The rates are set at 17 cents per mile for tax year 2020 and 16 cents per mile for tax year 2021. Payments of fees to doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists, and nontraditional medical practitioners…”

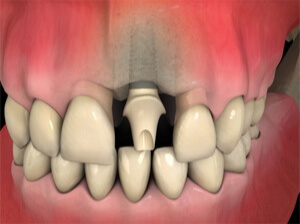

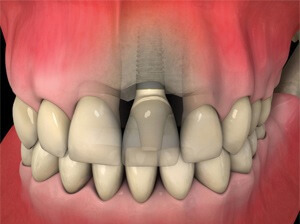

Dental Implants Navan Meath Navan Dental

When you itemize, the irs allows you to deduct medical and dental expenses that exceed 7.5 percent of your adjusted gross income for tax year 2020.

Are dental implants tax deductible 2021. All dental implants are tax deductible. Yes, dental implants are tax deductible. For example, if you claimed $2000 that you had spent on dentures in your tax return filed on march 12, 2021, the total amount of $2000 must be made within the twelve months no earlier than march 21,.

According to the new york times and the american academy of implant dentistry. This includes the following procedures: Acquire new teeth with dental implants mini dental.

Basically, any treatment to prevent or alleviate dental disease is considered tax deductible. Let’s say you make $40k a year. The good news is that will include all of your medical (and dental) expenses, not just your dental implants.

The deduction is not automatically deducted, however, so you will need to itemize your deductions in order to claim it. For instance, if you had $3,000 in. [1] follow along as we break down the hidden features , benefits, and caveats for each of the three options and illustrate the potential savings.

There is a small catch though. Are dental implants tax deductible in canada. On the other hand, teeth whitening is considered cosmetic and not deductible.

If you have incurred medical expenses in the past year, you can receive a 25% tax refund on the cost of treatment. Have a form med 2 completed by your dentist. Your dentist will normally give a med 2 to you after your treatment.

Any 7 should be remembered as a good thing. The good news is, yes, dental implants are tax deductible! In the case of dentures and dental implants, the entire procedure can be deducted from your tax return if you do not have insurance that covers them.

It also explains, “the cost of medical care includes payments for diagnosis, treatment, alleviation, treatment or prevention of disease, or payments for treatments that affect any structure or function of the body.”. The good news is, yes, dental implants are tax deductible! 10 best life insurance images life insurance universal life insurance cheap term life insurance.

Yes, dental implants are tax deducible per the irs, “deductible medical expenses may include but aren’t limited to the following: The short answer here is yes, they may very well be. So fully deductible (if exceed 10% agi) in 2019?

Since the average middle class worker earns about $50,000 a year, you will be on the hook for $3,750. Teeth cleanings, sealants, and fluoride treatments are examples of common preventive treatments. The good news is, yes, dental implants are tax deductible!

350 dentist ideas dentist dentistry for kids cosmetic dentist. For instance, if you had $3,000 in dental expenses and made $20,000, $1,500 of your expenses are deductible. But it's not always deducted;

Any portion of the fee for your calgary orthodontic treatment that is not reimbursed can be claimed as a medical expense. According to the new york times and the american academy of implant dentistry. You can deduct 5% of your gross income.

Have a form med 2 completed by your dentist. A good thing to keep in mind is that any dental implants cost over 7.5 percent of your overall income are tax deductibles. However, it’s not automatically deducted — you will need to itemize your deductions.

You can only deduct expenses greater than 7.5% of your income. You can claim dental expenses on your taxes if you incurred fees for the prevention and alleviation of dental disease. A good things to remember is that anything 7.5% of your gross total income is tax deductible.

The irs publication 502 details specific dental procedures that are tax deductible. In fact, most of the dental expenses you pay for throughout the year are deductible including basic. You'll have to itemize your deductions in order to claim as much of your implant costs as they are qualifying for.

However, the good news is that dental implants are definitely tax deductible! It is possible that your dental implants will get you a tax deduction from the internal revenue services. If you receive treatment over more than one year, they must complete a separate med 2 for.

Acquire new teeth with dental implants mini dental You can only deduct expenses greater than 7.5% of your income. Are dental implants tax deductible in canada.

Are dental implants tax deductible in australia when you itemize, the irs allows you to deduct medical and dental expenses that exceed 7.5 percent of your adjusted gross income for tax year 2020. Dental implants are tax deductible, so that’s good news!! Are dental implants tax deductible?

This would include dental implants. Are dental implants tax deductible 2019. You would have to eat the first $3,000 of those expenses before it starts lowering your tax obligation.

Dentrix Automatically Tracks Benefits Used And Deductibles Met For Patients When You Post An Insurance Paym Term Life Life Insurance Policy Term Life Insurance

The Complete Guide To Getting Dental Implants In Thailand

Dental Implants Navan Meath Navan Dental

Dental Insurance Bright Smiles Sunny Options Military Spouse

Frisco Tx Invisalign Cost - Frisco How Much Are Invisalign Clear Aligners 2021 Highland Oak Dental

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Tooth Contouring Navan Navan Meath - Navan Dental

Dentrix Tip Tuesdays Automatically Creating Secondary Insurance Claims Dental Insurance Dental Insurance Plans Cheap Dental Insurance

How Much Do Dental Implants Cost Cost Of Dental Implants

Dental Implant Cost Santa Fe Nm - Taos Nm - Los Alamos Nm - Oral Surgery And Dental Implant Center Of Santa Fe

The Complete Guide To Getting Dental Implants In Thailand

How Much Do Dental Implants Cost In Canada Explained

How Much Do Dental Implants Cost Cost Of Dental Implants

How Much Do Dental Implants Cost Cost Of Dental Implants

All On 4-6 Full Arch Dental Implant Courses - Itc Seminars

State Farm Homeowners Insurance Declaration Page Sample In 2021 Homeowners Insurance State Farm Insurance Homeowner

Are Dental Implants Tax Deductible - Drake Wallace Dentistry

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Dental Implants Navan Meath Navan Dental

Comments

Post a Comment