Get reviews, hours, directions, coupons and more for 1st choice tax services at 3950 n campbell ave, tucson, az 85719. 3365 n campbell ave, #121, tucson, az 85719 tel:

Residential Property Tax Solutions Corelogic

I had previously had my taxes prepared by one of those big chain co.s and was apparently mis informed and it created alot of anxiety for me.

First choice tax service tucson. 1st choice tax services inc. Get reviews, hours, directions, coupons and more for 1st choice tax services at 3950 n campbell ave, tucson, az 85719. 2 reviews of 1st choice tax service absolutely wonderful.

If you are dealing with irs federal and or state tax issues, our tax attorneys can help! 3365 n campbell ave, #121, tucson, az 85719 tel: 1st choice tax services inc., tucson, arizona.

I highly recommend these guys! Your 1st choice for tax services. Trolley on mt pleasant c1920 bus terminal, ttc, bus.

This is an incredibly common type of windshield damage in. Present offer at time of service. We are conveniently located near you in awendaw.

Www.1stchoicetaxservices.com 3365 n campbell ave suite 121 tucson, az 85719 presented we will do so at no charge. Zions bank, a division of I had anxiety about filing back taxes.

Tax flyers tax prep tax accountant business flyer. No interest charge on tas. ♦ we are open all 12 months, unlike some other

1st choice tax services offers tax preparation services for businesses and individuals. 1st choice tax services, inc. Personal and business tax preparation.

226 likes · 33 were here. Year a round service, irs representation service, payroll services and bookkeeping. The 2020 tax organizer is now available!

Please enter your ssn / itin / ein (no dashes): Start your review of 1st choice tax services. 3860 s palo verde rd ste 314.

First vehicle services mt pleasant sc. Search for other tax reporting service in tucson on. 1stchoice@1stchoicetaxservices.com www.1stchoicetaxservices.com your 1st choice for tax services.

3950 n campbell ave tucson, az 85719 business type: Year a round service, irs representation. First choice tax service tucson.

Grinding coffee down to a fine art since 1967first choice provides everything from coffee brewing machines, water coolers, bottled water, filtered water systems,…. We are the #1 mt. Categorized under tax return preparation and filing.

First vehicle services mt pleasant sc. Almost as much as our customers!

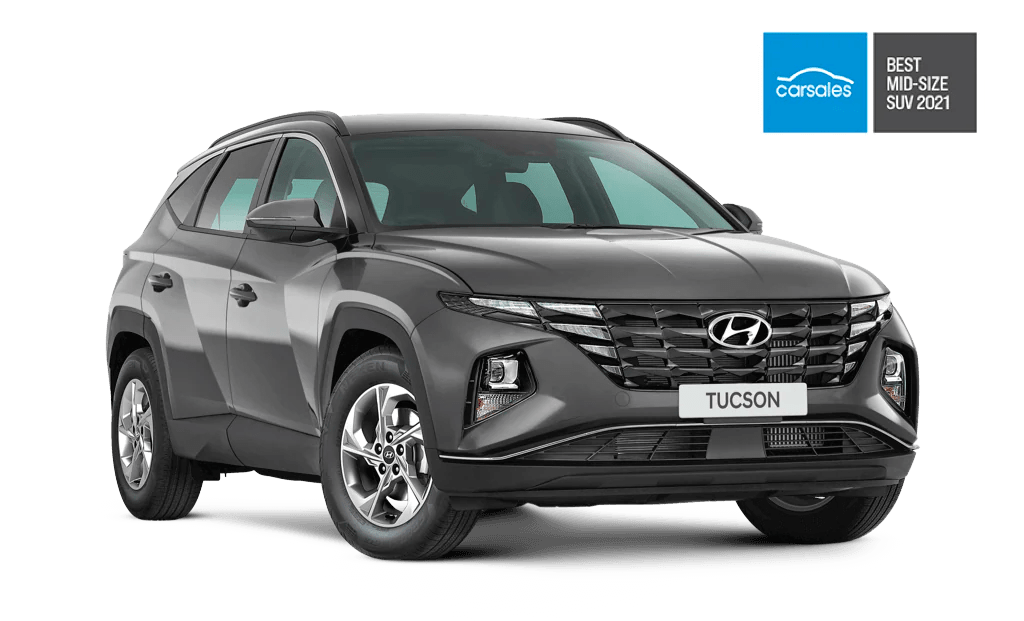

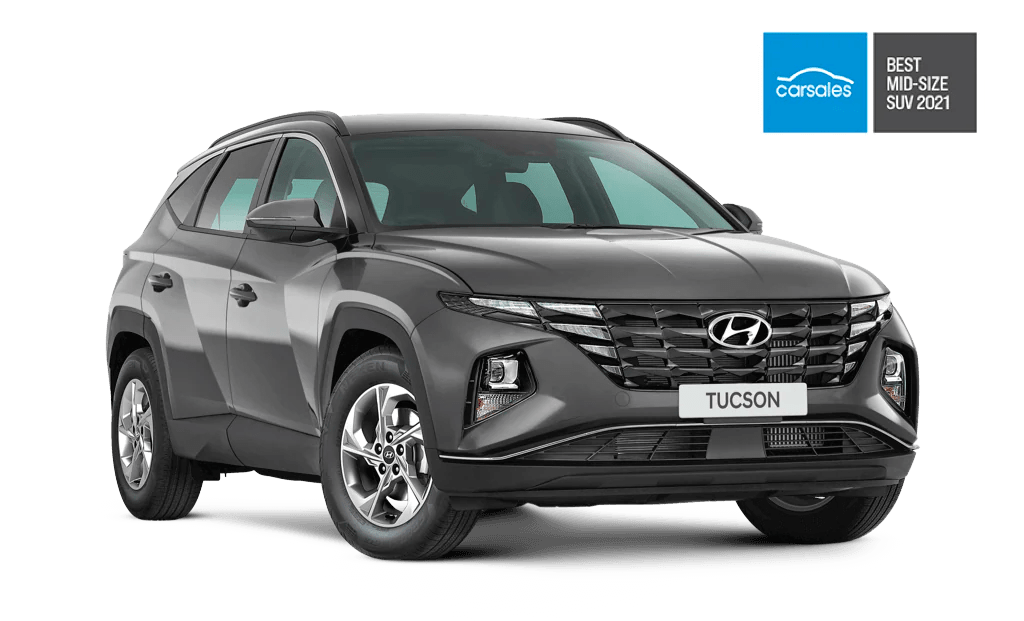

New Used Hyundai Tucson Cars For Sale Autotrader

Hyundai Tucson First Drive A Big Step Forward Company Car Reviews

Search Hyundai Mobil Indonesia

/GettyImages-1172587262-86fb3d1af81045259b9625d1fde48136.jpg)

The 5 Best Tax Preparation Services Of 2021

New Hyundai Tucson For Sale In Laurel Md Ourisman Hyundai

How To Determine Whether To Buy Rent Or Lease Compact Excavators For Construction Pros

2021 Hyundai Tucson Vs 2021 Hyundai Santa Fe Buy A 2021 Hyundai Online Albany Ga

Home

Home

About The Team

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

Home

Home

Meet The All-new 2022 Hyundai Tucson

Home

Home

Tucson - Doncaster Hyundai

Kia Sportage Vs Hyundai Tucson Comparison Carwow

2021 Hyundai Tucson Vs 2021 Hyundai Santa Fe Buy A 2021 Hyundai Online Albany Ga

Comments

Post a Comment