The current total local sales tax rate in vista, ca is 8.250%. Bakersfield, ca sales tax rate:

Sales Tax Rates In Major Cities Tax Data Tax Foundation

You can print a 8.75% sales tax table here.

Chula vista california sales tax rate. Sellers are required to report and pay the applicable district taxes for their taxable. This rate is made up of a base rate of 6%, plus california adds a mandatory local rate of 1.25% that goes directly to city and county tax officials. For tax rates in other cities, see california sales taxes by city and county.

California department of tax and fee administration. The state general sales tax rate of california is 6%. Find your california combined state and local tax rate.

The minimum combined 2021 sales tax rate for chula vista, california is. You can find more tax rates and allowances for chula vista and california in the 2022 california tax tables. The december 2020 total local sales tax rate was also 8.250%.

Irs tax settlement lawyers of chula vista. Vista, ca sales tax rate. The california sales tax rate is currently %.

City of imperial beach 8.75%. This is the total of state, county and city sales tax rates. The chula vista sales tax rate is %.

Food and prescription drugs are exempt from sales tax. California sales and use tax rates by county and city* operative october 1, 2021 (includes state, county, local, and district taxes). , ca sales tax rate.

Depending on local sales tax jurisdictions, the total tax rate can be as high as 10.25%. In most areas of california, local jurisdictions have added district taxes that increase the tax owed by a seller. Identify the licenses, permits, and how many you need to start or grow your business in chula vista.

What is the sales tax rate in chula vista, california? , ca sales tax rate. The california state sales tax rate is 7.25%.

San diego county, california sales tax rate 2021 up to 8.75%. This local tax is scheduled to expire in 2026. [ 1 ] state sales tax is 7.25%.

Those district tax rates range from 0.10% to 1.00%. The december 2020 total local sales tax rate was also 8.750%. The current total local sales tax rate in chula vista, ca is 8.750%.

Notes q4 2016 city of chula vista sales tax update $0 $1,000 $2,000 $3,000 $4,000 sales per capita chula vista q4 13 q4 16 q4 14 q4 15 county california 41% cons.goods 15% pools 12% restaurants 9% autos/trans. This includes an existing local sales tax of 0.5% that was approved by chula vista voters in 2016. 31 rows anaheim, ca sales tax rate:

The 91915, chula vista, california, general sales tax rate is 8.75%. Sales tax and use tax rate of zip code 91911 is located in chula vista city, san diego county, california state. The combined rate used in this calculator (8.75%) is the result of the california state rate (6%), the 91915's county rate (0.25%), the chula vista tax rate (1%), and in some case, special rate (1.5%).

If the proposed measure a sales tax were approved, the sales tax rate in the city would increase to 8.75%. California sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. The statewide tax rate is 7.25%.

Some cities and local governments in san diego county collect additional local sales taxes, which can be as high as. 1788 rows chula vista* 8.750%: Sales and use tax rates.

City of la mesa 8.50%. 103 press ln, chula vista, ca 91910. Chula vista in california has a tax rate of 8.25% for 2022, this includes the california sales tax rate of 7.5% and local sales tax rates in chula vista totaling 0.75%.

Find my licenses avalara license guidance $99: The 8.75% sales tax rate in chula vista consists of 6% california state sales tax, 0.25% san diego county sales tax, 1% chula vista tax and 1.5% special tax. Not only will they go the extra mile for you, they will bring in tax professional, ex irs agents, what ever it takes to make sure you are not taken….

Learn license requirements, find applications, and get. There are a total of 513 local tax jurisdictions across the state, collecting an average local tax of 2.492%. Chula vista collects a 2.25% local sales tax, the maximum local sales tax allowed under california law chula vista has a higher sales tax than 51.8% of california's other cities and counties chula vista california sales tax exemptions

City of el cajon 8.25%. Local tax rates in california range from 0.15% to 3%, making the sales tax range in california 7.25% to 10.25%. Every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25% to 1%), the california cities rate (0% to 1.75%), and.

City of chula vista 8.75%. The county sales tax rate is %. Cities and/or municipalities of california are allowed to collect their own rate that can get up to 1.75% in city sales tax.

Average sales tax (with local): California has state sales tax of 6% , and allows local governments to collect a local option sales tax of up to 3.5%. City of del mar 8.75%.

The san diego county sales tax is 0.25%. Some areas may have more than one district tax in effect. The current sales tax rate in chula vista is 8.25%.

California Sales Tax Rates By City

The San Diego County California Local Sales Tax Rate Is A Minimum Of 625

Thai Bond Market Association To Launch Blockchain-based Registrar Bond Service Platform Blockchain Association Marketing Bond Market

2

La Mesa Ca Bike Trails Trail Maps Traillink Moving To San Diego Chula Vista San Diego

2

2

Sales Use Tax

Pin On Metropoint Tax Services

Frequently Asked Questions City Of Chula Vista

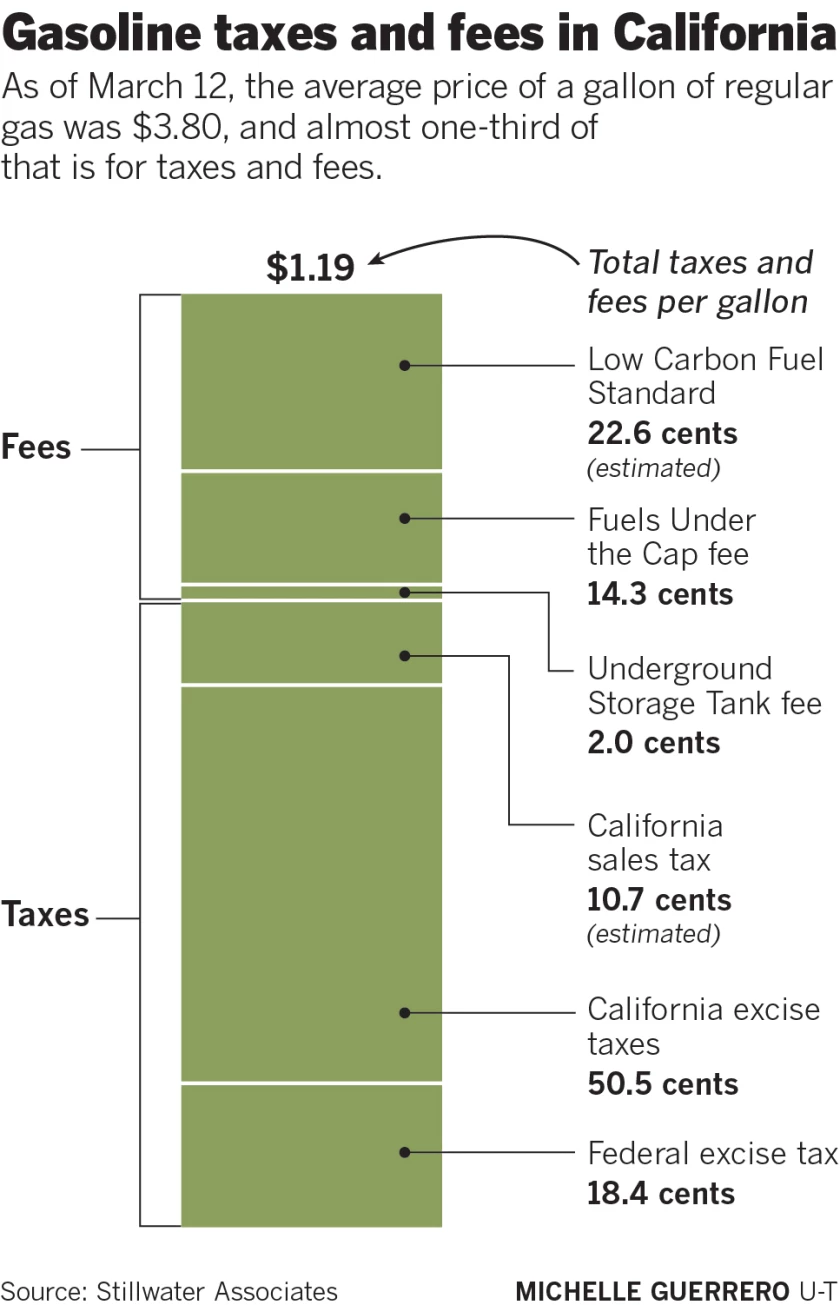

How Much Are You Paying In Taxes And Fees For Gasoline In California - The San Diego Union-tribune

Frequently Asked Questions City Of Chula Vista

Californias Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

San Diego County Public Records Public Records San Diego San Diego County

2

San Diego Found States Cheapest Area For Business - The San Diego Union-tribune

San Diego Property Tax Rate San Diego Real Estate Taxes Welcome To San Diego

California Public Records Public Records California Public

Georgia Sales Tax Rates By City County 2021

Comments

Post a Comment