Hyde park (los angeles) 9.500%: A base sales and use tax rate of 7.25 percent is applied statewide.

1400 Pacific Coast Hwy Apt 301 Huntington Beach Ca 92648 - Realtorcom

Find more tax info, including assessment history and abatements, on.

Huntington beach ca sales tax rate 2020. The homeownership rate in huntington beach, ca is 56.7%, which is lower than the national average of 64.1%. The huntington beach, california, general sales tax rate is 6%. Surf city auto group ii.

The median property value in huntington beach, ca was $771,100 in 2019, which is 3.21 times larger than the national average of $240,500. Notice of public hearing pursuant to section 53083 (a) (6) of the california government code (ab 562. The minimum combined 2021 sales tax rate for huntington beach, california is.

The long beach sales tax rate is %. The california sales tax rate is currently %. There is no city sale tax for huntington beach.

2020 office completions (sqft) view more huntington beach market trends tax. Utilize leading marketing tools to boost your business and get found online. Ad start your dropshipping storefront.

What is the sales tax rate in long beach, california? The california sales tax rate is currently %. This is the total of state, county and city sales tax rates.

These cars are a great deal for undefined shoppers. Total tax rate property tax; 2020 ford edge st line.

The county sales tax rate is %. There is no applicable city tax. Huntington beach, ca sales tax rate the current total local sales tax rate in huntington beach, ca is 7.750%.

The tax amount paid for 21922 seaside lane, huntington beach is $14,798. City of huntington beach finance department 2000 main street huntington beach, ca phone: What is the assessed value of 21922 seaside lane, huntington beach?

Between 2018 and 2019 the median property value increased from $728,200 to $771,100, a 5.89% increase. The sales and use tax rate varies depending where the item is bought or will be used. The huntington beach sales tax rate is %.

101 rows the 92649, huntington beach, california, general sales tax rate is 7.75%. Utilize leading marketing tools to boost your business and get found online. Sales tax in huntington beach, ca while the state of california only charges a 6% sales tax, there's also a state mandated 1.25% local rate, bringing the.

Ad start your dropshipping storefront. Office rental rates are based on aggregated data of asking rates. 2020 office vacancy rate 12.65%;

The december 2020 total local sales tax rate was also 7.750%. The sales tax rate is always 7.75% every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), and in some case, special rate (1.5%). The sales tax jurisdiction name is huntington beach tourism bid, which.

The county sales tax rate is %. The december 2020 total local sales tax rate was also 9.000%. The local sales tax rate in orange county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.25% as of november 2021.

Click below to find your next car. This is the total of state, county and city sales tax rates. The minimum combined 2021 sales tax rate for long beach, california is.

The huntington beach's tax rate may change depending of the type of purchase. The 7.75% sales tax rate in huntington beach consists of 6% california state sales tax, 0.25% orange county sales tax and 1.5% special tax. The assessed market value for the current tax year is $1,347,345.

County of orange tax rate book.

1400 Pacific Coast Hwy Apt 301 Huntington Beach Ca 92648 - Realtorcom

2020 Volkswagen Atlas Cross Sport Special Price At Mckenna Vw

California Sales Use Tax Guide - Avalara

Sales Tax In Orange County Enjoy Oc

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

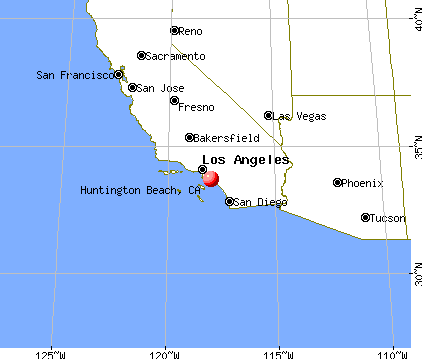

Huntington Beach California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Huntington Beach California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Huntington Beach California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

6 Differences Between Vat And Us Sales Tax

Huntington Beach California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Frequently Asked Questions

2

2

2

2

Economy In Huntington Beach California

California Sales Tax Rates By City County 2021

Covid-19 Business Resources Hb Ready

19341 Brooktrail Ln Huntington Beach Ca 92648 Mls Oc20214916 Redfin

Comments

Post a Comment