Fort bend county collects, on average, 2.48% of a property's assessed fair market value as property tax. No appointment required for this event.

Jury Summons Fort Bend County Tx

Fort bend county, texas dps & dmv office locations.

Fort bend county tax office appointment. Skip to content property tax inquiries call 713.290.9700 The fort bend county passport office, located in richmond, tx, accepts passport applications and issues passports to u.s. Please contact your county tax office, or visit their web site, to find the office closest to you.

Home driver services dmv office locations texas fort bend county. Please enter your zip code or city and state abbreviation. The passport office works with the federal office of passport services, as part of the bureau of consular affairs at the u.s.

Fort bend home owners who appeal will likely see a reduction in their property taxes. Fort bend county has a new financial leader. Fort bend county has one of the highest median property taxes in the united states, and is ranked 57th of the 3143 counties in order of median property taxes.

All other automobile transactions 33 minutes. The deadline to appeal fort bend county property taxes is the later of may 15 th, or 30 days after fort bend central appraisal district sends the 2021 notice of assessed value. The median property tax in fort bend county, texas is $4,260 per year for a home worth the median value of $171,500.

Local time, monday through friday, except for holidays when all state agencies are closed. Auto tag renewal 38 minutes. Statewide, 85% of home owners who appealed their property taxes were successful, with average savings of about.

In cases of inclement weather, please call your county tac prior to planning travel. This averages 20% annual increase in fbcad budget. Most vehicle title and registration services are provided by your county tax office.

The number of appraisers has risen substantial; Please do not delay making an appointment with your county tax office if you need to renew your registration in person. The fort bend county appraisal district budget rose from $5.99 million in 2012 to $13.1 million in 2018, a 119% increase over 6 years.

Thank you for your cooperation and understanding. If your title or registration paperwork has been sent to our main office, please do not set an appointment. Share tweet pin it email print.

All deed record changes are then recorded in the fort bend central appraisal district system to match what has been filed with the county clerk’s office. To 4:30 p.m., monday through friday. Disabled placards and permits 27 minutes.

O’connor has provided property tax consulting services in the fort bend county appraisal district and has continuously produced results for over 20 years. This county tax office works in partnership with our vehicle titles and registration division. From 35 in 2012 and 49 in 2018.

All regional service centers are open from 8 a.m. New texas resident 15 minutes. This change affects the richmond, missouri city, sugar land, and katy offices, which previously had extended hours on mondays.

Effective monday, february 15, 2021, all fort bend county tax office locations will be open from 8:00 a.m. Citizens living in texas state. Otherwise click 'ok' to make an appointment.

It is possible that these appointments are booked several weeks in advance. The fort bend county arb has increased from 30 in 2012 to 38 in 2018.

Motor Vehicle Information Fort Bend County Tx

Detention Bureau Fort Bend County Tx

Fort Bend County Tax Office Facebook

New Tax Assessor-collector Appointed In Fort Bend County Community Impact

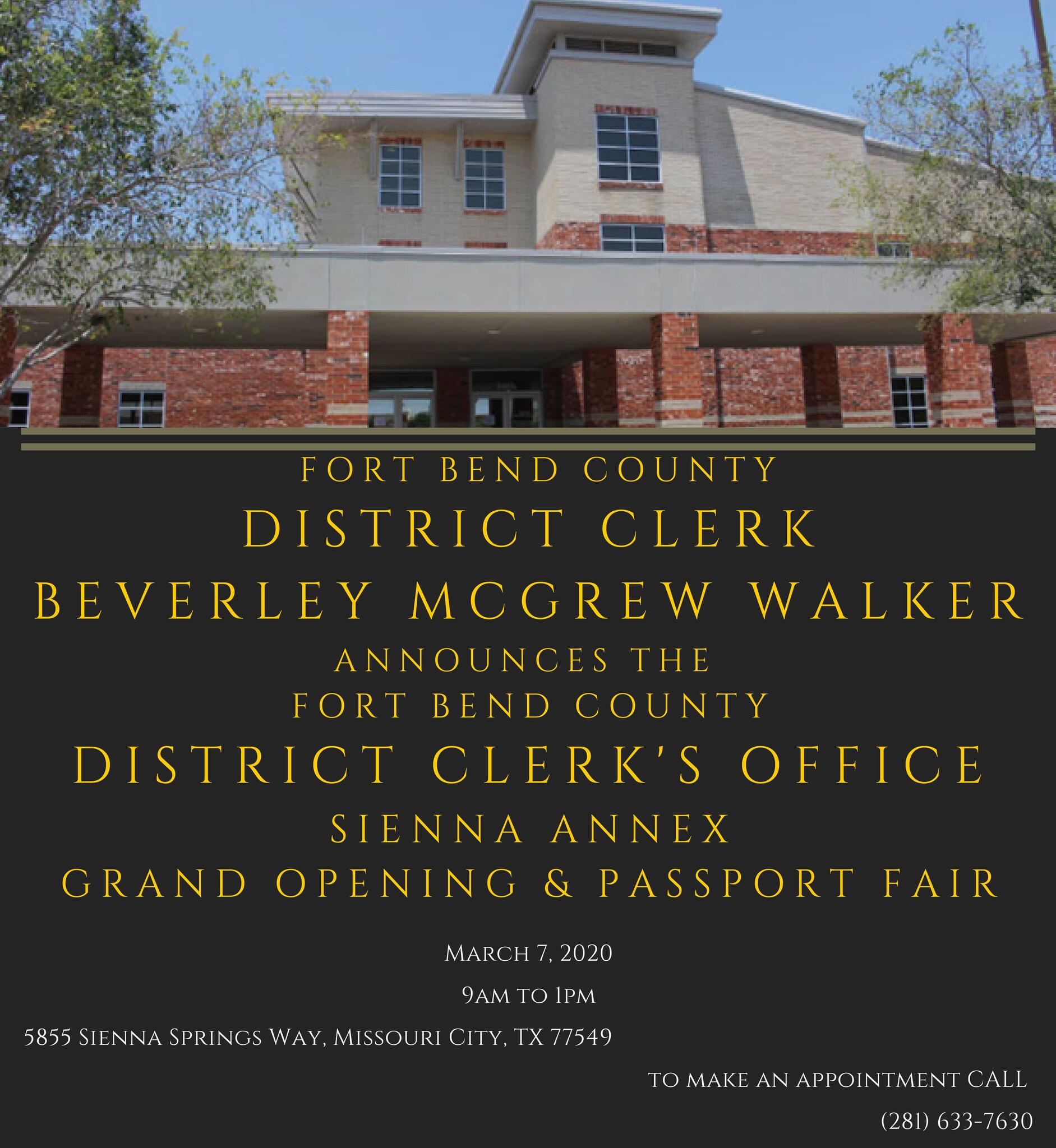

Sienna Annex Grand Opening Nextdoor Nextdoor

County Community Village Of Oak Lake Homeowners Association

Fort Bend County Tax Office Facebook

Fort Bend County Appraisal District - How To Protest Property Taxes

Fort Bend County Tax Office Facebook

Fort Bend County Clerks Northkaty Annex Temporarily Closed To Public Fort Bend County Precinct Three

![]()

Fort Bend County - 408 Updates Nextdoor Nextdoor

Locations Fort Bend County Tx

Fort Bend County Tax Office Facebook

Fort Bend County Tax Office Facebook

Jury Summons Fort Bend County Tx

Fort Bend County Tax Office Facebook

Fort Bend County Tax Office Facebook

Fort Bend County Tax Office Ftbendcntytax Twitter

Online Services Fort Bend County Tx

Comments

Post a Comment