To apply to star, a new applicant must: Current basic star exemption recipients will keep their exemption as long as they continue to own their current home.

Saladino Announces 2019 Free Summer Concert Series Town Of Oyster Bay

The town of oyster bay will host a free.

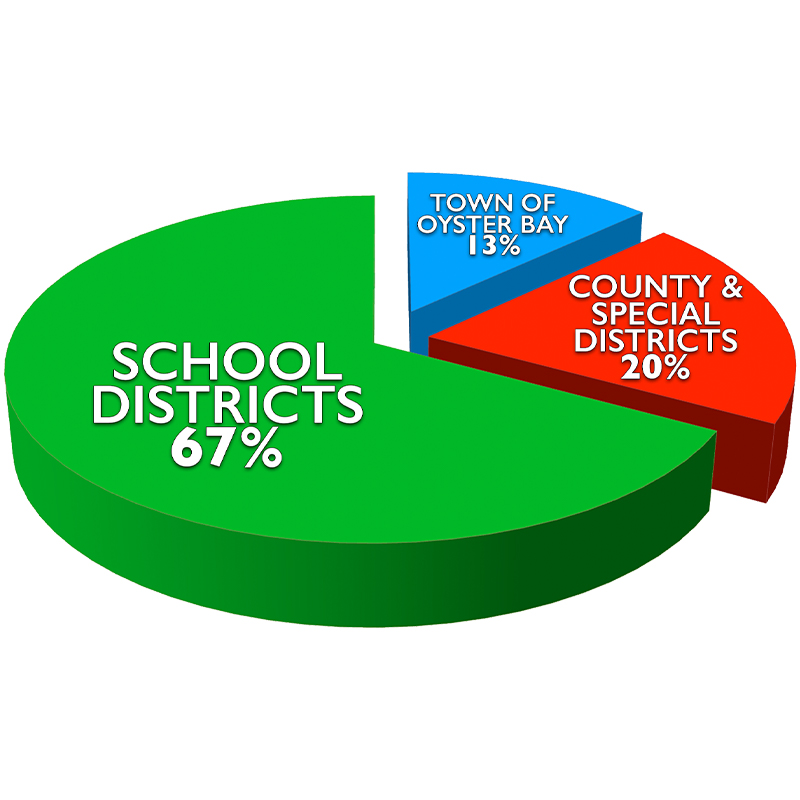

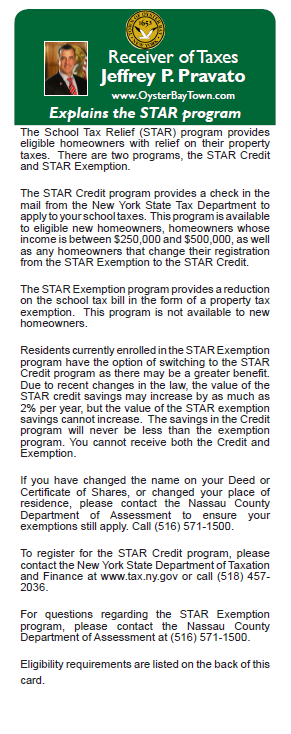

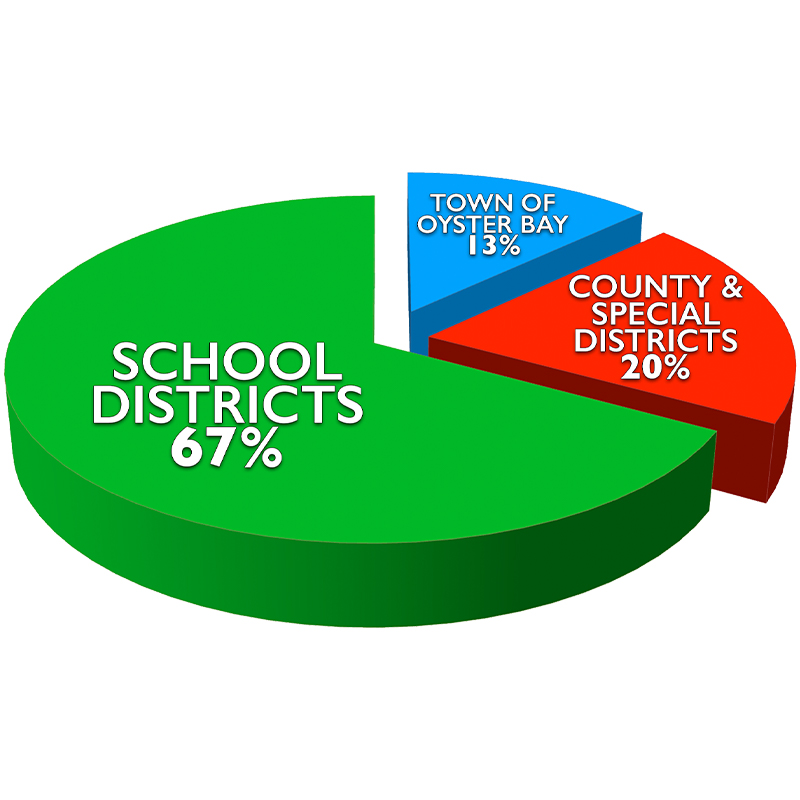

Town of oyster bay taxes star program. The star credit program provides a check in the mail from the new york state tax department to apply to your school taxes. Helpful information guide for 202 1 File the application with the nassau county assessor’s office.

There are two programs, the star credit and star exemption. Two weeks prior to april 1: The town of oyster bay will host a free.

You must apply for the star exemption. 182 rows town of oyster bay: To apply to star, a new applicant must:

Enhanced star applications will also be processed for homeowners already enrolled in the star program prior to jan. The enhanced star exemption amount is $70,700 and the school tax rate is $13.123456 per thousand. This program is available to eligible new homeowners, homeowners whose income is between $250,000 and $500,000, as well as any homeowners that change their registration from the star exemption to the star credit.

There are two programs, the star credit and star exemption. Banking websites which allow the bill pay option should caution you that you should not pay your local, state or federal taxes by that method. Two weeks prior to april 1:

New york state’s enhanced star program provides eligible senior homeowners with relief on their property taxes. Ny.gov or contact the nassau. Two weeks prior to april 1:

Oyster bay town tax receiver james stefanich would like to notify residents of recent changes to the enhanced school tax relief (star) program. To apply to star, a new applicant must: Two weeks prior to april 1:

Two weeks prior to april 1 What exemptions are available under the star program? New york state’s enhanced star program provides eligible senior homeowners with relief on their property taxes.

Two weeks prior to april 1: File the application with the nassau county assessor’s office. There are two programs, the star credit and star exemption.

Oyster bay town tax receiver james stefanich would like to notify residents of recent changes to the enhanced school tax relief (star) program. (1) the basic star exemption is for How do i apply for the star program in nassau county?

Enhanced star applications will also be processed for homeowners already enrolled in the star program prior to jan. Oyster bay town receiver of taxes james j. To apply to star, a new applicant must:

November 13, 2012 at 3:59 pm est.

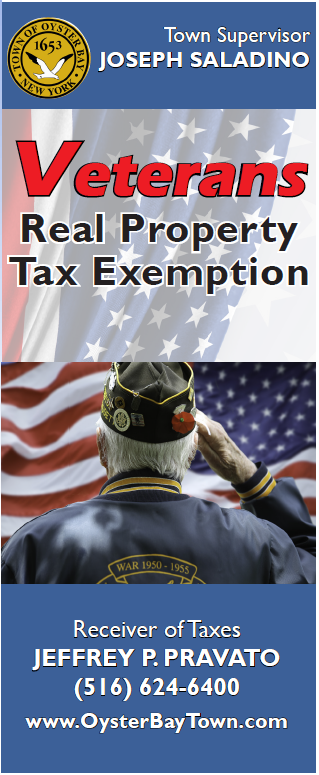

Tax Exemptions Town Of Oyster Bay

K0ypwnfaxasozm

Town Of Oyster Bay - Posts Facebook

510 Centre Island Road Oyster Bay Ny 11771 Compass

Tax Exemptions Town Of Oyster Bay

11 Grace Ln Oyster Bay Cove Ny 11771 Realtorcom

Receiver Of Taxes Town Of Oyster Bay

Oyster Bay Ny Real Estate Homes For Sale - Signature Premier Properties

63 Park Ave Oyster Bay Ny 11771 Mls 3237439 Zillow

Councilman Thomas Hand - Home Facebook

K0ypwnfaxasozm

Around La L E Oyster Bar Menu Signage Menu Boards Menu Board Design

Tax Exemptions Town Of Oyster Bay

Receiver Of Taxes Town Of Oyster Bay

2018 Oyster Bay Merlot Hawkes Bay Prices Stores Tasting Notes Market Data

Tax Exemptions Town Of Oyster Bay

Big Development Coming To Lis Convenient Plainview Newsday

Oyster Bay Ny Real Estate Homes For Sale - Signature Premier Properties

Oyster Bay 6 Book Series Kindle Edition

Comments

Post a Comment