We suggest that you consult your tax advisor, who is most familiar with your circumstances and the laws of the state in which you reside, to. State fidelity® conservative income municipal bond fund:

2

Those living within these states may choose to use these funds to take advantage of state tax benefits.

Fidelity tax free bond fund by state 2020. 0.29% of the dividends paid by the segall bryant & hamill colorado tax free fund in 2020 are subject to the federal alternative minimum tax (amt). As of august 18, 2021, the fund has assets totaling almost $4.74 billion invested in 1,368 different holdings. The minimum initial investment is $25,000.

Fees are low compared to funds in the same category. It potentially invests more than 25% of total assets in municipal securities that finance similar types of projects. View mutual fund news, mutual fund market and mutual fund interest rates.

Learn more about mutual funds at fidelity.com. Here are the best muni single state long funds. The fund invests in a combination of fidelity ® u.s.

Nuveen wisconsin municipal bond fund No transaction fee fidelity funds are available without paying a trading fee to fidelity or a sales load to the fund. This strategy steers clear of leveraged structures and large stakes in troubled names and nonrated bonds, as well as bonds subject to the alternative minimum tax.

The investment seeks to provide a high current yield exempt from federal income tax. To find the 2020 dividends amount you received for each. Muni new york long portfolios invest at least 80% of assets in new york municipal debt.

These portfolios have durations of more than 6.0 years (or average maturities of more than 12 years).: The adviser allocates its assets according to a neutral asset allocation strategy shown in the glide path below that adjusts over time until it reaches an allocation similar to that of the fidelity freedom ® income fund, approximately 10. Before investing, consider the fund’s investment objectives, risks, charges, and expenses.

Nuveen la municipal bond fund; The expense ratio is 0.25%; Conservative income municipal bond fund (fuemx) fidelity flex.

Municipal income fund (fuenx) fidelity® intermediate municipal income fund (fltmx) alabama 1.10% 1.73% 0.90% 1.27% Because the income from these bonds is generally free from federal taxes and new york state taxes, these portfolios are most appealing to residents of new york. Nuveen missouri municipal bond fund;

Learn more about mutual funds at fidelity.com. Mainstay mackay california tax free opportunities fund and mainstay mackay new york tax free. Shareholders should consult with their tax advisor concerning the application of the above information.

Contact your investment professional or visit i.fidelity.com for a prospectus or, if available, a summary prospectus containing this information.

2

Fidelity Mutual Fund Tax Information - Fidelity

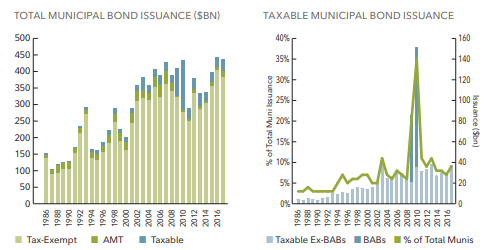

The Role Of Taxable Municipal Bonds In Investor Portfolios Seeking Alpha

Ftemx - Fidelity Total Emerging Markets Fund Fidelity Investments

Why Asset Location Matters - Fidelity Personal Financial Planning Investing Real Estate Investment Trust

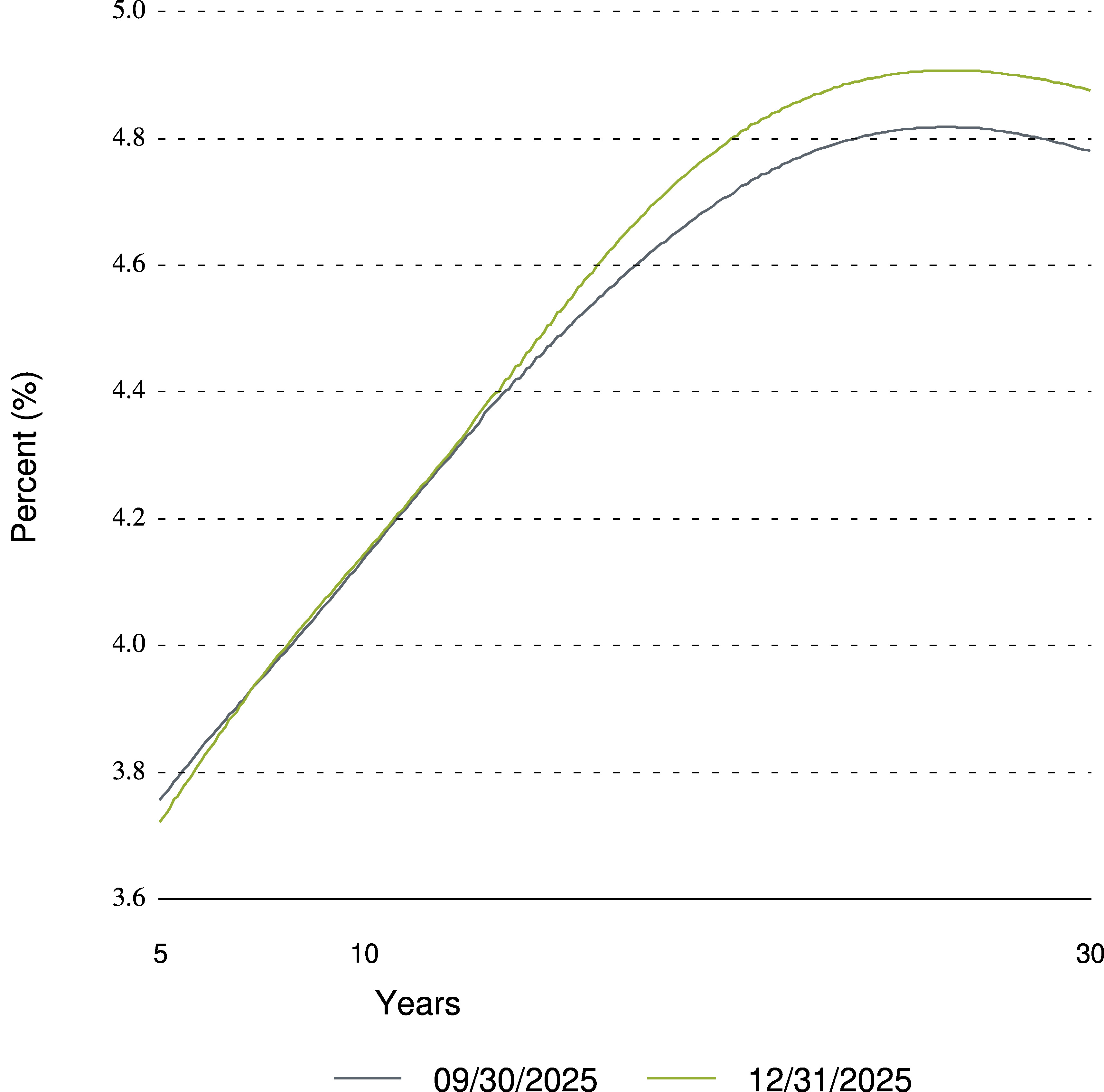

Market Watch 2021 The Bond Market Fidelity

N-csr 1 Filing836htm Primary Document United States Securities And Exchange Commission Washington Dc 20549 Form N-csr Certified Shareholder Report Of Registered Management Investment Companies

Fsabx - Fidelity Sai Municipal Bond Index Fund - Portfolio Holdings Aum 13f 13g

Familiar Themes Dominate October Us Fund Flows Morningstar Fund Bond Funds Fund Management

2

Wealth Is The Stuff You Cant See - A Wealth Of Common Sense Wealth Saving Habits Gross Domestic Product

/pencil_chart-56a693f15f9b58b7d0e3acb4.jpg)

Best Fidelity Funds To Keep Taxes Low

Tax Information Center 2020 - Fund Data And Rates Table Fidelity Institutional

2

Ftbfx - Fidelity Total Bond Fund Fidelity Investments

2

Etfs Again Proved Their Worth To Taxable Investors In 2020 Morningstar Portfolio Management Bond Funds Investors

Ftabx - Fidelity Tax-free Bond Fund Fidelity Investments

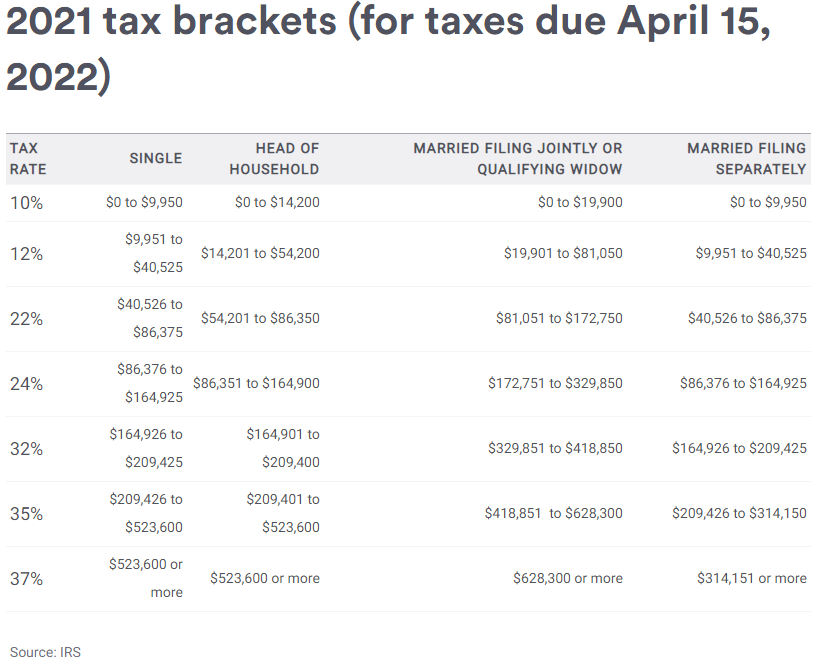

2020-2021 Federal Income Tax Brackets

Comments

Post a Comment