The employer must collect the employee’s portion. (section 2302 of the cares act calls this.

How To Report Self-employment Income In 3 Simple Steps

Employers that file annual employment tax returns and that are not required to deposit.

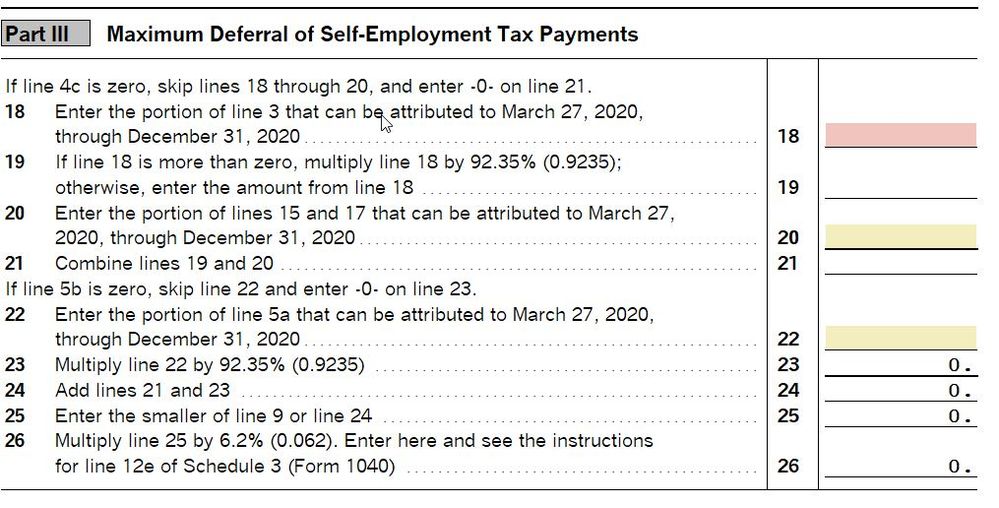

Self employment tax deferral due date. Half of the deferred amount is due by 12/31/21 and the other half is due by 12/31/22. Half of the deferred social security tax is due by december 31, 2021, and the remainder is due by december 31, 2022. 50% of the amount owed will be due on december 31, 2021, and the remaining amount will be due on december 31, 2022.

(section 2302 of the cares act calls this period the payroll tax deferral period.) self. Filing date for 2020 tax year. You will need to contact the irs to see if they are applying your refund to your 2020 deferred self employment taxes.

The employer selects deferral payment and then changes the date to the applicable tax period for the payment. >an entry be made into turbotax 2021 as an estimated tax. Half of the deferred social security tax is due by the end of this year (2021).

If the employee no longer works for the organization, the employer is responsible for repayment of the entire deferred amount. (section 2302 of the cares act calls this period the “payroll tax deferral period.”) 10. Check if you have a schedule 3 line 12e which goes to 1040 line 13.

It is also a deferral rather than forgiveness, so those amounts will eventually need to be repaid. Categories deferred social security tax. If you have employees, you can defer the 6.2% employer portion of social security tax for march 27, 2020 through december 31, 2020.

After it is paid, should. The self employment tax deferral is an optional benefit. You pay preliminary tax (an estimate of tax due for your current trading year) on or before 31 october each year and make a tax return for the previous year not later than 31 october.

Half of the deferred amount is due on december 31, 2021, and the other half is due on december 31, 2022. Will a penalty be assessed for the failure to make. >entry for the amount paid to avoid having turbotax pull in.

If the 2020 tax return had a self employment tax. >deferral amount to be paid later. Here’s how you would calculate how much self.

This deferral also applies to deposits of the employer's share of social security tax that would otherwise be due after december 31, 2020, as long as the deposits relate to the tax imposed on wages paid on or before december 31, 2020 during the payroll tax deferral period. Deferred self employment tax payments not tracked. If you file your tax return online using the revenue online service (ros) ,.

Payment date for 2020 tax year.

What The Self-employed Tax Deferral Means For Your Self-employed Tax Clients - Taxslayer Pros Blog For Professional Tax Preparers

Reminder Half Of 2020 Deferred Fica And Self-employment Taxes Are Due December 31 2021 - Marks Paneth

What The Self-employed Tax Deferral Means Taxact Blog

Manual Book 1770

Deferral Credit For Certain Schedule Se Files - Intuit Accountants Community

What Does Self-employed Mean Are You Self-employed

Profitsharing Contributions An Employer Profit Sharing Contribution Is A Contribution Made By The Employer To An Employ How To Plan Profit Retirement Planning

2

Deferral Of Se Tax - Intuit Accountants Community

What Is Payroll Tax Relief And When Does It Apply - Turbotax Tax Tips Videos

Manual Book 1770

Coronavirus Further Self-employment Considerations Low Incomes Tax Reform Group

How To Defer Social Security Tax Covid-19 Bench Accounting

Manual Book 1770

Guidance For Repayment Of Deferred Payrollself-employment Taxes

How To Pay Tax On Self-employed Income Debitoor Invoicing Software

14 Tax Tips For The Self-employed Taxact Blog

Coronavirus Self-employment Illness Or Self-isolation Low Incomes Tax Reform Group

Coronavirus Seiss Fourth Grant Low Incomes Tax Reform Group

Comments

Post a Comment