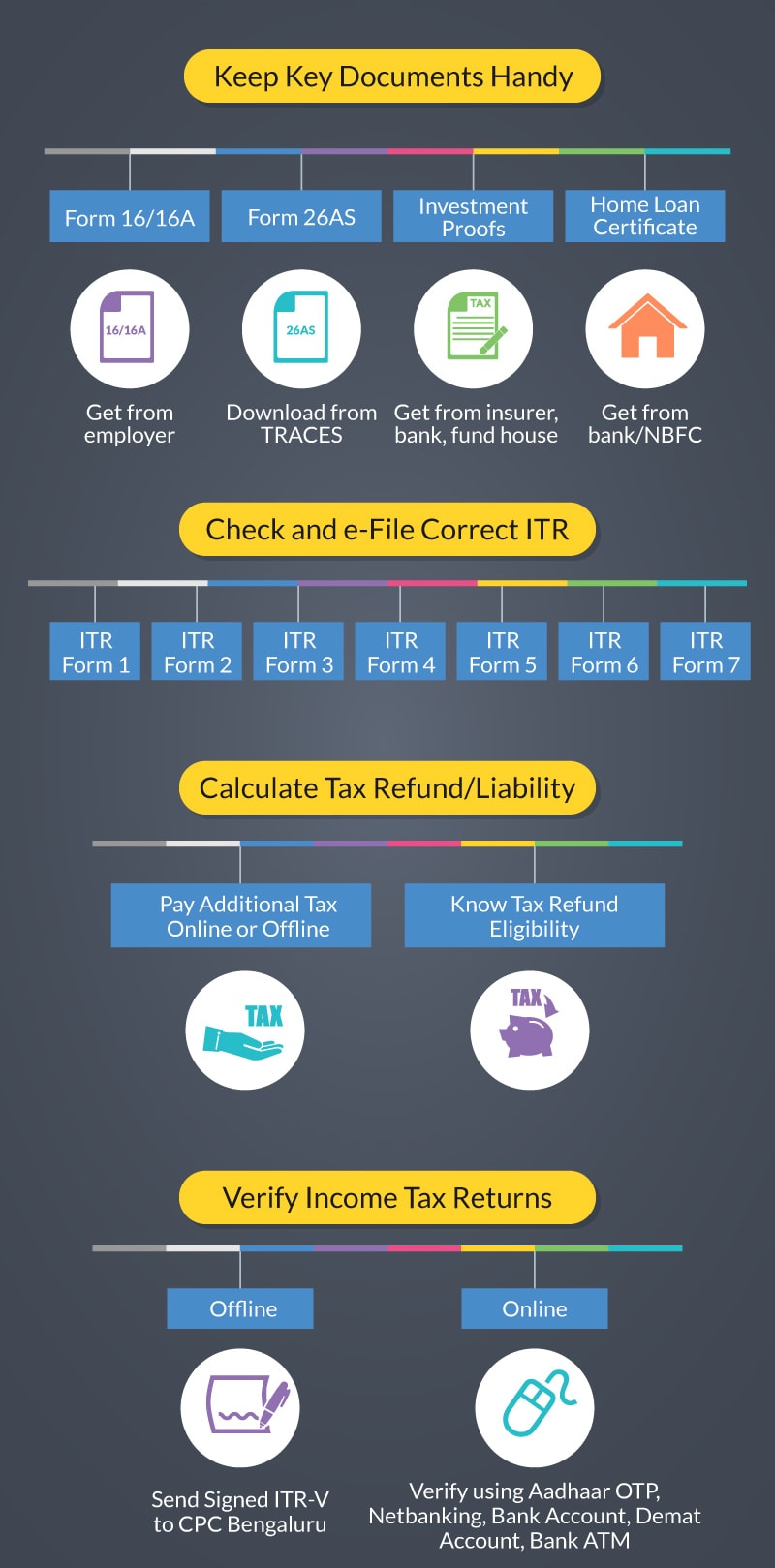

The income tax department has mandated it for all assesses to file their income tax returns online. Businesses authorized by the dmv to handle certain registration services, often with much shorter wait times (if any!). 1119 w orangethorpe ave, fullerton, ca 92833.

Prepare complete and accurate tax returns; Experto tax service our services for you for your businessfor your corporation. We are dedicated to providing individuals and small businesses with professional, accurate and timely service and guidance in a wide range of financial and business areas.

The businesses listed also serve surrounding cities and neighborhoods including south gate ca, fullerton ca, and torrance ca. Sales tax in fullerton, ca. 8 reviews of accurate income tax & consulting my family has known rafael for years.

Ad a tax advisor will answer you now! We decided to follow rafael on his venture to fullerton because he is extremely knowledgeable and can answer any and all questions we have. Individuals or members of huf whose annual income does not exceed rs.5 lakh.

Accurate income tax and consulting; Tax preparers in fullerton, ca. Taxes, accounting & bookkeeping · open · 8 on yelp

Accounting services recording business transactions. Get directions * * *. Our clients benefit from our range of professional tax preparation and accounting services.

115 e commonwealth ave # 4. This business offers tax preparation and consultation services. Additional fees may be applied by this partner.

Successful completion of the h&r block tax knowledge assessment or income tax course**. Questions answered every 9 seconds. Office of financial aid p.o.

Accurate Income Tax Consulting - Tax Services - 1119 W Orangethorpe Ave Fullerton Ca - Phone Number

Budget 2019 Highlights Income Tax Slabs For Fy 2019-20 And Tax Exemptions - Finserv Markets

Accurate Income Tax Consulting - Tax Services - 1119 W Orangethorpe Ave Fullerton Ca - Phone Number

Are You In The Zero Income Tax Bracket Remember To Fill Form 15g - Loan Blogs By Finserv Markets

The French Digital Services Tax An Economic Impact Assessment

Home Accutax

Home Accutax

Home Accutax

2

Income Tax Declaration - Difference Between Income Tax Declaration And Tax Filing - Finserv Markets

More Ctc-educated Victories For The Rule Of Law- Page 60

Pdf Personal Income Taxation The Cornerstone Of The Tax System In Democratic Spain

1098t - Student Business Services Csuf

2

Accurate Income Tax Consulting - Tax Services - 1119 W Orangethorpe Ave Fullerton Ca - Phone Number

Contact Form 1 - Sarah In 2021 Tax Refund Tax Preparation Tax Consulting

Home Accutax

Marginal Income Tax Rate At Apw Level Download Scientific Diagram

Orozco Tax Income Tax And Services - Tax Preparation Service In Fullerton

Comments

Post a Comment