I don’t own property in pa, never have. No fees charged to our clients:

Statewide Tax Recovery Inc - Home Facebook

Statewide tax recovery, llc (str) began as a branch of central credit audit, inc;

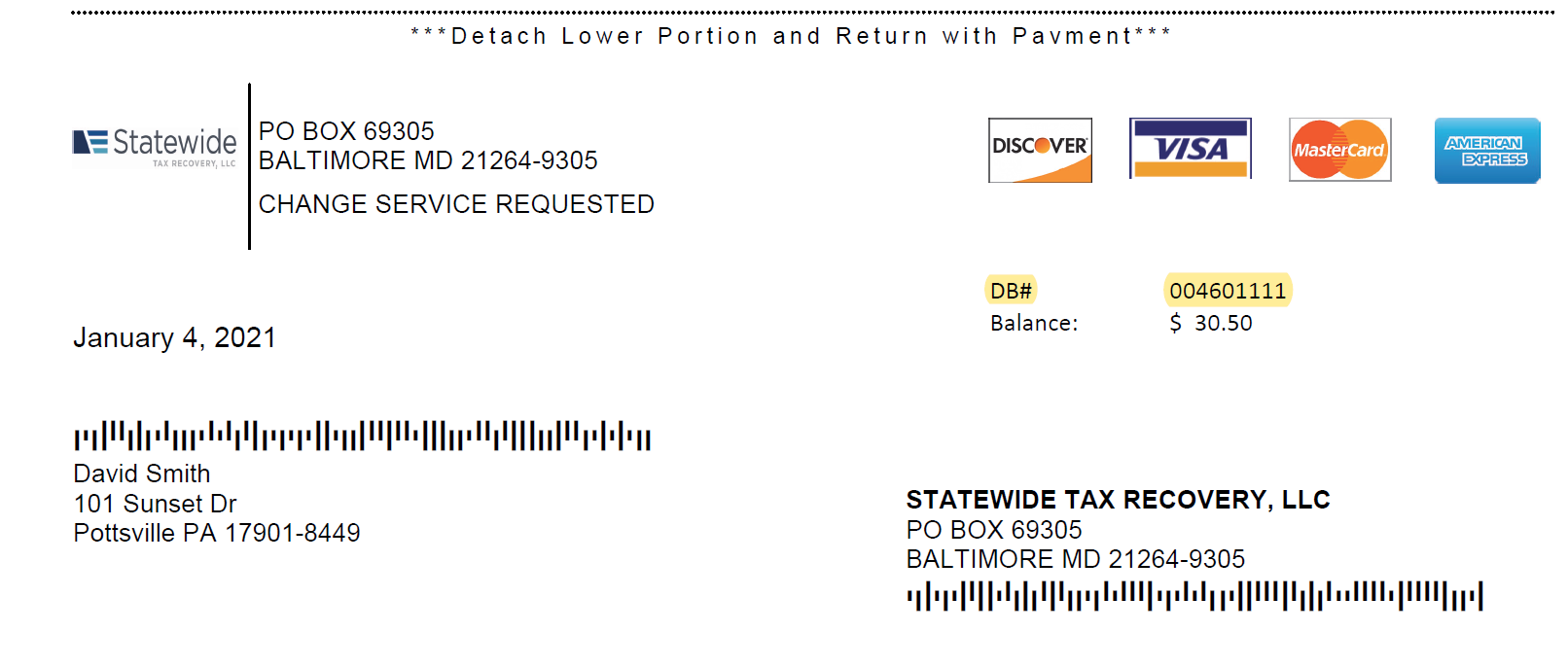

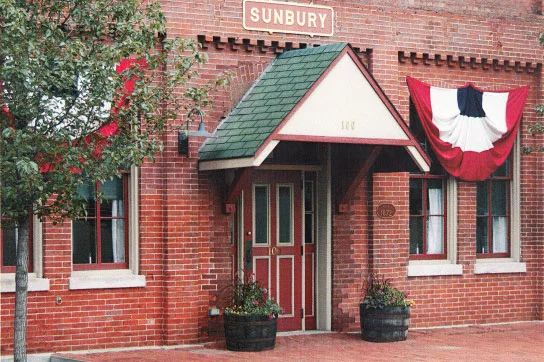

Statewide tax recovery llc baltimore md. Statewide tax recovery, llc 100 north third street p.o. Statewide tax recovery llc reviews, check statewide tax recovery llc scam or legit. It provides occupational assessment and tax recovery services.

Statewide tax recovery began as a branch of central credit audit tax division in 1980. © 2021 statewide tax recovery, llc. Statewide tax recovery, llc 100 north third street p.o.

Department of revenue warns of common scams with tax season underway. Statewide tax recovery, llc 100 north third street p.o. Also known as str, the company offers tax collection services.

— the department of revenue today issued a reminder to taxpayers to be cautious of scams and “phishing” schemes that are being used by criminals to steal taxpayers’ money and personal financial information. Nick roth doesn't recommend statewide tax recovery. On january 1, 1990, str was incorporated to form an autonomous company following ten years as an integral part of central credit audit, inc

Statewide tax recovery, llc provides collection services for the following taxes: Contact statewide tax recovery on messenger. Administrative and operations manager at statewide tax recovery llc.

© 2021 statewide tax recovery, llc. Tax division in 1980 as a delinquent tax collection service. By checking the box to the left, you are indicating that you give statewide tax recovery llc authorization to process the above payment of $ 0.00.

This business is not bbb accredited f. Str’s primary business is the collection of delinquent taxes. Majestic hall of events limited liability company:

Mega milkshakes by sweet suprise iii, llc:. © 2021 statewide tax recovery, llc. Statewide tax recovery, inc., baltimore, maryland.

Got a letter saying they made multiple attempt to contact me and will now be making a personal visit to my residence to deliver a distraint requiring immediate payment and additional fees. Statewide tax recovery, llc (str) began as a branch of central credit audit, inc. Find matching businesses for sic code 7291 from 15 million business records

Southwest airlines, +6 more calvert hall, +1 more We’ve rented ever since we moved back to pa after. Save this payment information for later use.

Type of a scam tax collection. The new markets tax credit program (nmtc program) helps economically. I’ve received multiple letters from this company stating i owe back school taxes.

Str’s primary business is the collection of delinquent taxes. Tax division in 1980 as a delinquent tax collection service; Statewide tax recovery llc, +3 more.

Regional vice president at central credit audit llc and statewide tax recovery llc bloomsburg metropolitan area. Regional vice president at central credit audit llc and statewide tax recovery llc Fees are passed on to the debtor, clients receive the full tax amount recovered.

On january 1, 1990, str was incorporated to form an autonomous company following ten years as an integral part of central credit audit, inc. • per capita • occupational assessment • occupational privilege • mercantile (sales tax) • earned income • local services. Statewide tax recovery maintains a team of professional collectors and office staff members.

Do you know the hours for this business? 7 hcd montgomery knowles manor senior housing, llc

Statewide Tax Recovery Llc Complaints Better Business Bureau Profile

Pustaka-digitalkemdikbudgoid

Statewide Tax Recovery Llc

Statewide Tax Recovery - Home Facebook

Repositorypoltekkes-kaltimacid

Saotexasgov

Statewide Tax Recovery Inc Reviews Ratings Tax Services Near 100 North 3rd Street Sunbury Pa

Statewide Tax Recovery

Statewide Tax Recovery Llc

Statewide Tax Recovery Llc

Statewide Tax Recovery - Home Facebook

Statewide Tax Recovery Llc

Statewide Tax Recovery Llc

Statewide Tax Recovery Llc

Statewide Tax Recovery Llc Linkedin

Cdnwhoint

Statewide Tax Recovery - Home Facebook

Statewide Tax Recovery Inc Reviews Ratings Tax Services Near 100 North 3rd Street Sunbury Pa

Statewide Tax Recovery Llc Linkedin

Comments

Post a Comment