Utah state tax commission subject: It does not contain all tax laws or rules.

Current Forms

File online at tap.utah.gov check here if this is an amended return.

Utah tax commission forms. File online at tap.utah.gov check here if this is an amended return. If you need more information or access to online services, forms or publications, visit the tax ommission’s site at tax.utah.gov. Make a copy for your records.

Visit tax.utah.gov/training for a list of all training resources. Name) email address phone owner’s driver’s license no. Printable utah state tax forms for the 2020 tax year will be based on income earned between january 1, 2020 through december 31, 2020.

United states government or native american tribe Ut ah st a te t ax commission fax: Visit utah.gov (opens in new window) services (opens in new window) agencies (opens in new window) search utah.gov (opens in new window) skip to main content.

From (mmddyyyy) to (mmddyyyy) return due date: It does not contain all tax laws or rules. Utah has a flat state income tax of 4.95%, which is administered by the utah state tax commission.taxformfinder provides printable pdf copies of 56 current utah income tax forms.

Utah taxpayer access point (tap) tap. The utah income tax rate for tax year 2020 is 4.95%. This form is for income earned in tax year 2020, with tax returns due in april 2021.we will update this page with a new version of the form for 2022 as soon as it.

File online at taxexpress.utah.gov check here if this is an amended return. From (mmddyyyy) to (mmddyyyy) return due date: Preparer ’s name and address or organization (if applicable) preparer ’s phone number.

210 n 1950 w phone: Make a copy for your records. Official site of the property tax division of the utah state tax commission, with information about property taxes in utah.

Make a copy for your records. Signature of applicant date signature of spouse date. Mine discounted cash flow questionnaire instructions.

From (mmddyyyy) to (mmddyyyy) return due date: (mmddyyyy) save postage & a check. Ifta fuel tax and utah special fuel tax (round to nearest whole gallons and miles) check box if no operation check box if neededaddress correction cancel ifta license (cancel date:

Do not send this certificate to the tax commission keep it with your records in case of an audit. (mmddyyyy) save postage & a check. Property tax forms created date:

Application for utah motor vehicle identification number. Sal t lake city, ut 84134. (mmddyyyy) save postage & a check.

The current tax year is 2020, and most states will release updated tax.

2

Utah Tax Forms And Instructions For 2020 Form Tc-40

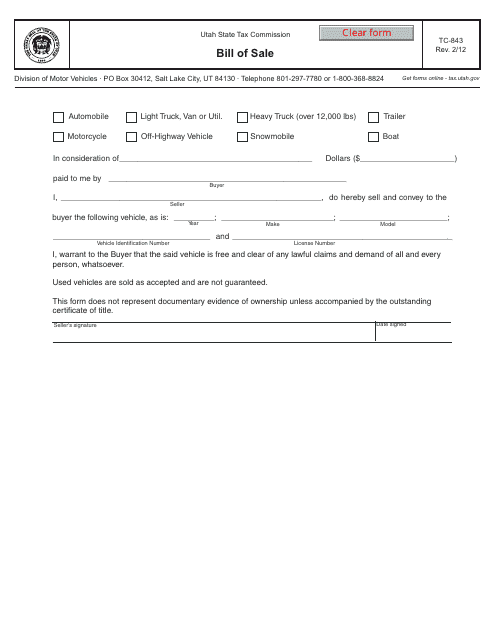

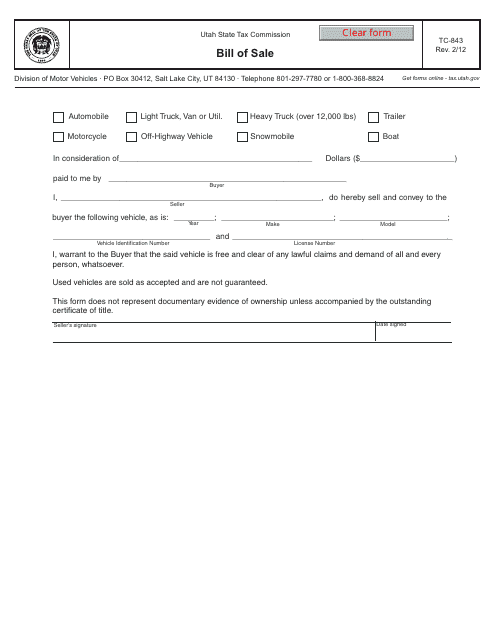

Bill Of Sale-utah State Tax Commission In 2021 State Tax Bills Bill Of Sale Template

Sample Limited Power Of Attorney Form Power Of Attorney Form Power Of Attorney Attorneys

Oklahoma Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft Bill Of Sale Template Bills Templates

Utah State Tax Commission Official Website

Free Minor Child Power Of Attorney Delegation Form Colorado Pdf - Power Of Attorney Form For Child Power Of Attorney Power Of Attorney Form Attorneys

Income Tax Withholding

Free Purchase Agreement Form - Free Printable Documents Purchase Agreement Purchase Contract Contract

Sample Pasture Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Lease Agreement Lease Being A Landlord

2

Business Plan Templates - 43 Examples In Word Free Premium Regarding Business Plan Template Word Simple Business Plan Template Business Plan Template

Utah Bill Of Sale Automobile Trailer Boat Download Fillable Pdf Templateroller

Fill Out Print And Use This And Thousands Of Other Free Templates At Templaterollercom Commercial Vehicle Street Legal Atv Utility Trailer

How To Get A Sales Tax Exemption Certificate In Utah

Commercial Real Estate Lawyer Estate Lawyer Family Law Attorney Divorce Attorney

Sample Pasture Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Lease Agreement Lease Being A Landlord

Georgia Medical Release Form Download The Free Printable Basic Blank Medical Release Form Template Or Waiver I Document Templates Doctor For Kids Doctor Names

Utah Quit Claim Deed Form Quites Utah Form

Comments

Post a Comment