Hmrc call it ‘relief at source’. Tax relief on pension contributions may be given in two ways:

Pin On Tax Returns

If, like most taxpayers in the uk, you are a 20% taxpayer (a basic rate taxpayer), you will make your contribution out of income that has already had 20% tax deducted.

People's pension tax relief at source. There are two ways that staff can get tax relief on what they pay into their pension (however, some providers use different names): When you earn more than £50,270 per year, you can claim an additional tax relief (either an extra 20% for higher rate taxpayers or 25% for additional rate taxpayers) to be added to your pension pot. The last point means that if your pension uses the ‘relief at source’ method of tax relief and you earn, say, £5,000 in the 2021/22 tax year, you can make a gross contribution of up to £5,000 into that pension.

Tax relief can be applied in two very different ways (and it’s important to get it right): Before tax has been deducted). You should do this by filing a tax return.

Salary sacrifice pension tax relief. Net pay arrangement is a deduction taken from salary before tax is calculated so tax relief is already applied. The tax relief available for pension savings is subject to certain limits known as the annual and lifetime allowances, which are restrictions put in place by hmrc.

We call this the net tax basis. Deducting employee contributions after tax? For example, if you have agreed to pay £100 a month (gross) into your pension, you only need to pay £80 from your take home pay.

The employee then pays tax only on salary. Application for relief at source from uk income tax and claim to repayment of uk income tax dt individual sa page 1 hmrc 01/20 this form is for use by an individual resident of south africa. When you set up your workplace pension with the people’s pension, you can choose to deduct your employees’ contributions from their wages either before or after tax.

There are 2 types of arrangements: You can find out more about these allowances on our annual and lifetime allowances web pages. Under this tax basis you’d deduct employee contributions from their pay after tax is taken.

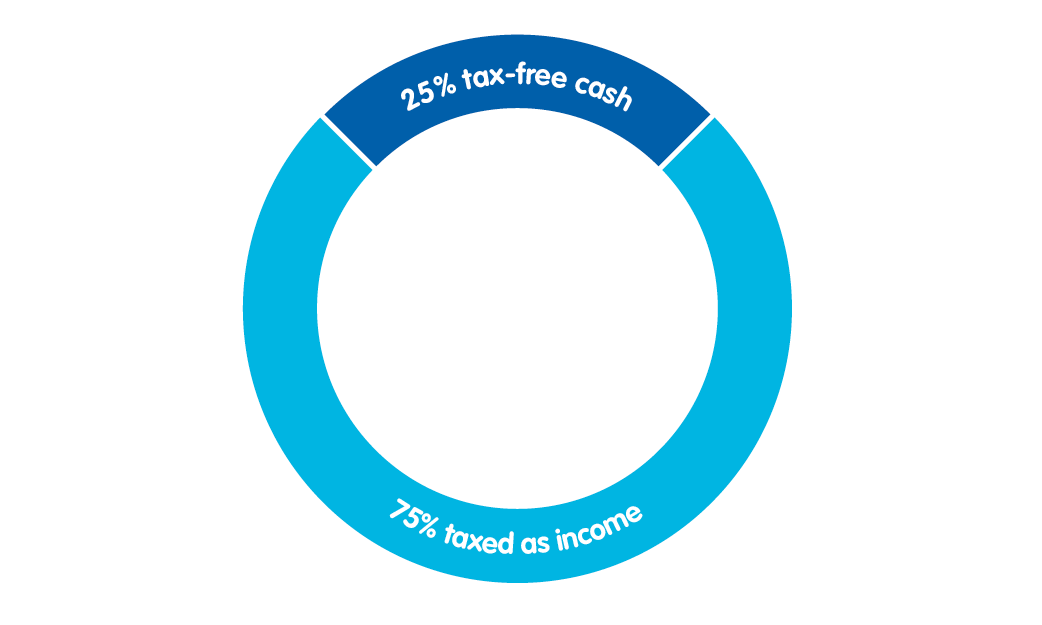

You may see hm revenue & customs (hmrc) referring to this as the ‘relief at. This is where your employer deducts your contribution from your earnings after tax, and your pension scheme gives you back tax at the basic rate. You can tell if it's relief at source if the pension provider has to claim the tax relief from hmrc.

In this scenario, employee contributions are usually reduced by the paye basic rate. Members will get tax relief, based on their residency status, at the relevant basic rate. Find out more about tax relief.

“net pay” or “relief at source”: ‘relief at source’ arrangements are used by personal and stakeholder pensions (that is, pensions set up with an insurance company) and some auto enrolment workplace pensions. But if you earn more than £100,000, your annual allowance will be reduced.

You might have more than one source of income. When someone else (for example your partner) pays into your pension, you automatically get tax relief at 20% if your pension provider claims it for you (relief at source). Relief at source is a deduction taken from an employee’s salary after tax is applied.

This equates to a net contribution of £4,000, because. In a net pay scheme, contributions are deducted from the employee’s gross salary (i.e. Receiving pensions, purchased annuities, interest or royalties arising in the uk.

For more information about the relief at source method, please visit our pension tax webpage. If you do, this relief is only from the source of income in respect of which the contributions are made. ‘relief at source’ is a little more complicated and applies to all personal pensions and some workplace pensions.

You do not need to do anything to get tax relief at the basic rate on your pension contributions. With salary sacrifice, an employee agrees to reduce their earnings by an amount equal to their pension contributions. Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme.

Net tax basis is great for lower paid employees: Tax relief is paid on your pension contributions at the highest rate of income tax you pay. This means tax relief cannot be claimed because the employee has been taxed on a lower amount of salary.

Your pension provider applies tax relief by claiming back the basic rate from hmrc to add to your pension savings.

Kambodza Wonders Of The World Places To See Places To Visit

Changes To Pension Tax Relief Create Few Winners And Many Losers Pensions And Lifetime Savings Association

60 Tax Relief On Pension Contributions - Royal London For Advisers

Pension Tax - Tax Relief Lifetime Allowance The Peoples Pension

Pensions Tax Relief Contributions Explained - Interactive Investor

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Changes To Pension Tax Relief Create Few Winners And Many Losers Pensions And Lifetime Savings Association

Changes To Pension Tax Relief Create Few Winners And Many Losers Pensions And Lifetime Savings Association

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sche Small Business Bookkeeping Small Business Accounting Business Expense

Pension Tax - Tax Relief Lifetime Allowance The Peoples Pension

Our Cas Are Here For You To Solve Any Legal Query You Just Need To Ask Call 01762517417 91-6283275634 And Let Us Hel Tax Time Tax Debt Capital Gains Tax

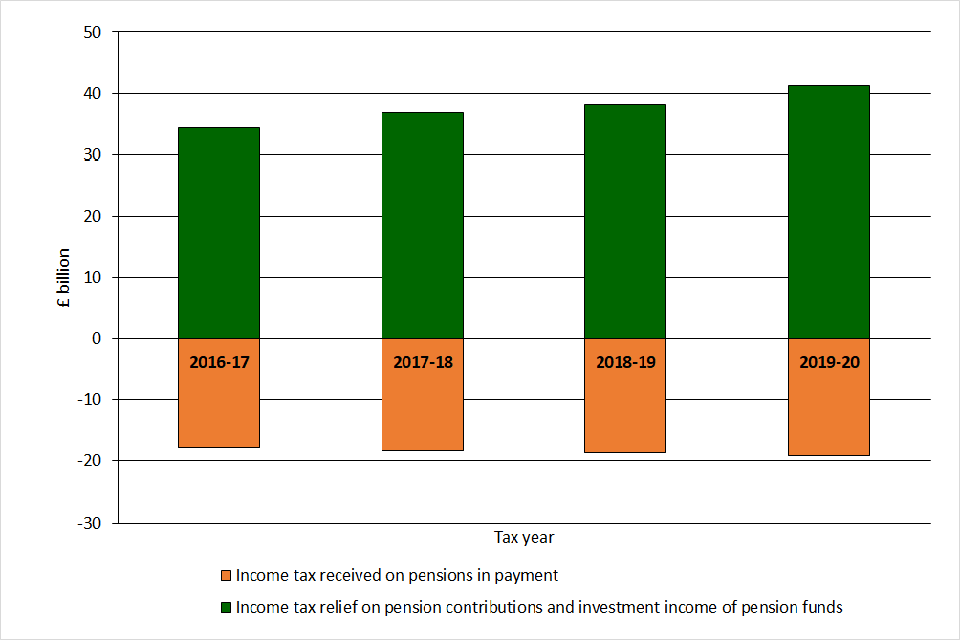

Pension Tax Relief Cost Hits 42bn - Ftadvisercom

What Uk Tax Do I Pay On My Overseas Pension Low Incomes Tax Reform Group

Eligibility To Claim Rebate Under Section 87a Fy 2019-20 Ay 2020-21 Illustrations In 2021 Business Tax Deductions Small Business Tax Deductions Tax Deductions

Uk Pension Transfer Httpwwwexpatwealthcarecomwealth-solutionssipps-qrops-qnups Uk Pension Pensions Solutions

How Pension Tax Relief Works And How To Claim It Wealthifycom

Commentary For Personal And Stakeholder Pension Statistics September 2021 - Govuk

Pin On Misc

Workplace Pension Contributions The Peoples Pension

Comments

Post a Comment