Search nj tax records & Murphy says that should mean property tax relief.

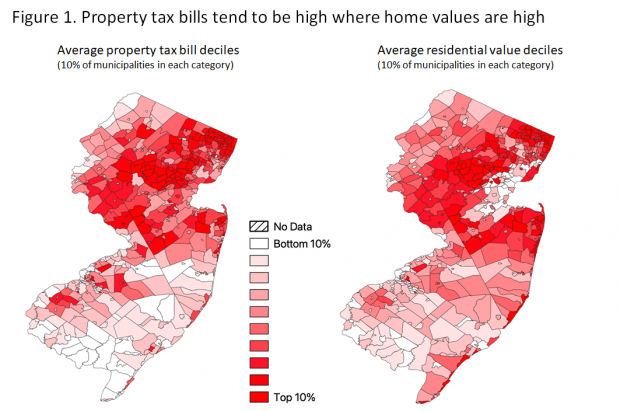

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

For most homeowners, the benefit is distributed to your municipality in the form of a credit, which reduces your property taxes.

Nj property tax relief check 2020. In new jersey, localities can give. Phil murphy and lawmakers agreed to in september, about 800,000 garden state residents could receive a $500 rebate check within a few. All property tax relief program information provided here is based on current law and is subject to change.

Nearly 170,000 new jerseyans received a senior freeze reimbursement check worth. The garden state is home to the highest levies on property in the nation, with a mean effective property tax rate of 2.21%, according to the tax foundation. We will continue to issue rebates to eligible recipients as 2020 tax returns are processed through december 31, 2021.

Nj gets more than expected in taxes; New jersey — as part of a $319 million package that gov. I had my accountant do my taxes.

$150,000 or less for homeowners aged 65 or over, blind, or disabled. Gross sales of products from the land must average at least $1,000 per year for the first 5 acres. Check the status of your new jersey senior freeze (property tax reimbursement).

Our information indicates that this property does not currently benefit from any exemptions or. So i get the basic tax refund. • applicant must notify division of the property tax change • file amended property tax reimbursement application • greater reimbursement:

Senior freeze (property tax reimbursement) program forms are sent out by the state in late february/early march. If a reimbursement has been issued, the system will tell you the amount of the reimbursement and the date it was issued. They might need to forget about looking in.

New jersey has one of the highest average property tax rates in the country, with only states levying higher property taxes. Residents who paid less than $500 in income tax will receive an amount equal to what they paid. Division issues check for the difference • lesser reimbursement:

Senior freeze (property tax reimbursement) inquiry. The state budget for fy2022 has been finalized and there were no changes made to the income limit established in the 2020 eligibility requirements. The homestead benefit program provides property tax relief to eligible homeowners.

New jersey offers taxpayers various tax relief and credit programs, which may lower the property's tax bill. The rules were tightened up in 2013, making it tougher to. Be a new jersey resident for all or part of 2020;

Here are the programs that can help you lower property taxes in nj: Active military service property tax. So i got my state refund check for 2020 i’m single with a job, don’t own a home.

So my tax info isn’t special just basic. Counties in new jersey collect an average of 1.89% of a property's assesed fair market value as property tax per year. New jersey's finances surged back up in april, mostly due to a record increase in income tax payments, and.

And i just got my state refund check. We began mailing checks july 2 and anticipate it will take about six weeks for all of the initial checks to be processed. Phil murphy ’s proposed $32.4 billion spending plan includes $275 million for the property tax relief program, which lowers tax bills.

The program reimburses eligible residents for increases on their property tax bills over a certain period of years. The homestead benefit program offers property tax relief to eligible homeowners. The new jersey homestead benefit program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on behalf of eligible homeowners to reduce their tax liability.

All property tax relief program information provided here is based on current law and is subject to change. For instance, an eligible family who paid $200 in taxes will get a $200 rebate check. The median property tax in new jersey is $6,579.00 per year for a home worth the median value of $348,300.00.

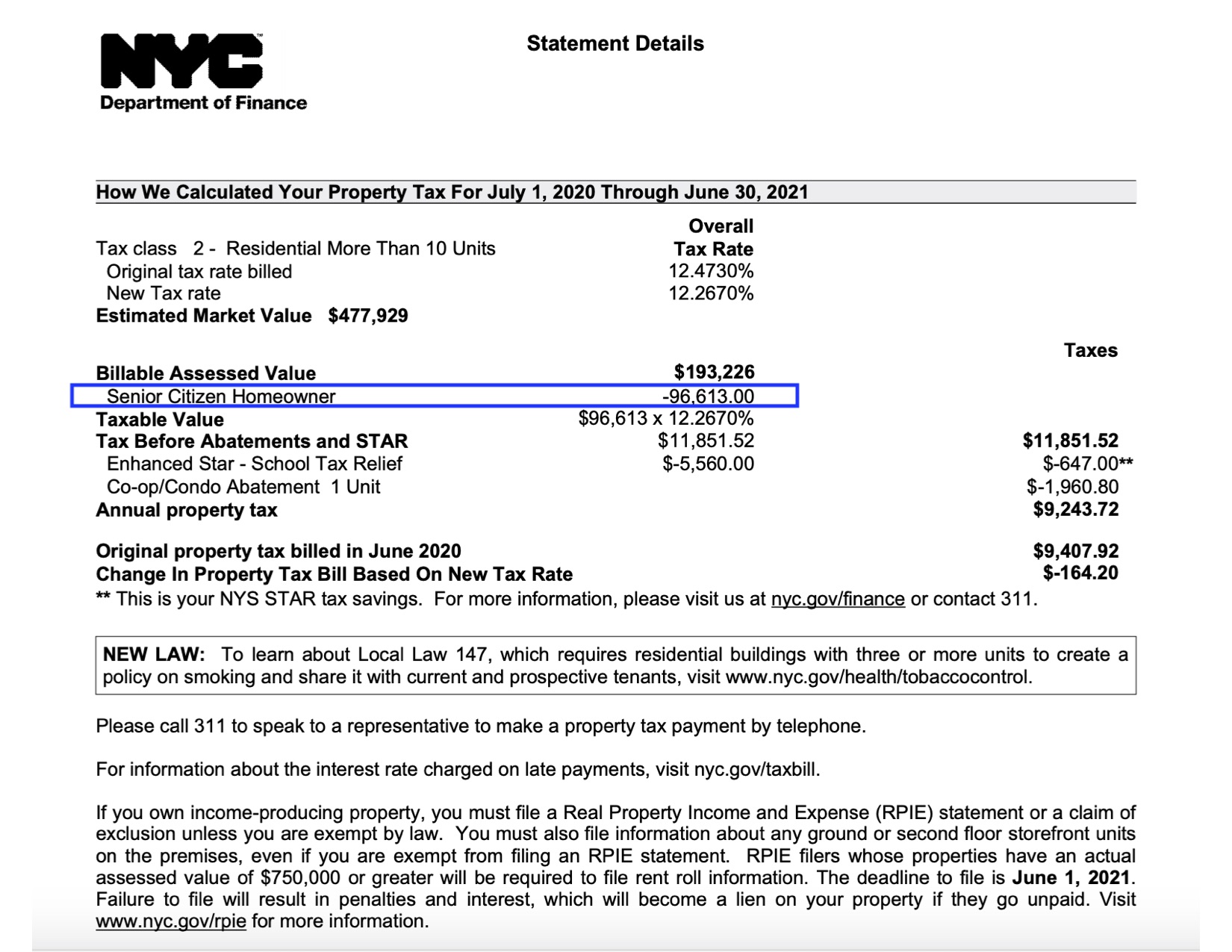

New jersey offers different tax relief programs —not only typical exemptions but also deductions of $250 and deferments or postponements of tax payments. These are deducted from the assessed value, giving the property's taxable value. But literally in the center top of the check under “trenton, new jersey 08695” it says “property tax relief.

$75,000 or less for homeowners under the age of 65 and not blind or disabled. 100% disabled veteran property tax exemption. We began mailing approved 2020 payments on july 15, 2021.

$250 veteran property tax deduction.

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

Florida Property Tax Hr Block

Disabled Veterans Property Tax Exemptions By State

Nj Property Tax Relief Program Updates Access Wealth

The Official Website Of The Borough Of Roselle Nj - Tax Collector

Nj Property Tax Relief Program Updates Access Wealth

What Is The Nyc Senior Citizen Homeowners Exemption Sche

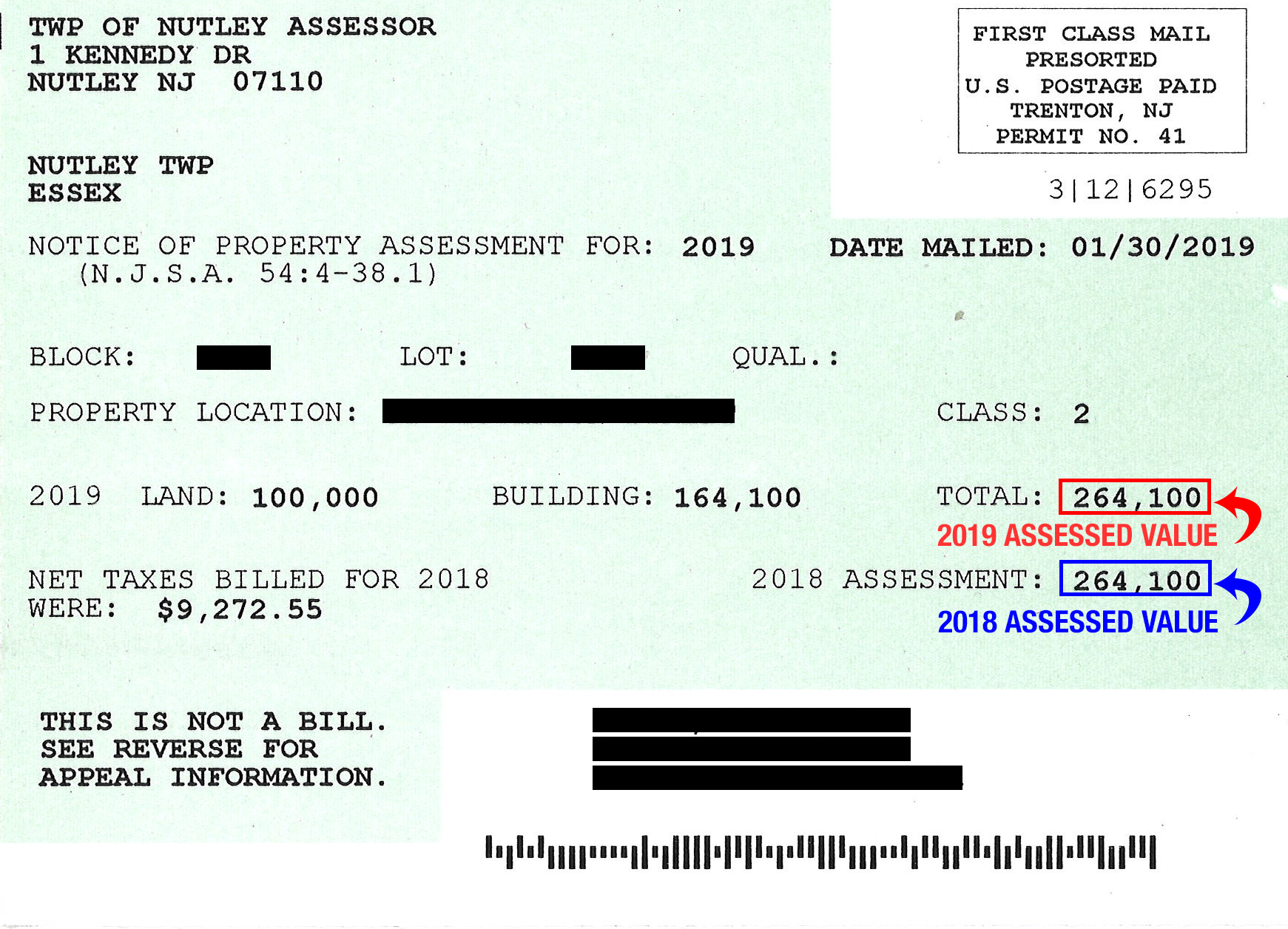

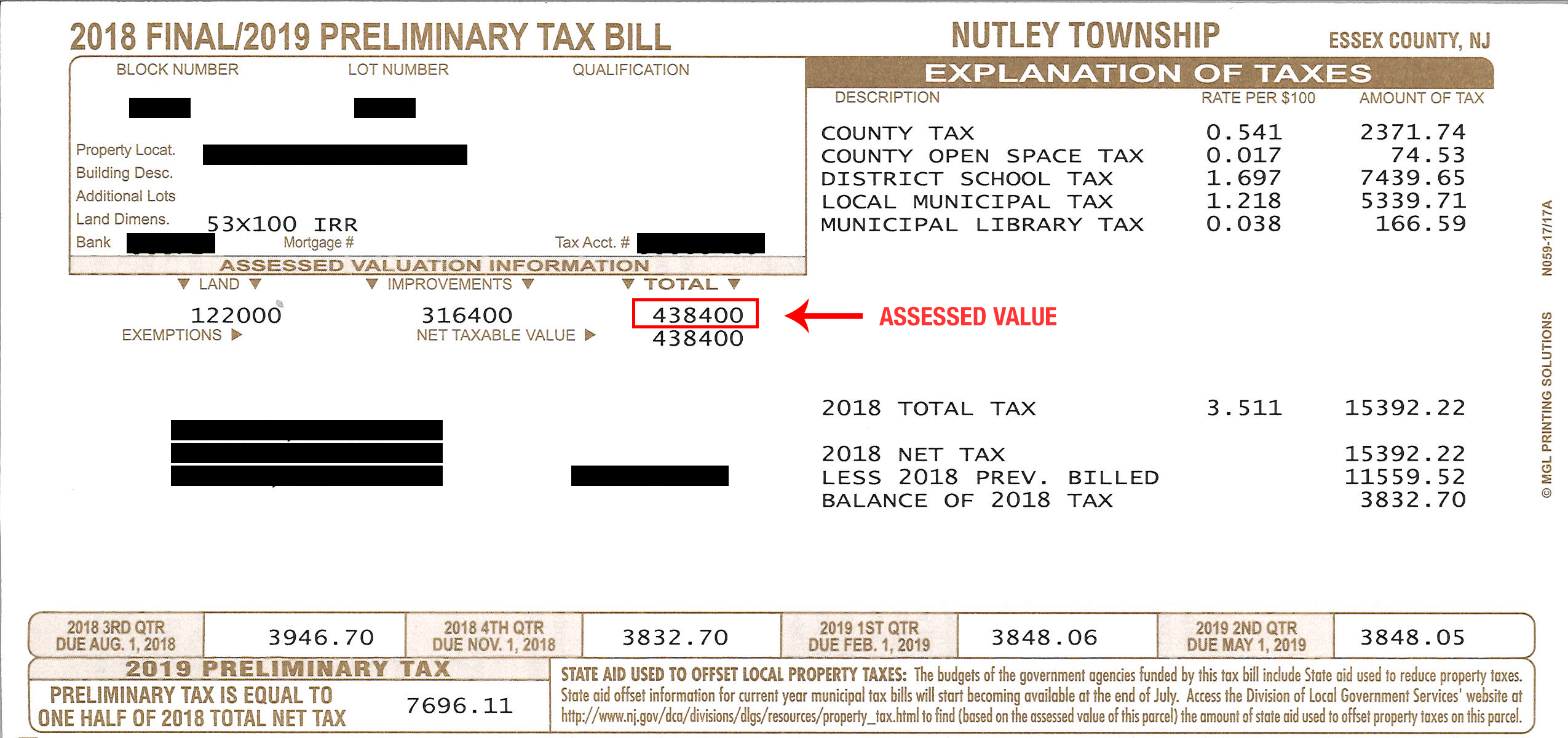

Nutley New Jersey - Property Tax Calculator

Freehold Township Sample Tax Bill And Explanation

Freehold Township Sample Tax Bill And Explanation

Here Are The 30 Nj Towns With The Highest Property Tax Bills In 2021 Union County Property Tax Mountain Lakes

Are There Any States With No Property Tax In 2021 Free Investor Guide

New York Property Tax Calculator 2020 - Empire Center For Public Policy

I Want You On My Rodan Fields Team Invest Your Tax Refund In Something That Will Give You A Great Return Youll Be In 2020 Tax Refund Income Tax

Nutley New Jersey - Property Tax Calculator

Illinois Income Tax Calculator - Smartasset Federal Income Tax Capital Gains Tax Income Tax

New Jersey Property Tax Records - New Jersey Property Taxes Nj

Deducting Property Taxes Hr Block

Real Property Tax Howard County

Comments

Post a Comment