Anytime a property changes its use from agricultural use to any other use, it causes rollback taxes to be assessed and billed to that portion of the property. Who pays the rollback tax?

Govt Backtracks On Farm Laws Announces Repeal

Property and rollback tax bills will be issued as a result signature signature of owner date phone # email lancaster county assessor's office p.o.

What are roll back taxes in sc. The assessor is required to keep records, which indicate both the fair market value of property and use value and the applicable ratio used. Rollback taxes go back a maximum of 5 years from the year a change in property use has occurred. Rollback taxes are assessed when the use of property that has been taxed as agricultural rate changes.

Changes that can trigger the rollback provision may be the addition of a new house or mobile home, The rollback tax is a requirement codified in south carolina state law. From the seller’s prospective, it’s the buyer who is charging the use and therefore it should be responsible.

Assessor’s office must go back, up to a period of five (5) years, and collect those deferred taxes. Typically rollback taxes apply in transactions in which a developer is purchasing property for development that previously received the benefit of an agricultural use special assessment ratio property tax exemption. The legislature also changed the rollback calculation to adjust the total reassessed property values to exclude increases in value in the current year resulting from a sale or transfer of property.

The rollback tax is a requirement codified in south carolina state law. Rollback taxes are assessed when the use of property that has been taxed as agricultural rate changes. Changes that can trigger the rollback provision may

Anytime a property changes its use from agricultural use to any other use, it causes rollback taxes to be assessed and billed to that portion of the property. The rollback taxes could apply In south carolina, for example, this is done for the year of the change in land use and for the five previous years.

Anytime a property changes its use from agricultural use to any other use, it causes rollback taxes to be assessed and billed to that portion of the property. How are rollback taxes calculated? It becomes subject to additional taxes referred to as rollback taxes.

If the affidavit is not submitted, the assessor will automatically convert to commercial use and apply rollback taxes. The difference is multiplied by the millage rate in the appropriate district and that results in the amount of tax due. The assessor’s office will facilitate the.

In south carolina, there is no rule as to whether the purchaser or seller pays the rollback tax. A brief explanation the rollback tax is a requirement codified in south carolina state law. When agricultural real property is applied to a use other than agricultural;

In 2011, the legislature amended the rollback millage calculation to address local government concerns and take into account uncollected taxes and tax assessment appeals.

2

2

20192020 Back To School Information For Fort Mill Sc Fort Mill School Site School Information

Pin By Sri Kriti On Read Turbotax Tax Software Tax Refund

Yofkvza7o4cqcm

2

Creonque La Mas Basica Es La De South Carolina Pero Seamos Sinceros A Quien Le Gusta Lo Basico Food Truck Menu Food Burger Toppings

Heres What A Joe Biden Presidency Might Look Like

Everything You Need To Know About Getting Your Countys Delinquent Tax List - Retipster

2

2

Tax Liens And Your Credit Report Lexington Law

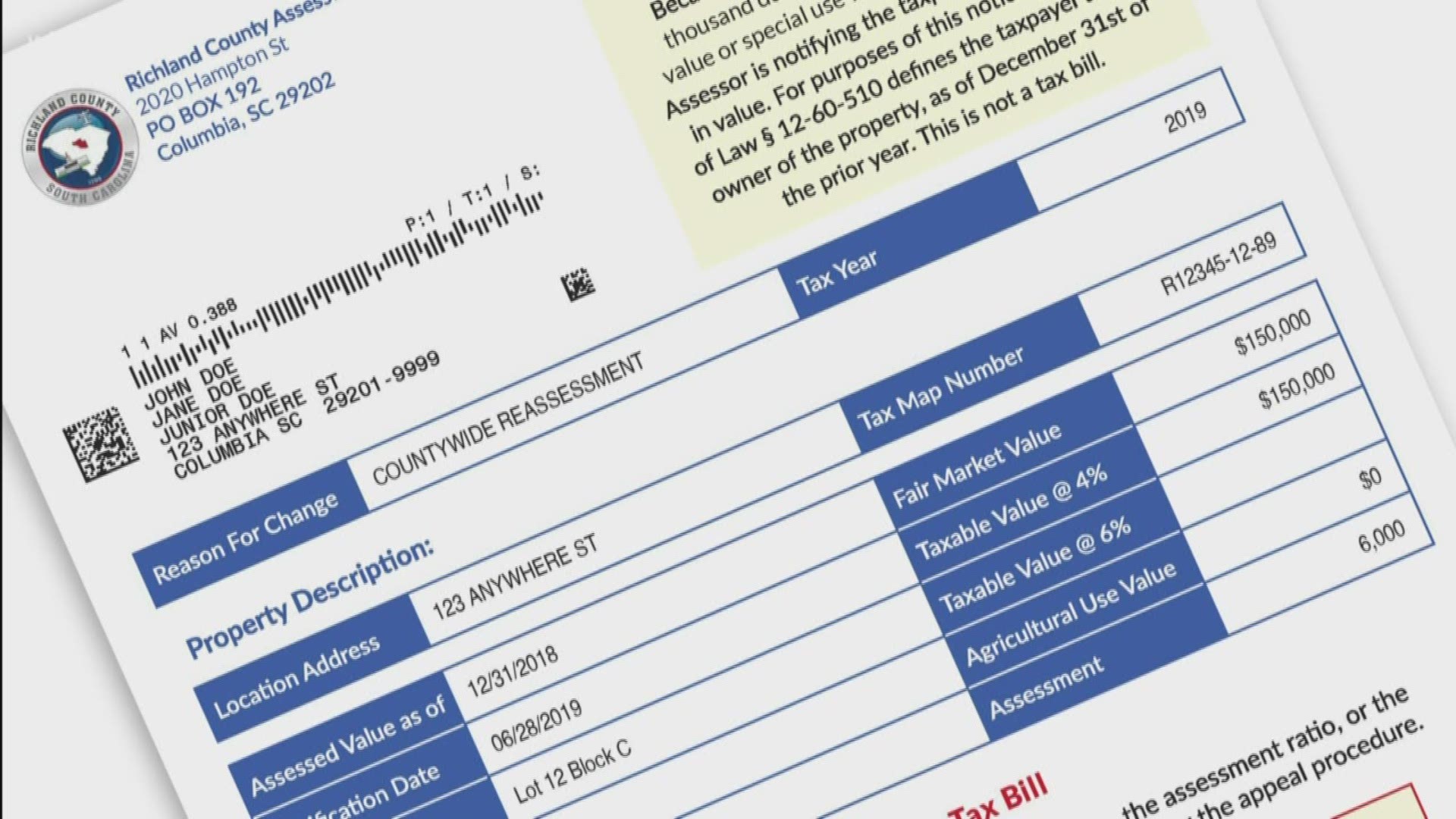

County Reassessment Notices Go Out

Cloudaccounting Is The Future Cloud Accounting Accounting Financial Information

2019 Richland County Property Tax Reassessment Notices In The Mail Wltxcom

Everything You Need To Know About Getting Your Countys Delinquent Tax List - Retipster

2

20192020 Back To School Information For Fort Mill Sc Fort Mill School Site School Information

How Blessed I Am To Ride Among This Beautiful Land That God Has Created To Be One With God Become One With Nature To F One With Nature Country Quotes Nature

Comments

Post a Comment