The sales tax jurisdiction name is san antonio atd transit, which may refer to a local government division. 1568 rows combined with the state sales tax, the highest sales tax rate in texas is 8.25% in.

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Start yours with a template!.

San antonio sales tax rate 2021. Method to calculate san bernardino sales tax in 2021. Texas has recent rate changes (thu jul 01 2021). It was lowered 1.5% from 8.25% to 6.75% in february 2021.

As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. Please refer to the texas website for more sales taxes information. The sales tax jurisdiction name is san antonio atd transit, which may refer to a local government division.

These tax rates are then applied to the values (less any exemptions) certified by the chief appraiser on the unit's appraisal roll to calculate the levy (tax) for the year. Revenue growth beyond fy 2022 is forecasted at rates of 3.0% in fy 2023, 3.2% in fy 2024, 2.9% in fy 2025, and 2.8% in fy 2026. The minimum combined 2021 sales tax rate for san antonio, texas is.

Let more people find you online. 6.25% is the smallest possible tax rate (, texas) 6.3%, 6.5%, 6.75%, 7%, 7.25%, 7.5%, 7.75%, 8%, 8.125% are all the other possible sales tax rates of texas. 2020 actual tax rates / 2021 actual tax rates (as of 10/12/2021) tax rates bexar county city of san antonio incorporated cities school districts

Start yours with a template!. 0.250% san antonio atd (advanced transportation district); The minimum combined 2021 sales tax rate for san antonio, texas is.

Texas state rate(s) for 2021. San antonio in texas has a tax rate of 8.25% for 2021, this includes the texas sales tax rate of 6.25% and local sales tax rates in san antonio totaling 2%. Ad earn more money by creating a professional ecommerce website.

The average sales tax rate in california is 8.551% Other 2021 sales tax fact for texas as of 2021, there is 554 out of 1492 cities in texas that charge city sales tax for a ratio of 37.131%. Use leading seo & marketing tools to promote your store.

The san antonio atd transit sales tax has been changed within the last year. Let more people find you online. 1.000% city of san antonio;

The arkansas sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%. Texas has recent rate changes (thu jul 01 2021). The san antonio, texas sales tax is 8.25% , consisting of 6.25% texas state sales tax and 2.00% san antonio local sales taxes.the local sales tax consists of a 1.25% city sales tax and a 0.75% special district sales tax (used to fund transportation districts, local attractions, etc).

0.125% dedicated to the city of san antonio ready to work program; The texas sales tax rate is currently %. The texas sales tax rate is currently %.

As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. 0.500% san antonio mta (metropolitan transit authority);. Local tax rates in texas range from 0.125% to 2%, making the sales tax range in texas 6.375% to 8.25%.

This is the total of state, county and city sales tax rates. If you have questions about local sales and use tax rate information, please contact us by email at [email protected] the san antonio sales tax is collected by the merchant on all qualifying sales made within san antonio. The sales tax jurisdiction name is san antonio atd transit, which may refer to a local government division.

Use leading seo & marketing tools to promote your store. Sales and use tax san antonio’s current sales tax rate is 8.250% and is distributed as follows: The san antonio sales tax is collected by the merchant on all.

Find your texas combined state and local tax rate. , tx sales tax rate. Anticipate any tax rate impact.

Zillow home value index for san antonio is $239,817 through october 2021. Ad earn more money by creating a professional ecommerce website. The base state sales tax rate in texas is 6.25%.

San antonio, tx sales tax rate. Other 2021 sales tax fact for texas as of 2021, there is 554 out of 1492 cities in texas that charge city sales tax for a ratio of 37.131%. The san antonio sales tax rate is %.

The average sales tax rate in arkansas is 8.551%. The current total local sales tax rate in san antonio, tx is 8.250%. Texas sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

Home values in san antonio have increased 20.1% over the last year. San antonio in texas has a tax rate of 8.25% for 2022, this includes the texas sales tax rate of 6.25% and local sales tax rates in san antonio totaling 2%. Method to calculate bexar sales tax in 2021.

Texas has recent rate changes (thu jul 01 2021). The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%. The rate of revenue growth projected in fy 2022 over the fy 2021 adopted budget is a 3.2% increase.

The county sales tax rate is %. This is the total of state, county and city sales tax rates. The texas sales tax rate is currently %.

Primarily due to city sales tax outperforming projections.

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Why Are Texas Property Taxes So High Home Tax Solutions

Democrats Spending Plan Funding Is Unstable And Unsustainable

Hotel Occupancy Tax San Antonio Hotel Lodging Association

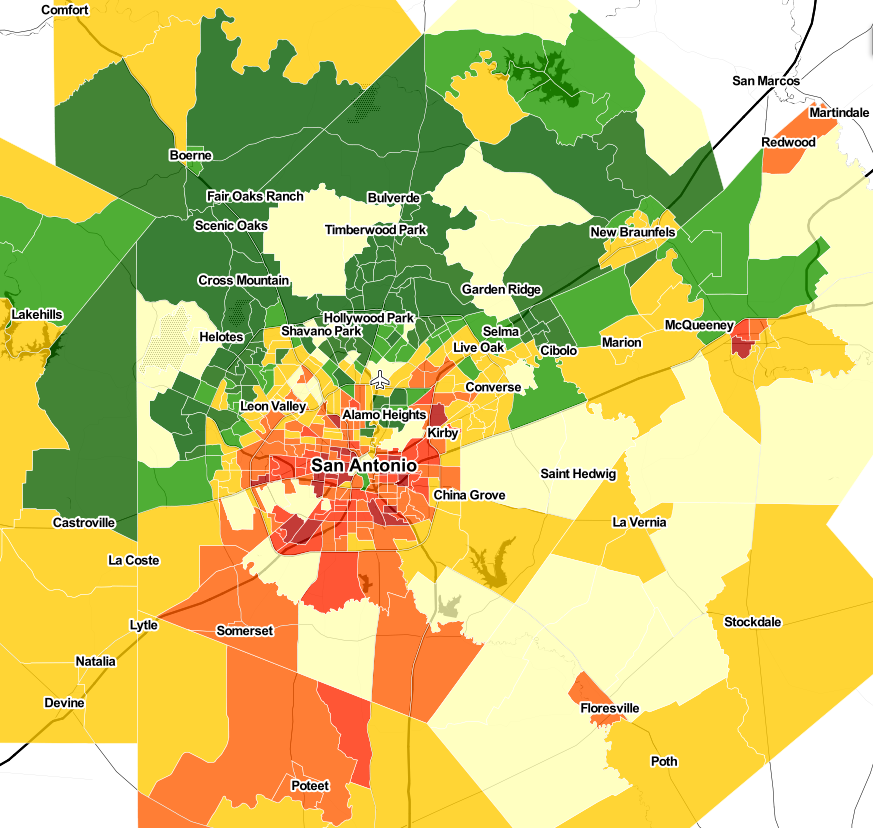

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

How High Are Cell Phone Taxes In Your State Tax Foundation

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

A Closer Look At 2021 Proposed Tax Changes - Charlotte Business Journal

2

The San Antonio Real Estate Market Stats Trends For 2021

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

A Texas Sales Tax Increase Would Hit Poor People The Hardest The Kinder Institute For Urban Research

Texas Sales Tax - Small Business Guide Truic

Annexation

Tax Rates Bexar County Tx - Official Website

2

Texas Sales Tax Rates By City County 2021

Comments

Post a Comment