The real estate investment trust (reit) act of 2009 proposes several incentives for establishing these corporations in the country, including tax exemptions on revenues and shareholder dividends. Since reits are obliged by law to maintain 33% of the company’s share to be owned by public investors and distribute a minimum of 90% of their taxable income to shareholders in the form of dividends, wealth is diversified.

Are These 7 Reits Ticking Time Bombs Or Treasure Chests Nasdaq

A reit investor’s effective federal tax rate on distributions may be reduced to as low as 3.0% when a 90% return of capital (roc) tax deferral is combined with the 20% rate reduction applicable to ordinary dividend distributions.

Reit dividend tax philippines. More so for ofws who invest in philippine reits, as they’re exempted from paying the 10% income tax or withholding tax on dividends for seven years starting from january 20, 2020. This will ultimately increase returns since the philippines has an income tax rate of 30 percent (25 percent under create). How to invest in fixed income securities in the philippines

During its initial public offering (ipo) listing last august 12, filrt projected a dividend yield of 6.3% for 2021 and 6.6% for 2022 based on a price of ₱7.00 per share. Taxation of dividends paid by reits. Reit investing comes with tax benefits.

This tax provision meant that. Besides tax savings, property owners will be able to liquidate the value of their properties, leading to an opportunity to raise capital that can be used for other investment opportunities. Cynics might imply that the real reason to want to keep such a high stake is that (and unusually under reit regimes), the dividend income from reits to corporates will not be taxed in the philippines, so this is a perpetual windfall for the already wealthy developers.

The following are the top dividend stocks in the philippines to invest in 2021. Reits will also benefit from the documentary stamp tax exemption recently issued on its original shares of stock. In general, dividends paid by the reit will be subject to a final tax of 10%, unless paid to a domestic or resident foreign corporation or an overseas filipino investor (ofw).

Overseas filipinos investing in local real estate investment trusts (reits) will be exempted from income tax or withholding tax on dividends from this new asset class for the next seven years. According to philippine stock exchange (pse) president and chief executive. Top dividend paying stocks in the philippines in 2021:

Therefore, they are expected to provide upside results or outperform the psei. The law also mandates reits to declare as dividends at least 90 percent of its distributable income. The tax to be deducted from the dividend payment is called final withholding tax.

(rcr), the country’s largest real estate investment trust (reit) and backed by robinsons land corporation, declared its first cash dividend amounting to p616.8 million. Just over a month since its debut at the philippine stock exchange, the rcr board of directors approved the declaration of its first cash dividend payout in the amount of p0.062 per outstanding common share. In the case of ofws, the exemption will remain for a period of seven years from the implementation date of the regulations.

The bir also removed the requirement for a reit to place in escrow, the income tax collectible from the reit on dividends declared and deducted from its. See section 4 of the implementing rules and regulations ( this. In fact, reits are required by law to give out 90% of their distributable income as dividends.

Some of these amazing provisions include the 10% ofw tax exemption. This is the full and final payment of income tax due from the recipient of the dividend income. Another way to make money from reits is to buy reit shares at a low price and then sell them later at a higher price.

Distributable income paid as cash dividends by reits are exempted from corporate income tax. The real estate investment trust (reit) act of 2009 proposes several incentives for establishing these corporations in the country, including tax exemptions on revenues and shareholder dividends. Shareholder owns more than 10% of the reit’s stock.

You may avail tax perks with reit investments. Amount of cash dividend per share: 5% tax rate if the corporate shareholder owns at least 10% of the reit’s voting stock and in the case of reit dividends paid to a corporation resident in cyprus or egypt, no more than 5% of the reit’s gross income consists of interest and dividends.

More so for ofws who invest in philippine reits, as they’re exempted from paying the 10% income tax or withholding tax on dividends for seven years starting from january 20, 2020. The amount is equivalent to a quarterly yield of 1.6% or an annualized yield of 6.4%. Here are the upcoming reit dividend payouts this september:

— in general, cash or property dividends paid by a reit shall be subject to a final tax of ten percent (10%), unless: The reit act of 2009, however, allows such dividend distribution to be deducted from a reit’s taxable income. Reits will also benefit from the documentary stamp tax exemption recently issued on its original shares of stock.

Cash or property dividends paid by a real estate investment trust (reit) to corporations. With the help of better reit guidelines in 2020, reit in the philippines is becoming an attractive investment prospect to both newbies and expert investors. Generally, reits are predicted to give between 4% to 6% in dividends every year.

Gsis Sss Dividend Gains On Areit Ddmp Reit

Reit Investment In The Philippines The Facts You Need To Know Blog Citiglobal Realty Development Inc

Mreit - Megaworld Reit Traders And Investors - Home Facebook

Reits Vs Bonds In Retirement - Intelligent Income By Simply Safe Dividends

Pdf Reit Performance Analysis Are Other Factor Determinants Constant

Reit Investment Malaysia - How To Invest In Reit In Malaysia Reit Investing Real Estate Investment Trust

2

Mreit - Megaworld Reit Traders And Investors - Home Facebook

Upcoming Reit Dividends This September 2021 - Reit Philippines

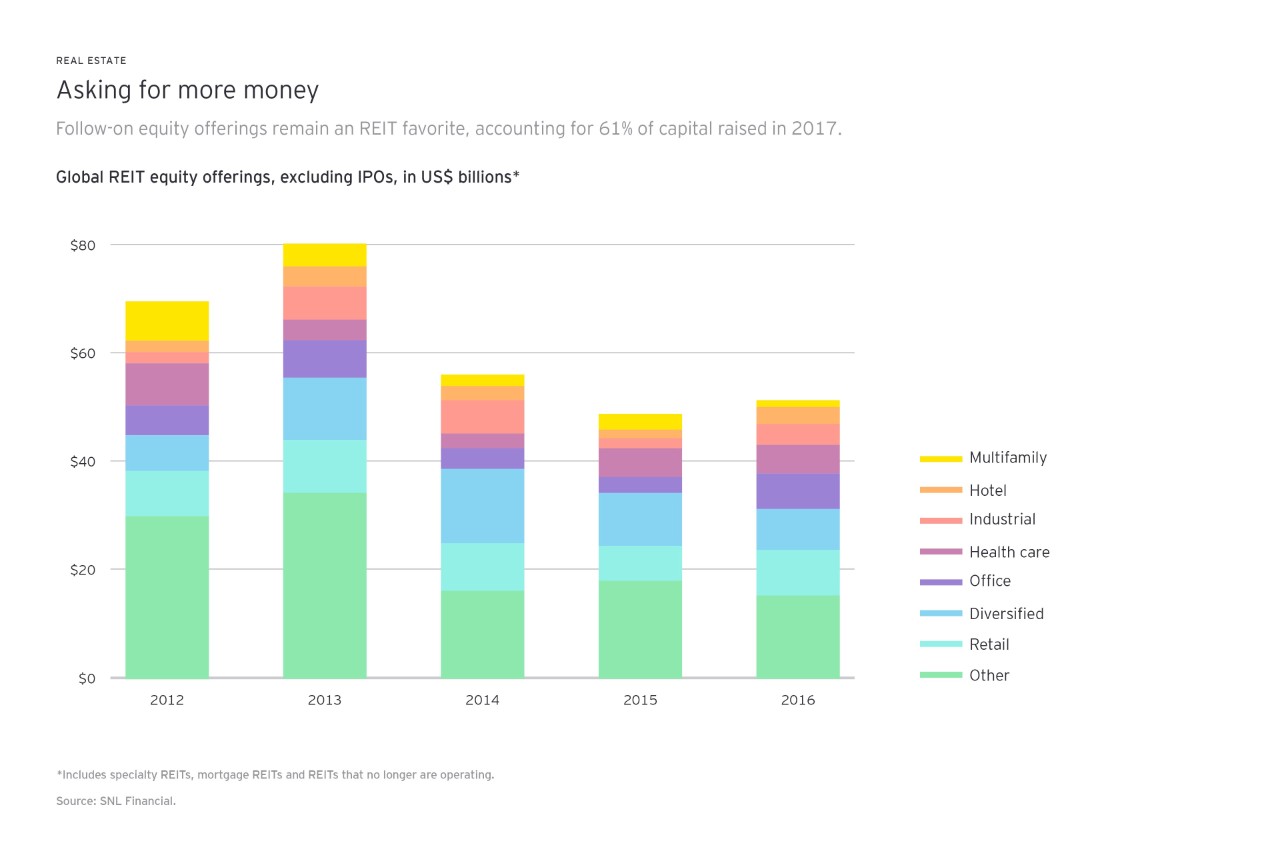

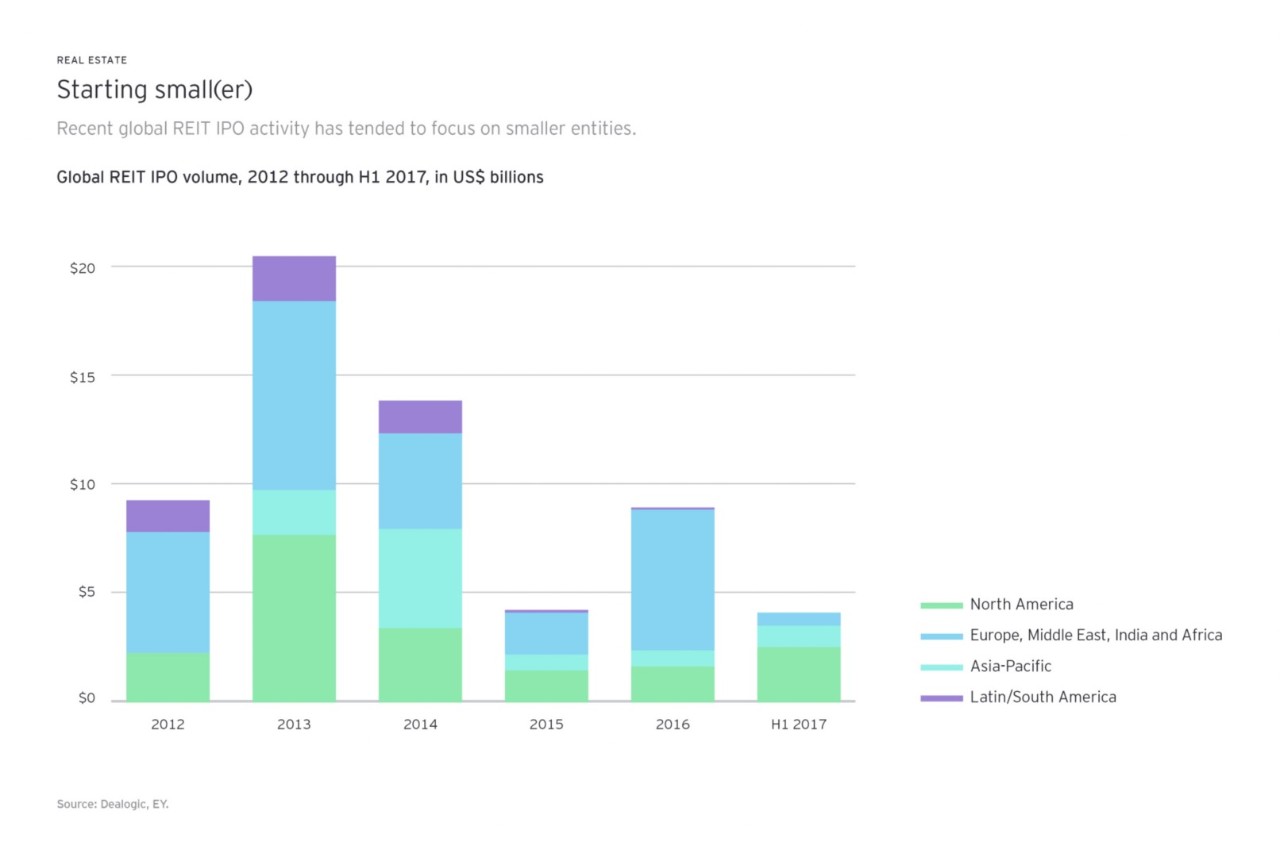

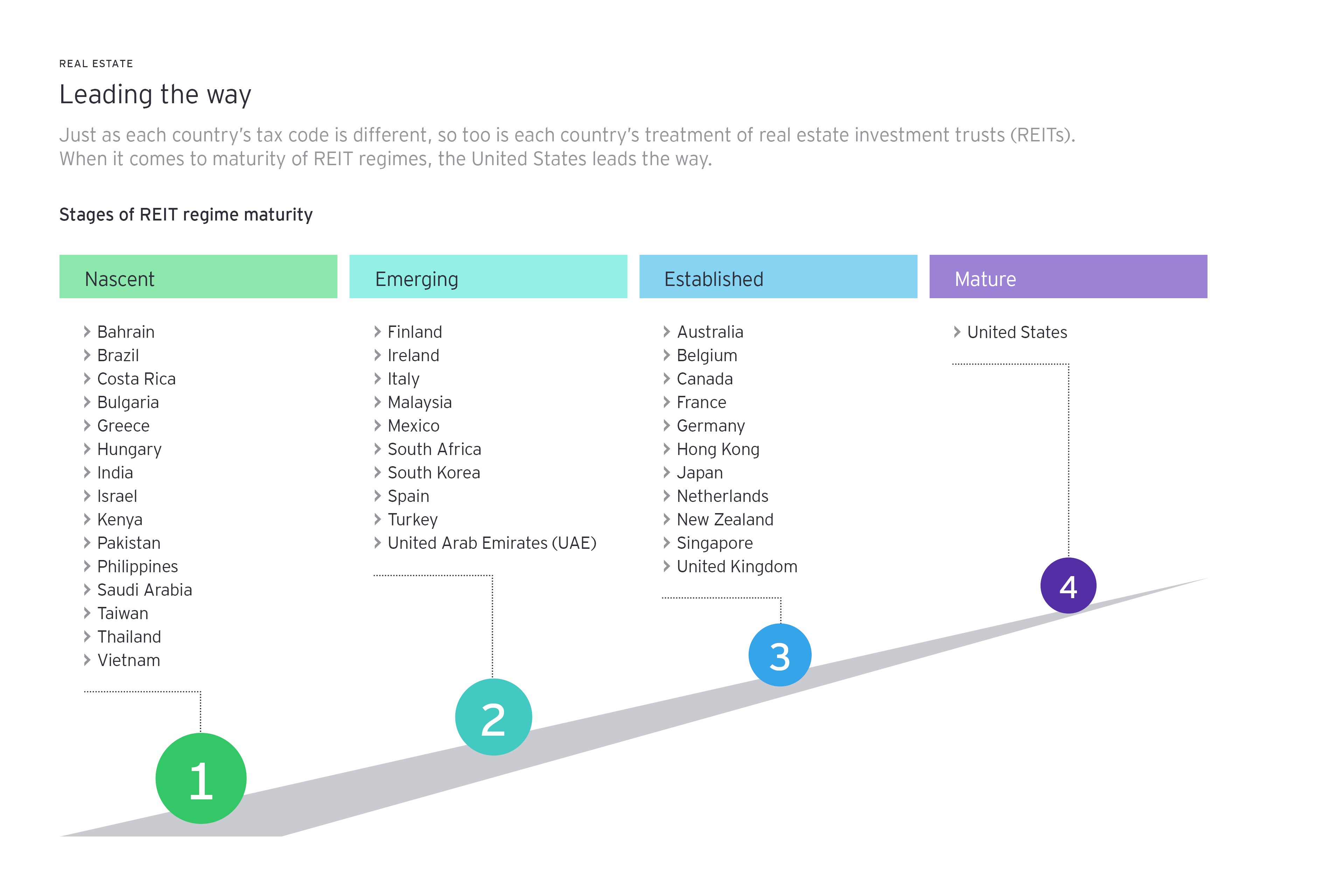

How Reit Regimes Are Doing In 2018 Ey Slovakia

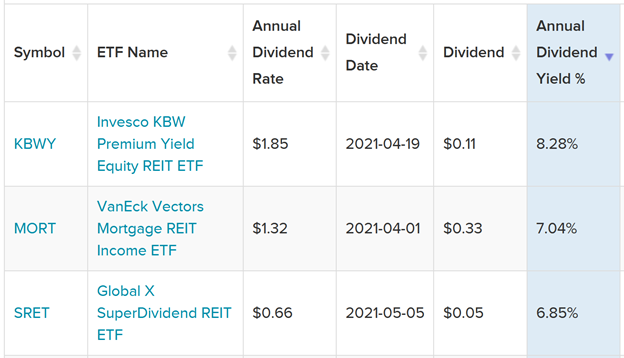

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

Philippines Tax Talk Understanding The Reit Act Incorp Philippines

How To Invest In Reits In The Philippines 2021 - The Thrifty Pinay

How Reit Regimes Are Doing In 2018 Ey Slovakia

Equity Reit Vs Mortgage Reit

Reit - Real Estate Investment Trust Robert G Sarmiento Realty

How Reit Regimes Are Doing In 2018 Ey Slovakia

Are Reits Finally About To Take Off In The Philippines Magazine Reit Asiapac

Reits Real Estate Investment Trusts And Tax - Tax - Worldwide

Comments

Post a Comment