In 2004 the city of medina initiated a municipal income tax of 1.25%. Through strategic planning, efficiency studies, and a thorough budgeting process the city has remained fiscally strong during the current economic.

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

All my questioned were answered, leaving no doubts.

Medina immigration income tax service. Jfs director jeff felton told county commissioners jan. Individuals under 18 years of age are exempt from paying municipal income tax. Hours may change under current circumstances.

Medina immigration & income tax service. Leyva partner up with him as a father/daughter team. Medina immigration & income tax service.

Proof of security for international travel: Leyva proudly continues to run the office along with her trusted and knowledgeable team. We bring families and communities together.

Germain multi services cares about each and every single customer, our main goal is for you to have a good service and a solution for your problems. For tax year 2017 and prior, 2106 business expenses are limited to the amount deductible for federal tax purposes. Medina immigration & income tax service 16689 fthill boulevard # 213 fontana, ca 92335

We offer a variety of tax and business services. We can help you navigate and take the most advantages available to you under the tax reform which will take effect this coming tax season. 5 out of 5 stars.

444 likes · 185 were here. The registered agent on file for this company is medina income tax services corporation and is located at 4853 44 st., apt. Nathan medina tax services is different than other tax preparation firms.

Immigration and income tax service. The company's filing status is listed as active and its file number is 4779517. We will put our knowledge and experience to work for you.

9161 sierra ave ste 201b fontana, ca 92335. I was in & out in under 30 minutes. With the addition of the.5% increase to the sales tax, only 4 counties of ohio's 88 have a lesser tax than medina county's 6.5%.

3 reviews of medina immigration & income tax service awesome! We go beyond preparing and filing personal tax returns by assessing ways to save you taxes now and in the future while keeping an eye on other components of your financial situation. We have been helping thousands of clients to obtain the benefits they deserve.

Profesionales altamente calificados al servicio de la comunidad latina. Immigration assistance servicios leyva was founded in chicago since 1968 by hermes j. The business license issue date is december 17, 2018.

We currently serve miami dade, broward county, palm beach and port saint lucie counties. The principal address is 2973 s. Medina immigration & income tax service is located at 9161 sierra ave ste 201b in fontana and has been in the business of tax return preparation services since 2005.

Medina's income tax, metairie, louisiana. There are 6 other people named renee medina on allpeople. They truly care about their customers and their attention is personalized.

Medina income tax services corporation is a new york domestic business corporation filed on june 24, 2015. This family business office is so efficient and always on point. Many countries ask to show the details of income tax file returns before issuing a.

Oficina dedicada a la preparación profesional de impuestos personales y de negocios, asesoramiento en la apertura de nuevas. Tax & business loan preparation service in naperville. Beginning with tax year 2018, the unreimbursed employee expense (2106) deduction is eliminated for federal income tax purposes for most employees.

Be the first to review! We are your one stop shop for all immigration, real estate, credit repair and income tax needs. Find more info on allpeople about renee medina and medina tax services, as well as people who work for similar businesses nearby, colleagues for other branches, and more people with a similar name.

24 that his office will be offering assistance filling out income tax forms from 9:30 a.m. Many service providers, employers and real estate businesses, often asks people about their income tax return on time as a proof. We truly are your partners when navigating the stormy waters of federal and state income.

12 reviews of medina's tax service they're very professional and friendly. I'm definitely having them take care of my taxes next year. We work with both individual and business clients to help them maximize deductions and credits.

Medina community services specializes in preparing individual tax returns. Get contact details or leave a review about this business. 9161 sierra ave, ste 201b, fontana, ca 92335.

To help eliminate any barriers that might come in the process of integrating immigrants into our communities and in the us.

No Bank Account - How To Apply For Tourist Visa Without Bank Statements Visa Accounting How To Apply

Back Matter In Imf Working Papers Volume 2019 Issue 298 2019

Ohio Tax Rate Hr Block

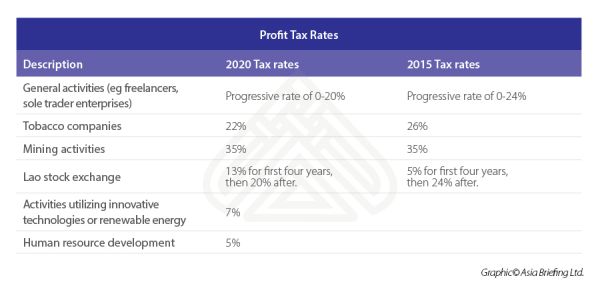

Laos To Implement New Income Tax Rates - Tax - Lao Peoples Democratic Republic

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Indonesias Omnibus Law Provisions On Special Economic Zones

Pembinaan Para Pendamping Sosial Dinas Sosial Kabupaten Cilacap Tahun 2019

Kunjungan Kerja Komisi Ii Dprd Kota Tegal Terkait Penanganan Masalah Sosial Di Kabupaten Cilacap

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Vol 4 No 4 2021

Designing A Tax Administration Reform Strategy In Imf Working Papers Volume 1997 Issue 030 1997

Vol 4 No 4 2021

Vol 10 No 1 2021 January 2021 Academic Journal Of Interdisciplinary Studies

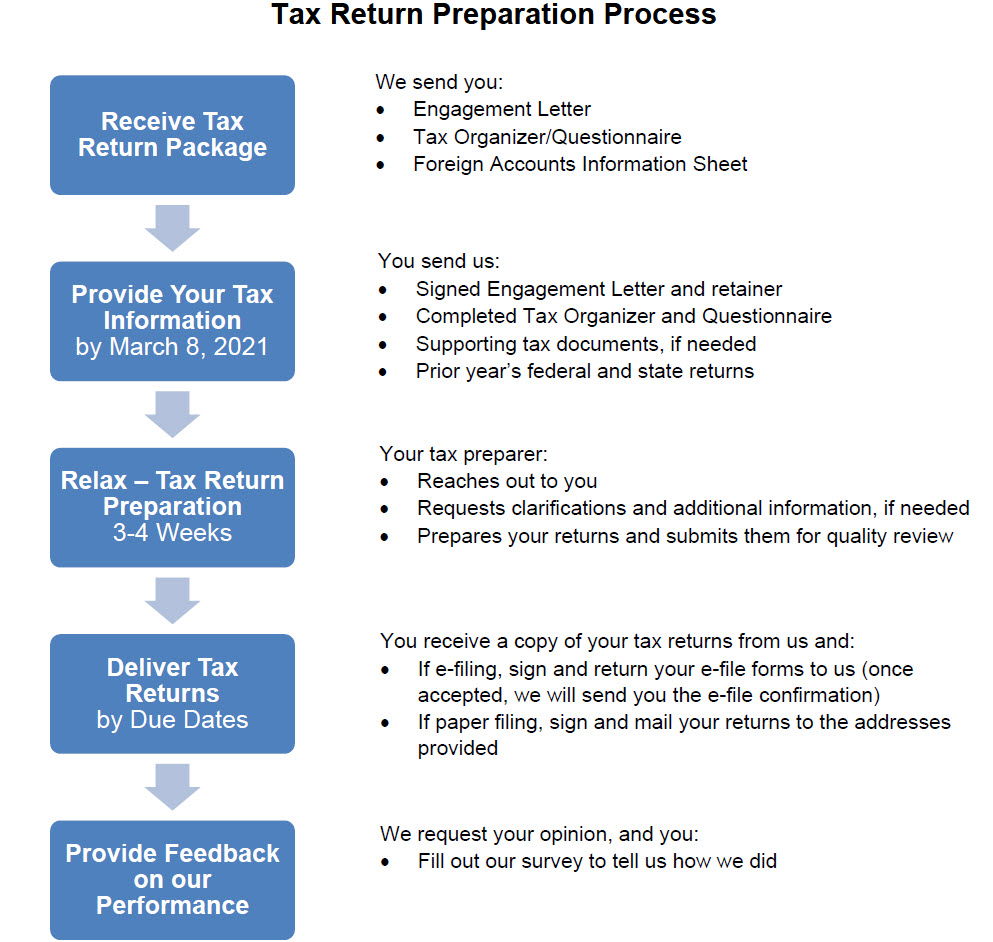

Tax Return Information - The Wolf Group

Back Matter In Imf Working Papers Volume 2020 Issue 094 2020

Laos To Implement New Income Tax Rates - Tax - Lao Peoples Democratic Republic

Ohio Property Tax Hr Block

The Guide To Employment Permits For Foreign Workers In Indonesia

Pendidikan Dan Pelatihan Bagi Penyandang Cacat Dan Eks Trauma Di Kecamatan Kedungreja

Comments

Post a Comment