Search all services we offer. Eglin parkway, suite 100 shalimar, fl 32579.

Shalimar

Our highest priority is the safety of our employees and the public.

Okaloosa county tax collector shalimar. 302 north wilson street, suite 101. It also applies to structural additions to mobile homes. Contact the okaloosa county property appraiser's office for more information on homestead exemption) vehicle titles expand to transfer a florida title, the seller must complete the transfer information on the current original title, including the purchaser's name, the selling price, and the odometer reading at.

Okaloosa tax lien sale site. Search for other county & parish government in shalimar on the real yellow pages®. Yesterday at 7:00 am ·.

It is the job of the tax collector to mail the tax notices on or before november 1st of. 1 review of okaloosa county tax collector hurry up and wait! 100.041(4)] supervisor of election's offices buddy brackin bldg.

Okaloosa county tax collector p.o. Property appraiser real estate tax estimator. In order to remove the lien, the property owner must pay the tax collector all delinquent taxes plus accrued interest, penalties and advertising fees.

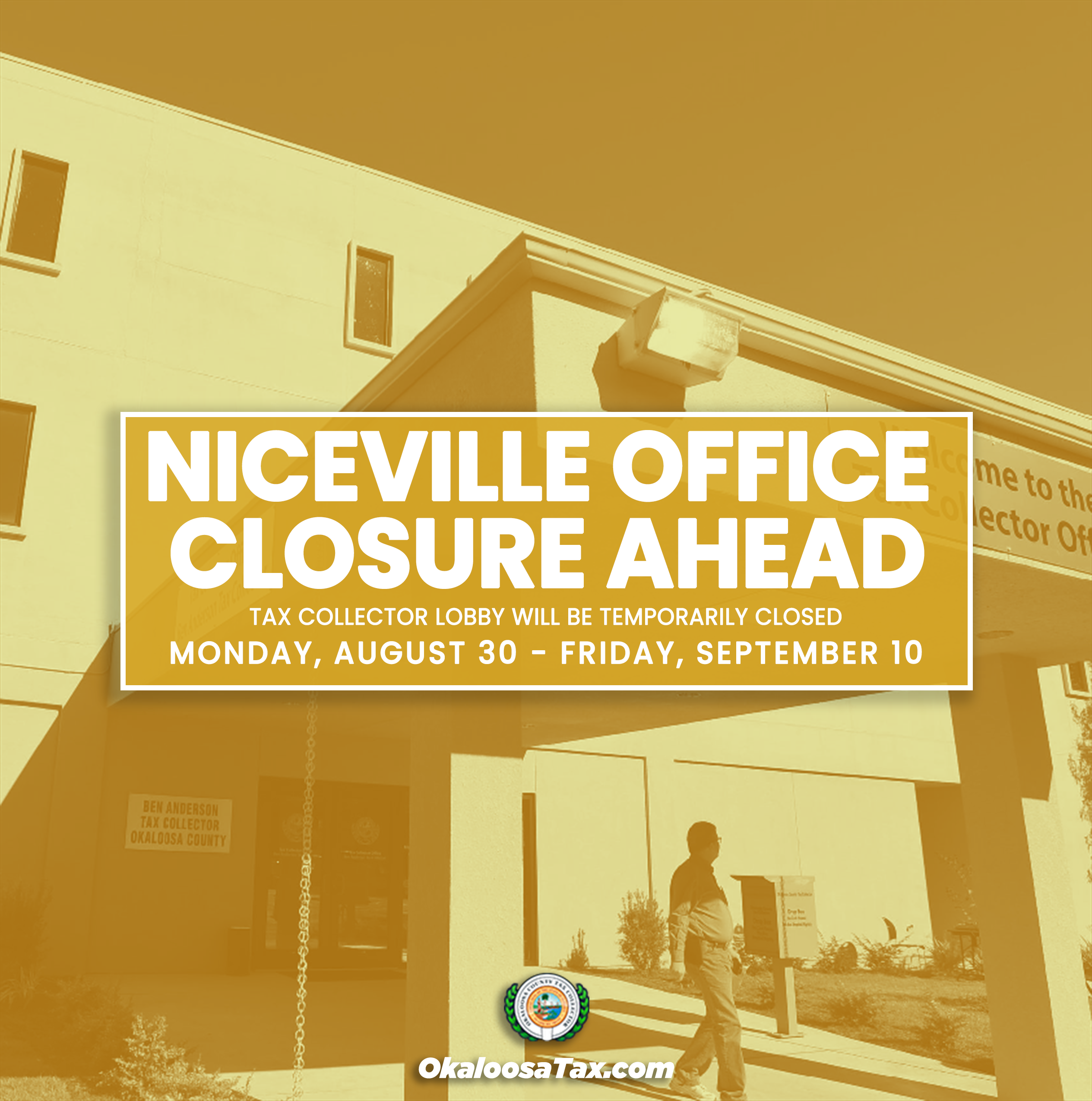

Passport services in their shalimar branch office. Get reviews, hours, directions, coupons and more for okaloosa county tax collector at 1250 n eglin pkwy, shalimar, fl 32579. Scheduled appointments for this week, in these two locations, are canceled.

The property appraiser’s office assesses the value of tangible personal property and presents a certified tax roll to the tax collector. The tax collector then notifies and issues a redemption payment to the certificate holder. It makes you want to run far, far away to a beautiful mountain with a sunset and lots of friendly forest creatures.

You're corralled in like cattle. In florida, okaloosa county is ranked 36th of 67 counties in treasurer & tax collector offices per capita, and 15th of 67. Type of business business address make checks payable to:

A tax certificate, when purchased, becomes an enforceable first lien against the real estate property. Wilson st., suite 102 1250 eglin parkway, suite 103. Okaloosa tax collector shalimar 302 n.

Take office the first tuesday after the first monday in january following the election. We will be closing early on wednesday, nov 24th at 2 pm with driver license services ending at 12:30 pm for that day. We will also be closed on thursday the 25th and friday the 26th in observance of the thanksgiving holiday.

👍 there are no additional fees when you pay by echeck! Okaloosa county tax collector ben anderson okaloosa county local business tax receipt state of florida receipt no. The statutory deadline for filing an application for all exemptions, including homestead exemption for the 2022 tax year, is march 1, 2022.

Okaloosa county tax collector government administration shalimar, fl 1,576 followers the tax collector is a separate and independent government entity to. 📬 property tax bills will be arriving this week! 🌐 on our website okaloosatax.com you can pull up your bill, pay it and print your receipt.

Click on the links below to download the corresponding shapefiles. Eglin parkway, suite 100 shalimar, fl 32579. 👍 you will receive a 4% discount when you pay in the month of november!

Quick and friendly service was provided. Renew vehicle registration search and pay property tax search and pay business tax apply for business tax account edit business tax account run a business tax report run a real estate report get bills by email The gis data for the okaloosa county property appraiser is updated on monday morning of each week and uploaded directly to the okaloosa county gis department’s ftp server.

Box 9, shalimar, fl 32579 total collection cost penalty amount original tax transfer new business renewal supplemental Bannerphoto2 bannerphoto1 bannerphoto3 bannerphoto4 bannerphoto5. There are 4 treasurer & tax collector offices in okaloosa county, florida, serving a population of 197,591 people in an area of 931 square miles.there is 1 treasurer & tax collector office per 49,397 people, and 1 treasurer & tax collector office per 232 square miles.

I hope you like computerized voices and fluorescent lighting. Term of office is four years. The okaloosa county tax collector’s office is now offering u.s.

The okaloosa county property appraiser’s office is accepting exemption applications for the 2022 tax year. Passport services currently offered include original application and photo processing.

How To Get To Shalimar Fl In Shalimar By Bus

Okaloosa County Tax Collector - Tax Cert Workshop Shalimar Facebook

Okaloosa County Florida - Wikipedia

Shalimar

Okaloosa County Tax Collector Official Site Serving You

Okaloosa County Administration Building

Okaloosa County Tax Collector Official Site Serving You

Okaloosa County Tax Collector - Request Consultation - Tax Services - 1250 N Eglin Pkwy Shalimar Fl - Phone Number

Passport Services Now Available In Shalimar

Home Page

Okaloosa County Tax Collector - Covid-19 Update The Okaloosa County Tax Collector Branch Locations In Shalimar And Niceville Will Be Closed July 6-10 Due To Exposure To Individuals Who Have Tested

Okaloosa County Administration Building

Okaloosa County Tax Collector Issues Scam Warning Holt Enterprise News

Okaloosa County Florida Property Owners Can Get Tax Bill Discount

Locations

Registrations - Taxsys - Okaloosa County Tax Collector

Home Page

Coronavirus Okaloosa Tax Collector Offices Are Now Closed To The Public

Gis Contact Us Okaloosa County

Comments

Post a Comment