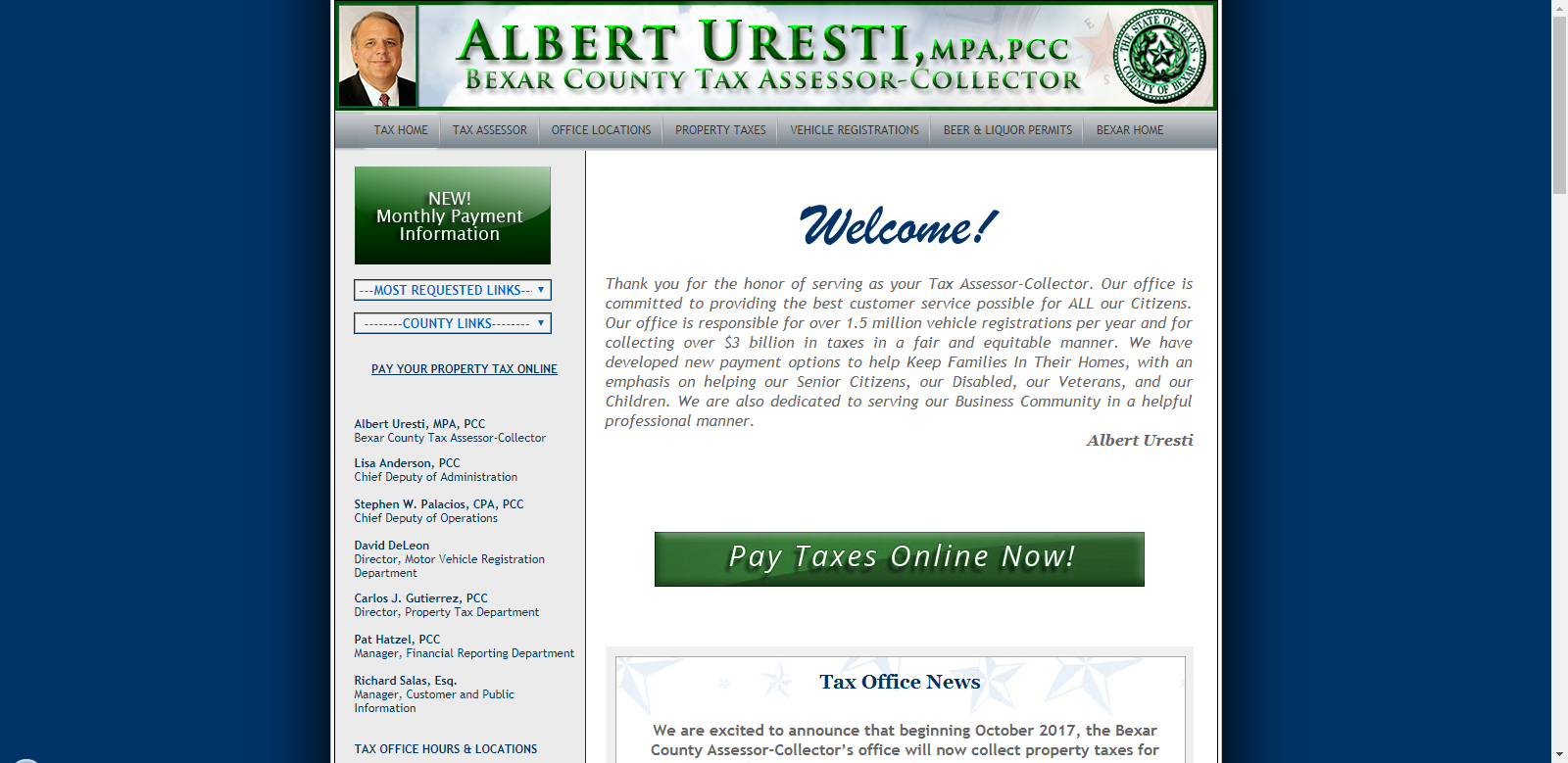

Please follow the instructions below. The bexar county tax office offers the option of paying your property taxes online with either a major credit card or an electronic check (ach).

2

Chief deputy of administration and operations.

Bexar county tax assessor payment. Registration renewals (license plates and registration stickers) vehicle title transfers. Our office is committed to providing the best customer service possible for all our citizens. Search for any account whose property taxes are.

For convenience, taxpayers can now request to receive their property tax statement via email. Bexar county property tax payments (annual) bexar county texas; Tax bills are sent out in october and are payable by january 31.

Tax bills are sent out in october and are payable by january 31. Serving up to 400 customers per day. Median property taxes (mortgage) $3,545:

There is a convenience charge of 2.10% added by jetpay to cover the processing cost. A down payment will be required to initiate a payment agreement. Last day to make a payment arrangement for past due.

Albert uresti, mpa, pcac, ctop. You can search for any account whose property taxes are collected by the bexar county tax office. A tax lien is placed on every bexar resident’s property on january 1 to ensure that they are liable regarding delinquent payments — the only way to remove the lien is to pay your property taxes.

Median property taxes (mortgage) $3,545: Median property taxes (no mortgage) $1,918: Bexar appraisal district is responsible for appraising all real and business personal property within bexar county.

Continues to be open for tax payments and vehicle registration renewals. Pay your property taxes online. Chief deputy of financial reporting department and operations.

After locating the account, you can pay online by credit card or echeck. Search accounts whose taxes are collected by bexar county for overpayments. Bexar county property tax payments (annual) bexar county texas;

There are many ways to pay property taxes in bexar county. To set up a payment plan as soon as Credit card payments are processed through jetpay, which charges a 2.10% convenience fee.

What forms of payment are accepted? Bexar county tax assessor accepts credit cards. Our office is responsible for over 1.4 million vehicle registrations per year and for collecting over $2.5 billion in taxes in a fair and equitable manner.

11.38 and 61.36, texas alcoholic beverage code) for your county liquor permit. Change of address on motor vehicle records. You could visit a local tax office, but it is far more convenient to pay online using a credit card or using echeck to pay directly from a bank account.

Median property taxes (no mortgage) $1,918: The district appraises property according to the texas property tax code and the uniform standards of professional appraisal practices (uspap). If you remain in delinquency, the tax lien will stay, and your property could eventually be sold in a public sale conducted by the tax assessor.

Bexar County Property Tax Loans - Ovation Lending

Bexar County Property Tax Deadline Looming Tpr

Bexar Talk Tax Assessor-collectors Office - Youtube

Bexar County Considers 28b Budget Raises For Employees Officials

Public Service Announcement Residential Homestead Exemption

Bexar County Tax Assessor Collector 3370 Nacogdoches Rd San Antonio Tx County Government Finance Taxation - Mapquest

2

Bexar County Precinct 1 Justice Of The Peace Court In San Antonio

Cash-strapped Property Owners In Bexar County Face June 30 Tax Deadline Tax Deadline Bexar County Tax

Bexar County Careers And Employment Working At Bexar County Indeedcom

Bexaracttaxcom Act_webdev Bexar Javasecure Pay_nowjsp Bexar County Webdev Acting

How To Get To Albert Uresti Bexar County Tax Assessor-collector In San Antonio By Bus

Property Tax Information Bexar County Tx - Official Website

Bexar County Jobs - 102 Open Positions Glassdoor

Albert Uresti Bexar County Tax Assessor-collector In San Antonio Tx Bexar County County The Collector

2

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

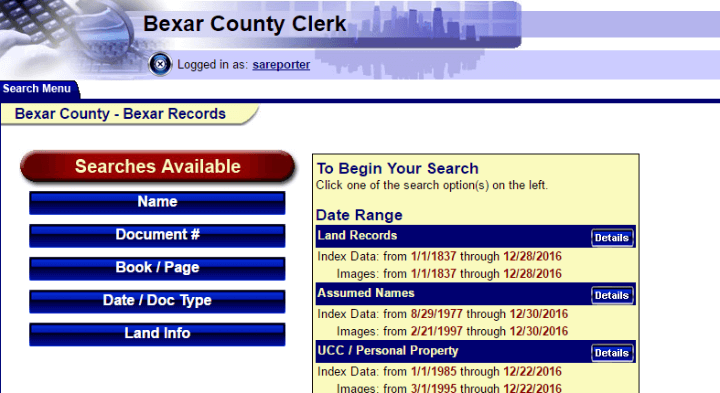

How To Research A Propertys History Using Bexar Countys Free Records Search John Tedesco

Information Lookup Bexar County Tx - Official Website

Comments

Post a Comment