Property assessments cannot increase more than 2% per year. Property tax is calculated by multiplying the property's assessed value by all tax rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

Pin On Real Estate

The minimum combined 2021 sales tax rate for santa clara county, california is.

Santa clara property tax rate 2021. County of santa clara government. The following are the requirements imposed by proposition 13 active as of 2021: Typically buyers and sellers split city transfer tax 50/50.

In santa clara county, it is customary for sellers to pay for the county tax ($1.10 per $1,000). Tax rates are expressed in terms of per 100 dollars of valuation. The local sales tax rate in santa clara, california is 9.125% as of november 2021.

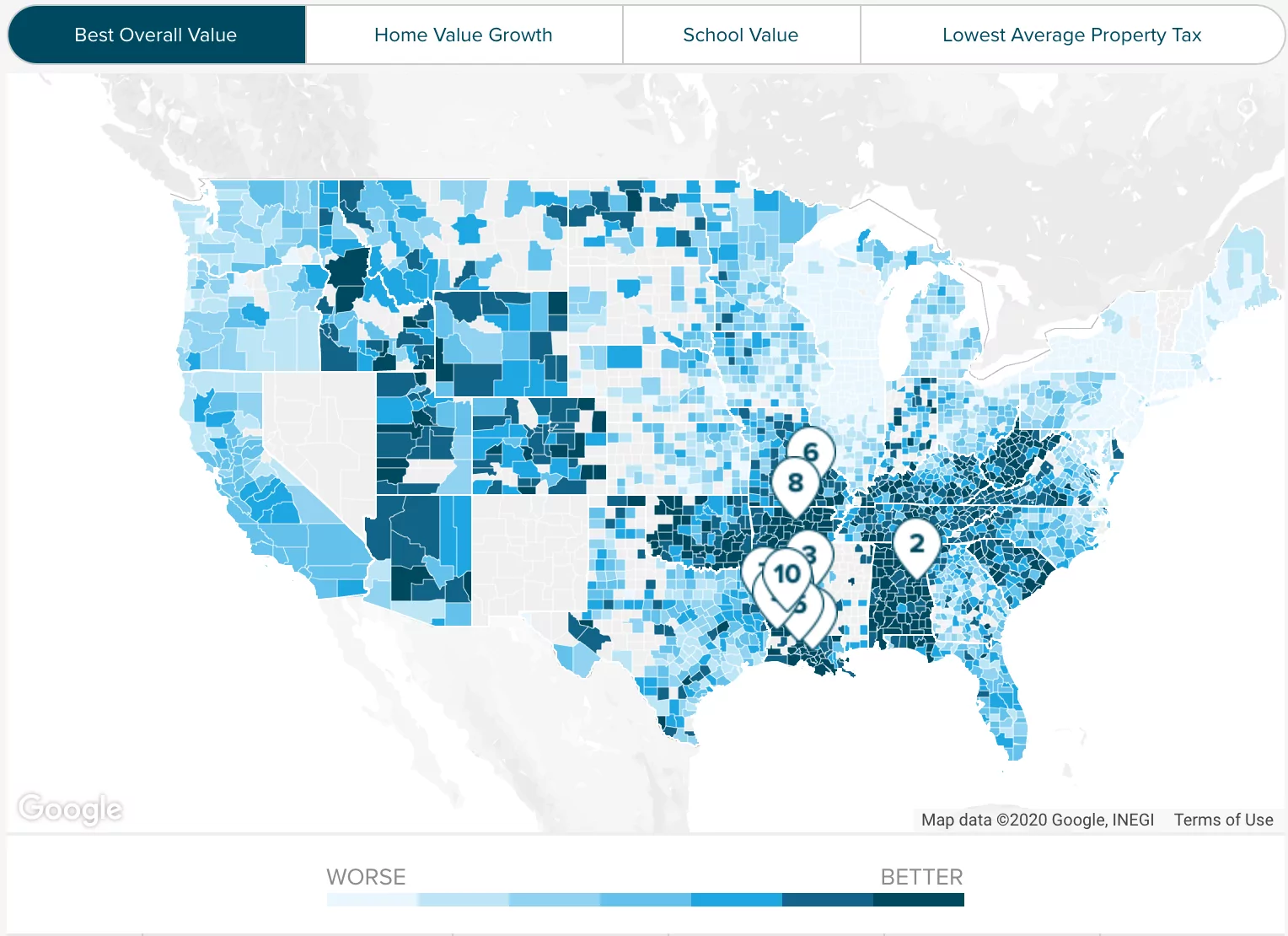

Santa clara county has one of the highest median property taxes in the united states, and is ranked 38th of the 3143. It limits the property tax rate to 1% of assessed value (ad valorem property tax), plus the rate necessary to fund local voter‐approved debt. It also limits increases on assessed values to two percent per year on properties with no change of ownership or no new construction.

57 out of 58 counties have lower property tax rates. The tax calendar is as follows: The santa clara county sales tax rate is %.

Santa clara county collects, on average, 0.67% of a property's assessed fair market value as property tax. Charles county collects the highest property tax in missouri, levying an average of $2,377.00 (1.2% of median home value) yearly in property taxes, while shannon county has the lowest property tax in the state, collecting an average tax of $348.00 (0.48% of. The tax rates are expressed as dollars per 100 of assessed value, therefore the tax amount is already divided by 100 in order to obtain the correct value.

Property tax in santa clara county. Santa clara county has one of the higher property tax rates in the state, at around 1.202%. The schedule for when property taxes are due in santa clara county is not intuitive and confuses most people, at least initially.

Santa clara county projected that the assessment roll would grow to $572.1 billion, meaning an. Properties are reassessed to market value upon sale or upon the completion of new construction. 1% maximum tax levy 1.00000 santa clara county:

Mountain view, palo alto, and san jose all charge an additional city transfer tax of $3.30 per $1,000. Note that 1.202% is an effective tax rate estimate. This report shows the allocation of property tax in santa clara county for your tax rate area.

2198 rosita av santa clara tax rate area: 0 counties have higher tax rates. Similarly, you may ask, how much.

The median property tax (also known as real estate tax) in santa clara county is $4,694.00 per year, based on a median home value of $701,000.00 and a median effective property tax rate of 0.67% of property value. The california state sales tax rate is currently %. This is the total of state and county sales tax rates.

The median property tax in santa clara county, california is $4,694 per year for a home worth the median value of $701,000. Jose santa clara county property tax rates city median home value average effective property tax rate san jose 714,200 0.81 san martin 840,200 0.73 santa clara 831,600 0.66 saratoga 1,933,900 0.52 approx.

Property Tax Distribution Charts - Controller-treasurer Department - County Of Santa Clara

Santa Clara County Ca Property Tax Calculator - Smartasset

Balance Sheet Assets And Liabilities Excel Spreadsheet For Property Investors Couples And Small Business - Net Worth Calculator Template In 2021 Excel Spreadsheets Templates Balance Sheet Accounting Basics

What Is Escrow In 2021 What Is Escrow Self Storage Meridian Magazine

Santa-clara-county Property Tax Records - Santa-clara-county Property Taxes Ca

Herbal Supplement Business Plan In 2021 Essay Writing Writing Services Essay

Santa Clara County Ca Property Tax Calculator - Smartasset

Santa-clara-county Property Tax Records - Santa-clara-county Property Taxes Ca

Santa-clara-county Property Tax Records - Santa-clara-county Property Taxes Ca

Santa Clara County Ca Property Tax Calculator - Smartasset

Secured Property Taxes Treasurer Tax Collector

Santa-clara-county Property Tax Records - Santa-clara-county Property Taxes Ca

Amazon Customer Service Number Amazon Prime Phone Numbers One Time Password

Secured Property Taxes Treasurer Tax Collector

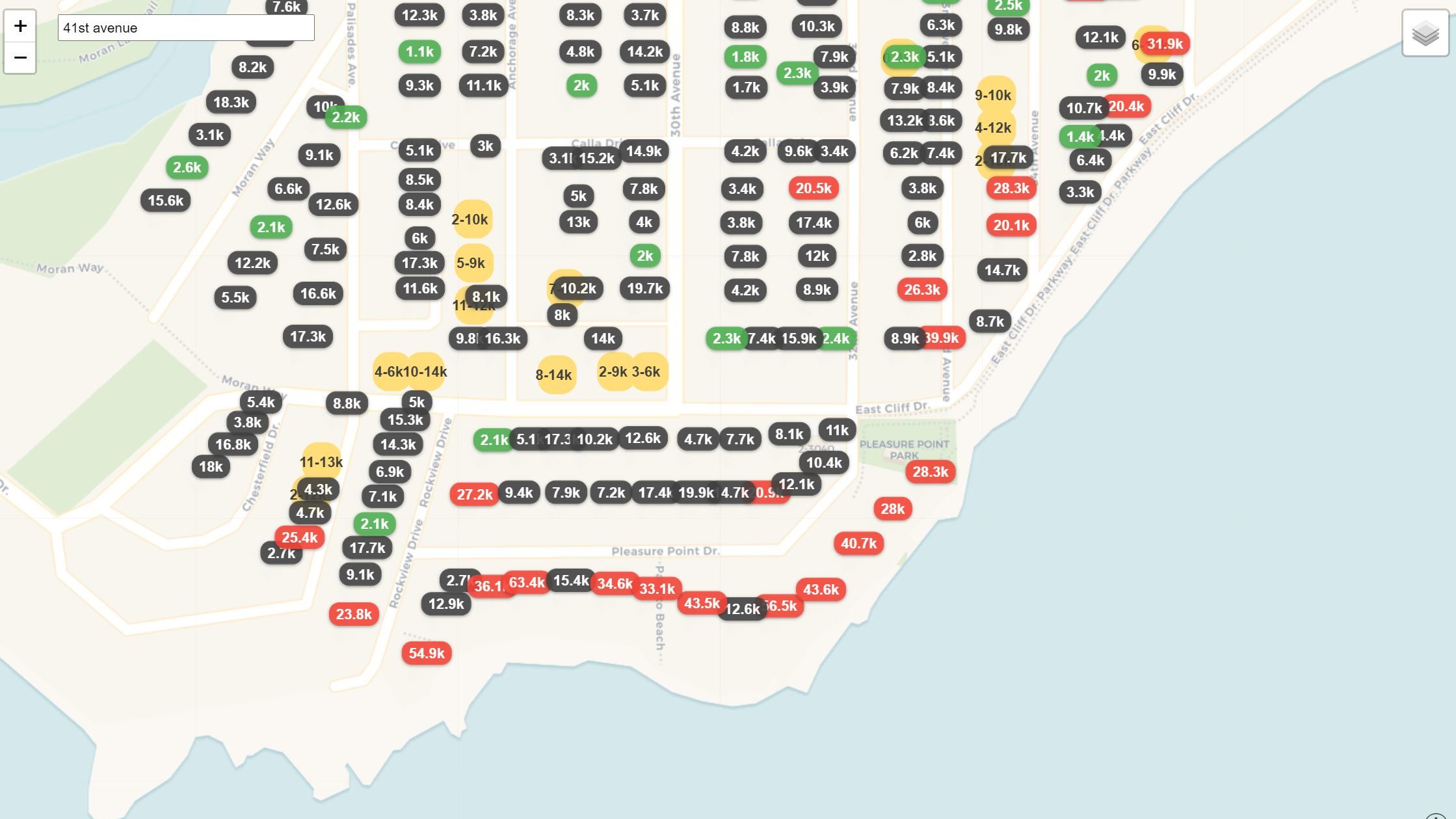

Maps Show Disparity In Santa Cruz County Property Taxes Santa Cruz Local

Property Taxes - Department Of Tax And Collections - County Of Santa Clara

Property Taxes - Department Of Tax And Collections - County Of Santa Clara

Santa Clara County Ca Property Tax Calculator - Smartasset

Property Tax Rate Book - Controller-treasurer Department - County Of Santa Clara

Comments

Post a Comment