By law, property tax bills have to be mailed out at least 30 days prior to the due date. Cynthia burke treasurer donna waldrop deputy treasurer phone:

Helpful Links Laurens Co Development Corporation

Laurens county courthouse, located at 200 courthouse public, laurens, sc, in the upstairs courtroom on wednesday.

Laurens county tax assessor sc. Remember to have your property's tax id number or parcel number available when you call! Laurens county, south carolina treasurer the treasurer is an elected constitutional officer responsible for the collection of property taxes, including the processing of homestead exemptions, preparation of the county tax digest, billing of taxes, and the accounting for and distribution of those taxes. When are my property taxes due in county of laurens, sc?

When will the next laurens county tax sale be held? Where is the tax sale held and what time does it begin? Below you’ll find all the information you’ll.

Laurens county collects, on average, 0.51% of a property's assessed fair market value as property tax. Property tax lookup link to gis. Laurens county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in laurens county, south carolina.

They are due by january 15th without penalty unless the 15th falls on a weekend or a holiday. All returned checks due to insufficient funds, closed accounts, incorrect routing numbers or any other related bank account issue will be charged. If you have documents to send, you can fax them to the.

© 2015 laurens county, sc Laurens county has one of the lowest median property tax rates in the country, with only two thousand five hundred thirty two of the 3143 counties collecting a. You can search our site for a wealth of information on any property in laurens county.

The acrevalue laurens county, sc plat map, sourced from the laurens county, sc tax assessor, indicates the property boundaries for each parcel of land, with information about the landowner, the parcel number, and the total acres. Monday through friday 9:00 a.m. Wednesday, december 15, 2021 q.

The laurens county assessor's office, located in laurens, south carolina, determines the value of all taxable property in laurens county, sc. These returns are filed with the tax assessors office and forms are available in that office. The tax return is a listing of property owned by the taxpayer and the taxpayer's declaration of the value of the property.

These records can include laurens county property tax assessments and assessment challenges, appraisals, and income taxes. The laurens county tax assessor is the local official who is responsible for assessing the taxable value of all properties within laurens county, and may establish the amount of tax due on that property based. You may contact the laurens county tax collector's office for questions about:

Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. The median property tax in laurens county, south carolina is $439 per year for a home worth the median value of $85,800. Property records requests for laurens county, sc.

The laurens county gis maps search (south carolina) links below open in a new window and take you to third party websites that provide access to laurens county public records. Looking up property owners by name and address. Click here for property search lookup.

Once the initial tax return is filed, the law. To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent. Acrevalue helps you locate parcels, property lines, and ownership information for land online, eliminating the need for plat books.

Our variety of living, beautiful rivers and lakes, and bustling urban centers draw a diverse mix of residents. Laurens county assessor's office services. Perform a free laurens county, sc public gis maps search, including geographic information systems, gis services, and gis databases.

Our laurens county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in south carolina and across the entire united states. Netr online • laurens • laurens public records, search laurens records, laurens property tax, south carolina property search, south carolina assessor from the marvel universe to dc multiverse and beyond, we cover the greatest heroes in print, tv and film In laurens county, the time for filing returns is january 1 through april 1.

The goal of the laurens county assessors office is to provide the people of laurens county with a web site that is easy to use. The laurens county assessor's office and the laurens county treasurer's office disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data system. The information contained herein reflects the values established in the most current published tax digest.

Laurens county is a fantastic place for families, young people, and retirees alike! The laurens county treasurer and tax collector's office is part of the laurens county finance department that encompasses all financial functions of the local government.

Tax Commissioner Laurens County Ga

Treasurer

Helpful Links Laurens Co Development Corporation

Laurenscountyus

Helpful Links Laurens Co Development Corporation

Laurens County South Carolina Public Records Directory

Laurens County Tax Assessors Office

South Carolina Assessor And Property Tax Records Search Directory

Laurens County Real Property Search Gis - Property Walls

Laurenscountyus

Laurens County Suspending Public Access To Hillcrest Square Due To Covid-19 Cases News Golaurenscom

Ultimate Guide To Understanding South Carolina Property Taxes

Laurenscountyus

Treasurer

Mcclibraryfunctionsazurewebsitesus

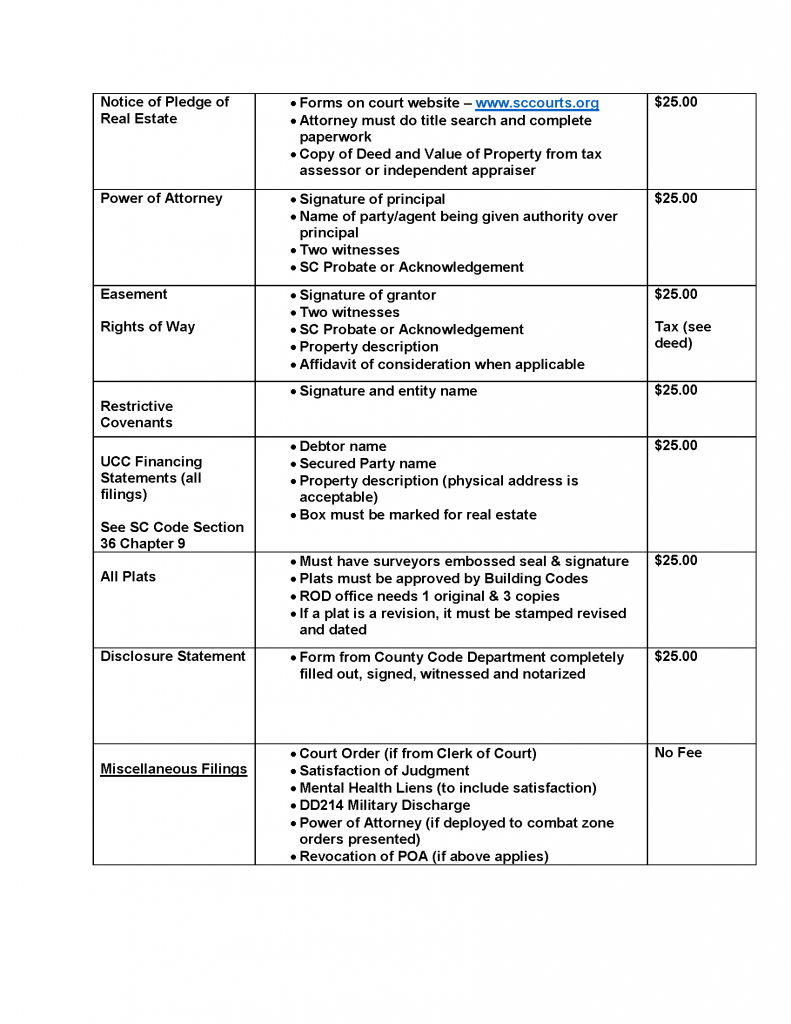

Recording Fees Laurens County

Laurens County Real Property Search Gis - Property Walls

Laurens County Real Property Search Gis - Property Walls

Laurens County Real Property Search Gis - Property Walls

Comments

Post a Comment