The us average is 7.3%. Florence (140) north charleston (130) rock hill (128) fort mill (115) anderson (112) there are 293 cities in south carolina with businesses in the financial category.

2

The average household income in the eureka trail area is $58,540.

Laura's income tax longs sc. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Contact laura baez income tax on messenger. While south carolina’s top income tax of 7% is one of the highest in the country, the bottom rate is the lowest.

The state also has some of the lowest property and gas taxes in the country, but its total sales tax, when including local rates, ranks in the top 20 across the country. Horry county tax collector's office contact information. The average property tax on hyacinth drive is $618/yr and the average house or building was built in 2004.

Your federal taxable income is the starting point in determining your state income tax liability. Counties and cities can charge an additional local sales tax of up to 3%, for a maximum possible combined sales tax. This table shows the total sales tax rates for all cities and towns in horry county, including all local taxes.

Rates include state, county and city taxes. Laura baez income tax is a cpa business specializing in bookkeeping, tax preparation and & filing, as well as typical accounting assistance for individuals and also area businesses. Horry county collects, on average, 0.41% of a property's assessed fair market value as property tax.

Select an address below to search who owns that property on eureka. Accountant· tax preparation service· legal service. Hyacinth dr, longs, sc, 29568.

The average property tax on eureka trail is $135/yr. Laura briggs is 67 years old and was born on 11/25/1953. We found 23 addresses and 23 properties on hyacinth drive in longs, sc.

The south carolina state sales tax rate is 6%, and the average sc sales tax after local surtaxes is 7.13%. Get reviews, hours, directions, coupons and more for laura baez income tax at 2126 highway 9 e ste g8, longs, sc 29568. In the past, laura has also been known as laura b briggs, laura b wheeler and laura l briggs.

Individual income tax south carolina has a simplified income tax structure which follows the federal income tax laws. The latest sales tax rates for cities in south carolina (sc) state. Laura baez income tax 2126 highway 9.

This publication contains information for south carolina’s main state and local taxes. 4309 peck road, suite 3 el monte, ca 91732 Search for other bookkeeping in longs on the real yellow pages®.

See all cities for financial in south carolina. Exact tax amount may vary for different items. The fees amount to $1.85 per $500, based on the amount that the property sold for.

Get reviews, hours, directions, coupons and more for laura baez income tax at 2126 highway 9 e ste g8, longs, sc 29568. South carolina has a 6% sales tax and horry county collects an additional n/a, so the minimum sales tax rate in horry county is 6% (not including any city or special district taxes). Individual income tax rates range from 0% to a top rate of 7% on taxable income.

The median property tax in horry county, south carolina is $696 per year for a home worth the median value of $170,100. We found 14 addresses and 14 properties on eureka trail in longs, sc. Tax services in longs on yp.com.

South carolina has a simplified income tax structure which follows the federal income tax laws. Of time, you may have questions about south carolina’s tax structure. Previous to laura's current city of longs, sc, laura briggs lived in millbrook ny.

Description for 166 junco circle longs, sc 29568. Click here for accounting firms located in longs, south carolina. The average price for real estate on eureka trail is $81,497.

2020 rates included for use while preparing your income tax deduction. The us average is 4.6%. South carolina is ranked 2052nd of the 3143 counties in the united states, in order of the median amount of property taxes collected.

We've listed the top ten (based on number of businesses) above. Eureka trl, longs, sc, 29568. This 3 bedroom, 2 full bathrooms has an open area feeling.

Located in longs,south carolina and providing service to the greater myrtle beach, sc metropolitan area, their establishment resides in horry county and has approximately 2 employees. See reviews, photos, directions, phone numbers and more for the best tax return preparation in longs, sc. South carolina accepts the adjustments, exemptions and deductions allowed on your federal tax return with few modifications.

How much are transfer taxes in south carolina? The ucpaa works to connect consumers to skilled cpas all over the country. A bright and open floor plan.

Address, phone number, fax number, and hours for horry county tax collector's office, a treasurer & tax collector office, at 2nd avenue, conway sc. Groceries and prescription drugs are exempt from the south carolina sales tax. The average price for real estate on hyacinth drive is $143,927.

The average household income in the hyacinth drive area is $58,540. Sometimes laura goes by various nicknames including laura wilson burns, laura m wilson, laura w burns and laura marie wilson. Although real estate transfer taxes are collected by your respective county, the rates remain constant throughout the state.

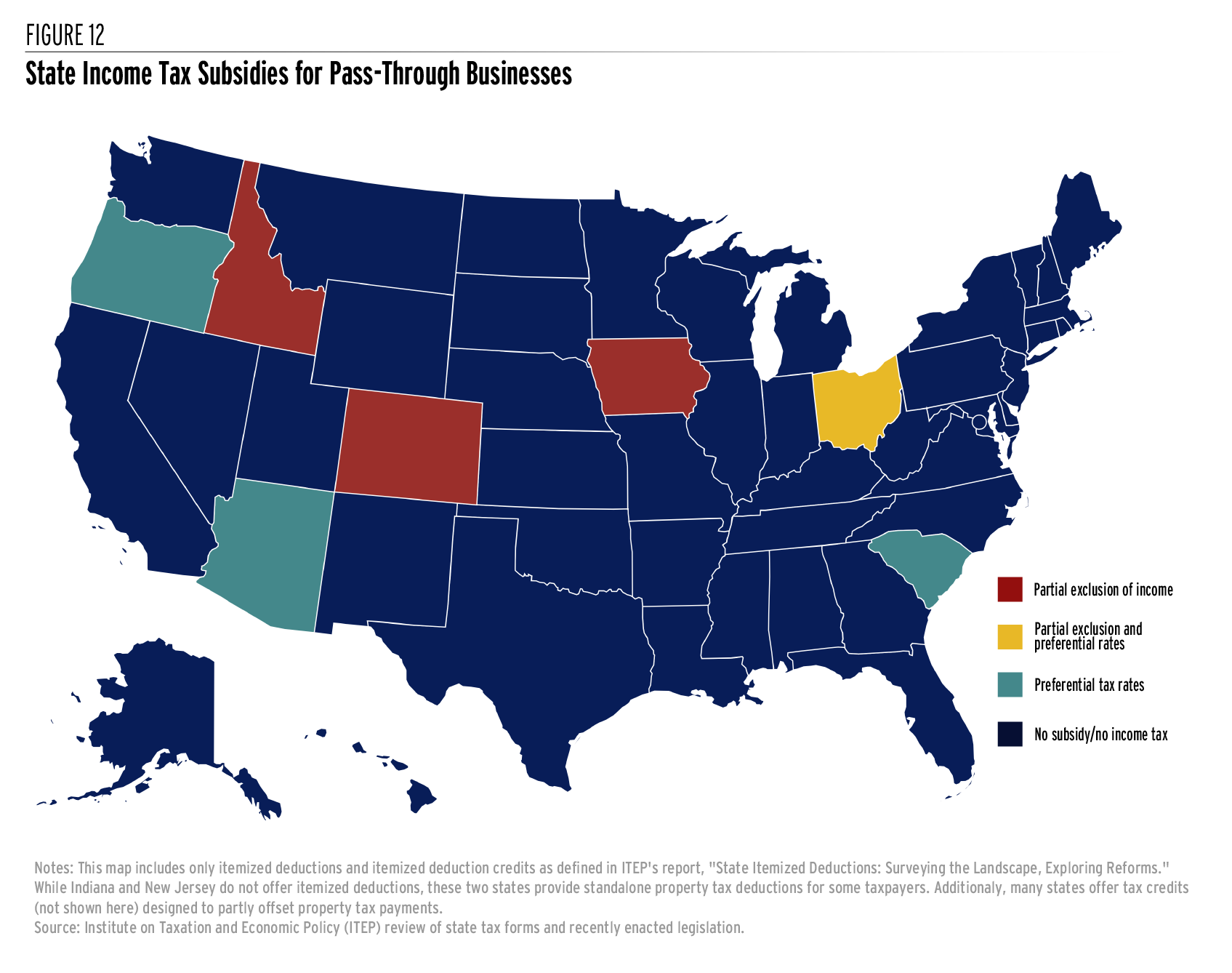

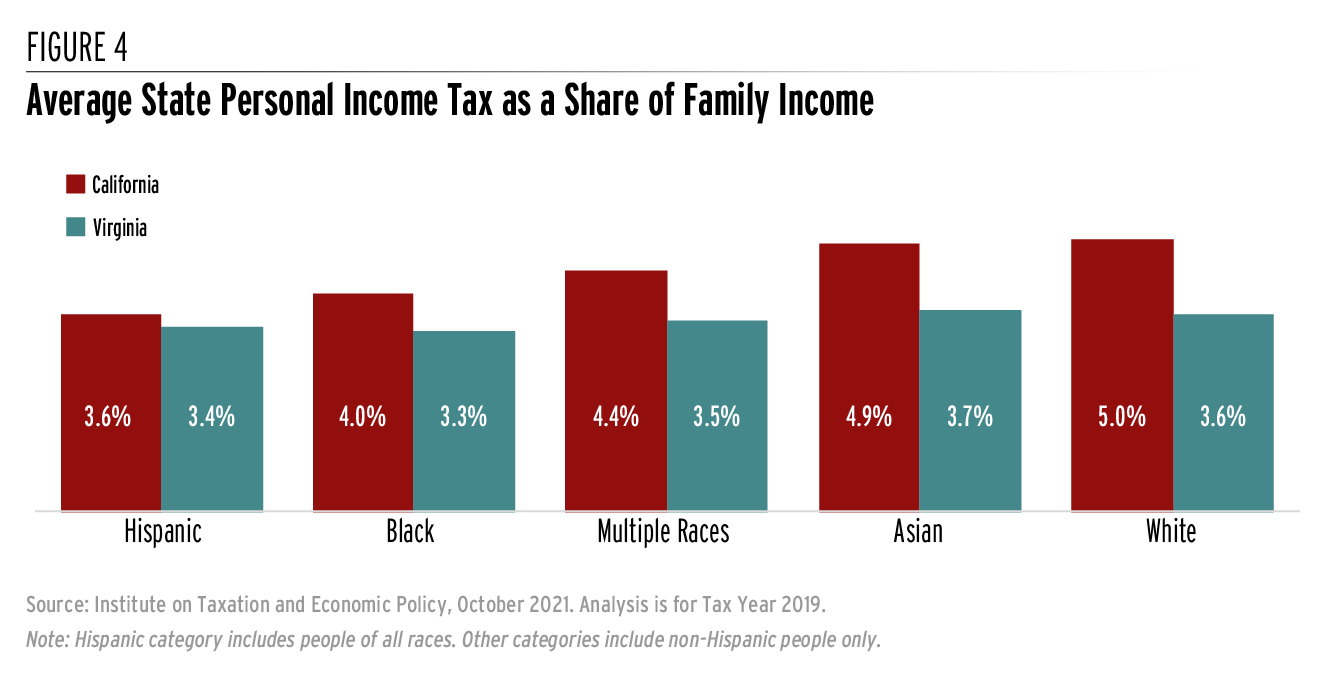

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Trinas Income Tax Service - Home Facebook

Laura Baez Income Tax - Home Facebook

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

The 7 States With No Income Tax What To Know Credit Karma Tax

Laura Baez Income Tax - Home Facebook

Rental Property Owner Management Kit Rental Owner Printable Etsy Being A Landlord Rental Property Management Rental Property

How To Get Organized Using An Income Tax Binder Income Tax Business Tax Tax Help

Laura Baez Income Tax - Home Facebook

Trinas Income Tax Service - Home Facebook

Pin On Old Abandoned Forgotten

Laura Baez Income Tax - Home Facebook

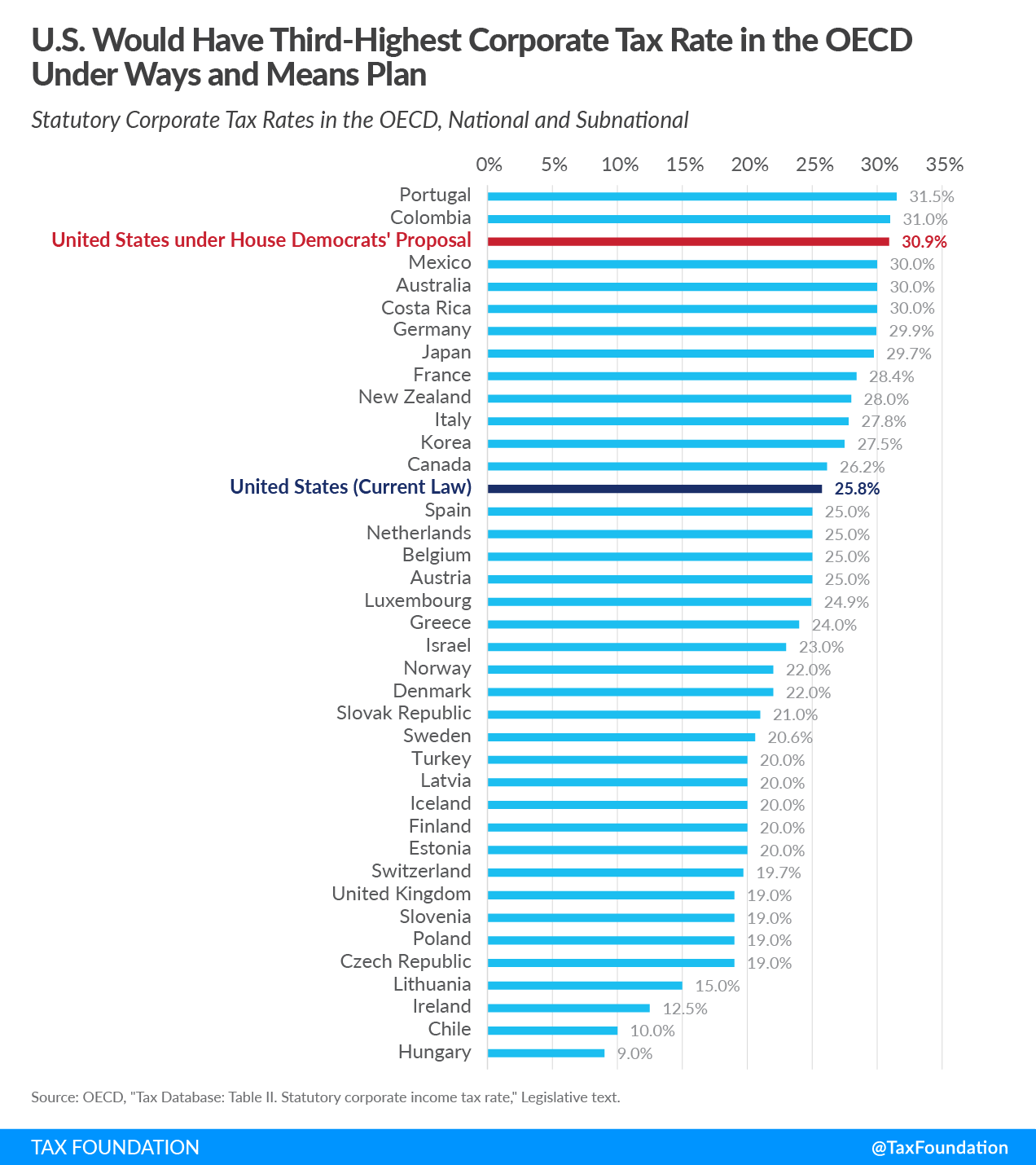

Joint Economic Committee Tax Hearing Build Back Better Revenue Items

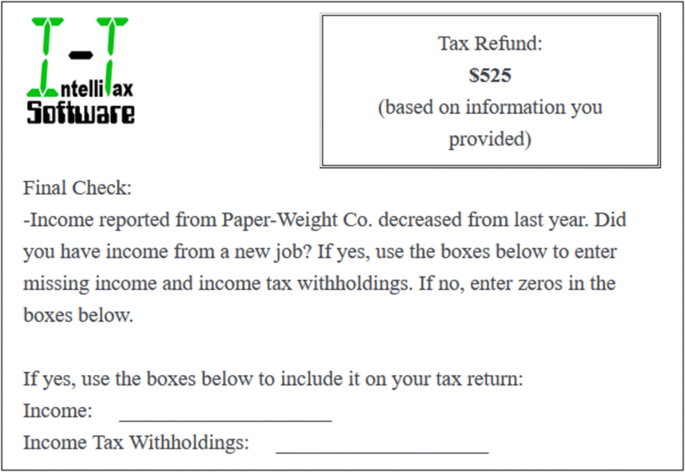

Are Individuals More Willing To Lie To A Computer Or A Human Evidence From A Tax Compliance Setting Springerlink

Laura Baez Income Tax - Home Facebook

Laura Baez Income Tax - Home Facebook

Pin On News 2018 Various News Articles 2018

Joint Economic Committee Tax Hearing Build Back Better Revenue Items

Finding The Perfect Rental Apartment Decorating For Couples Renting A House Apartment

Comments

Post a Comment