To grow the state’s manufacturing industry, a variety of producers (electrical energy, coal, gas, machinery equipment, chemicals, energy sources, materials, etc), can access a 4.225 state sales tax exemption as well as a local use tax. The form is on the dor forms web site.

Ksrevenueorg

Used in manufacturing, processing, recycling, compounding, mining, or quarrying tangible personal property for sale.

Kansas manufacturing sales tax exemption form. Ad access any form you need. Attach all documents as required 1) federal employer identification number the application cannot be processed without this number. Certificates for nonprofit organizations require the exempt entity’s tax id number.

The buyer must have either a kansas sales tax number. The kansas exemption certificates that begin on page 15 meet these requirements. The form may be photocopied for use in claiming the exemption.

An authorized official of the company purchasing the equipment must sign the form, and file a copy of the form. Ad access any form you need. Download or email fillable forms, try for free now!

That meet the definition of an ingredient or component part may use this certificate. The seller must collect and report local sales taxes The applicability of this machine exemption depends on whether the machine is integral and necessary to the manufacturing process.

However, if they do not also sell to the final consumer and do not have a sales tax account number, they will not be able to provide the kansas retailers’ sales tax account number that is required to use the ingredient or component part exemption certificate. An exemption certificate is a document that a buyer presents to a retailer to claim exemption from kansas sales or use tax. A kansas manufacturers’ or processors’ sales tax exemption certificate number.

Kansas offers an exemption from state and local sales tax on the purchase of electricity, natural gas, and water used in qualifying production activities. What is an exemption certificate? The first page is the resale certificate which is needed for cost of goods sold items that are purchased and resold as part of the finished.

All sales tax refunds are limited to kansas’s statute of limitations of 36 months. Manufacturers and processors are eligible to purchase their raw materials or parts exempt from sales tax. This program is exclusively for manufacturing companies.

The kansas investment tax credit, which equals 10% of all eligible capital investment that exceeds $50,000. It shows why sales tax was not charged on a Most exemptions from sales tax require a buyer to present an exemption certificate and the exemption is to be on file in the selling department to avoid the collection of sales tax.

The hpip is intended to encourage companies to expand their capital investment and raise employee wage and training levels through kansas income tax credits and sales tax exemptions. Complete, edit or print your forms instantly. Manufacturers and industrial processors with facilities located in kansas, may be eligible for a utility tax exemption.

If you do not have an fein, see previous section on how to apply. Complete, edit or print your forms instantly. The appropriate kansas exemption certificate from your customer is to be obtained at the time of the sale or no later than the actual delivery of the taxable item or service.

This exemption does not include automobiles or trucks. Hpip offers three major state tax benefits: If the buyer purchases tax free for a reason for which this form does not provide, the buyer should send the seller its special certificate or statement.

This tax exemption is authorized by k.s.a. Retailer is liable for the 5% wisconsin state sales tax, the 0.5% washington county sales tax, and the 0.1% baseball stadium Download or email fillable forms, try for free now!

Name telephone number contact person doing business as name (dba) address city state zip code these only apply to state tax (4.225%) and local use tax, but not sales tax. Complete the “sales tax exemption on purchases of machinery and machine tools” (form dr 1191). The kansas utility sales tax exemption allows businesses to claim an exemption on the portion of their utility that is consumed in the production, manufacturing, processing, mining, drilling, refining, compounding of tangible personal property or the providing of a taxable service.

When the appropriate certificate is used, and all the blanks are accurately filled out, the certificate may be accepted by a retailer. These apply to state and local sales and use tax. A signed exemption form on file is required before we can put your company on the permanent mailing list.

If the buyer is entitled to a sales tax exemption, the buyer should complete the certificate and send it to the seller at its earliest convenience. How to use sales tax exemption certificates in kansas. The sourcing rule in part xv.b.1.b.

Applies, and the sale is sourced to washington county.

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Ksrevenueorg

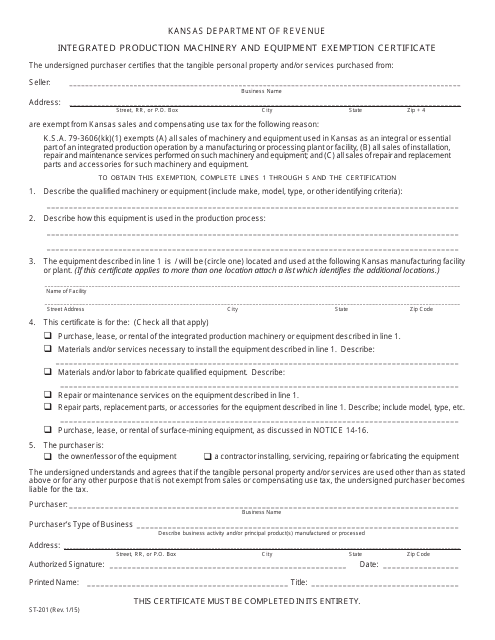

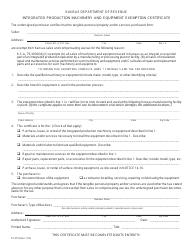

Form St-201 Download Fillable Pdf Or Fill Online Integrated Production Machinery And Equipment Exemption Certificate Kansas Templateroller

Ksrevenueorg

Ksrevenueorg

Zillionformscom

Ksrevenueorg

Zillionformscom

Ksrevenueorg

How To Get A Certificate Of Exemption In South Dakota - Startingyourbusinesscom

Physksuedu

Exemption Certificates Pub Ks-1520 - Kansas Department Of

Mississippi Sales Tax Exemption Form Pdf - Fill Online Printable Fillable Blank Pdffiller

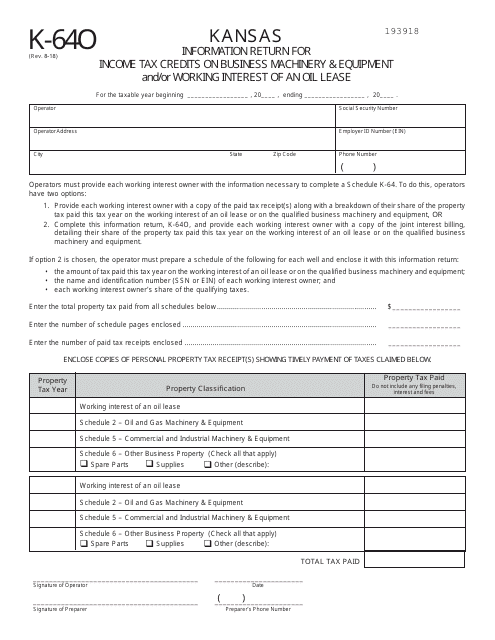

Form K-64o Download Printable Pdf Or Fill Online Information Return For Income Tax Credits On Business Machinery Equipment Andor Working Interest Of An Oil Lease Kansas Templateroller

How To Get An Exemption Certificate In Pennsylvania - Startingyourbusinesscom

Ksrevenueorg

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form St-201 Download Fillable Pdf Or Fill Online Integrated Production Machinery And Equipment Exemption Certificate Kansas Templateroller

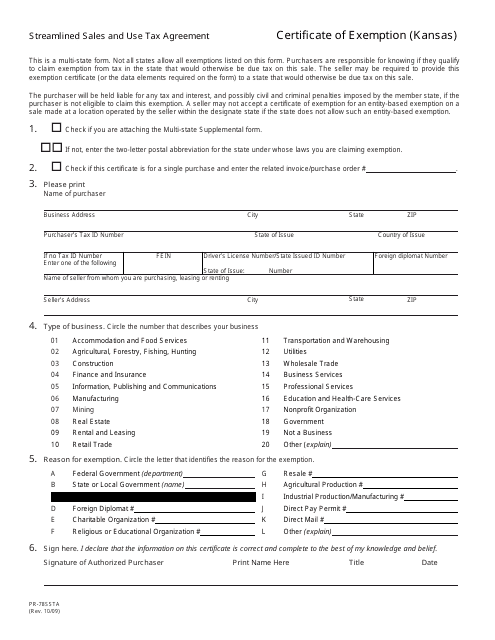

Form Pr-78ssta Download Fillable Pdf Or Fill Online Streamlined Sales And Use Tax Agreement Certificate Of Exemption Kansas Kansas Templateroller

Comments

Post a Comment