We’re here to help you launch a strategy to regain stability and build credit. Recipients of the student loan debt relief tax credit must, within two years from the close of the taxable year for which the credit applies, pay the amount awarded toward their college loan debt and provide proof of payment to mhec.

Addressing The 15 Trillion In Federal Student Loan Debt - Center For American Progress

Students meeting all four criteria are likely to receive larger tax credits.

Student loan debt relief tax credit virginia. At debt.com, we’re here to help you find debt relief. Am i eligible for the credit? The tax credit has to be recertified by the maryland state government every year, so it's not a guaranteed credit each year.

President joe biden's administration has announced major changes to a federal student loan forgiveness program that could relieve borrowers of more than $4.5 billion in debt. To qualify, you must be making payments on student loan debt incurred in pursuit of eligible undergraduate or graduate degrees from accredited universities or colleges. They also must show proof of payment to the lender to mhec.

Virginia loan forgiveness program for law school. Based on our research of state tax laws, you may still have to pay a tax bomb on student loan forgiveness to your state. Beginning in the 2022 tax year, employers will be provided with a 50% tax credit of up to $2,625 per year for payments made on a student loan.

The primary aim of this scheme or program is to provide an income tax credit to the residents as taxpayers of maryland, and later as a student loan debt relief. The full amount of credit can be up to $5000 i believe, and you are not guaranteed to receive the credit. Have at least $5,000 in outstanding student loan debt remaining when applying for the tax credit;

Garten loan repayment assistance program [1] (lrap) is intended to help programs recruit and retain qualified attorney staff. You may qualify for tpd if: If a lot of people applied, the ones who are picked are based on total debt amount and other factors.

The $300,000 fund awards $15,000 a year in debt relief for at least four years but is limited to a total of five veterinarians who agree to work in a rural area or an area with a veterinary shortage. When the student is awarded with the tax credit (up to $5,000) they must use the credit to pay their college loan debt within two years. Student loans did you know that there are currently over 33 million americans who qualify for the public service loan forgiveness program, but less than 1% will actually correctly enroll and take advantage of the program?

Failure to do so will result in recapture of the tax credit back to the state. Our solutions include help for credit card. Lsc loan repayment assistance program.

For example, if you have $10,000 in student loans forgiven, that amount gets added to your income, and you pay tax on the result. For federal student loan borrowers that have qualifying total and permanent disabilities, the department of education is providing $5.8 billion in automatic loan forgiveness, according to an. Until the end of 2020, employers can contribute up to $5,250 toward an employee’s student loan balance and the payment will be free from payroll and income tax under a provision in the coronavirus.

Please note that the full amount of the tax credit will have to be used to pay down There were 9,600 applicants who were eligible for the student loan debt relief tax credit, according to officials. Have incurred at least $20,000 in undergraduate and/or graduate student loan debt;

Iowa established a rural veterinarian loan repayment program for veterinary students and certain licensed veterinarians. The student loan debt relief tax credit program deadline of september 15 is just under two weeks away, and comptroller peter franchot and maryland college officials are urging students to take. Maintain maryland residency for the 2021 tax year;

Save time and money by getting a custom debt relief strategy from cfp® and cfa professionals who know credit cards student loans and irs debt. In some states, the discharge of debt is considered taxable income. Failure to pay within the two years.

Employees must be a state resident, recent college graduate and employed full time in the state. Hello and welcome to debt.com’s solution center. They found that 387,000 students would qualify for tpd loan forgiveness.

Student loan debt relief tax credit. So, that’s a lot of relief for people who really need it. And the forgiven amount is.

If written proof isn’t submitted to the mhec, the agency. Enter the total level of tax credit, up to $5,000, being claimed based upon the total eligible undergraduate student loan debt balance as of submission of the tax credit application. Up to $5,600 yearly, for 3 years.

To be eligible for the student loan debt relief tax credit, you must: Students have two years to submit proof to the mhec that they used their tax credits to reduce their loan balances. 100% of the tax credit must be used to pay down student debt.

From student loans and credit card debt to tax debt and bankruptcy, we have trusted solutions and answers for you. The tax general article belongs to the annotated code of maryland. Those borrowers collectively owe about $7.7 billion in student loans.

States Most Interested In Student Loan Forgiveness Student Loan Hero

Virginia Student Loan Forgiveness Programs

Student Loan Forgiveness Programs The Complete List 2021 Update

The Full List Of Student Loan Forgiveness Programs By State

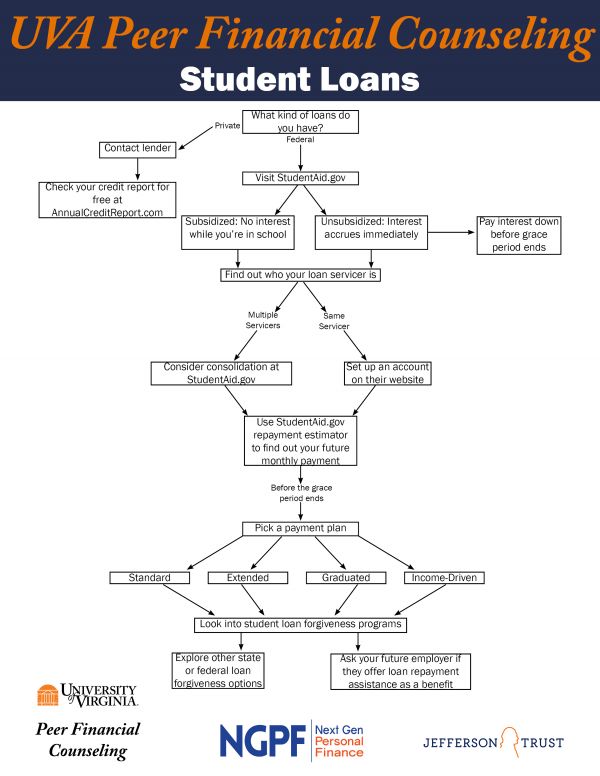

Student Loans Student Financial Services

Paying Off 88000 Student Loan Debt In Harrisonburg Va Student Loan Hero

Military Student Loan Forgiveness And Discharge Programs Militarycom

26 Million In Private Student Loans Will Be Forgiven Following A Settlement Key Details

West Virginia Student Loan Forgiveness Programs

Biden Has Forgiven 95 Billion In Student Loan Debt Money

Paying Off 88000 Student Loan Debt In Harrisonburg Va Student Loan Hero

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Debt Forgiveness Now Tax-free For-profit-college Rule Changed In New Stimulus Package - The Washington Post

Learn How The Student Loan Interest Deduction Works

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Student Loans May Qualify For Federal Forgiveness

Paying Off 88000 Student Loan Debt In Harrisonburg Va Student Loan Hero

Chart Americans Owe 17 Trillion In Student Loans Statista

Troubled Student Loan Forgiveness Program For Military Public Servants Gets An Overhaul Militarycom

Comments

Post a Comment