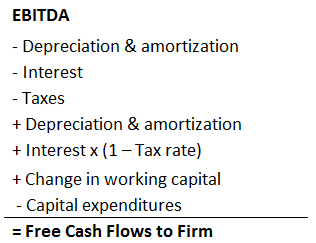

1) interest expense is not included because it is paid to bond holders. Fcff is a hypothetical figure, an estimate of what it would be if the firm was to have no debt.

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

In addition, the “tax shield” associated with interest must be added back too (i.e., the tax savings).

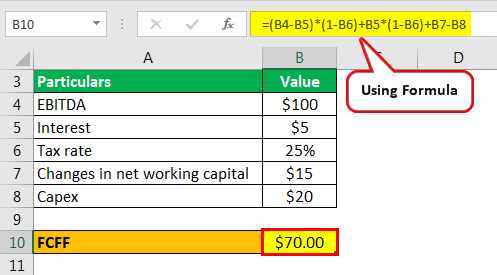

Interest tax shield fcff. Start with earnings before interest and tax (ebit) calculate the hypothetical tax bill the company would have. → if τ ¿ > 0, there isthe tax advantage of using debt → if τ. My understanding is that interest expense impacts the tax amount.

In the year of change, net borrowing increases fcfe. You are right that the amount available to equity holders is less, but the fcff is higher. For fcfe, however, we begin with net income, a metric that has already accounted for the interest expense and tax savings from any debt outstanding.

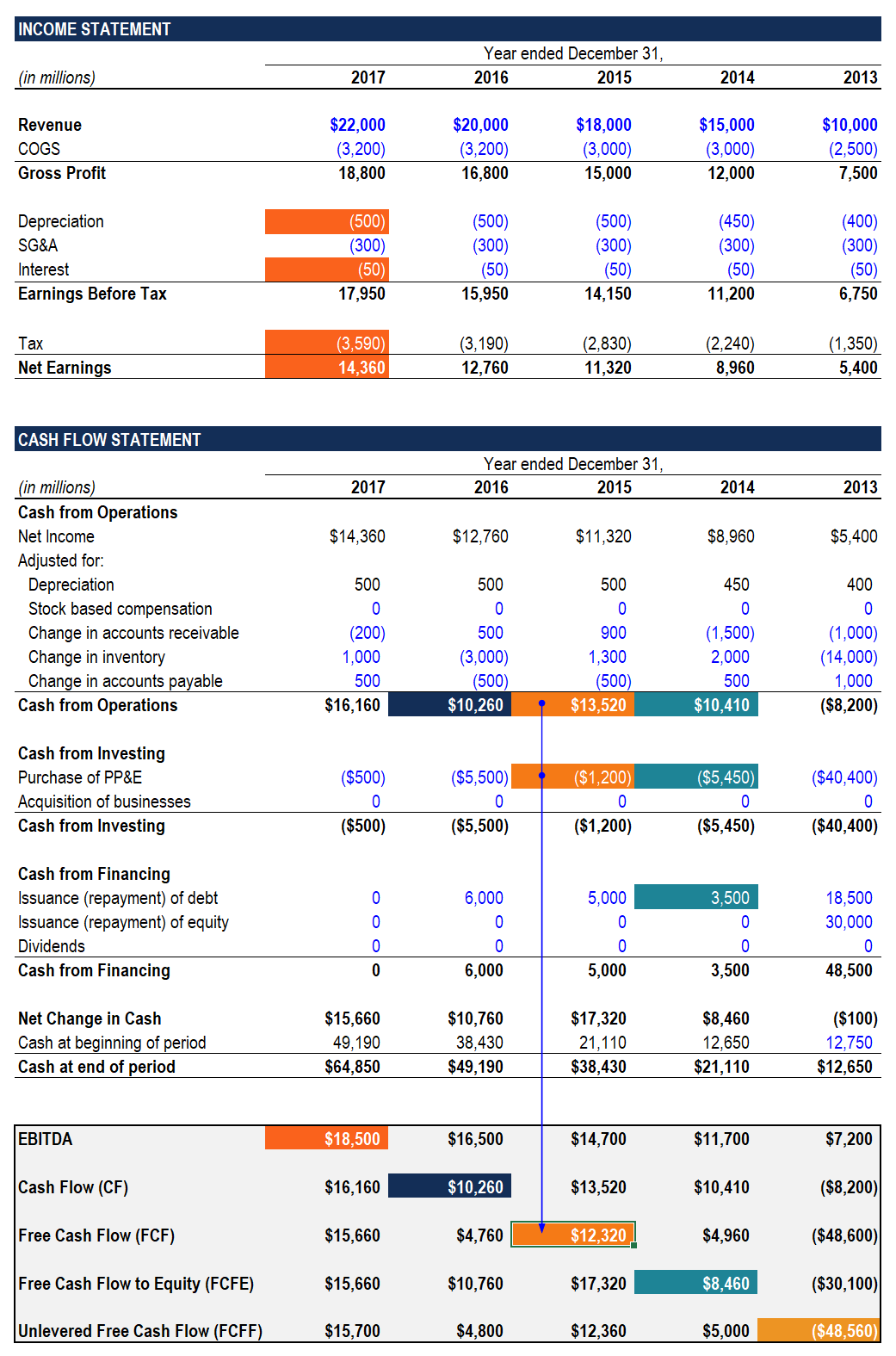

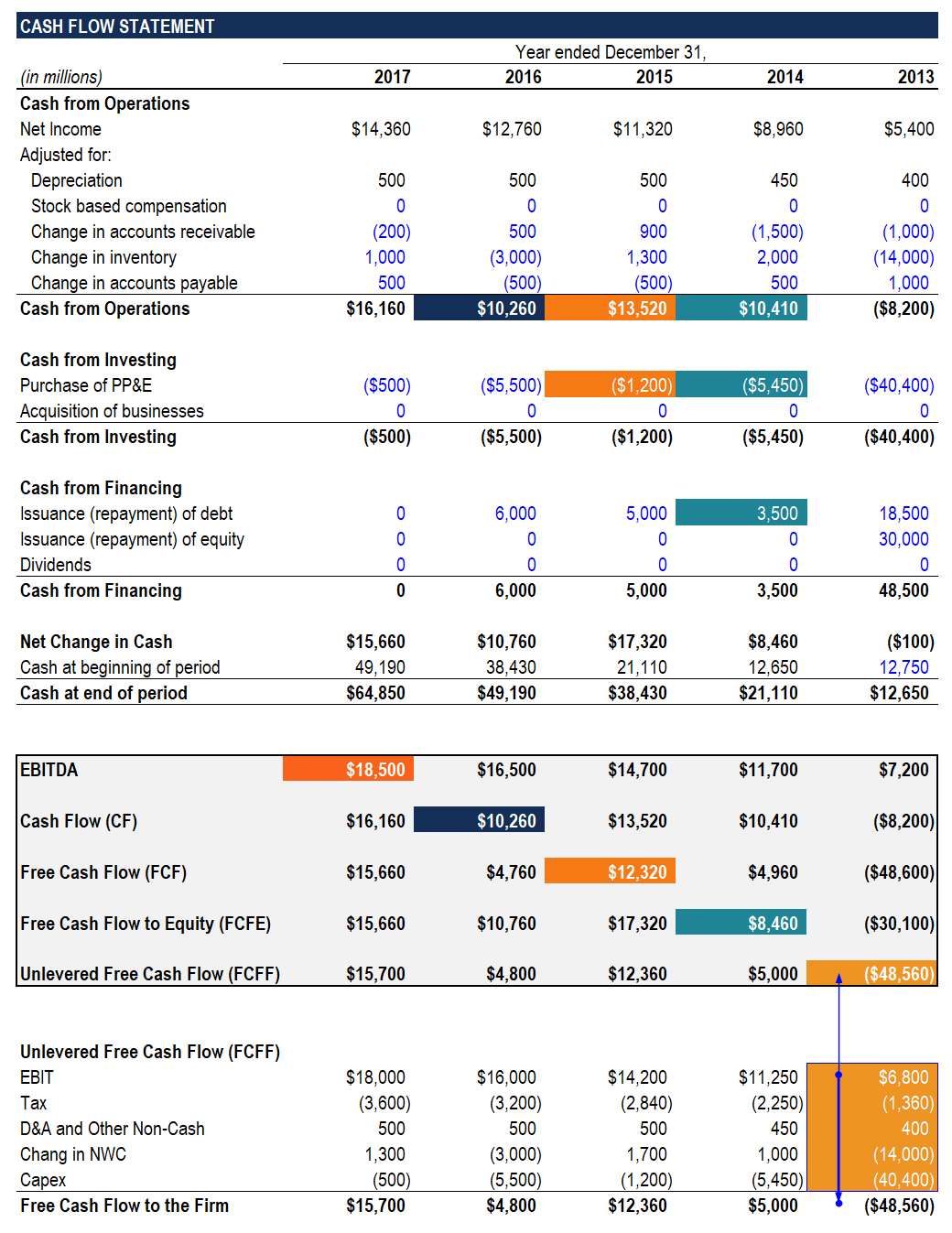

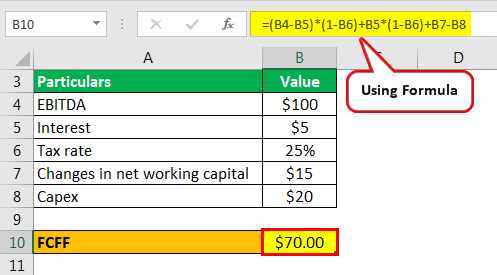

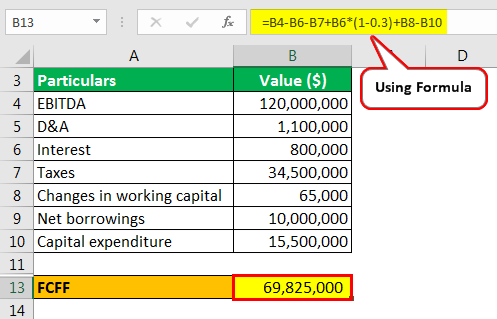

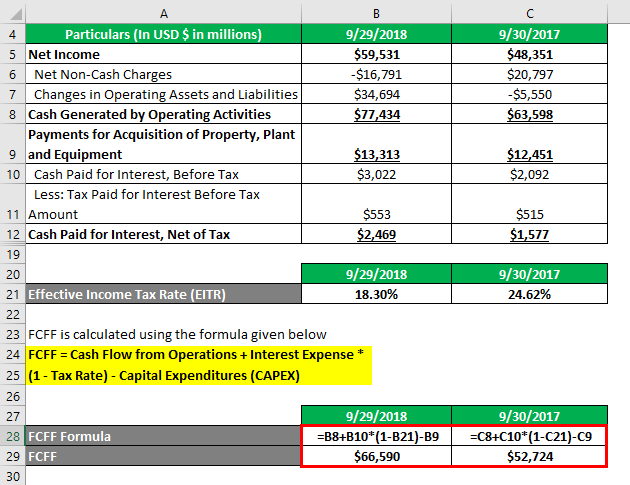

Free cash flow for firm(fcff) means cash flow available for distribution to both debt and equity holders. Changes in leverage have only a minor effect on fcfe and no effect on fcff. Fcff is calculated using the formula given below.

Hence there is a tax shield. It will be clear with the help of the following hypothetical scenarios: The intuition here is that the company has an $800,000 reduction in taxable income since the interest expense is deductible.

In calculating fcff, if you deduct interest as expense, you also get tax benefit resulting out of claiming interest as a n expense. They recognize the underlying expenses while calculating net cash net cash net cash represent the company's liquidity position and is calculated by deducting the current liabilities from the cash balance reported on the company’s financial statements at the end of a particular period. The $25 between the two scenarios is the tax shield.

There are two types of free cash flows: It is important to understand the difference between fcff vs fcfe, as the discount rate and numerator of valuation multiples. When it comes to depreciation, depreciation has no effect on the fcff as it is not a cash expense.

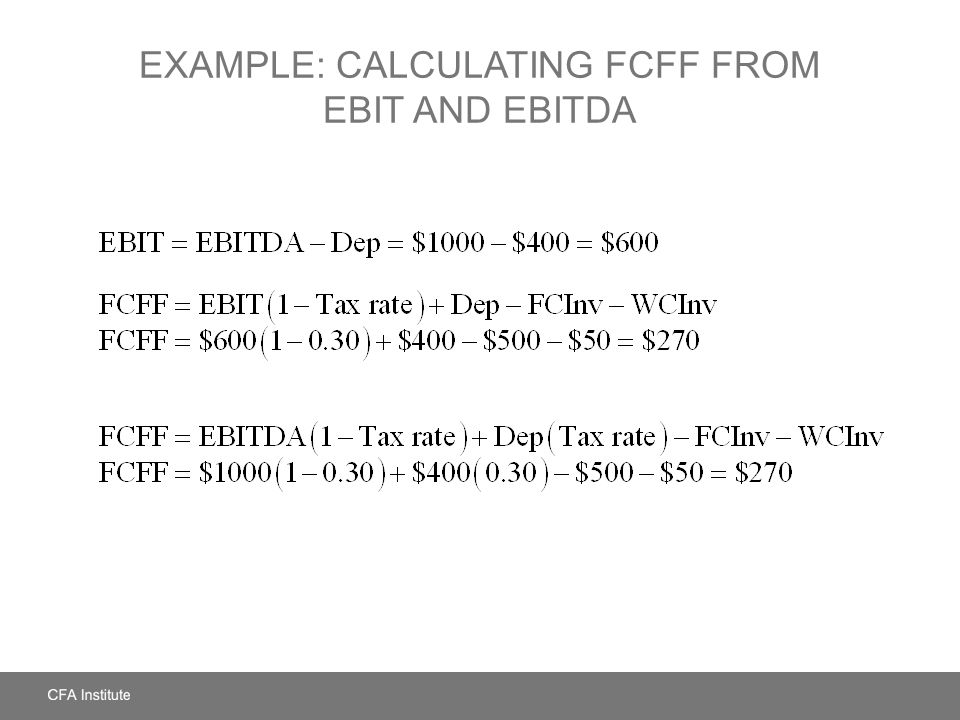

In fcff, debt is not treated as outsiders. Ebit represents earnings before interest and tax. Free cash flow to firm (fcff) (also referred to as unlevered free cash flow) and free cash flow to equity (fcfe), commonly referred to as levered free cash flow.

Since fcfe is intended to reflect the cash flows that go only to equity holders, there is no need to add back the. Fcff includes an interest tax shield as opposed to fcfe. Finally, we identify those that can be used in the conditions of emerging markets.

They think tax shield, which is [interest expenses * tax rate], should be added back to calculate fcff because most companies deduct interest expenses in calculating taxes. Since tax is an outflow and needs to be reduced we are reducing the tax payable from ebit. Fcff = ni + nc + ( i × ( 1 − tr ) ) − li − iwc where:

Ebit 200000, tax rate is. This is equivalent to the $800,000 interest expense multiplied by 35%. ★ effective tax advantage of debt:

As such, the shield is $8,000,000 x 10% x 35% = $280,000. Fcff is cash available to equity and bond holders. The tax shield is the amount saved in taxes by paying interest.

Free cash flow to the firm (fcff) = cash flow from operations + interest expense * (1. However, here in fcf formula, we don't account the tax shield because we are going to discount the fcf by the wacc that already factors in the impact of tax shield and thus we are avoiding double counting of tax shield. By taking on an extra $50 in interest payments, fcff increased by $25.

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

The Ultimate Cash Flow Guide - Understand Ebitda Cf Fcf Fcff

Valuation Leverage Capital Budgeting Considering Risk And Leverage

The Ultimate Cash Flow Guide - Understand Ebitda Cf Fcf Fcff

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition

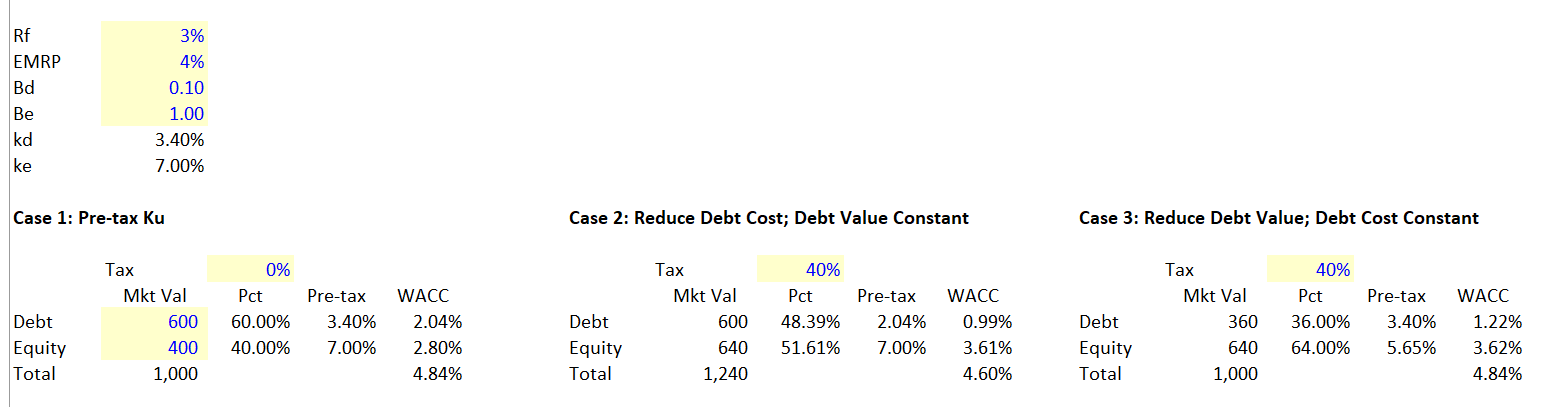

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Free Cash Flow Valuation - Ppt Download

Frm Free Cash Flow Fcff Fcfe - Youtube

Unlevered Free Cash Flow - Definition Examples Formula

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Valuation Leverage Capital Budgeting Considering Risk And Leverage

2

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-b54b46188f5746769a37298478048177.jpg)

Free Cash Flow Fcf Definition

Fcff Formula Examples Of Fcff With Excel Template

Tax Shields Financial Expenses And Losses Carried Forward

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Unlevered Free Cash Flow - Definition Examples Formula

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-3c51e1263e6f488daa2d923e2a43a33d.jpg)

Free Cash Flow Fcf Definition

Comments

Post a Comment