This relief is in place until the end of 2021. Powered only by an electric motor;

Government Incentives In Ireland For Electrichybrid Vehicles New Used Cars Dublin Joe Duffy

Now is the perfect time to purchase with several attractive government incentives in place for those considering an electric vehicle in ireland.

Tax incentives for electric cars ireland. Public administrations must reform their tax systems to provide more fiscal incentives for cycling and include support schemes for buying electric and cargo bikes in their national recovery and resilience plans. While new car sales continue to decline, sales of electric vehicles (evs) are up 3.39pc this year. Vrt relief is up to €5,000 for battery electric vehicles (bev).

Percentage used in tax benefits of electric cars (registered before 6th april 2020) The sustainable energy authority of ireland (seai) offers a grant of up to €5,000 on the purchase of an electric vehicle (either a battery. No changes to the motor tax rates were announced, and the expected rolling back of the €5,000 vrt rebates for evs costing above €30,000 was also not announced.

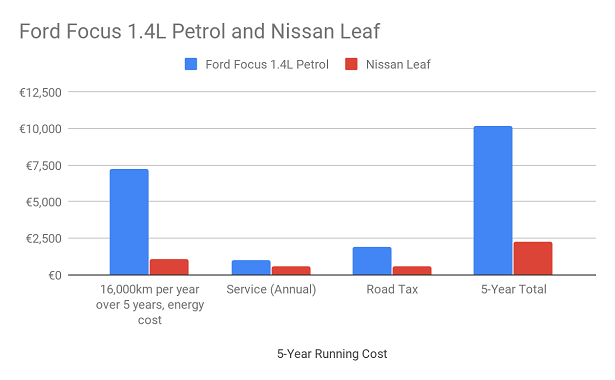

The electric vehicle grant scheme in ireland offers grants for both private and commercial evs. Indeed, the €5,000 vrt rebate for evs has now been extended until the end of 2023. Reduction in transport costs compared to a comparable new diesel engine car;

Why drive an electric vehicle? Also, there are reductions for electric hybrids depending on their electric only range. Electric vehicles receive vrt relief separately to seai grant support.

Full cap allowance tax saving accomplished in year 1 of ownership; It is typically reflected in the vehicle price displayed by a dealer. Series production passenger cars or commercial vehicles (vrt categories a and b) that are:

Low rate of annual motor tax Despite irish motorists being able to claim up to €10k off the price of a new electric vehicle thanks to seai grants, the average. Ad outstanding electric range, powerful performance & zero emissions.

Fully electric tech, crossover suv versatility and packed with the latest innovations. Vehicles with an open market selling price (omsp) of up €40,000 will be granted relief of up to. The irish times reports that the government is mulling dropping the cap for tax relief on electric cars to €40,000, warding off criticism that electric vehicle tax breaks primarily.

Following the proposal by the department of finance’s tax strategy group to raise the price of new electric vehicles by as much as €4,100 in the upcoming budget, experts in the field are campaigning to both retain and expand ev incentives. Eligible candidates can claim lower of purchase price or €24,000 against trading profits in year of purchase; A vrt rebate of up to €5,000;

Other tax incentives for electric cars in addition to the grants for the purchase of electric cars and the installation of the home charger unit, there are other additional economic incentives to the benefit of electric mobility. For example, in ireland, registration and motor tax rates are calculated based on co2 emissions. Ad outstanding electric range, powerful performance & zero emissions.

In addition, these vehicles also qualify for vrt relief of up to €5,000 for a bev and €2,500 for a phev, providing a maximum combined subsidy (grant + vrt relief) of €10,000 for bevs and €7,500 for phevs. Fully electric tech, crossover suv versatility and packed with the latest innovations. Motor tax on a battery electric vehicle in ireland is the lowest rate possible which is €120 a year.

Conventional company vehicle takes 8 years to realise this saving; Registered before 31 december 2021; Only evs with a list price of more than €14,000 are eligible.

In the case of the new nissan. Lowest rate of motor tax at €120 per annum Available on new 100% electric vehicles purchased by ltd company’s & sole traders;

Electric car servicing costs a big difference between traditional and electric cars is that electric cars don’t need nearly as much servicing as traditional cars. Are eligible for relief from vrt up to a maximum amount of €5,000. Vrt is paid whenever a car is registered for the first time in ireland.

Up to €5,000 for battery electric vehicles. A maximum grant of €5,000 is available for eligible evs when purchased privately and a maximum of €3,800 is awarded for commercial vehicles. A list of the eligible vehicles can be viewed here, and include both plugin hybrid and battery electric cars.

But the 2,956 battery evs sold represent less than 4pc of. These schemes can be put in place at a fraction of the cost governments are investing in tax cuts for company cars and subsidies for electric cars.

10 Things To Know Before Buying An Electric Car

Electric Car Grants Ireland Ev Grants Liberty Insurance Ireland

Ireland Halves Phev Subsidies - Electrivecom

Electric Cars In Ireland - Why So Few

Electric Cars In Ireland - Why So Few

Electric Vehicles Ireland Ranked Fourth Most Expensive Country For Charging

The Expert View On The Real Cost Of Running An Ev - Independentie

How Much Does It Cost To Buy An Electric Car

Tax Incentives Grants For Electric Cars

Government Grants Incentives For Evs In Ireland 2021

Green Technology And Wireless Charging How Electric Driving Will Change In The Next Ten Years

Ev Experts Call For Greater Incentives In Next Budget - Irish Tech News

The Cost Of Charging An Electric Car In Ireland

All-electric Cars Vans Ford Ie

How Much Does It Cost To Buy An Electric Car

Teslas Opens Their First Store Service Center And Supercharging Station In Ireland - Info Photo Galleries Supercharger Tesla Car Tesla

Will Electric Cars Require Ever-more Incentives

.jpg)

A Guide To Owning An Electric Vehicle In Ireland Fitzpatricks Garages

Electric Car Grants Benefits Of Electric Cars

Comments

Post a Comment