If your return status says your return is being processed, it is very likely that your return is being reviewed. Integrity tax group of holland.

We Take Great Pride In Our Web Modules For Staffing Agencies Our Tools Give Your Staffing Company The Ability To Sha Staffing Agency Staffing Company Staffing

The registered agent on file for this company is scott d van kampen and is located at 537 devillen ave, royal oak, mi 48073.

Integrity tax service holland mi. We followed her from her previous firm to integrity,. This process can take at least 4 months. Setup and planning) and tax services for personal and business returns of all types.

Refunds are being delayed as the irs has flagged millions of returns for manual review. We help our clients achieve the retirement lifestyle of. Top landscape contractor in zeeland, mi and other areasy nearby in michigan.

Currently, the company's michigan locations include jenison, grand haven, benton harbor, kentwood, ne grand rapids, holland, and rockford with more to come in the future! Integrity tax group of grand haven. Jodi schierbeek recommends integrity tax group (753 butternut drive, holland, mi).

We've used diemer accounting for our business, personal tax and accounting needs for over 35 years. 5 reviews of integrity tax group brenda lewis is a. Being a first time customer, i was very disappointed in the service i received at diemer accounting.

File your taxes at jackson hewitt, a tax preparation service with nearly 6,000 tax offices nationwide, including 2629 north park drive, holland, mi! I love coming here to get my taxes done. Integrity tax group proudly serves the indiana region through our sister company, stadler & company.

Don't let the only other review on yelp make you think they are not a solid cpa and tax. Integrity tax group of grand haven. Currently, we have locations in jenison, grand haven, kentwood, grand rapids, holland.

Integrity offers full and partial service payroll, bookkeeping, small business assistance (i.e. That’s why we put our all into every project we do. Accounting & bookkeeping, taxes · 2.

Search reviews of 29 holland businesses by price, type, or location. The highest standards of integrity our vision is to be a premier financial services organization by helping people protect and grow their assets, save money on taxes, and give them and their families peace of mind for the future. Integrity offers full and partial service payroll, bookkeeping, small business assistance (ie setup and planning) and tax services for personal and business of all types.

August 5 at 5:47 am ·. Ask tax professional near you if they would be willing to give a consultation via phone call, zoom, skype or other video conferencing software to discuss the scope of work. You need a trusted ally who can help you navigate through the government requirements.

We recommend them without reservation. 9 east main street, suite 201. Find the best tax services on yelp:

Jodi schierbeek recommends integrity tax group (753 butternut drive, holland, mi). She's prepared our return for the past 4 years and we are always very happy and completely satisfied. The company's filing status is listed as active and its file number is 802664521.

Integrity tax group is located at 753 butternut drive holland, mi and integrity tax group operates in the accounting industry. Get directions, reviews and information for integrity accounting & tax service in jenison, mi. For more information, click below!

6 reviews of integrity tax group brenda lewis is a tax rockstar. They are very helpful and friendly. Action tax service provides a full range of tax preparation and accounting solutions.

The irs is asking for patience with this review process. She's absolutely wonderful and goes the extra mile to make sure you are getting every deduction and that your tax needs are fully met. Currently, the company's michigan locations include jenison, grand haven, kentwood, ne grand rapids, holland, benton harbor, and rockford with more to come in the.

Reviews and information for integrity accounting & tax service in jenison, mi. Diemer accounting and tax service. Integrity offers full and partial service payroll, bookkeeping, small business assistance (ie setup and planning) and tax services for personal and business of all types.

Integrity tax group of holland, mi there are no current ratings for this location. Integrity payroll services is part of the integrity tax group and stadler family. Also, ask them how they handle payments.

Brenda is 5 stars no question. Integrity tax group of rockford formerly action tax. Let action tax service help!

Integrity Tax Group Formerly Action Tax Service - Home Facebook

Integrity Tax Group Meet Our Team

Integrity Tax Group Formerly Action Tax Service - Home Facebook

Pin On Lds Quotes And Other Good Quotes

Integrity Tax Group - Home Facebook

Integrity Tax Group - Home Facebook

Payroll For Small Business Integrity Payroll Services

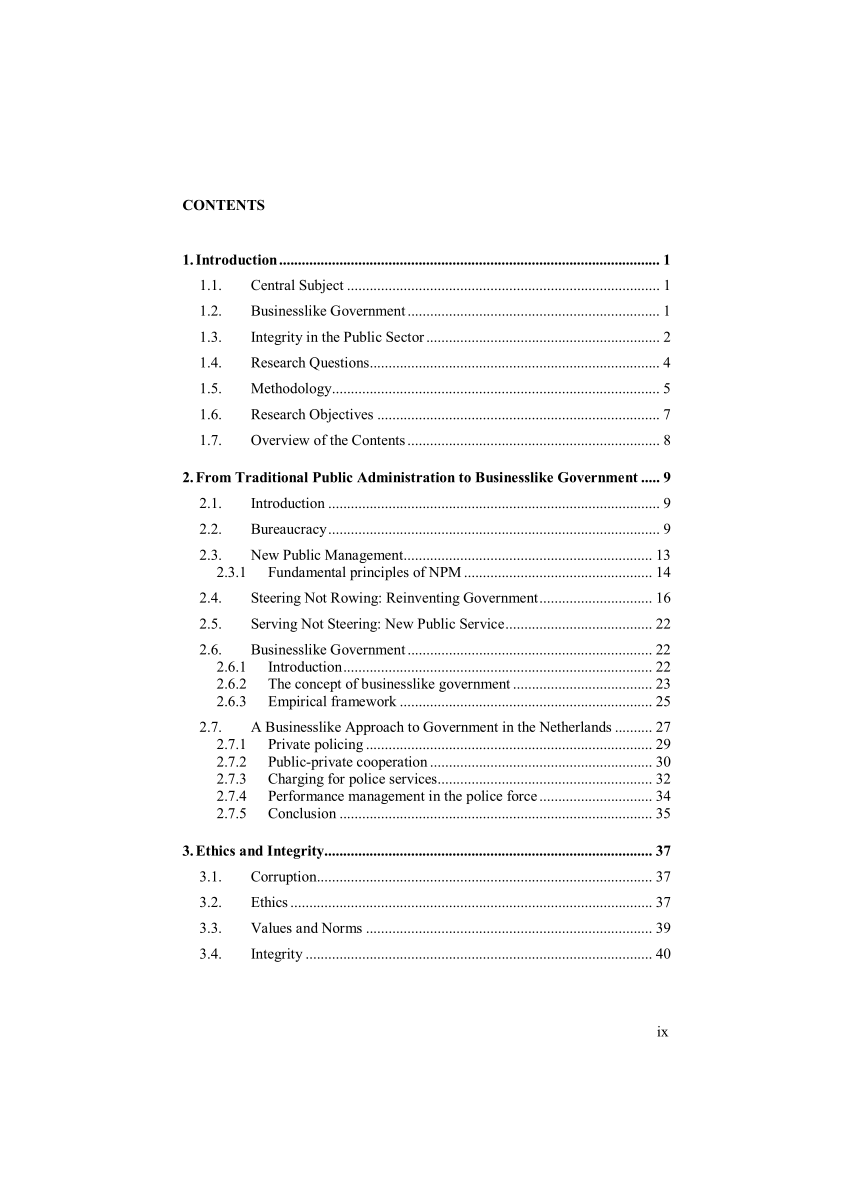

Pdf Ethics And New Public Management Empirical Research Into The Effects Of Businesslike Government On Ethics And Integrity

1 Sm Pdf

2

Pdf National Integrity Systems In Small Pacific Island States

Integrity Tax Group - Home Facebook

Integrity Tax Group - Tax Services - 7683 Cottonwood Dr Jenison Mi - Phone Number

Pdf Ethics And New Public Management Empirical Research Into The Effects Of Businesslike Government On Ethics And Integrity

Pdf Ethics And New Public Management Empirical Research Into The Effects Of Businesslike Government On Ethics And Integrity

Integrity Tax Group Meet Our Team

Have The Courage To Say No Have The Courage To Face The Truth Do The Right Thing Because It Is Right These Are Courage Quotes Wisdom Quotes Integrity Quotes

2

Pin On Vacations 2021

Comments

Post a Comment