While the pa department of revenue and the irs announced. Tax collectors elected for a 4 year term:

Instructions - Berkheimer Tax Administrator

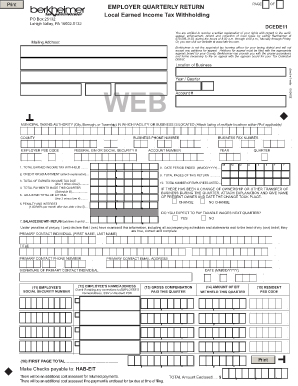

Within 30 days after the end of each month, the employer must electronically remit withheld taxes and employee information to a single tax collector/officer where the.

Pa local tax deadline 2021 berkheimer. We are pennsylvania's most trusted tax administrator. Payments not made on or before april 30, 2021 will not be eligible for the. Pennsylvania has extended its personal income tax deadline, to may 17, 2021 to coordinate with the extended federal tax return deadline.

Of revenue (pdor) state law requires that the pa and federal tax due dates be tied together. Harrisburg, pa — pennsylvania collected $6.6 billion in general fund revenue in november, which was $217.9 million, or 3.4 percent, more than anticipa. Important—there has been a change in the way active duty military pay is taxed for 2012—this is per act 32 guidelines:

Berkheimer tax administration collects the following taxes for butler township: All berkheimer offices statewide will be closed to the public until further notice. The pandemic changed a lot of things, including the tax deadline which would normally be april 15.

2021 real estate tax bill due dates: Sign up to receive reminder emails; 11 rows berkheimer tax administrator:

We are the trusted partner for 32 tcds and provide services to help individuals, employers,. Local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest and/or penalties for local tax filings and payments that are made on or before may 17, 2021, which is the extension for filing. A statement on the extension can be found on the home page of the berkheimer website.

Dced lacks the legal authority to extend the statutory local filing and payment deadline of april 15. Local earned income tax reminder notice faq your browser does not have javascript enabled. According to the pa dept.

The collection of this tax is handled by berkheimer associates. We specialize in all pennsylvania act 32 and act 50 tax administration services. The last day for discount period payments for 2021 county and township real estate tax will be on friday april 30, 2021.

If you expect to make less than $12,000 in a year, you can file for an exemption with your employer. The city of meadville on thursday said berkheimer tax administrator, the collector for the meadville and crawford central school district,. This site requires javascript for some of its features and navigation.

Important changes regarding any of the taxes we administer. Keystone collections said today, the local earned income tax filing deadline has not been extended beyond the april 15, 2021 due date. Residents of springfield township and nonresidents working in the township are subject to the tax, which is assessed on earned income.

Per capita tax, real estate / property tax, utility bills are being mailed. Berkheimer tax administrator, the township's contracted tax collector, has extended the filing date for local taxes to july 15, 2020, matching the state and federal extension. The deadline for filing your local tax returns has not.

Deadline to file local taxes is unchanged, but fees will be waived for another month. The rate is 1% of earned income, with half going to the school district and half remaining with the township to provide municipal services. Revenue department releases november 2021 collections.

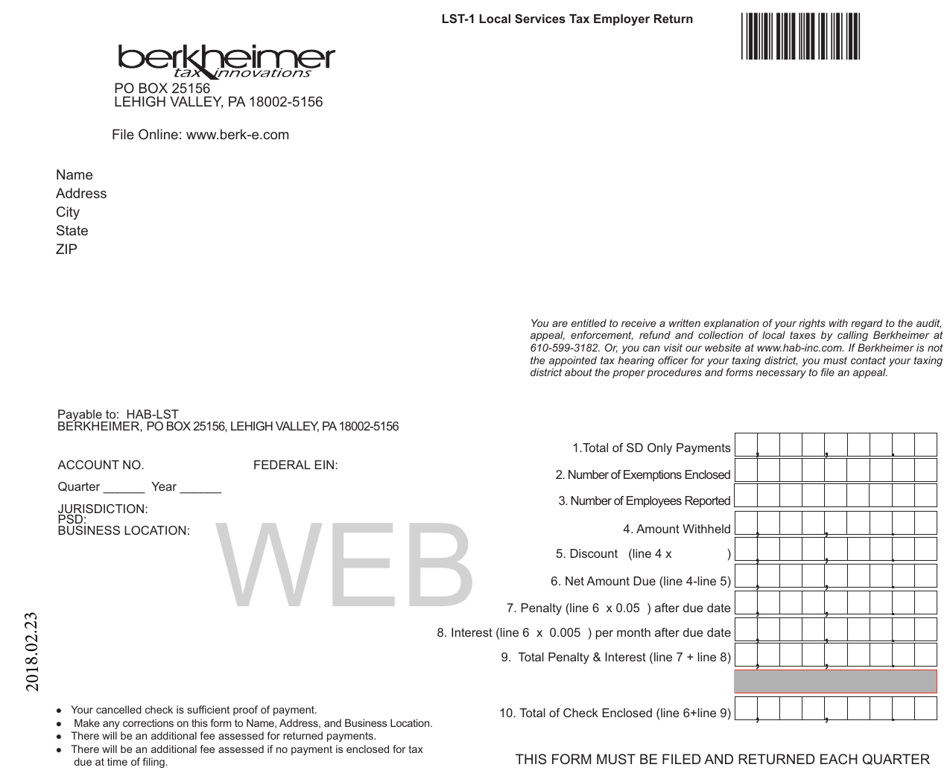

There is an exemption from the earned income tax for any individual earning less than $5,000 annually. April 15 remains the deadline for paying local earned income taxes, but the city of meadville will not impose any additional fees. Lst is collected by your employer via payroll withholding and remitted to berkheimer tax administrator.

Has issued an emergency declaration that extends the deadline for filing city income taxes until may 17, 2021 to coincide with the extended federal and state income tax deadlines.

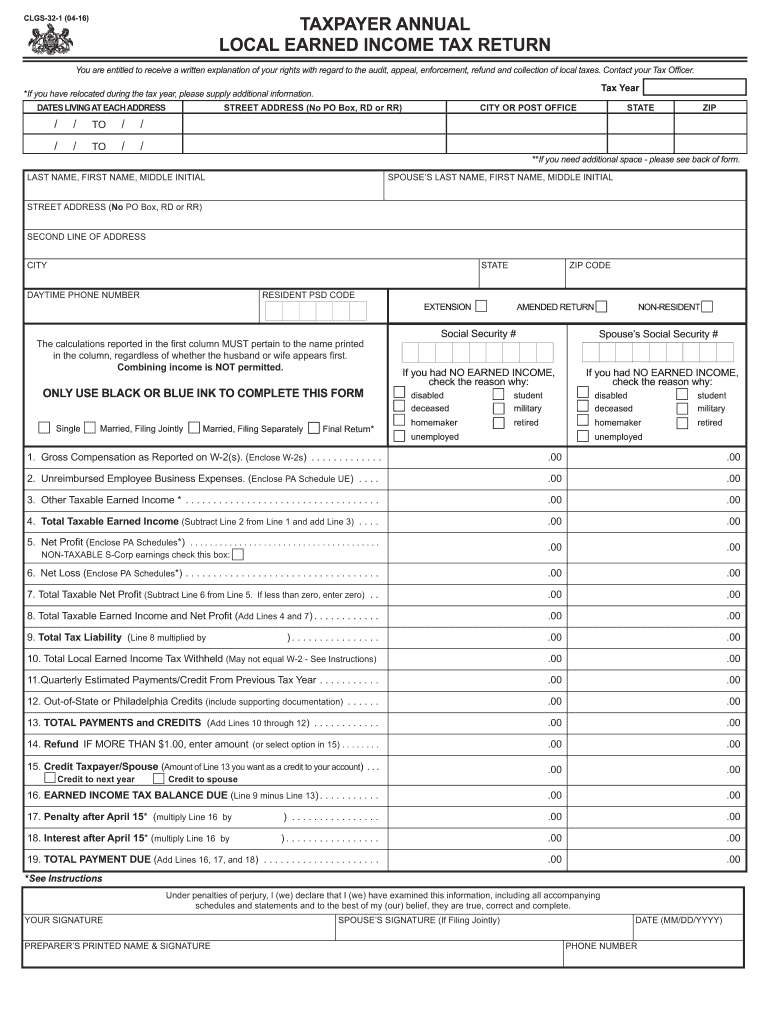

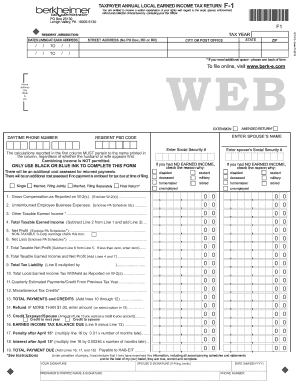

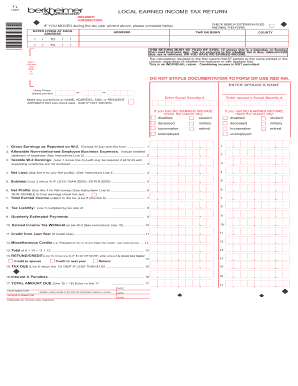

Pa Berkheimer Tax Form - Fill Out And Sign Printable Pdf Template Signnow

Berkheimer Tax Administrator Forms Pdf Templates Download Fill And Print For Free Templateroller

Berkheimer Pa Tax Administration Services

Fillable Online Borough Emmaus Pa Earned Income Tax For Emmaus Form Fax Email Print - Pdffiller

Berkheimer Pa Tax Administration Services

Berkheimer Lehigh Valley Pa - Fill Online Printable Fillable Blank Pdffiller

Lehigh Valley Pennsylvania Business Privilege Andor Mercantile Tax License Form Download Printable Pdf Templateroller

Why Do Local Taxes Always Have Terrible References To Your W-2 - Personal Finance Money Stack Exchange

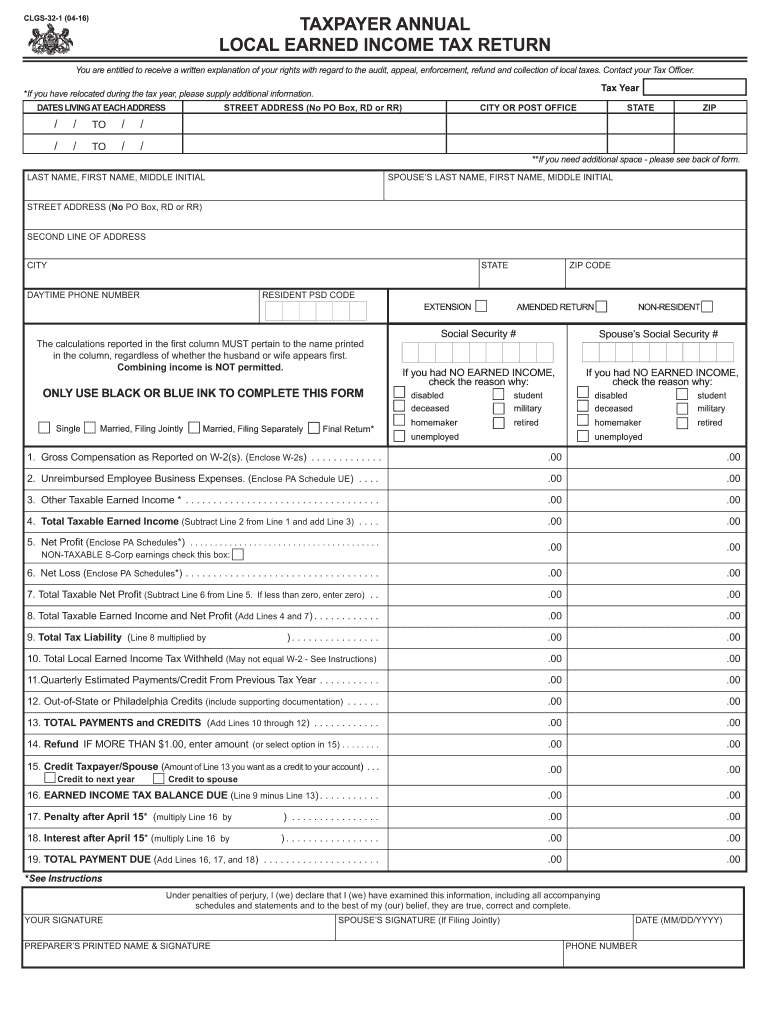

Pa Local Earned Income Tax Return - Fill Out Tax Template Online Us Legal Forms

Form Lst-1 Download Fillable Pdf Or Fill Online Local Services Tax Employer Return Pennsylvania Templateroller

Local Tax Form - Fill Out And Sign Printable Pdf Template Signnow

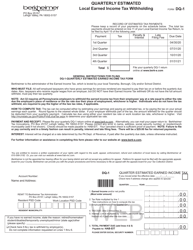

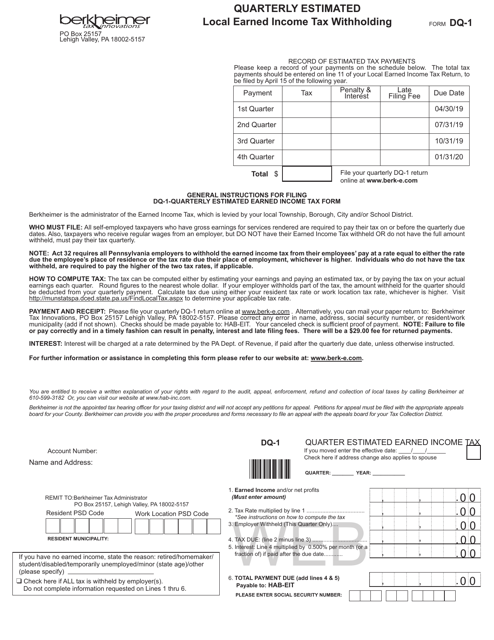

Form Dq-1 Download Fillable Pdf Or Fill Online Quarterly Estimated Local Earned Income Tax Withholding Pennsylvania Templateroller

Berkheimer Pa Tax Administration Services

Berkheimer And Keystone

Berkheimer Pa Tax Administration Services

Pa Taxes Local Filing Date April 15 But Fees Will Be Waived For A Month

Berkheimer Pa Tax Administration Services

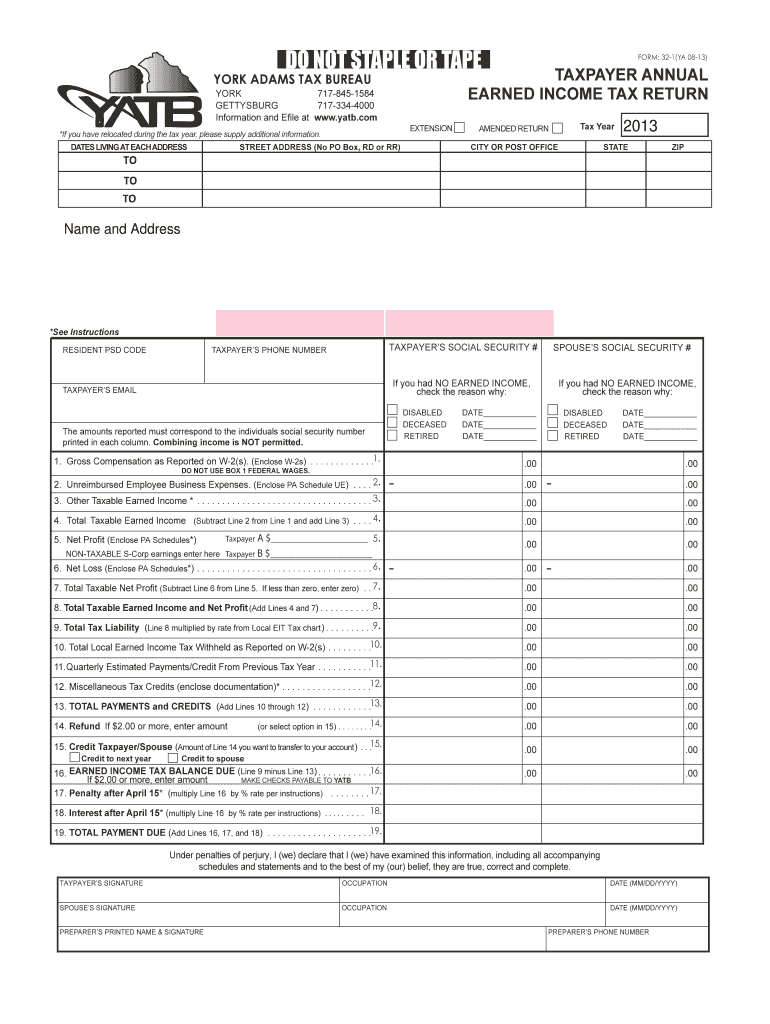

Pa Yatb 32-1 2013-2021 - Fill Out Tax Template Online Us Legal Forms

Berkheimer Tax Innovations - Psba

Comments

Post a Comment