Questions answered every 9 seconds. For example, let’s say you bought a property a couple of years ago and recently sold it.

Make Tax-free Capital Gains On Australian Shares Whilst A Non-resident Expat - Expat Taxes Australia

According to the ato, most personal assets are exempt from cgt, including your home, car, and most personal use assets such as furniture.

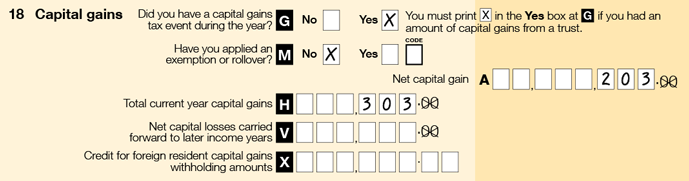

Defer capital gains tax australia. You are taxed on your net capital gain at your marginal tax rate. You report capital gains and capital losses in your income tax return and pay tax on your capital gains. There are a number of concessions and exemptions when it comes to paying capital gains tax, and numerous strategies designed to reduce your overall tax bill, too.

The number one thing to remember is that this discount. Capital gains tax was introduced in australia in 1985 and applied to any asset you've acquired since that time unless specifically exempted. Losses on the disposal of capital assets are only deductible against capital gains and not against other income.

You may be eligible for an extension of time. Capital losses can be offset against capital gains, and net capital losses in a tax year may be carried forward indefinitely. Although it is referred to as 'capital gains tax,' it is part of your income tax.

There is no separate tax on capital gains, it is a component of your income tax. Unless the property in question is real estate, you have to pay capital gains tax on a disposition of a capital asset before reinvesting the proceeds. Ad a tax advisor will answer you now!

E15 capital gains tax deferral of liability when taxpayer dies other economic affairs — other economic affairs, nec. That means that if you make a million in capital gains from the sale of your business’ assets or an investment, you can lower the reported gains to $500,000. Sometimes you can choose to roll over, or defer, a capital gain.

When and how you make a choice. Generally you make this choice when you lodge your tax return. Capital gains tax (cgt) is the tax you pay on profits from selling assets, such as property.

The limitation of australian taxation of the capital gains of foreign residents to gains on the direct or indirect disposal of interests in australian land (and similar assets such as mining rights) and branch office assets. Deferral of capital gains via reinvestment. They’ll consider all the options and help you prevent or reduce the amount you are liable to pay, including whether you are eligible to claim that the property you are selling is actually your primary residence.

If you made a capital gain of $200,000, the taxable amount will be 50 percent of this i.e. Ad a tax advisor will answer you now! When you own property for at least 12 months, you qualify for a 50 percent tax discount on the capital gain when you sell it.

The longer you wait to settle taxes on capital. Fortunately, the system does give you a 50 per cent discount on the tax payable if you. You can offset any capital losses you've made for the year against any capital gains you've made and this will reduce the amount of capital gains that'll be included in.

A australia does not have any system where you can defer cgt by rolling the profit into another investment. It is not a separate tax. Applying for an extension of time.

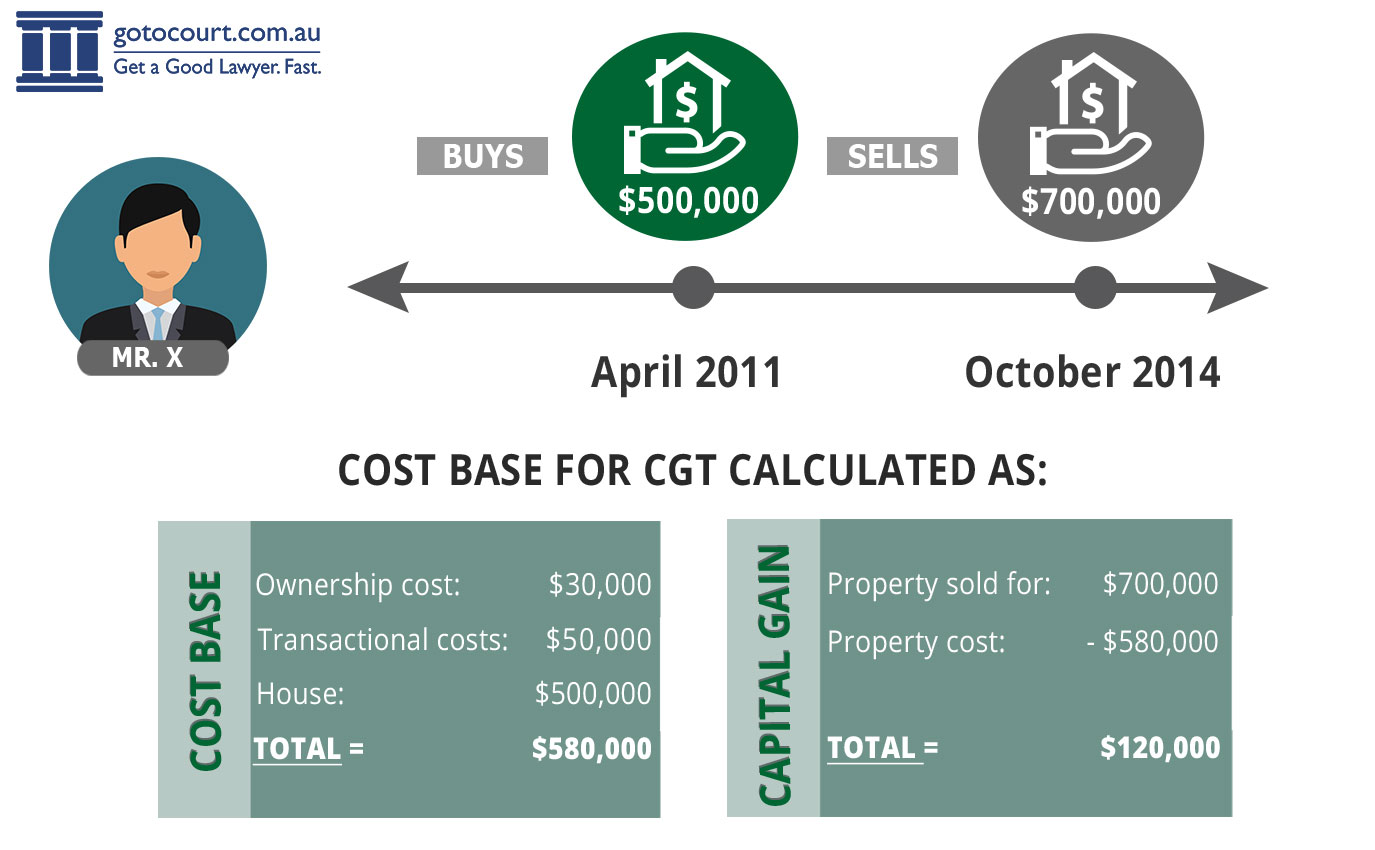

The australian tax office (ato) will work with you to establish a repayment plan on any outstanding capital gains taxes. According to the australian tax office, a capital gain or capital loss on an asset is the difference between what it cost you and what you receive when you dispose of it. To get the best possible advice on how to avoid capital gains tax in australia, you should talk to a tax accountant.

See the introduction to capital gains tax guidance note. Questions answered every 9 seconds. Depending on the nature of the asset disposed of, this can result in the individual paying capital gains tax (cgt) at 20% or 28% in tax years where their taxable income and gains exceed the basic rate threshold (£37,700 for the 2021/22 and 2022/23 tax years) but only 10% or 18% on gains.

Remember, if your capital losses exceed your capital gains, or you make a capital loss in an income year and you don’t have a capital gain, you can carry the loss forward indefinitely and deduct it against capital gains in future years. Here are some of the main strategies used to avoid paying cgt: Capital gains tax (cgt) capital gains tax (cgt) is the tax you pay on any capital gain you make in the financial information that you include in your annual income tax return.

How to avoid capital gains tax on your property. One of the best ways to avoid paying capital gains taxes is to be an individual or a trust because you’ll get access to the capital gains tax general discount. It’s in your best interest to reach out to them or respond to their communication.

However, capital losses cannot be offset against normal income.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Pdf Taxing Capital Gains A Comparative Analysis And Lessons For New Zealand

There Are Only Limited Opportunities To Defer Capital Gains Tax

Calculating Capital Gains Tax Cgt In Australia

The Six-year Capital Gains Tax Rule Explained Your Investment Property

3 Simple Methods How To Calculate Capital Gains Tax And Concessions You Can Take Advantage Of - Box Advisory Services

There Are Only Limited Opportunities To Defer Capital Gains Tax

Calculating Capital Gains Tax Cgt In Australia

2

Capital Gains Tax On Shares In Australia - Explained Sharesight

Non-assessable Payments From A Trust Australian Taxation Office

Capital Gains Tax - Lexisnexis

How To Minimise Capital Gains Tax Cgt

What Is Capital Gains Tax And When Might I Pay It Amp

The Six-year Capital Gains Tax Rule Explained Your Investment Property

Capital Gains Tax Ato

How Long Do You Have To Live In A House To Avoid Capital Gains Tax

![]()

Is There Capital Gains Tax On My Home Or Business Bishop Collins

2

Comments

Post a Comment