This is the total of state, county and city sales tax rates. This sales tax will be remitted as part of your regular city of aurora sales and use tax filing.

1016 Celebration Dr Aurora Il 60504 - Photo 9 Of 33 White Backsplash Home Decor Home

The county sales tax rate is %.

Aurora co sales tax 2021. The minimum combined 2021 sales tax rate for aurora, colorado is. The state sales tax rate in. 31 rows colorado (co) sales tax rates by city.

Average sales tax (with local): Quarterly if taxable sales are $4,801 to $95,999 per year (if the tax is less than $300 per month). The colorado sales tax rate is 2.9%, the sales tax rates in cities may differ from 3.25% to 10.4%.

Since the retailer’s sales in colorado in the current year exceed $100,000, the retailer will be required to maintain a sales tax license and collect sales tax on all sales made in colorado in. The december 2020 total local sales tax rate was also 8.000%. Aurora | proposition 119 invites the colorado electorate to consider ratcheting up taxes on retail marijuana sales in order to buoy extracurricular educational opportunities statewide.

Try it now & grow your business! 2021 cost of living calculator for taxes:aurora, colorado and denver, colorado. Good day, effective june 1, 2021, menstrual care products are exempt from city of aurora sales tax.

Try it now & grow your business! Method to calculate arapahoe county sales tax in 2021. Our premium cost of living calculator includes, state and local income taxes, state and local sales taxes, real estate transfer fees, federal, state, and local consumer taxes (gasoline, liquor, beer, cigarettes), corporate taxes,.

The colorado sales tax rate is currently %. Depending on local municipalities, the total tax rate can be as high as 11.2%. 2021 colorado state sales tax.

For 2021, sales taxes are up 15.2% or $24.1 million from 2020. The sales tax jurisdiction name is aurora (arapahoe co), which may refer to a local government division. 2021 list of illinois local sales tax rates.

Exact tax amount may vary for different items. The colorado (co) state sales tax rate is currently 2.9%. Companies doing business in colorado need to register with the colorado department of revenue.

Note that this only applies to the city of aurora’s 3.75 percent sales and use tax and the products are still taxable by the state of colorado and it’s subdivisions. Create your own online store and start selling today. The colorado state sales tax rate is 2.9%, and the average co sales tax after local surtaxes is 7.44%.

Create your own online store and start selling today. Monthly if taxable sales are $96,000 or more per year (if the tax is more than $300 per month). , co sales tax rate.

Enjoy the pride of homeownership for less than it costs to rent before it's too late. Aurora, co sales tax rate. Lowest sales tax (6.25%) highest sales tax (11%) illinois sales tax:

The average sales tax rate in colorado is 6.078% Consequently, the retailer must obtain a colorado sales tax license and begin collecting sales tax on any retail sale the retailer makes in colorado no later than october 1 st of the current year. Cities and/or municipalities of colorado are allowed to collect their own rate that can get up to 7% in city sales tax.

The proposal calls to ramp up the sales tax on retail marijuana sales in the coming years, eventually bringing the total to 20% by 2024. 26 rows sales & use tax rate changes effective july 1, 2021. Illinois has state sales tax of 6.25% , and allows local governments to collect a local option sales tax of up to 4.75%.

As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. Aurora, colorado and denver, colorado. The 8% sales tax rate in aurora consists of 2.9% colorado state sales tax, 0.25% adams county sales tax, 3.75% aurora tax and 1.1% special tax.

Groceries and prescription drugs are exempt from the colorado sales tax. Retailers are required to collect the aurora sales tax rate of 3.75% on cigarettes beginning dec. Annually if taxable sales are $4,800 or less per year (if.

That $5 million draw likely won't have a large impact on aurora residents since city sales taxes are up. The current total local sales tax rate in aurora, co is 8.000%. Every 2021 combined rates mentioned above are the results of colorado state rate (2.9%), the county rate (0% to 6.5%), the colorado cities rate (0% to 7%), and in some case, special rate (0% to 2.1%).

The aurora sales tax rate is %. The state general sales tax rate of colorado is 2.9%.

Pin By Sharon Brownlie On Geico Car Insurance Geico Car Insurance Insurance Printable Car Insurance

Mere Jeevan Ka Lakshman Essay In Hindi Free Download In 2021 Essay Creative Writing Programs Essay Contests

Large Aurora Borealis Star Burst Sun Catcher Swarovski Crystals Crystals Sun Catcher

Ex-992

Pengertian Dan 7 Contoh Gambar Poster Seni Budaya Poster Seni Budaya

Zenzii Gold-tone Painted Metal Flower Stud Earrings Reviews - Earrings - Jewelry Watches - Macys In 2021 Flower Earrings Studs Flower Studs Clay Jewelry

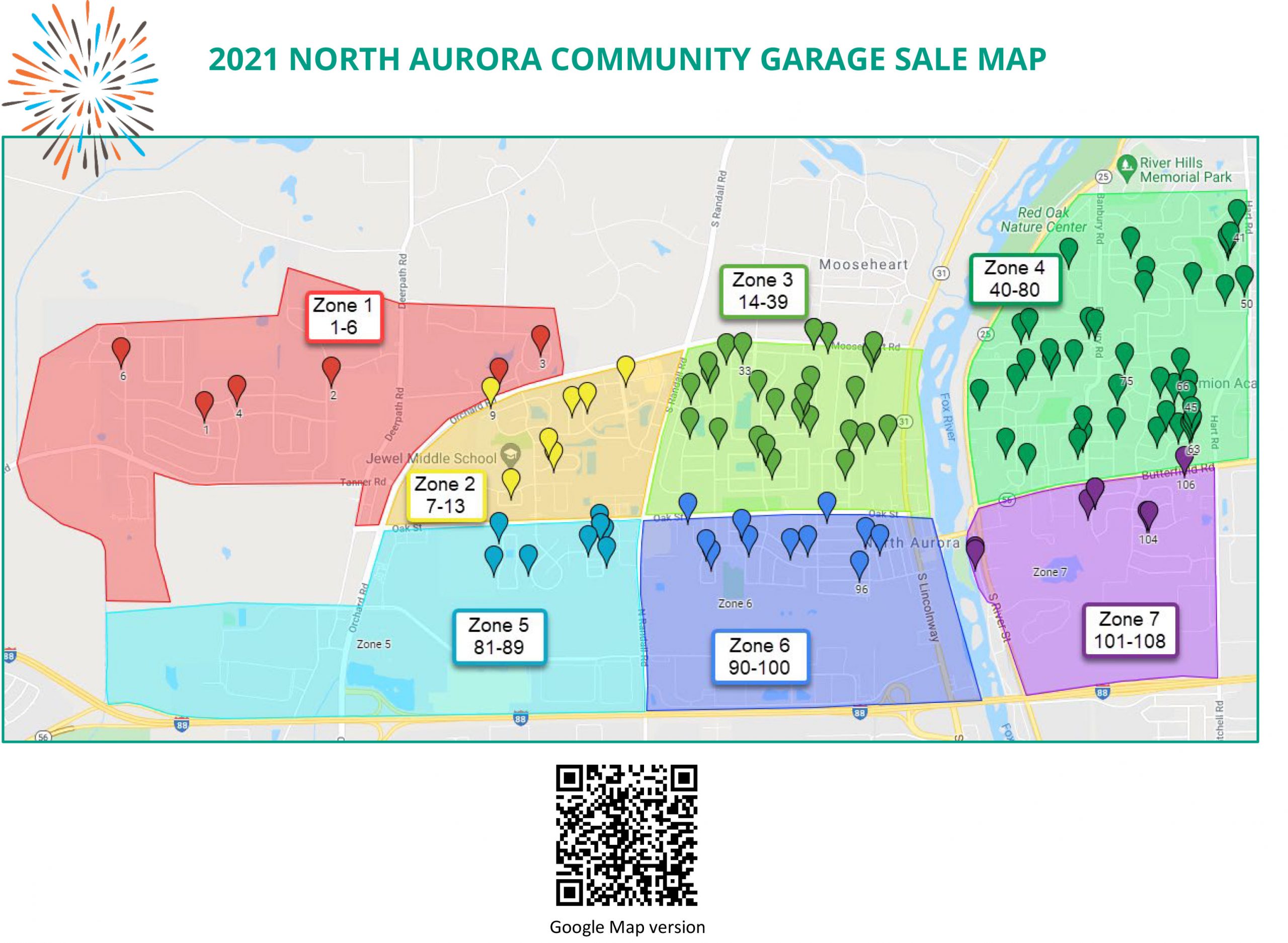

Community Garage Sale - Map Available - Village Of North Aurora

Starbucks Mint Recycled Glass Tumbler In 2021 Starbucks Starbucks Cups Starbucks Tumbler

Nuevo Reloj Metalch Swiss Made Diver 100 Suizo 100 Calidad Visitanos En La Aurora O Pidelo En Linea Amazing Watches Watches Accessories

14434 E 1st Dr Unit A01 Aurora Co 80011 Mls 4152324 Redfin

Charitable Donation Receipt Template In 2021 Checklist Template Receipt Template Template Printable

Photos Stunning Northern Lights Dance Over Seattle Here Are Tips For Catching The Next One - Geekwire

Aurora Vote 2021 Leadership Style And Critical Issues Dominate At-large Race For City Council - Sentinel Colorado

5524 Aurora Pike Terra Alta Wv 26764 Mls 10131041 Zillow Fruit Trees Acre West Virginia

Photos Stunning Northern Lights Dance Over Seattle Here Are Tips For Catching The Next One - Geekwire

Solar Flare Could Make Aurora Visible Across The Northern Us Wralcom

Aurora Vote 2021 1a County Wants To Make Open Space Program Tax Permanent - Sentinel Colorado

The Chambers 2021 Business Directory By Aurorachamber - Issuu

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Comments

Post a Comment