In case you are interested in doing the calculation manually, here is how to calculate sales tax: This is very simple gst calculator for québec province.

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Here is how the total is calculated before sales tax:

Reverse sales tax calculator california. Amount without sales tax * qst rate = qst amount. Transfer/excise tax calculator welcome to the transfer/excise tax calculator. California’s base sales tax is 7.25%, highest in the country.

Enter the sales tax percentage. Please ensure the address information you input is the address you intended. For example, if you received a $3,000 rebate on your vehicle, and it decreases the total cost to $7,000, you still have to pay sales tax on $10,000, says the sales tax handbook.

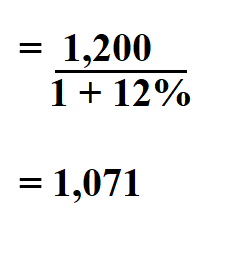

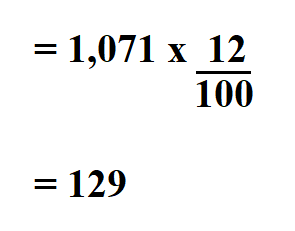

When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction. Amount with sales tax / (1+ (gst and qst rate combined/100)) or 1.14975 = amount without sales tax. Reverse sales tax computation formula.

5 digit zip code is required. Divide the sales tax percentage by 100 (or move the decimal point two places to the left) to get the decimal equivalent of the rate. New brunswick, newfoundland and labrador, nova scotia, ontario, and prince edward island.

21 rows putting different, the reverse calculator calculates the amount before the sales tax is. That entry would be.0775 for the percentage. Amount after taxes sales tax rate (s) 6.5% 7.25% 7.375% 7.5% 7.75% 7.875% 7.975% 8% 8.125% 8.25% 8.375% 8.475% 8.5% 8.725% 8.75% 8.875% 8.975% 9% 9.125% 9.225% 9.25% 9.5% 9.75%.

The formula is fairly simple. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. On the right sidebar there is list of calculators for all canadian provinces where hst is introduced.

Welcome to the transfer/excise tax calculator. How to calculate sales tax. Divide your sales receipts by 1 plus the sales tax percentage.

The combined rate used in this calculator (7.75%) is the result of the california state rate (6%), the 91761's county rate (0.25%), and in some case, special rate (1.5%). This level of accuracy is important when determining sales tax rates. The 91761, ontario, california, general sales tax rate is 7.75%.

Amount without sales tax * gst rate = gst amount. The second script is the reverse of the first. Enter hst inclusive price on the bottom:

Pre tax price of product = sale price (post tax price) / (1 + tax rate) have you checked california sales calculator? Hst value and price without hst will be calculated automatically : If you know the total sales price, and the sales tax percentage, it will calculate the base price before taxes and the amount of sales tax that was in the.

Any input field of this calculator can be used: Instead of using the reverse sales tax calculator, you can compute this manually. Calculation of the general sales taxes of the city california city, california for 2021.

Op with sales tax = [op × (tax rate in decimal form + 1)] This tool can calculate the transfer/excise taxes for a sale or reverse the calculation to estimate the sales price. Reverse calculation of the general sales taxes of california state for 2021.

The tax rate given here will reflect the current rate of tax for the address that you enter. Reverse sales tax calculator of sacramento calculation of the general sales taxes of the city sacramento, california for 2021 amount after taxes sales tax rate(s) 6.5% 7.25% 7.75% 8% 8.25% 8.5% 8.75% amount of taxes amount before taxes Reverse sales tax calculator for 93901 salinas, california, united states in 2021

To find the original price of an item, you need this formula: Other provinces in canada do not use the hst and instead use a distinct goods and services tax (gst) and/or provincial sales tax (pst). Type an address above and click search to find the sales and use tax rate for that location.

That means that, regardless of where you are in the state, you will pay an additional 7.25% of the purchase price of any taxable good. Free online 2021 reverse sales tax calculator for 93901, salinas. The harmonized sales tax, or hst, is a sales tax that is applied to most goods and services in a number of canadian provinces:

For instance, in palm springs, california, the total sales tax percentage, including state, county and local taxes, is 7 and 3/4 percent. Since many cities and counties also enact their own sales taxes, however, the actual rate paid throughout much of the state will be even higher than that. There are times when you may want to find out the original price of the items you’ve purchased before tax.

Québec province is using qst instead of pst. This tool can calculate the transfer/excise taxes for a sale or reverse the calculation to estimate the sales price. Reverse sales tax calculator of california city.

Fast and easy 2021 sales tax tool for businesses and people from 93901, salinas, united states.

Sales Tax Calculator

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

California Sales Tax Calculator Reverse Sales Dremployee

Property Tax Calculator

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

California Sales Tax Calculator Reverse Sales Dremployee

Sacramento County Sales Tax Rates Calculator

How To Calculate Sales Tax Backwards From Total

Jyoti -

Ontario Sales Tax Hst Calculator 2021 Wowaca

Sales Tax Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

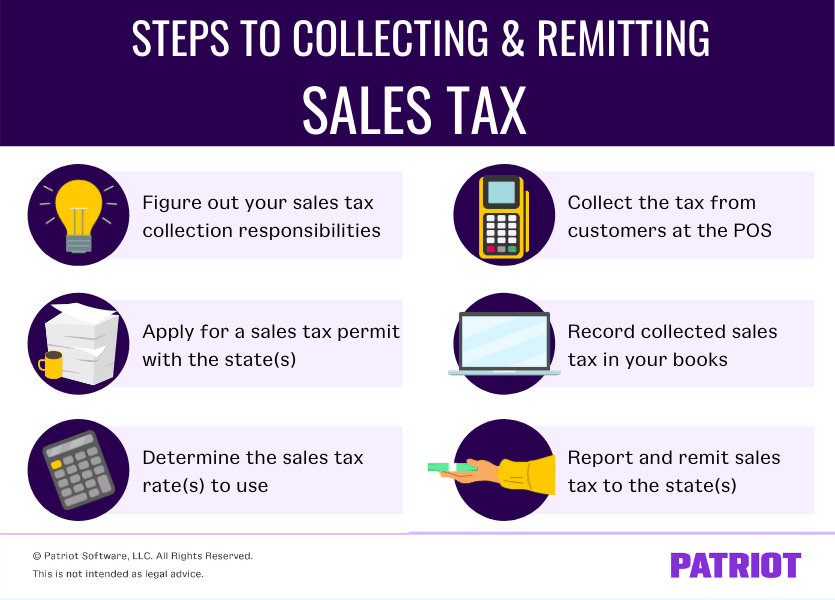

How To Pay Sales Tax For Small Business 6-step Guide Chart

How To Calculate Sales Tax In Excel

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

How To Calculate Sales Tax Backwards From Total

Sales Tax Reverse Calculator Internal Revenue Code Simplified

Us Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator De-calculator - Accounting Portal

Comments

Post a Comment