Listen to a brief overview of state tax developments this week, including virginia, or read full virginia development below. On june 30th, 2020, the internet tax freedom act’s grandfather clause will expire.

Pdf E-commerce And Tax Revenue

On july 1, 2020, the permanent internet tax freedom act (pitfa) will be fully implemented nationwide, causing the last few grandfathered states allowed to tax internet service providers to lose an estimated $1 billion in combined annual revenue.

Internet tax freedom act 2020. Grandfathering provisions that allowed certain jurisdictions to tax internet access set to expire on june 30, 2020 download the pdf. Internet tax freedom act’s prohibition against taxing internet access applies to all states beginning july 1, 2020 on june 30, 2020, the grandfathering provisions of the internet tax freedom act (itfa), 1 which permitted states that taxed internet access before the itfa’s enactment to continue doing so, will expire. Legislative status and background the internet tax freedom act of 1998 (itfa;

Background and need for the legislation i. Internet access fees are currently subject to state and local sales tax in hawaii, new mexico, ohio, south dakota, texas, and wisconsin. But the grandfather clause has permitted such taxes if they were generally imposed and actually enforced prior to october 1, 1998.

The internet tax freedom act (itfa), enacted in 1998, was intended to protect the developing internet technology. Beginning july 1, 2020, federal law will permanently prohibit state sales tax on internet access services under the internet tax freedom. Itfa prohibits states and political subdivisions from imposing taxes on internet access.

Bpol tax preempted by internet tax freedom act. On february 11, 2016, the u.s. The original moratorium on such taxes, enacted by the internet tax freedom act and extended multiple times (ifta), was set to expire on october 1, 2016.

On february 11, the united states senate approved a permanent extension of the internet tax freedom act (itfa) contained in the conference report accompanying h.r. House democrats today introduced a bill to attempt an end run around the internet tax freedom act. Under the internet tax freedom act (itfa), states who taxed internet access before 1998 can continue taxing internet access through june 30, 2020.

The ifta included a grandfather. Hawaii, new mexico, north dakota, ohio, south dakota,. The internet tax freedom act is controversial, and gets locked in on july 1.

Ten states (which were grandfathered under the internet tax freedom act as part of a political compromise) are allowed to provide for some manner of taxation on isp charges. As of july 1, 2020, those fees will be exempt. 644, the trade facilitation and trade enforcement act of 2015.

The democrat bill labeled the 'save the internet act' is simply washington. At the time, no one. Democrat bill will raise household internet costs.

The internet tax freedom act of 1998 temporarily stopped states and local governments from imposing new taxes on internet access and multiple or. In 2019, the french parliament approved a 3 percent tax on revenues derived from france by any large, internet business — regardless of. The gao and university of tennessee studies are summarized in michael mazerov, “making the ‘internet tax freedom act’ permanent could lead to a substantial revenue loss for states and localities,” center on budget and policy priorities, revised august 30, 2007, pp.

The exemption is mandated by the internet tax freedom act (itfa), which was first enacted in 1998 to encourage growth of the fledgling internet. A controversial law since its initial passing, tension has only increased as. The new democrat bill, laughably called the save the internet act, will raise household internet costs by about 20 percent.

(1) impose new taxes on internet access, or (2). Sales tax ends on internet access beginning july 1, 2020. The ten states are hawaii, new hampshire, new mexico, north dakota, ohio, south dakota, tennessee, texas, washington & wisconsin.

Permanent internet tax freedom act amends the internet tax freedom act to make permanent the ban on state and local taxation of internet access and on multiple or. Senate approved a permanent extension of the internet tax freedom act that was included in h.r. 644 on february 24, 2016 which permanently bans state and local taxes imposed on internet access and discriminatory taxes on internet commerce.

The bill also establishes an end date of june 30, 2020 for the seven states that currently impose a tax on internet access:

The Internet Tax Is Back The Shameless Plot To Sneak It Into The Internet Tax Freedom Act Family Guy Quotes Funny Weekend Quotes Band Jokes

Pdf Digital Citizenship Behaviours

Freedom Internet

The Earn It Act Is A Disaster For Online Speech And Privacy Especially For The Lgbtq And Sex Worker Communities

2

Freedom Internet

2

Uganda Abandons Social Media Tax But Slaps New Levy On Internet Data

Is A Global Internet Tax Coming In 2021 Thehill

Income Tax Exemption And Deductions For Employees Fy 2019-2020

Cell Phone Taxes And Fees 2021 Tax Foundation

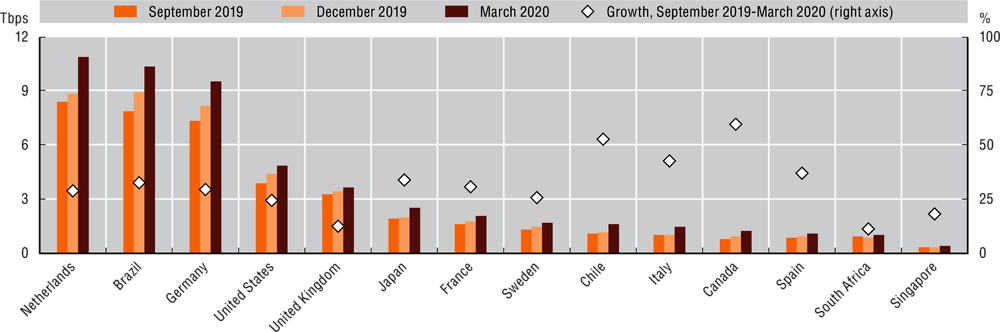

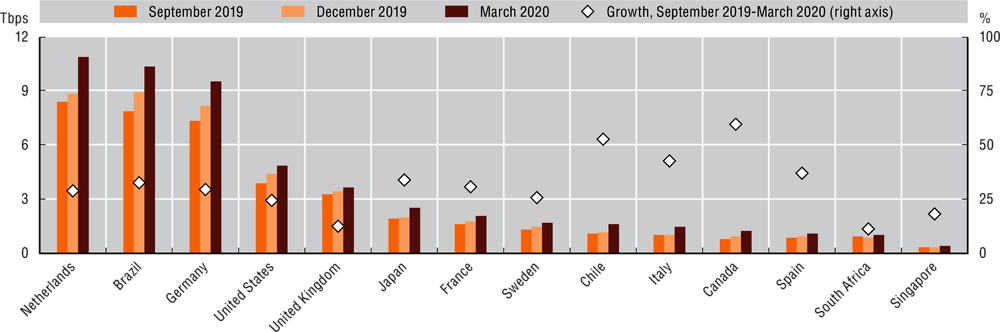

Chapter 3 Access And Connectivity Oecd Digital Economy Outlook 2020 Oecd Ilibrary

Telecoms Media Internet 2021 Switzerland Iclg

2

Freedom Of Expression And The Internet Updated And Revised 2nd Edition

Eu Internet Law In The Digital Single Market Springerlink

2

Freedom Of Expression Archives - Digital Watch Observatory

2

Comments

Post a Comment