The minimum combined 2021 sales tax rate for memphis, tennessee is. Here’s how to do it right.

Jackson Tennessee Food

However, cities and counties can collect additional sales taxes, with local rates ranging from 1.50% to 2.75%.

Sales tax on food in memphis tn. Sales or use tax (continued) there are some exceptions to the 7% general state sales or use tax rate: The county sales tax rate is %. Any person, legal entity, including heirs, or assignees who have a possible ownership interest, legal or.

Memphis city rate(s) 7% is the smallest possible tax rate (38110, memphis, tennessee) 9.25% are all the other possible sales tax rates of memphis area. 9.75% is the highest possible tax rate (37501, memphis, tennessee) the average combined rate of every zip code in memphis, tennessee is 9.346%. This tax is generally applied to the retail sales of any business, organization, or person engaged

Tennessee bill would exempt groceries from sales tax for may through october 2021 h.b. Accessories, furnishings, and + delivery or installation fees, are sales of food and food ingredients as defined in the law. The tennessee state sales tax rate is 7%, and the average tn sales tax after local surtaxes is 9.45%.

There is no sales tax on food items, but prepared meals purchased in a restaurant are subject to a meal tax of 6.25% (in some towns voters chose to add a local 0.75% tax, raising the meal tax to 7%, with that incremental revenue coming back to the town). Business licenses required at all levels of government for businesses in memphis, tennessee. Sales or use tax [tenn.

“it’s helpful, if our customers can save in their pocketbook, the 9.75 percent sales tax, and that incentivizes them to come and choose to eat out more than they would’ve,” she said. Electricity and natural gas are normally taxed at the rate of 7.0%; Taxed at 7%, plus local sales tax rate.

“i think for some tennesseans this will have a major impact. Sales tax reduction on utilities. It's just not worth driving 20 miles to fayette county to save 52 cents in.

California (1%), utah (1.25%), and virginia (1%). Visit www.tn.gov/revenue and click “revenue help.” • baby food • bottled water • bread • canned foods • cereal • chips, dips • coffee • condiments • $1,600 x 2.25% (local sales tax) = $36 • $1,600 x 2.75% (single article tax rate) = $44 • total tax due on the vehicle = $1,851 if purchased in tennessee • minus credit for $1,518 fl sales tax paid (must be on bill of sale) •.

We include these in their state sales tax. Memphis, tennessee sales tax rate details. Sales tax treatment of groceries, candy & soda, as of july january 1, 2019 (a) alaska, delaware, montana, new hampshire, and oregon do not levy taxes on groceries, candy, or soda.

But if passed, food would be tax free this summer starting june 1 to july 31 cutting grocery bills by $4 for every $100 you spend. The memphis sales tax rate is %. Exact tax amount may vary for different items.

1071 would exempt food items from sales tax for six months, and. This is the total of state, county and city sales tax rates. Memphis, tn sales tax rate the current total local sales tax rate in memphis, tn is 9.750%.

Please refer to the tennessee website for more sales taxes information. These items are taxed at a state rate of. Counties and cities can charge an additional local sales tax of up to 2.75%, for a.

Thanks to the improve act, the state sales tax rate on food and food ingredients has been reduced 20% from 5% to 4%, plus local sales tax rate. Water is taxed at the combined rate of 9.25%. Please note that the results below are for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown.

Sales tax in most places in tn is going to be between eight and ten cents on the dollar. That means 9.25% (7% is the state portion and 2.25% is the local). However, manufacturers may be granted a reduced rate of 1.5% for industrial machinery or a full exemption if the energy fuel or water comes in contact with the product.

The memphis, tennessee sales tax rate of 9.75% applies to the following 50 zip codes: Last sales taxes rates update 2021 tennessee state sales tax.

The december 2020 total local sales tax rate was also 9.750%. 37501, 37544, 38101, 38103, 38104, 38105, 38106, 38107, 38108, 38109, 38111, 38112, 38113, 38114, 38115, 38116, 38117, 38118, 38119, 38120, 38122, 38124, 38126, 38127, 38128, 38130, 38131, 38132, 38134, 38136, 38137, 38141, 38152, 38157, 38161, 38166, 38167, 38168, 38173, 38174, 38175, 38177, 38181, 38182,. The tennessee sales tax rate is currently %.

Ordering This Cute Portable Chopstick Tupperware

Pin On Hong Kong Unique Homes

Swoosh On Sale Favorite Places Places Trip

1940s San Francisco Playlandcliff House Places To Dine At Beach Restaurant Menu 1910668039 Menu Restaurant San Francisco Cafe Menu

Big Man Chairs Free Shipping Save On Sales Tax No Interest Financing Furniture Home Decor Man Living Room Oversized Recliner Chair

Pin On Muebles

Sales Tax On Grocery Items - Taxjar

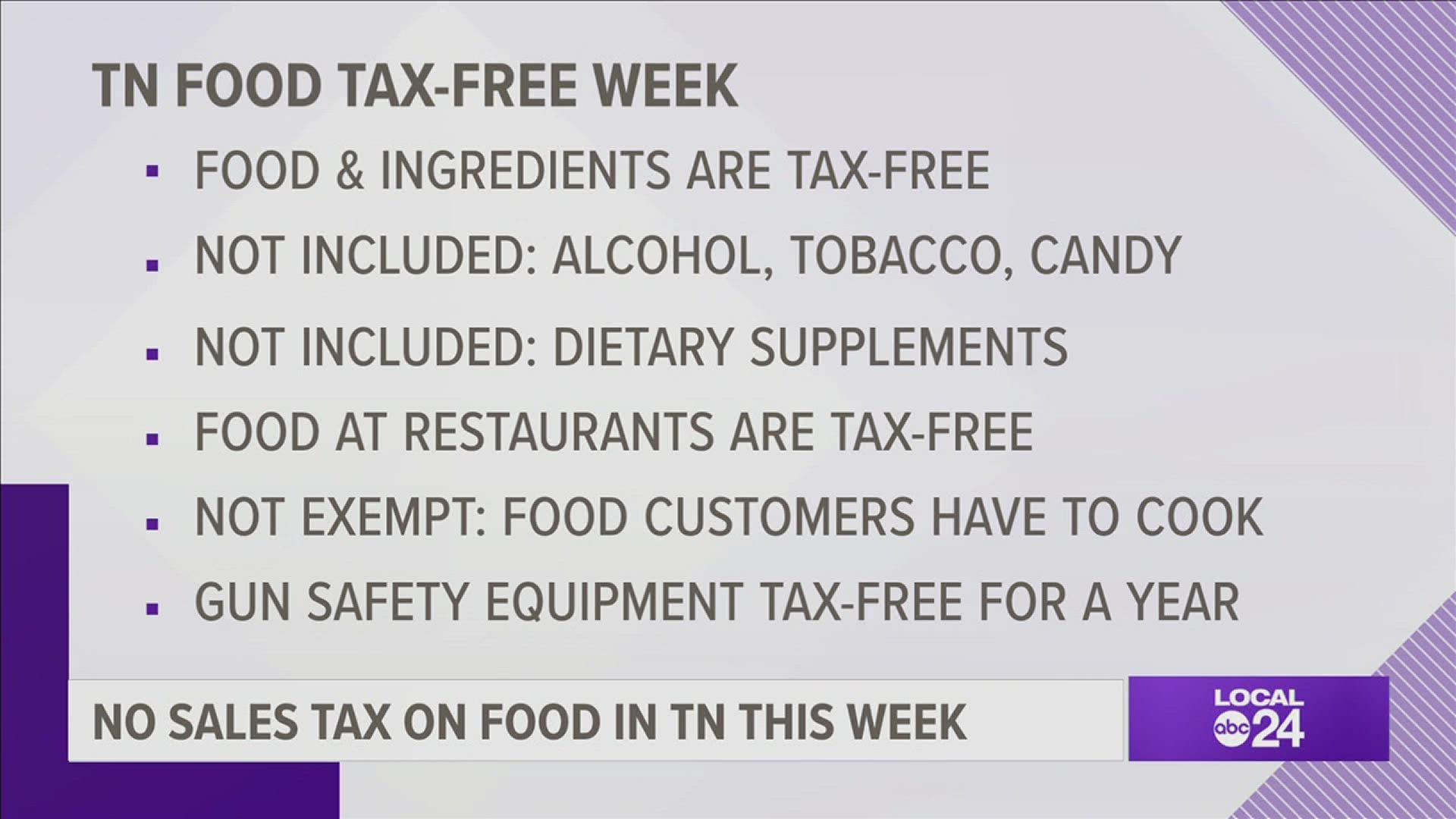

Tn Has Its First-ever Tax Free Week On Food Localmemphiscom

Sales Tax On Grocery Items - Taxjar

Bristol Va Meals Tax Among Highest Wcyb

Big Leather Arm Chairs Wide 500 Lb Heavy Duty Free Shipping Save On Sales Tax No Interest Financing A Man Living Room Affordable Leather Chair Big Chair

Tn Has Its First-ever Tax Free Week On Food Localmemphiscom

Pin On Real Estate

Pin On Weight Loss Arm Bands

Welcome To Pancake Pantry Pancake Pantry Fun Cooking Breakfast Treats

Big Man Patio Chairs Outdoor Living Furniture Free Shipping No Sales Tax In Most Outdoor Patio Furniture Sets Outdoor Patio Couch Sectional Patio Furniture

The Four Way - Home - Memphis Tennessee - Menu Prices Restaurant Reviews Facebook

Downtown Memphis Skyline Memphis Skyline Downtown Memphis Memphis

Img_1764 Modern Restaurant Design Rustic Restaurant Modern Restaurant

Comments

Post a Comment