What does a remote tax preparer do? Remote job for candidate who will research tax compliance questions, analyze and prepare data for income tax returns, prepare tax analysis schedules, and process the tax department's schedules.

10 Companies Hiring For Remote Cpa Jobs This Tax Season

New remote tax preparer careers are added daily on simplyhired.com.

Remote tax jobs usa. 336 remote tax preparer jobs. 1,127 remote tax accountant jobs available. There are over 362 remote tax preparer careers waiting for you to apply!

Apply to tax preparer, tax professional, tax manager and more! For remote workers in the u.s., physical location remains the determining factor for which taxes workers pay. 362 remote tax preparer jobs available.

Tax accountant, tax advisor, tax preparer, remote accounting. Remote working tax jobs, usa tax jobs. Discover our new ways of working at pwc.

Remote tax lead, bdo business service center bdo usa, llp columbus, oh just now be among the first 25 applicants There are over 1,127 remote tax accountant careers waiting for you to apply! 15,271 remote tax jobs available on indeed.com.

Apply securely with indeed resume. Apply to tax preparer, tax professional, tax manager and more! Every country in the world operates under its own tax code.

We are looking for an individual who desires to develop extended skills in us taxation and us tax compliance in. Become the transformative leader the world needs. At etaxjobs we think that remote working has worked well within the tax market, with many tax partners and heads of tax being surprised at how efficient and smooth the process can be.

Click on the details/apply button next to each job to see the full posting, or check the boxes next to the jobs that interest you and click view selected to see several jobs together. Temporary, remote/work from home position. You can harness technology and scale to continuously innovate and learn.

Tax specialist, us enrolled agent. 206 remote tax preparation jobs in united states (5 new) remote experienced tax preparer remote experienced tax preparer You may also add one or more jobs to your wish list by clicking on the check boxes next to them and then clicking add to wish list.

Your responsibilities in this career are to ensure that all paperwork is accurate and that your client gets the best possible returns. We’ve introduced a hybrid work model with three ways of working: Two to four years' tax /accounting experience required.

View job description, responsibilities and qualifications. New remote tax accountant careers are added daily on simplyhired.com. Associate or senior associate, business tax services.

Remote worker taxes outside the united states. 19,343 tax remote jobs available on indeed.com. We provide the scale, the technology, the teams, the challenges, the learning and the relationships for you to personalize and evolve your career.

Busy accounting and tax office seeking an experienced tax preparer to join our growing team. We therefore expect that most firms will offer some sort of. Associate / senior associate, m&a tax.

See salaries, compare reviews, easily apply, and get hired. See salaries, compare reviews, easily apply, and get hired. Allowing some remote and flex schedules.….

Search 5,065 us tax jobs now available on indeed.com, the world's largest job site. At ey, your career in tax is truly yours to build.

13 Companies That Hire For Remote Accounting Jobs Flexjobs

10 Companies Hiring For Remote Cpa Jobs This Tax Season

25 Best Work From Home Jobs For 2021 Make 50hour Remotely

Tax Implications For Hiring Remote Workers

Here Are Tax Issues To Know If You Will Work Remotely Permanently

What Is A Remote Job Flexjobs

10 Companies Hiring For Remote Cpa Jobs This Tax Season

Understanding Taxes And Contracts - The Remote Job Guide

28000 Tax Consultant Jobs In United States 1078 New

18 Work-from-home Jobs That Are Currently Hiring

10 Companies Hiring For Remote Cpa Jobs This Tax Season

/cdn.vox-cdn.com/uploads/chorus_asset/file/22411016/GettyImages_1224754012.jpg)

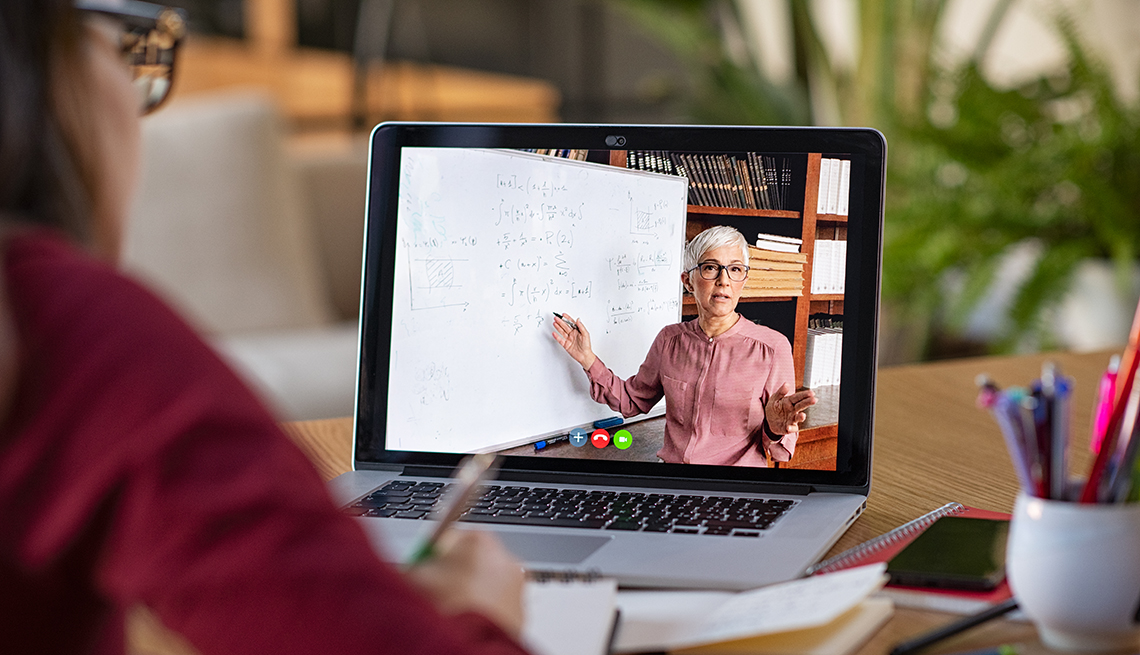

How Do Taxes Work For Remote Workers Its Complicated - Vox

Remote Tax Reviewer - Project Jobs Immediately Available At Paro

Dash Employment Solutions Llc Remote Tax Preparer Usa Only Smartrecruiters

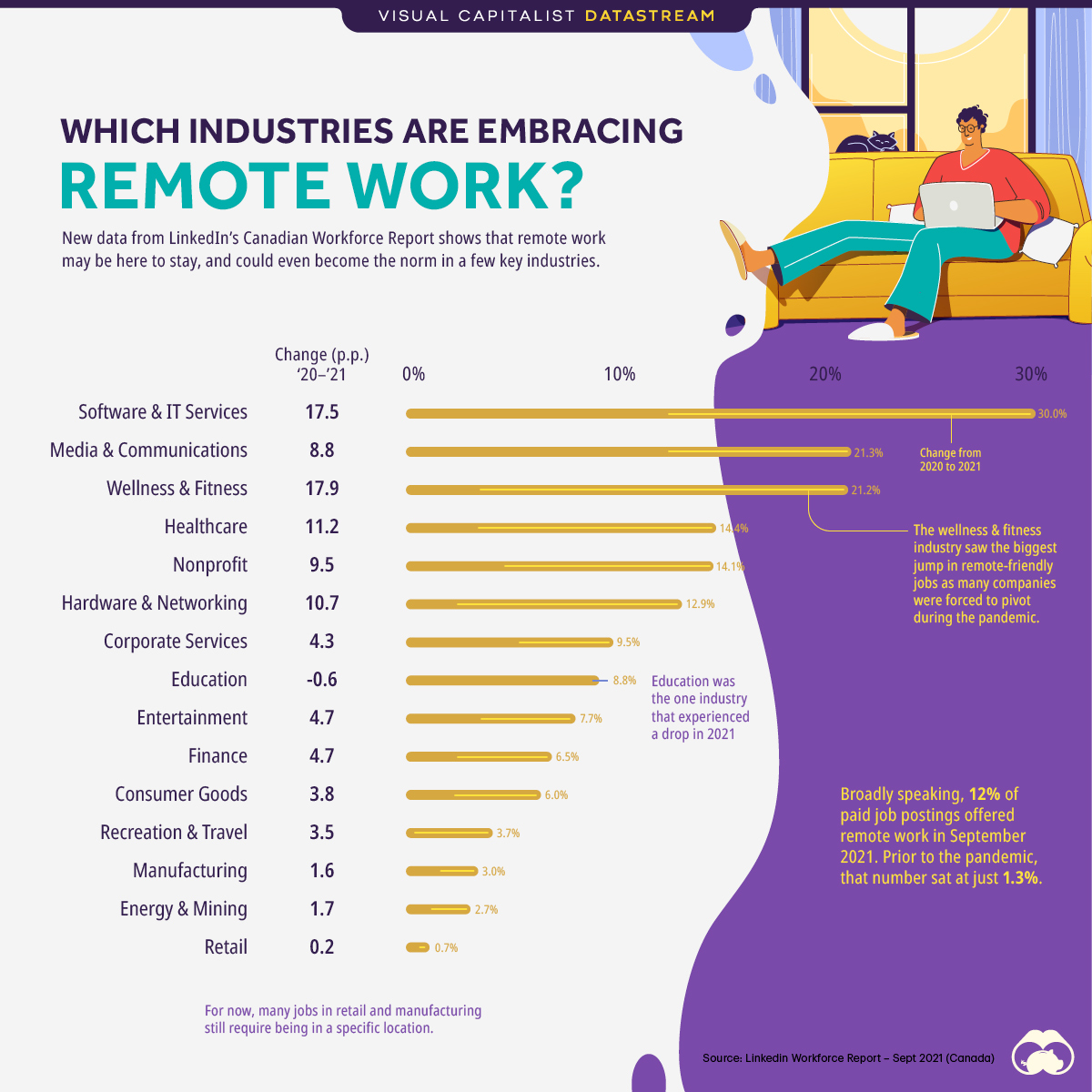

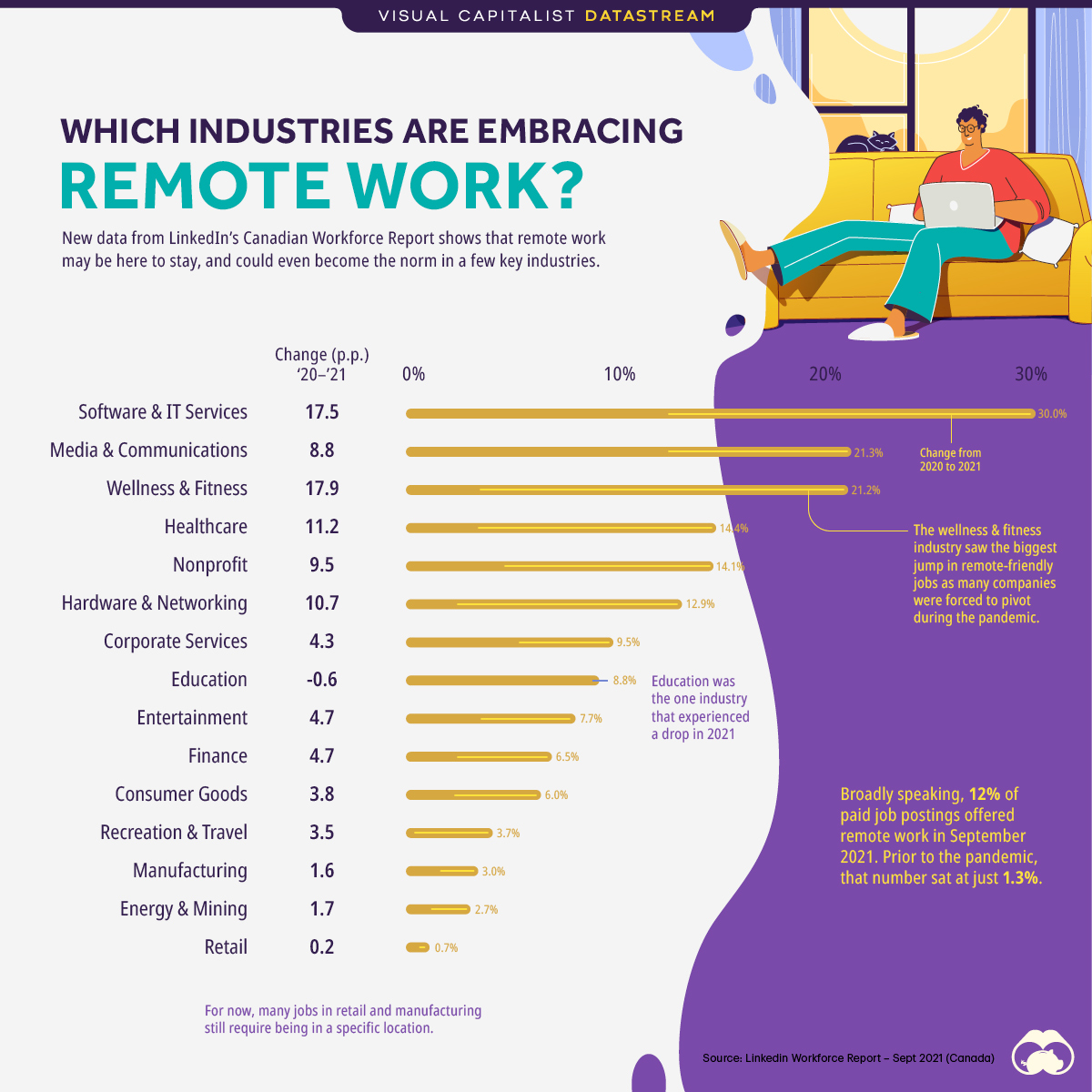

Charting The Continued Rise Of Remote Jobs

The Secret To Landing A Remote Job And Who Is Hiring Right Now

10 Companies Hiring For Remote Cpa Jobs This Tax Season

Usa H1b Salary - Working From Canada India Remotely Travel Ban - Usa

Remote Workers May Want To Check Their 2021 Tax Situation

Comments

Post a Comment