If you purchased your ev more than 3 years ago and the vehicle is still eligible for the tax credit, you can file an amended return to claim your credit. Conversion of a qualifying motor vehicle or truck may elect to assign the credit to the financing entity that finances the purchase, lease, or conversion.

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

The credit is worth up to $5,000 for passenger vehicles and more for trucks.

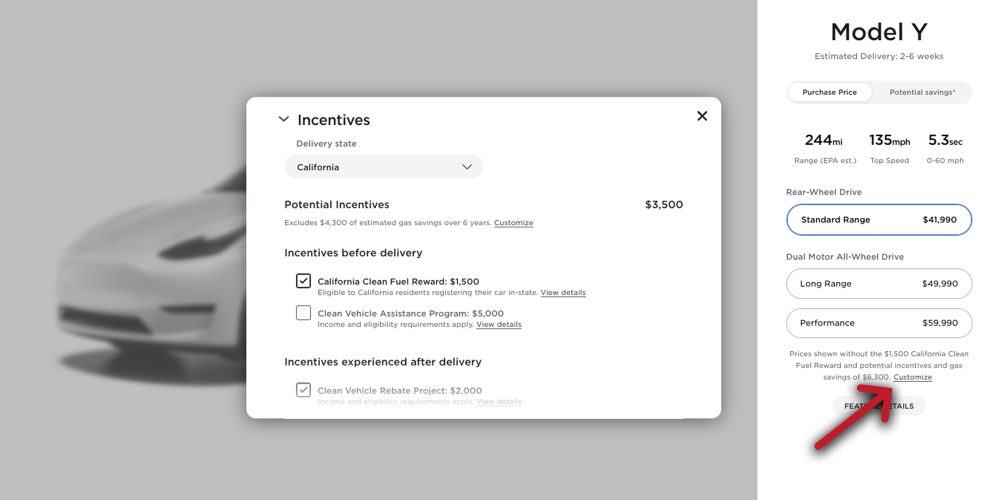

Colorado electric vehicle tax credit 2020 form. From july 1 st until the end of the year, the credit is only worth $1,875. Why buy an electric vehicle? $2,500 in state tax credits and up to $7,500 in federal tax credits.

Ev charging stations are being rapidly installed throughout our state and country. A separate form must be completed for each qualifying vehicle. In the case of assignment, the financing entity must file a colorado income tax return with all required forms and documents to claim the credit.

Electric motorcycles already receive a 10% federal tax credit, but that figure was tripled to 30% in the new bill, according to the washington post. If you lease an electric vehicle for two years beginning before the end of 2020, you can get a $2,500 tax credit. Innovative motor vehicle and truck credits tax year 2020 see page 1 for instructions use this form to claim innovative motor vehicle and innovative truck credits.

From april 2019, qualifying vehicles are only worth $3,750 in tax credits. Some dealers offer this at point of sale. As of january 1, 2017 the value of the credit is a flat rate of $5,000 that can be applied at the time of purchase.

Download or print the 2020 colorado form dr 0617 (innovative motor vehicle credit) for free from the colorado department of revenue. You can lease an electric vehicle instead and get $2,500 by the end of the year. If you don’t have $4,000 in colorado.

There is no tax credit if you decide to lease a new electric vehicle. The rebate amounts for vehicles purchased or leased between january 1, 2020, and december 31, 2020 are: November 17, 2020 by electricridecolorado.

The credit was capped at a maximum of $7,500. For additional information, consult a dealership or this legislative council staff issue brief. This tax credit goes down to $2,500 on january 1, 2021 so buy your car now to take advantage of the $4,000 credit.

Federal tax credits of up to $7,500 are still available for most evs, though tesla met its max at the end of last year and general motors phases out by april. The tax credit for most innovative fuel. We last updated the qualified electric vehicle credit in january 2021, so this is the latest version of form 8834, fully updated for tax year 2020.

Qualifying vehicle types include electric vehicles, plug‑in hybrid electric vehicles, liquefied petroleum gas (lpg) vehicles, and compressed natural gas (cng) vehicles. Colorado residents are able to claim an additional state tax credit of $2,500 when they buy an electric vehicle. The credit would begin phasing out for taxpayers earning over $75,000, though that figure increases to $112,500 for heads of household.

From 2020, you won’t be able to claim tax credits on a tesla. Utility and state evse rebates Generally, most electric vehicles qualify for the credit and all typically earn you the full amount of $7,500, but there are some criteria.

Secure online pdf signer that makes electronic signing incredibly easy for the client Colorado’s credit for new ev purchases dropped to $4,000 in january and will be reduced again next year. $2,500 for evs and $1,500 for hybrids.

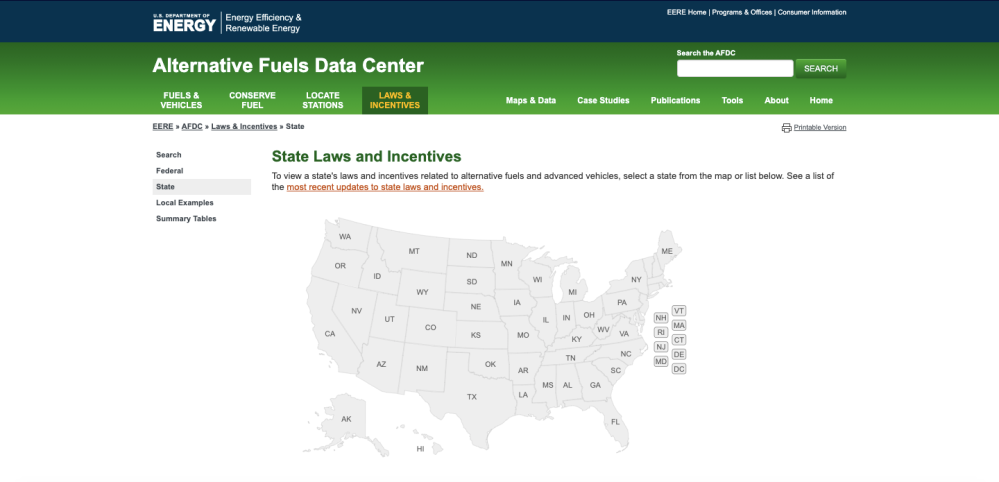

Check ’em all out and map your route. Information on tax credits for all alternative fuel types: Use form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year.

To claim your federal ev tax credit, you must fill out form 8936 along with form 1040. Colorado electric vehicle tax credit. General motors became the second manufacturer to hit this milestone in the final financial quarter of 2018.

You purchased this vehicle new, the vehicle has a 4. You can print other federal tax forms here. Please see the instructions and fyi income 69, available online at tax.colorado.gov before completing this form.

Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle, converted a motor vehicle to use an alternative fuel, or. If you purchase a new electric vehicle by the end of 2020, you can get a $4,000 tax credit. Tax credits can be stacked with federal ev incentives and will decrease in value after 2020, dropping to $2,500 in 2023 and $2,000 in 2026.

Zero Emission Vehicle Tax Credits Colorado Energy Office

A3spypssl3ruwm

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

/https://www.forbes.com/wheels/wp-content/uploads/2021/01/2021_Ford_Mustang_Mach-E_EV-14.png)

Best Electric Cars For 2021 - Forbes Wheels

Ev Stakeholder Engagement Colorado Energy Office

How Do Electric Car Tax Credits Work Credit Karma

Electric Car Tax Credits Whats Available Energysage

A Fleet Managers Guide Electric Vehicle Tax Credits

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

Charge Ahead Colorado Colorado Energy Office

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate - Roadshow

Taxcoloradogov

Rebates And Tax Credits For Electric Vehicle Charging Stations

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate - Roadshow

How To Claim An Electric Vehicle Tax Credit Enel X

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

Taxcoloradogov

Comments

Post a Comment