The estate tax exemption for 2020 is $11.58 million per decedent, up from $11.4 million in 2019. For 2019, the exemption has been adjusted for inflation to $11.4 million per taxpayer, and $22.8 million per married couple.

New Federal Estate Tax Exemption Amount 2021 Opelon Llp- A Trust Estate Planning And Probate Law Firm

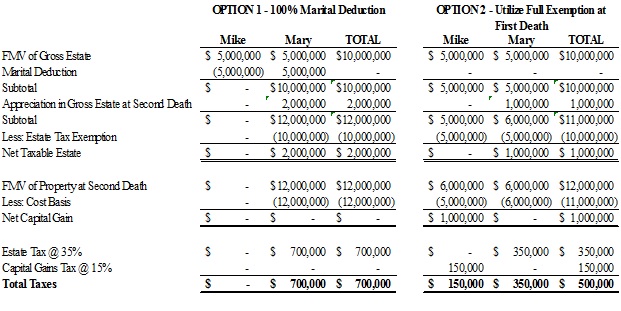

After all, electing “portability” could mean that a surviving spouse could have double the estate tax exemption at the second death (currently $5,430,000 x 2 = $10,860,000).

Portability of estate tax exemption 2020. As of 2021, the federal estate tax exemption is $11.4 million. The estate tax only applies to transfers made. In effect, portability increases the 2nd to die’s exemption by the unused.

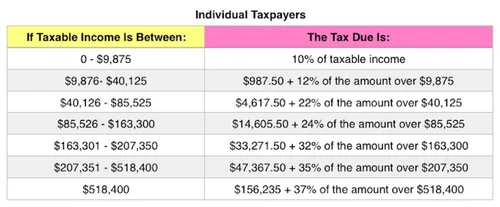

For individuals passing away in 2017, the estate tax is the tax applicable to any amount in the decedent‘s estate over the federal estate tax exemption of $5.49 million per person. The irs has announced that for 2021 the federal estate tax exemption will be $11.7 million per individual, up from $11.58 million per individual in 2020. The irs increases the federal estate tax exemption each year to account for inflation.

Estate tax portability allows the executor of an estate to exercise the option on behalf of the deceased’s spouse, to allow that spouse to use any available estate tax exemption amount that hasn’t yet been used at the time of the taxpayer’s death. The federal estate tax exemption will allow you to avoid some taxation as the exemption amount is subtracted from the value of the estate and only the remaining amount will be subject to the federal estate tax. That means that if you have less than that amount saved up in your estate when you die, your estate will owe no taxes.

Individuals currently have an estate tax exemption of $11,580,000 (in 2020). How does the portable estate tax exemption work? Since in 2015 the federal estate tax exemption is $5.43 million per person (the exemption changes every year since it is indexed for inflation), this means that a married couple can.

On top of this generous amount, the irs also allows for portability of the exemption between. While most states don’t have an estate tax, some do. The tax for the estate would be $568,000 at a 40% tax rate.

Estates valued above the threshold may be taxed on a graduated scale of up to 40 percent. The 2020 increases to the estate tax exemption also impact the portability of the exclusion from a deceased spouse to their surviving spouse. Hawaii and maryland are two of the few states that allow portability of their state estate tax exemption.

This is the amount a person can leave their heirs without paying federal estate taxes, and which is. In order for the surviving spouse to pick up and use the unused exemption of the deceased spouse, the deceased spouse’s estate has to file a federal estate tax return that makes an election to allow the surviving spouse to use that exemption. As previously discussed, “portability” refers to a spouse’s ability to claim unused exclusion amounts from the spouse who died.

Portability of estate tax exemption on behalf of griffin & van pelt, p.a. The tcja doubled the estate and gift tax lifetime exemption, from $5.49 million per taxpayer to $11.18 million per taxpayer. The need for splitting the estate into “marital” and “credit shelter” portions at the first death would be eliminated.

The “portability” rules provide for the transfer of a deceased spouse’s unused estate tax exemption (“deceased spousal unused exclusion amount” or “dsuea”) to a surviving spouse (without inflation adjustments). When mark dies in 2020, he is able to take advantage of the estate portability rules which means he gets the federal tax exemption that joan didn’t use ($11.4 million) plus his $11.4 million. If the estate representative did not file an estate tax return within nine months after the decedent's date of death, or within fifteen months of the decedent's date of death (if a six month extension of time for filing the estate tax return had been obtained), the availability of an extension of time to elect portability of the dsue amount depends on whether the estate has a filing requirement, based on the filing.

However, by applying for portability of the first to die’s unused exemption when he/she passes away, the surviving spouse can use the $9,580,000 unused exemption amount plus their $11,580,000 exemption amount to make the $568,000 tax go away. Importantly, portability is not automatic. Most people, unless they are very wealthy, don't use.

The estate tax exemption available at the decedent’s death is reduced by any amount of gift tax exemption that is used during the decedent’s. Portability is a federal exemption. The federal estate tax exemption is, however, indexed for inflation and does, therefore increase about every year or so.

Thus, if a 2020 decedent’s taxable estate is not more than $11,580,000, the dsuea | may 1, 2020 | estate taxes | many of you already know that under the 2010 tax act surviving spouses can take advantage of their deceased spouse’s unused federal estate tax exemption. The “portability election” refers to the right of a surviving spouse to claim the unused portion of the federal estate tax exemption of their deceased spouse and add it to the balance of their own exemption.

Atra includes a unified estate and gift tax exemption which means an individual can pass $11.58 million (2020) worth of assets to someone other than their spouse without a federal estate or gift tax, and a married couple can shelter up to $23.16 million of their estate. The portability of the federal estate tax exemption for married couples eliminated the need to plan in such a way. Since the testate is still worth $20 million, he can pass down his estate to his heirs without incurring any taxes.

The portability of a deceased spouse’s unused estate tax exemption is an important concept and is even more so in 2020, which is a pivotal year in so. The portability feature means that when one spouse dies and his or her estate value does not use up to the total available estate tax exemption, the unused portion of the estate tax exemption is then added to the available estate tax exemption for the surviving spouse. How does the federal estate tax exemption work?

Portability of estate tax exemption. In 2019, the federal estate tax exemption was at $11.4 million.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/senior-couple-outdoors-together-557921553-578501e63df78c1e1f3fc024.jpg)

The Portability Of The Estate Tax Exemption

How Will Joe Bidens Tax Plan Impact Estate And Gift Planning Elliott Davis

Understanding Qualified Domestic Trusts And Portability

Federal Estate Tax Portability - The Pollock Firm Llc

Dont Forget About Making A Portability Election Capell Howard Pc

Exploring The Estate Tax Part 2 - Journal Of Accountancy

Irs Increases 2020 Estate Tax Exemption Postic Bates Pc

Rbcwm-usacom

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Mastering Portability - Ultimate Estate Planner

Portability Of The Estate Tax Exemption - Cdh Law Pllc

Estate Planning In Uncertain Times May 27 2020

2020 Updates On The Estate Tax Exemption

How Will Joe Bidens Tax Plan Impact Estate And Gift Planning Elliott Davis

How Do The Estate Gift And Generation-skipping Transfer Taxes Work Tax Policy Center

Portability Of Estate Tax Exemption Revolution Law Group

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Exploring The Estate Tax Part 1 - Journal Of Accountancy

Comments

Post a Comment