Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made. To shareholders, members or partners.

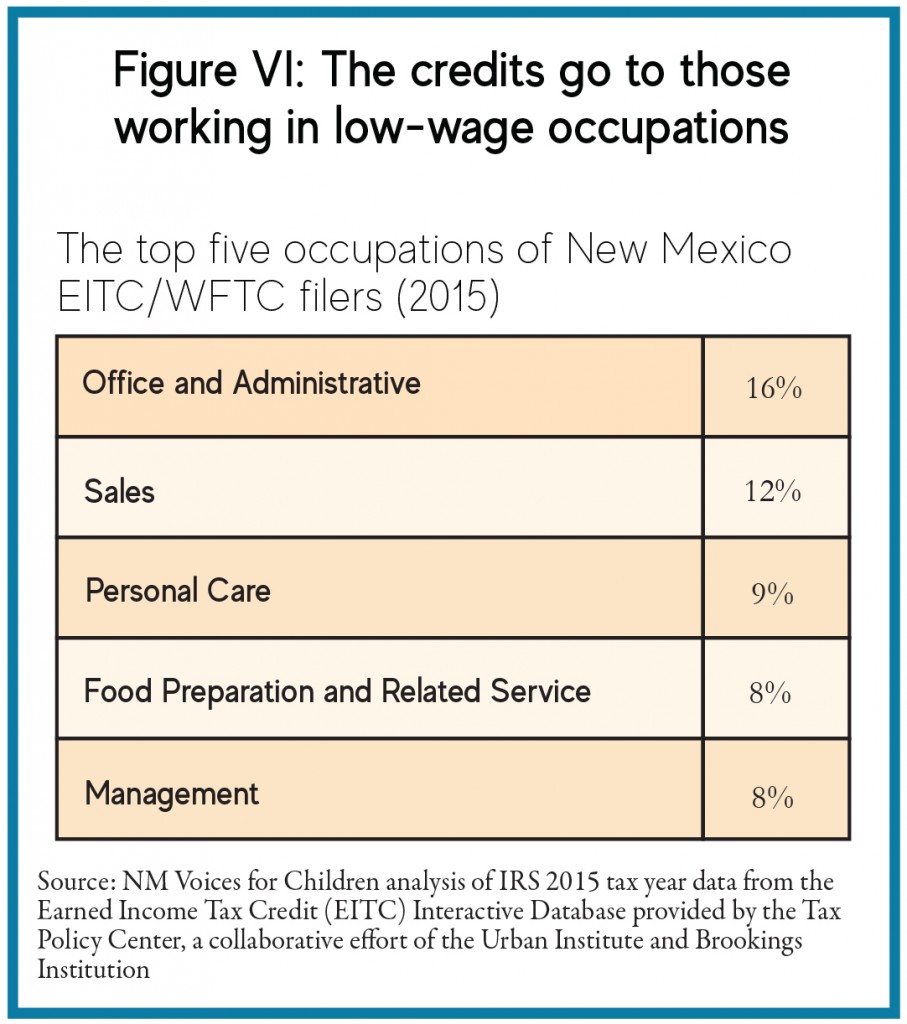

New Mexicos Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

An application must be submitted to the pa department of community and economic development.

Pa educational improvement tax credit application. Pennsylvania educational improvement tax credits. Dced will no longer require applicants to mail the signed signature page. If additional lines are needed, make a copy of this schedule to ensure all required information is provided.

Tax credit cannot be switched to the more popular education improvement (ei) tax credit in. Eitc provides companies with a 75% tax credit for donations to approved nonprofit educational improvement organizations (such as community giving foundation). How does a pass through entity that is granted an educational improvement tax credit make an election to pass through the credit to the owners?

All applications received on a specific day will be processed on a random basis before moving on to the next day’s applications. Applications will be approved until the amount of. The pennsylvania department of community and economic development (dced) has approved the foundation for free enterprise education as an educational improvement organization (eio) under the educational improvement tax credit (eitc) program.

If applicant is a business: Businesses pennsylvania businesses can begin applying for opportunity scholarship tax credits through dced’s electronic single application system. A separate election must be submitted for each year an eitc/ostc is awarded.

This tax credit increases to 90% if a company commits and is approved to making the same donation for two consecutive years. Eligible companies may take up to $750,000 in tax credits per fiscal year. College settlement is an educational improvement organization (eio) approved by the commonwealth of pennsylvania’s department of community and.

The amount of tax credits available under the ostc program increases to $55 million. Application information from the pennsylvania department of community and economic development. Here is the link to their website:

Individuals may now join a special purpose entity (spe) that allows personal tax liabilities to flow through it, allowing them to participate. 90% tax credit for donors with 2 year commitment. Key features of the eitc:

Pittston area educational improvement organization: Enter the applicant's name as registered under the federal employer identification number or social security number. Tax credit applications will be processed on a first.

A business paying taxes in pennsylvania can receive up to a. That allowance has nearly quintupled since the eitc program began in 2001. The average scholarship size is about $2,000, which is only about 13 percent of the average expenditure per student at pennsylvania’s district schools.

Pennsylvania's educational improvement tax credit (eitc) apply for pa tax credits available to eligible businesses contributing to scholarship organizations such as ceo america the children's educational opportunity fund. Do not use the single application. Businesses making an eio donation may be eligible to receive a tax credit of 75% for a one year commitment or 90% for a two year commitment.

Improvement or opportunity scholarship tax. Applicants can contact the tax credit division at 717.787.7120 to be connected to their assigned project analyst. Irrevocable election to pass educational improvement tax credit (eitc)/opportunity scholarship tax credit (ostc) through.

The business application guide explains the process of applying. Name and address of each owner having an interest in the entity. Pennsylvania businesses can apply for eitc credits through the pa department of community & economic development’s electronic single application system which can be accessed by clicking here.

Joining an spe enables pennsylvania taxpayers the ability to receive a credit up to 90% of the. In the educational improvement tax credit (eitc) and opportunity scholarship tax credit (ostc) programs. 1520 locust st., suite 901:

The business application guide explains the process of applying. The additional $5 million must be used to provide tax credits for contributions from business firms to increase the scholarship amount to students attending an economically disadvantaged school by up to $1,000 more than the amount provided during the immediately.

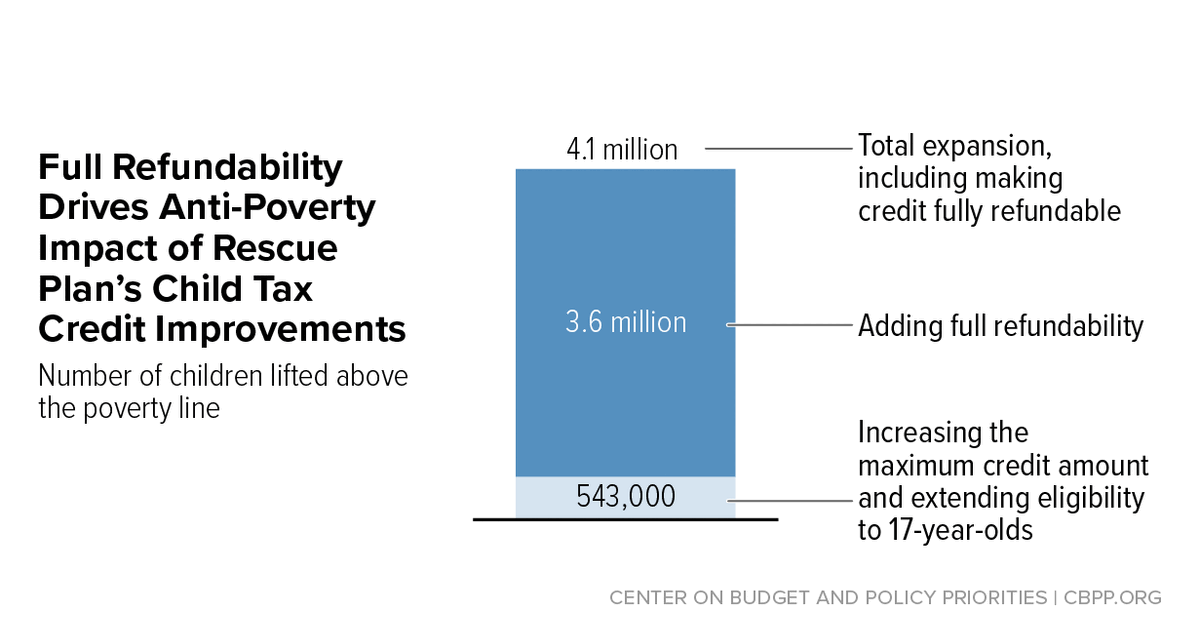

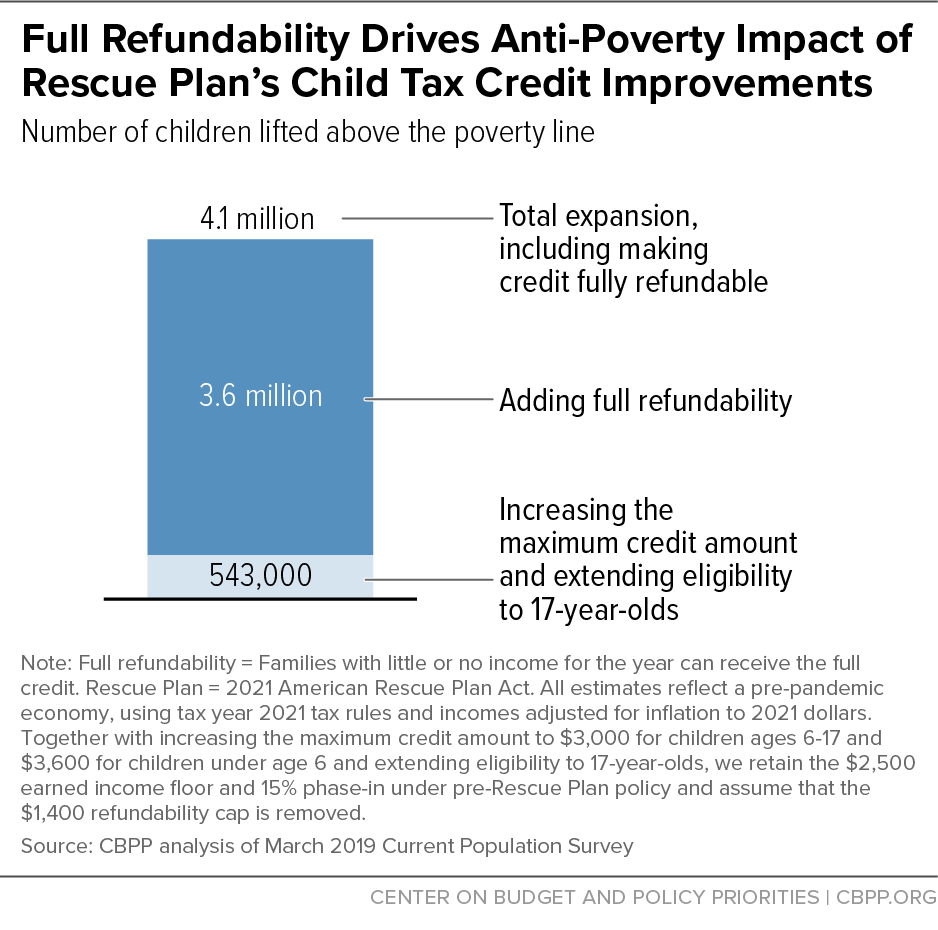

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Ratios Analysis Financial Statement Analysis Financial Statement Financial Ratio

Controller Business Manager Resume Sample Free Resume Sample Manager Resume Resume Resume Template Examples

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Western Pennsylvania Montessori School

New Mexicos Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

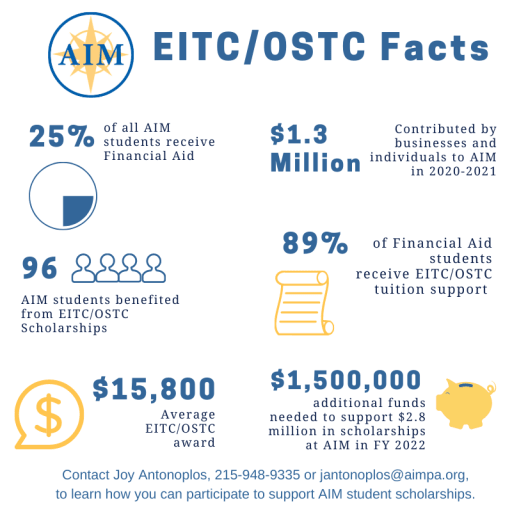

Eitcostc Program - Aim Academy

Five Ways To Save For A Home Loan Visually Home Loans Home Improvement Loans Loan

New Mexicos Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Return On Net Assets Formula Examples How To Calculate Rona Accounting And Finance Valuing A Business Time Value Of Money

New Mexicos Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Quidco Business Model Canvas In 2021 Business Model Canvas Business Model Canvas Examples Business Canvas

Defaulted Student Loans - Help With Defaulted Student Loans Get Help With Defaulted Student Loans In Student Loan Default Student Loans Student Loan Help

Eitcostc Program - Aim Academy

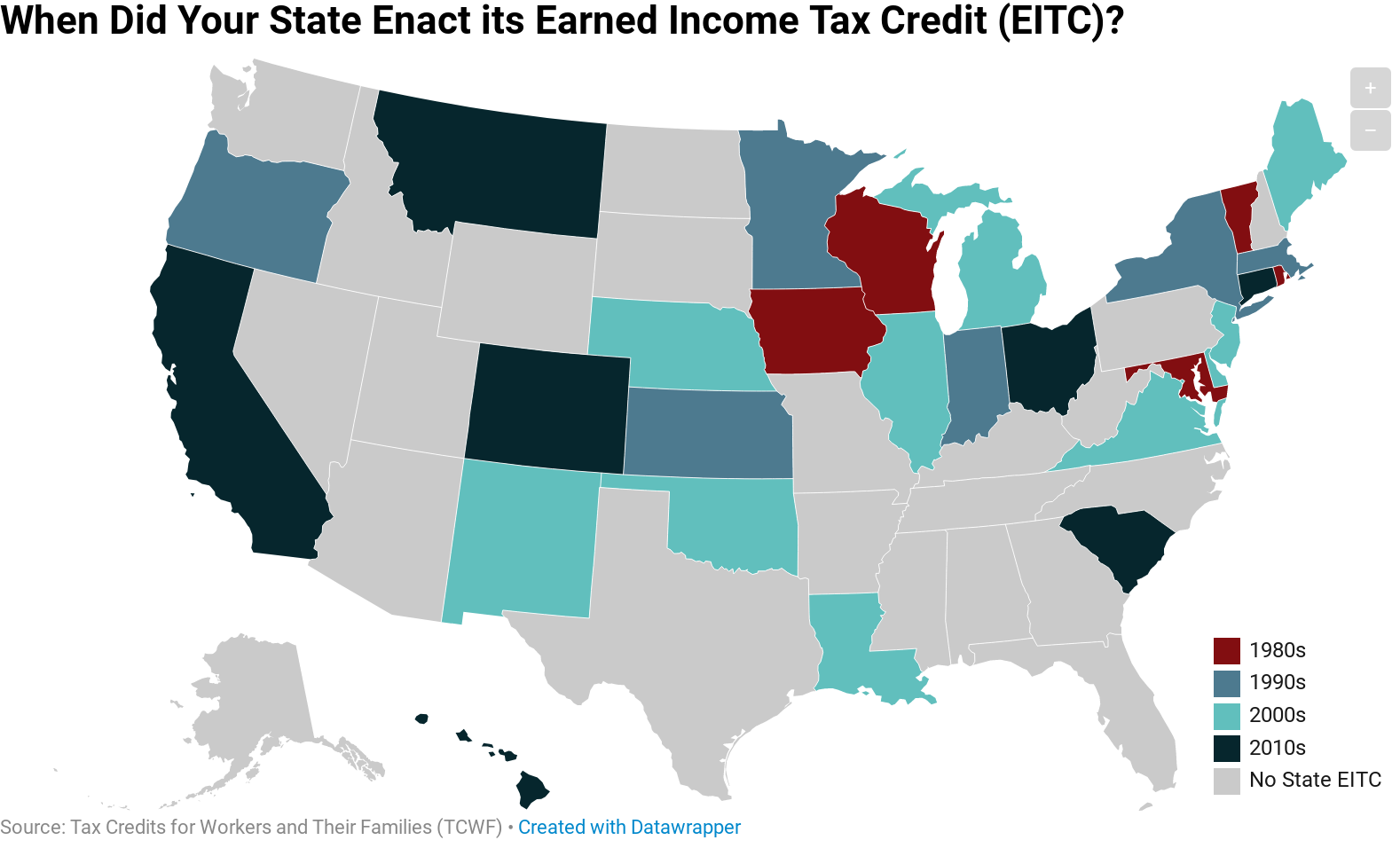

When Did Your State Enact Its Eitc Itep

New Mexicos Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Browse Through A Comprehensive Range Of Savings Accounts With High Interest Rates That Are Offered By Yes Bank Savings Account Saving Bank Account Accounting

The Diploma In Accounting Is A 2 12 Year Programme That Provides Students With Knowledge And Skills In Financial Acc Accounting Financial Accounting Economics

Redesign Slated For Loan Forms - Real Estate Agent And Sales In Pa Loan Application Lettering Application

Comments

Post a Comment