According to an august 2021 study from the urban institute, extending the advance child tax credit through as far out as 2025 would result in 4.3 million fewer children in poverty. The current expanded ctc is a refundable credit, being partially paid in.

Stimulus Update House Passes Bill Extending Payments Into 2022 Wbff

The tax credit’s maximum amount is $3,000 per child and $3,600 for children under 6.

Extended child tax credit 2022. The $2.2 trillion build back better bill would extend that amount through 2022 at the same levels. The credit is $3,600 annually for children under age 6 and $3,000 for children ages 6 to 17. 2022 changes to child tax credit in 2022, the monthly payments would continue, but this time would stretch throughout the full calendar year with 12.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Details of the 2022 advance child tax credit Makes the credit fully refundable.

Expanded advanced monthly child tax credit extended into 2022. However, to take advantage of. Under biden’s build back better spending plan the current expanded child tax credit will be extended for another year, bringing the total amount paid over 2 years to a maximum of $7,200.

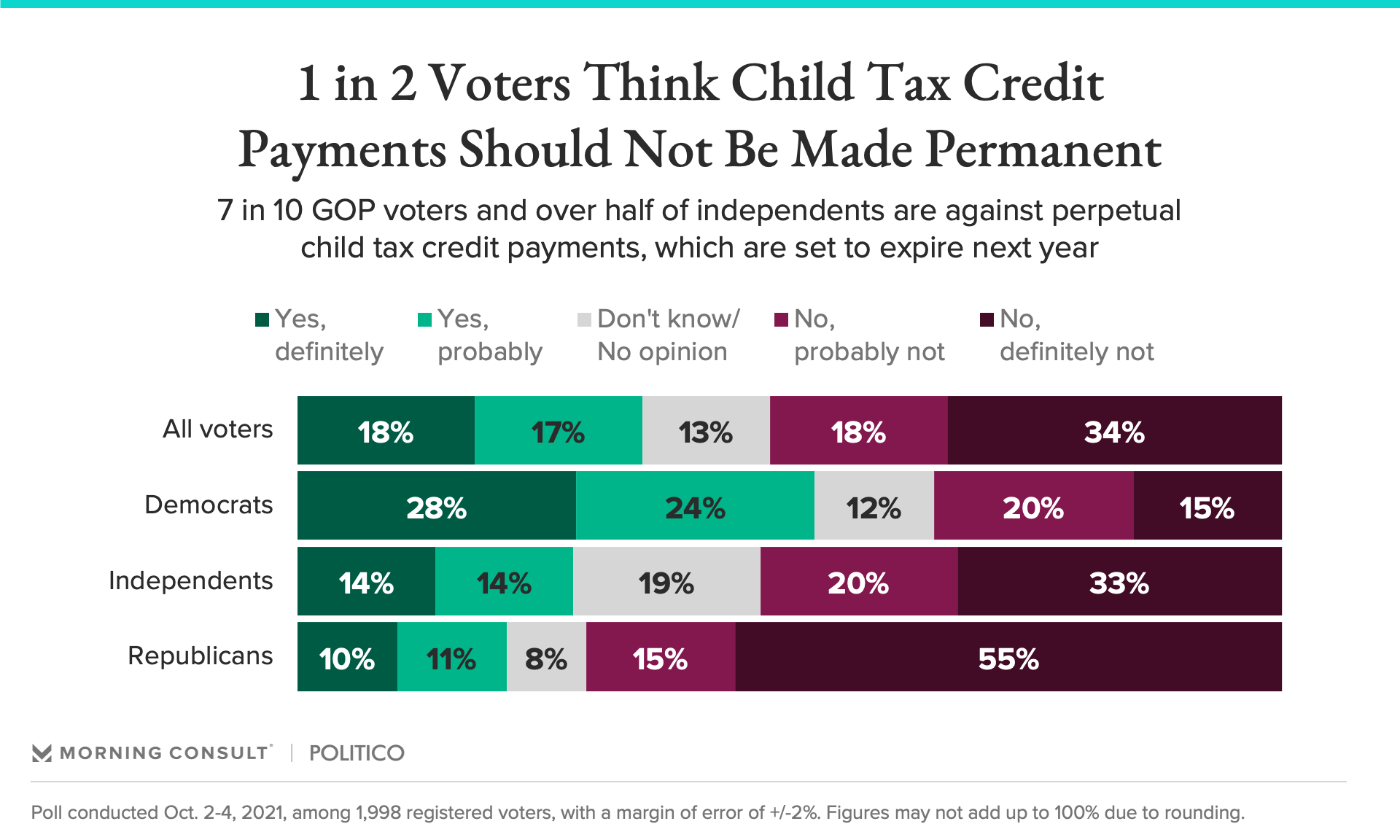

The latest on the enhanced child tax credit getting extended past 2022 given the popularity of the program with millions of families, there's a chance the credit could be extended. In 2021 and 2022, the average family will receive $5,086 in coronavirus stimulus money thanks to the expanded child tax credit. A group of 95 congressional democrats is pushing the senate to pass president joe biden’s spending bill by the end of december to avoid a lapse in monthly child tax credit payments.

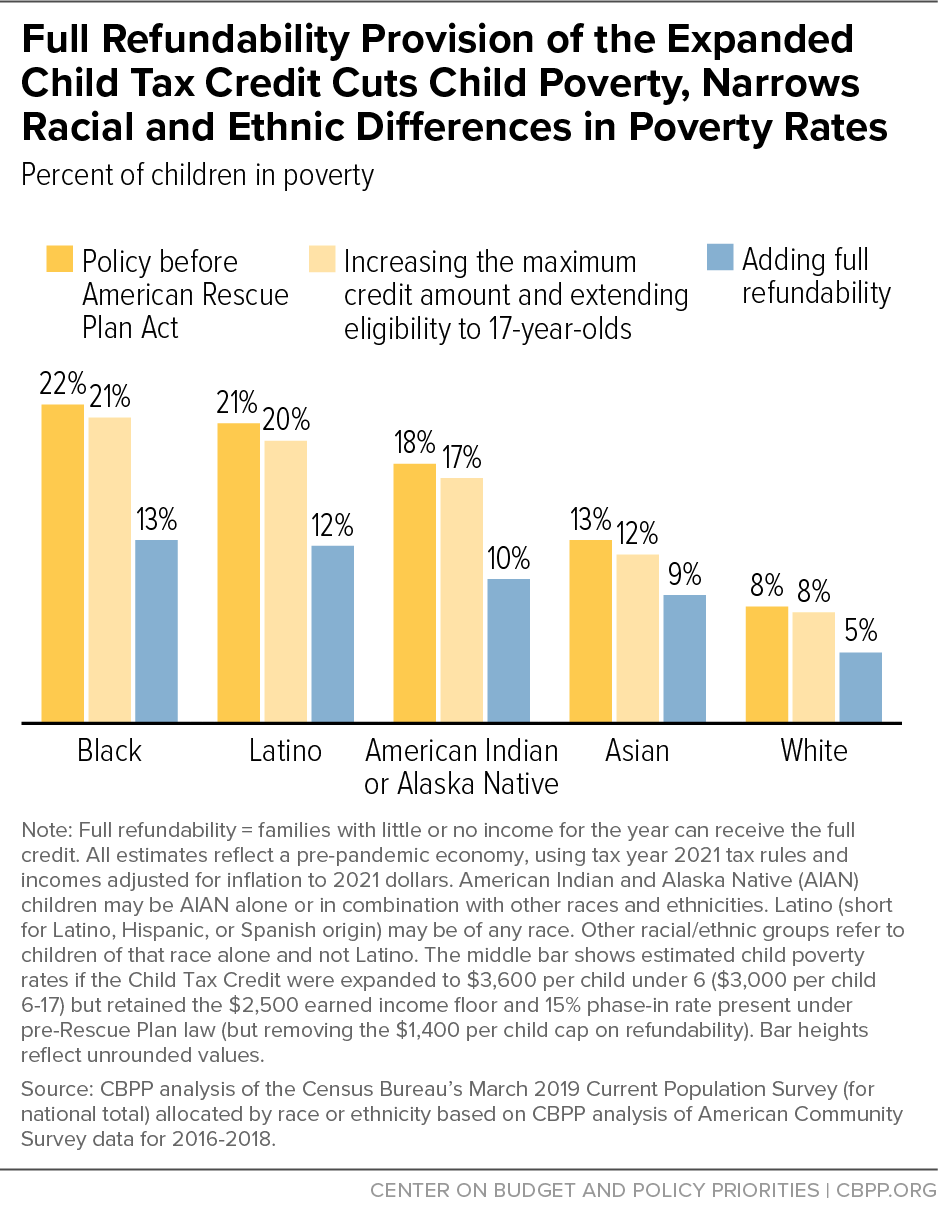

Many are hoping that the child tax credit payments could extend until 2025. As part of the american rescue plan, the child tax credit was expanded for 2021 only to include qualifying children ages 17 and under and increased from $2,000 to up to $3,600 per child. Even if you don’t owe taxes, you could get the full ctc refund.

10 tips to get the most out of your tax refund next year The main updates for the child tax credit for 2022 are as follows: In the past, joe biden has called to extend the child tax credit payments until at least 2025.

How to use your monthly payments to invest in your child’s future. President joe biden’s original pitch was to have it through 2025, but that was negotiated down Eligible families will receive $300 monthly for each child under 6 and $250 per older child.

Included in the bill is funding for the child tax credit (ctc) expansion for the next four years, with a price tag of $450 billion. What parents can still do in 2022 is claim the second half of the credits on their 2021 tax return. The child tax credit monthly payments began in july 2021 and will continue through december.

The president had been pushing to extend the benefit through 2025. Only one child tax credit payment remains in 2021, with the last payment set to roll out on december 15. Of course, families would be able to claim the remaining half of their payments on their tax returns.

This latest reiteration of the build back better plan would extend the $3,000 and $3,600 child tax credits for another year. There’s a decent chance that republicans will have regained. Key points the expanded child tax credit provides payments of.

The build back better act would not only extend full refundability to the 2022 child tax credit, but it would make the credit fully refundable on a permanent basis. Increases the tax credit amount. The expanded child tax credit, or ctc, is a cornerstone in president biden’s “build back better” agenda—an immediate method for reducing child poverty that has produced tangible results.

Calls are growing for the child tax credit benefits to be extended through 2022. For each qualifying child age 5 and younger, up to $1,800 (half the total) will come in. Removes the minimum income requirement.

The credit, which was expanded in march by the american rescue plan, will be continued through 2022, according to a framework of the now $1.75 trillion proposal released thursday. Changes to the child tax credit could be extended into 2022, making some parents eligible for continued payments.

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Extension 2022 Heres Where It Stands 13newsnowcom

Child Tax Credit 2022 Democrats Push Against Long-term Extension Marca

Child Tax Credit Deadline To Enroll Is November 15 Deadline To Opt-out November 11 Pix11

Child Tax Credit 2022 What Will Be Different With Your Payments Next Year Marca

Child Tax Credit 2022 How Next Years Credit Could Be Different Kiplinger

Child Tax Credit 2022 Who Will Be Eligible For Ctc Extension Payments Marca

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Child Tax Credit 2022 What We Know So Far

Will The Enhanced Child Tax Credit Continue In 2022 Heres Everything We Know - Cnet

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Child Tax Credit 2022 How Next Years Credit Could Be Different Kiplinger

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

/cdn.vox-cdn.com/uploads/chorus_asset/file/22959685/AP21257518603072.jpg)

Stimulus Checks Will There Be Child Tax Credit Payments In 2022 - Deseret News

Will The Enhanced Child Tax Credit Continue In 2022 Heres Everything We Know - Cnet

Child Tax Credit 2022 How Next Years Credit Could Be Different Kiplinger

Child Tax Credit Update Families Will Get Paid 7200 Per Child In 2022 By Irs - Fingerlakes1com

Comments

Post a Comment