Instructions on filling out the form are available here. Create an account with the governor’s office of energy development (oed) complete a solar pv application;

Heres How To Claim The Solar Tax Credits On Your Tax Return - Southern Current

Install a solar energy system;

Utah solar tax credit form. The utah solar tax credit, officially known as the renewable energy systems tax credit, covers up to 25% of the purchase and installation costs for residential solar pv projects, capped at $1,600, whichever is less. That’s in addition to the 26 percent federal tax credit for solar. Renewable energy systems tax credit.

Keep the form and all related documents with your records to provide the tax commission upon request. Log in or click register in the upper right corner to get started. If you install a solar panel system on your home in utah, the state government will give you a credit on your next year’s income taxes to reduce your solar costs.

In utah, you can claim up to $1000 in tax credits for switching to solar energy. Thanks to some helpful ut tax breaks for solar in utah, you won’t have to pay the government anything for your new solar panels. The restc program offers a tax credit of 25% of the eligible cost of the system or $1,600 until 2021.

The individual income tax credit for residential systems is 25% of the reasonable installed system costs up to a maximum credit of $2,000 per residential unit. Where do i enter the information to receive the utah state tax credit for solar? Write the code and amount of each apportionable nonrefundable credit in part 3.

The average cost for a 5 kilowatt (kw) solar installation in utah is $14,075 and $10,416 after the federal tax credit. Residents of utah installing a solar power system can benefit from both federal and state tax credits for renewable energy. Welcome to the utah energy tax credit portal.

Renewable energy systems tax credit. Do not complete part ii. Learn more and apply here.

Utah state tax credit instructions to claim your solar tax credit in utah, you need to do 2 things: Go solar today and claim your 30% tax credit incentive! We are accepting applications for the tax credit programs listed below.

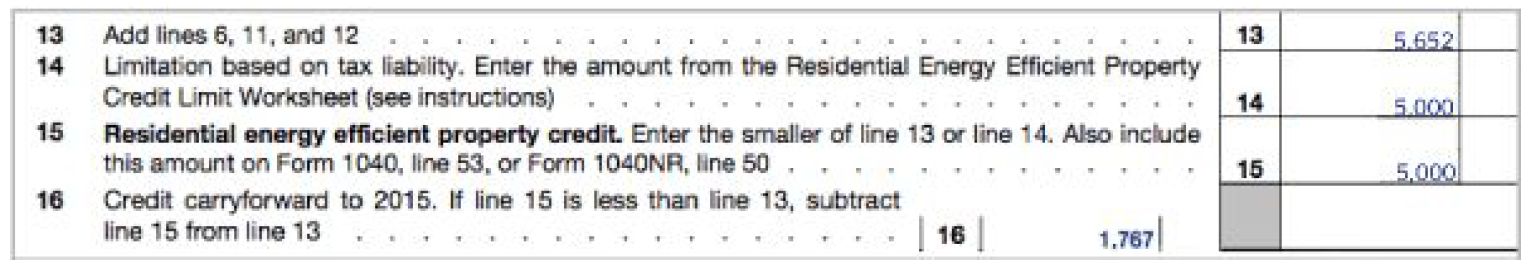

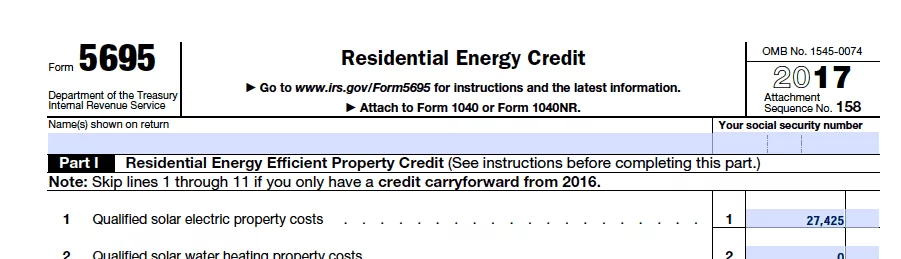

Taxpayers wishing to use this tax credit must first apply through the utah state energy program before claiming the tax credit against their utah state taxes. Download your instructions form here: After seeking professional tax advice and ensuring you are eligible for the credit, you can complete and attach irs form 5695 to your federal tax return (form 1040 or form 1040nr).

Steps for utilizing the utah solar tax credit: If you’re looking for yet another reason to go solar in utah, the state offers tax exemptions on pv systems that have a 2mw capacity or greater. Solar pv systems installed on your home or business.

Tax exemptions for renewable energy equipment. To apply for the renewable energy system tax credit (restc) program in utah you can take the following steps: Not only are we able to refuel our vehicles with it we can heat our water and light our homes.

Do not send this form with your return. To claim your solar tax credit in utah, you will need to do 2 things. Steps for utilizing the utah solar tax credit:

You can claim 25 percent of your total equipment and installation costs, up to $1,600. Claim the renewable residential energy system credit; For installations completed until 2023, the tax credit is 26% of solar costs.

Obtain an application and additional information on the internet (www.energy.utah.gov) or by contacting the ueo, 1594 w north temple, suite 3610, box 146480, Utah is the fourth state to enact legislation based on seia’s consumer protection work, following florida, nevada and new mexico. Thanks to utah’s solar easement law you can work with your neighbors to make sure that nothing shades your solar panel system while the.

In utah, you can claim up to $1,600 in tax credits for switching to solar energy. If you are starting a solar system project in 2021, but the completion date is 2022, the credit will be 22%. [note that this tax credit will be reduced in value by $400 each year and expires completely in 2022] utah is a “right to solar” state.

Utah’s solar tax credit currently is frozen at $1,600, but it won’t be for long. The cleanest form of electricity is the best option for today and the future. The alternative energy manufacturing tax credit is a nonrefundable tax credit for up to 100% of new state tax revenues (including state, corporate, sales, and withholding taxes) over the life of a manufacturing project, or 20 years, whichever is less.

To claim this energy credit, you must submit a written application to the utah energy office (ueo). If you checked the “no” box, you cannot claim the nonbusiness energy property credit. Utah renewable energy systems tax credit (restc) program

Utah solar customers would be wise to invest in solar before the available funding is no longer within their reach. Install a solar energy system create an account […] This program is no longer available, for more information on utah renewable energy tax credits visit here.

In addition to the solar rebates that are available, utah offers solar tax credits in the form of 25% of the purchase and installation costs of a solar system, up to $2,000. The federal tax credit brings a 26% credit until the end of 2021 for all fully installed and completed solar system installations. Starting in 2021, it will resume its yearly phase down until this tax credit reaches zero at the end of 2023.

Below, you will find instructions for both.

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Pin By Green Eco Services On Enviroment Diy Solar Panel Solar Energy Diy Solar Panels

Instructions For Filling Out Irs Form 5695 - Everlight Solar

Instructions For Filling Out Irs Form 5695 - Everlight Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Pin On Solar Power

Tc 40e - Fill Online Printable Fillable Blank Pdffiller

![]()

Claiming Your Residential Energy Tax Credit - Blue Raven Solar

Heres How To Claim The Solar Tax Credits On Your Tax Return - Southern Current

Panel Approves Bill To Extend Renewable Energy Tax Credits To Solar Projects Deseret News Solar Projects Renewable Energy Tax Credits

Claiming Your Residential Energy Tax Credit - Blue Raven Solar

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Instructions For Filling Out Irs Form 5695 - Everlight Solar

Pin On Energy And Its Future

Heres How To Claim The Solar Tax Credits On Your Tax Return - Southern Current

The Greatest Network The World Has Ever Seen The Global Internet Map New Scientist Internet Map Map Networking

Comments

Post a Comment