So, she just got her car payment slip for this month, but it also had a bill for $250 for the 'property tax' on the car. If i end up with a leased car cap cost (final sale price) of $45k should i expect to pay the following?:

Indemnity Calculation Kuwait Online 2021 In 2021 Indemnity Kuwait Days And Months

This means you only pay tax on the part of the car you lease, not the entire value of the car.

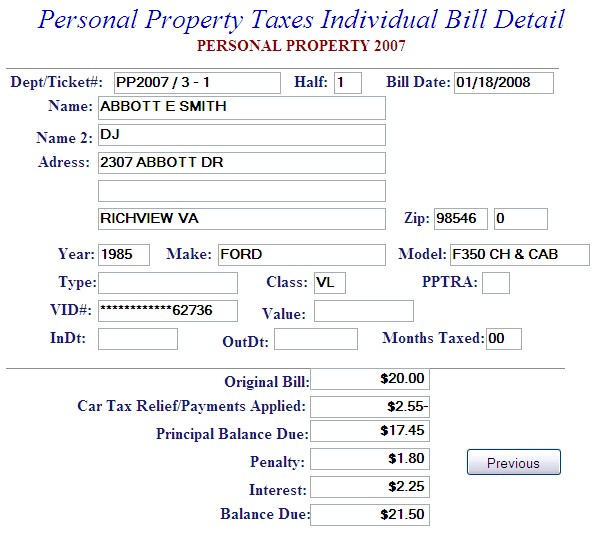

Property tax on leased car in va. If you didn’t already know, the following states apply a “personal property tax” on all leased vehicles: Gross proceeds means the charges made or voluntary contributions received for the lease or rental of tangible personal property computed with the same deductions, where applicable, as for sales price in 23vac10. Questions answered every 9 seconds.

Okay, my 29 y/o dd thinks i'm nuts for asking this here but i know someone will know this. Personal property taxes that are (1) assessed annually and (2) based on the value of the personal property are itemized deductions for federal tax purposes. Ad a tax advisor will answer you now!

To qualify, a vehicle must be owned by an individual or leased by an individual under a contract requiring the individual to pay the personal property tax; Sales tax in virginia is levied on the entire value of the car, not just the depreciation as is done in most other states. The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within state lines, with the minimum sales tax for purchased vehicles.

Virginia va sales tax and lease purchase option. Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on january 1. The credit will be reflected on the bill, but the leased vehicle.

For example, if your local sales tax rate is 5%, simply multiply your monthly lease payment by 5% and add it to the payment amount to get your total payment figure. The rate is 4.15% but can be higher with the addition of local taxes. Leased vehicles are eligible when the lessee is responsible for direct payment of the personal property tax by the terms of the lease agreement ;

Arkansas, connecticut, kentucky, massachusetts, missouri, north carolina, rhode island, texas (haha i always found it funny how when you flip the a and the e in texas, you get taxes, lol), virginia, west virginia and orleans parish (louisiana). However, the state has an effective vehicle tax rate of 2.6%, according to a property tax report published earlier this year by wallethub, which calculated taxes on a. The property taxes are separate from the sales taxes on cars and other purchases.

In va you are taxed up front on the cap cost of the leased car (sales tax rate of 6%,fairfax county) and then 4.15% tax rate based on the value of the car each year. The personal property tax relief act of 1998 provides tax relief for passenger cars, motorcycles, and pickup or panel trucks having a registered gross weight of less than 7,501 pounds. June 6, 2019 2:03 am.

It is an ad valorem tax, meaning the tax amount is set according to the value of the property. Vehicles leased by a qualified military service member and/or spouse will receive a 100% state vehicle tax subsidy (pptra) as a tax credit on the first $20,000 of assessed value. Motor homes, trailers and farm use vehicles do not qualify for tax relief.

The most recent tax relief rates are as follows: She is leasing a 2005 corolla. She got it last spring.

Tax bills are reduced by virginia beach's expected reimbursement under the personal property tax relief act from the commonwealth, for qualified vehicles based on the first $20,000 of value. The vehicle is registered in the name of the leasing company, and the car tax bills are sent directly to the leasing company for payment. And , be used 50% or less for business purposes.

The tax is based on the vehicle’s suggested retail price and a statutorily determined tax rate that decreases over six years. Taxes up front at signed lease = $2.7k (6%) The most common method is to tax monthly lease payments at the local sales tax rate.

Questions answered every 9 seconds. Generally, the tax applies to leases or rentals of machinery and equipment which is leased or rented without an operator. To qualify, a vehicle must be owned by an individual or leased by an individual under a contract requiring that individual to pay the personal property tax and be used 50% or less for business purposes.

Ownership and tax statements a dealership that leases a vehicle retains ownership. Virginia beach city council sets the tax relief each year. Loudoun county levies a tax each calendar year on all motor vehicles, trailers, campers, mobile homes, boats, and airplanes with situs in the county.

Vehicles are automobiles, motorcycles, pickups and panel trucks registered with dmv with a gross. For example, in alexandria, virginia, a car tax runs $5 per $100 of assessed value while in fairfax county the assessment is $4.57 per $100. Ad a tax advisor will answer you now!

Stat tit 36, § 1482 (1) (c)). Maine municipalities levy an annual motor vehicle excise tax on owned and leased vehicles “for the privilege of operating a vehicle on the public ways” (me. The bills are due each year on oct.

Paypersonalpropertytax

Why Does Virginia Have A Car Tax Wtop News

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Who Pays The Personal Property Tax On A Leased Car

Commercial Property Inspection Report Template 1 - Templates Example Templates Example Inspection Checklist Checklist Checklist Template

Open- Vs Closed-end Leases What To Know Credit Karma

Car Lease Calculator Get The Best Deal On Your New Wheels - Nerdwallet

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool

The States With The Lowest Car Tax The Motley Fool

Nj Car Sales Tax Everything You Need To Know

Which Us States Charge Property Taxes For Cars - Mansion Global

Virginia Sales Tax On Cars Everything You Need To Know

Is It Better To Buy Or Lease A Car Taxact Blog

Who Pays The Personal Property Tax On A Leased Car

How To Gift A Car A Step-by-step Guide To Making This Big Purchase

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool

How To Negotiate A Car Lease - Experian

911 Turbo S Via Porschesportgermany 911 Turbo S Porsche 911 Turbo

Debt To Income Ratio Spreadsheet Debt To Income Ratio Mortgage Payoff Mortgage Process

Comments

Post a Comment