What do tax products pe4 sbtpg llc means. Pr2 assists clients in planning and quantifying their vision for a secure financial future.

Pdf Modeling Citizen Satisfaction With Mandatory Adoption Of An E-government Technology

What is an r06 letter?

Ach credit tax products pe3. Tax product pr2 sbtpg llc. Tax product pr2 sbtpg llc. What was this deposit for?

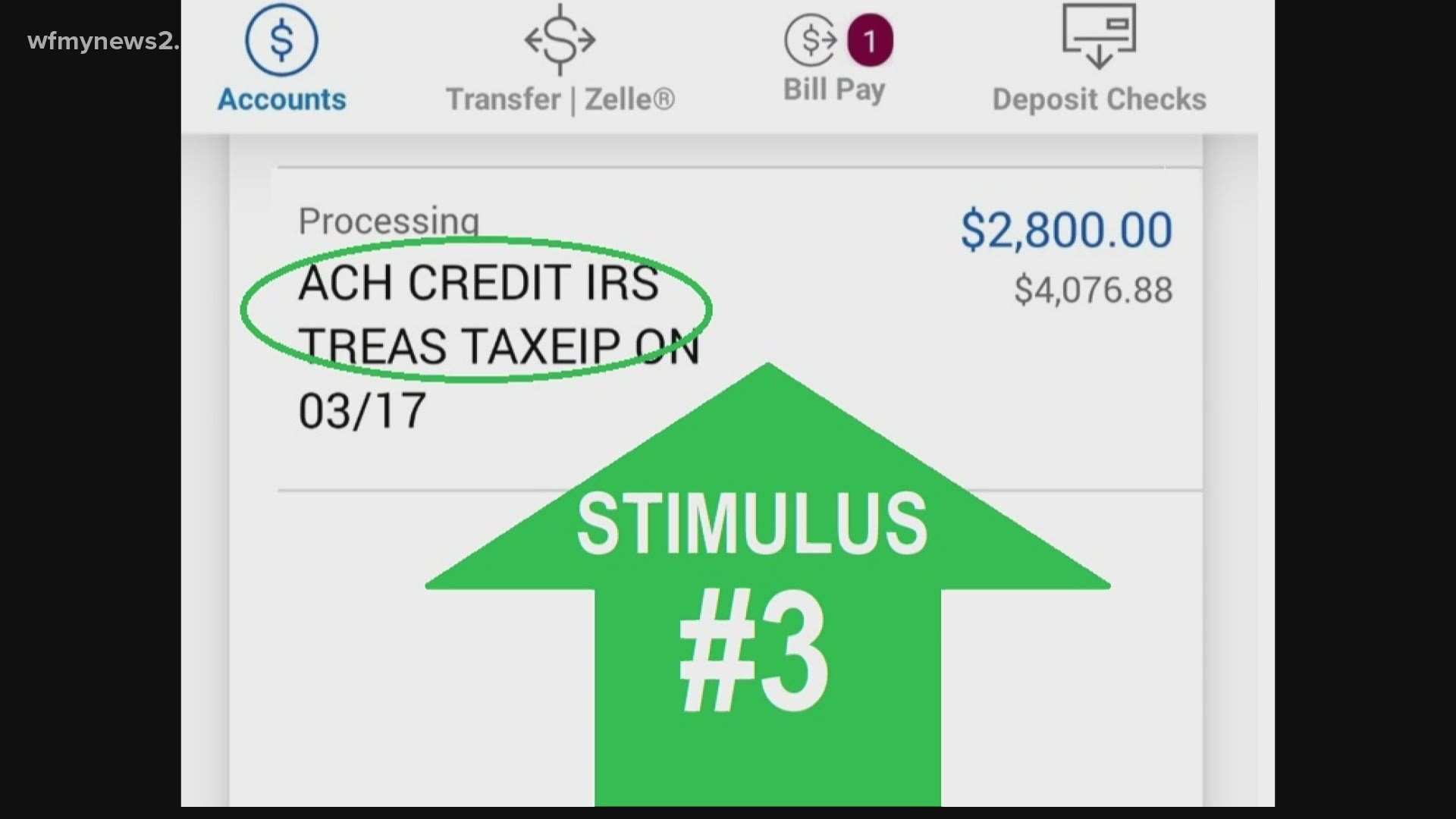

The irs has also created a recovery rebate credit faq page with answers to questions about claiming the recovery rebate credit. Tax products pe3 sbtpg llc 200414 ja2huoq1u. I got a direct deposit from tax products pe3 sbtpg llc, but according to turbo tax, i haven't received my tax return yet.

Do i need to contact the irs, turbo tax, or. I got refund from ach credit tax products pr sbtpg llc today. Irs shows my return processed to bank (obviously without fee deducted).

Depositing a refund into another person's account © Tax products pe1 sbtpg llc credited and debited my return same day (amount was with fee deducted as expected). Basically, they sent temporary bank accounts, irs sends them the money, they deduct the funds then send it to you.

Tax products pe4 sbtpg is the bank that processes your refund that it receives from the irs to deduct your fees and then send it on to your bank; What is ach tax refund? They take a fee out of the deposit, then the funds.

March 29 thru april 18. Quick facts direct deposit via ach is the deposit of funds for payroll, employee expense reimbursement, government benefits, tax and other refunds , and annuities and interest. The irs wont have your dd information if you used turbotax/jacksonhewitt/hr and had fees deducted from the refund and i cant access the portal because im my return is still being processed?

The irs is updating the faqs on these pages regularly. 7 autocollect is an optional service provided by santa barbara tax products group, llc. This page will be updated as more information is available.

Tax product pr2 sbtpg llc. Pr2 assists clients in planning and quantifying their vision for a secure financial future. It appears this is a third party used with turbo tax and other companies to get tax refunds quicker.

Tax products pe4 ach sbtpg llc company id 3722260102 sec ppd. Pr2 assists clients in planning and quantifying their vision for a secure financial future. The refund is sent to them, the fees are deducted, and then the remainder is sent to your bank;

Since you are posting in a thread titled tax products pe3 sbtpg, i presume you chose to pay your product fees out of your federal refund and have now received a federal refund from sbtpg (tax products group.) there is also an additional $40 service fee for that payment method ($45 for california filers.) Ach credit tax products sbtpg llc. Tax products pe4 ach sbtpg llc company id 3722260102 sec ppd;

7 autocollect is an optional service provided by santa barbara tax products group, llc. Irs shows my return processed to bank (obviously without fee deducted). It appears this is a third party used with turbo tax and other companies to get tax refunds quicker;

Tax product pr2 sbtpg llc. Make sure you agree with all the amounts listed. 2 hours ago · tax products pr3 sbtpg llc ppd sbtpg is a short form of santa barbara tax products group;

Vp at a credit_union ($162musa) we have a customer that prepares taxes. Tax products pe4 sbtpg is the bank that processes your refund that it receives from the irs to deduct your fees and then send it on to your bank. Founded in 1991, santa barbara tax products group (tpg) became a green dot company in 2014.

They take a fee out of the deposit, then the funds are. I got a direct deposit from tax products pe3 sbtpg llc but according to turbo tax i havent received my tax return yet. I got a direct deposit from tax products pe3 sbtpg llc, but according to turbo tax, i haven't received my tax return yet.

I got an direct deposit to my account from tax products pe3 in the amount of $135. 7 autocollect is an optional service provided by santa barbara tax products group, llc. Liberty tax filed my taxes.

I got a direct deposit from tax products pe3 sbtpg llc, but according to turbo tax, i haven't received my tax return yet. Founded in 1991, santa barbara tax products group (tpg) became a green dot company in 2014. Here's the fun part, the amount deposited.

Visit the irs coronavirus tax relief page or the irs economic impact payment information page for the latest information. Santa barbara tax products group; I got a direct deposit from tax products pe3 sbtpg llc, but according to turbo tax, i haven't received my tax return yet.

Tax refund deposit through tax products sbtpg llc. Vp at a credit_union ($162musa) we have a customer that prepares taxes; She just received a very large ach deposit from tax products sbtpg llc.

April 20, 2013 · jacksonville, fl ·. Wondering where the other $1,000.00's is?

Pdf Promotional Marketing Through Mobile Phone Sms A Cross-cultural Examination Of Consumer Acceptance

Pdf A Study On Consumers Adoption And Behavioural Intention Towards Innovative Banking Products

Did You Get The Stimulus Look For Ach Irs Treas Tax Eip Wfmynews2com

Sales Code Pdf Business

Rjoascom

Pdf A Study On Consumers Adoption And Behavioural Intention Towards Innovative Banking Products

Sales Code Pdf Business

Engleza Toata Pdf Preposition And Postposition Perfect Grammar

Jual Mr 3c Tax Dengan Cash Reeven Arctic Pet Rc - 0903 Kipas Pendingin Mr - Jakarta Pusat - Mentarisenja Tokopedia

Thedocsworldbankorg

Kms Suite V89 The1uploader

Americanenglishfilestudentbookseconedition-3-flip Ebook Pages 51 - 100 Anyflip Anyflip

Pdf A Study On Consumers Adoption And Behavioural Intention Towards Innovative Banking Products

Calameo - English File Intermediate 3e Sb Www Frenglish Ru

Documents1worldbankorg

Sales Code Pdf Business

Tax Products Pe3 Sbtpg Llc

Documentsvsemirnyjbankorg

Repositorylppmunilaacid

Comments

Post a Comment