Similarly, while democratic control of the. The change, which is part of his budget.

3 Ways To Calculate Capital Gains - Wikihow

President biden’s tax plan proposes a number of changes to capital gains tax that could have a major impact.

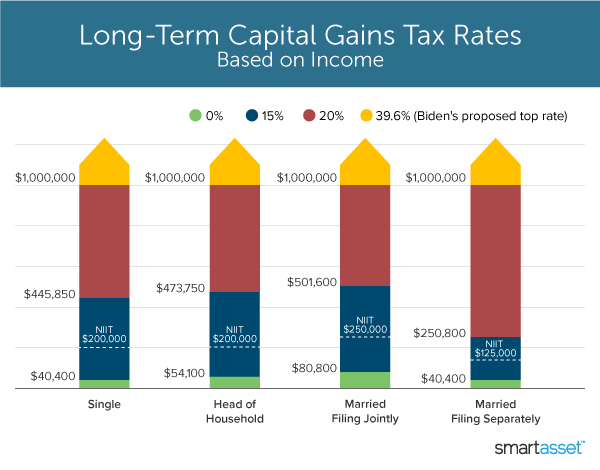

When will capital gains tax increase take effect. As one recent example, the tax cuts and jobs act (president trump's tax cuts) didn't go into effect until the 2018 tax year, the first full year trump was in office. However, it’s worth noting that along with the increase in capital gains tax, biden also plans to increase the top income tax bracket to 39.6%. The biden administration has proposed a plan that will essentially double the capital gains tax for those investors making over $1 million as.

Understanding capital gains and the biden tax plan. 5096), which was signed by governor inslee on may 4, 2021. Should biden's new capital gains provisions take effect in 2022, your total tax would be increased by over $300,000.

Should the capital gains tax rate increase pass, if you think your taxable income will be $1 million or more in a year when the higher rate is in effect, there are ways to reduce it, such as increasing itemized deductions. However, history tells us that isn't the most likely scenario. “ the new tax laws.

While the current top capital gains rate is 20%, the proposal will subject investors above the previously mentioned benchmark to a tax rate in line with the top income tax rate of 37%. This has canada speculating, again, if a hike to the capital gains inclusion rate may occur in the next federal budget. Originally posted on accounting today on july 7th, 2021.

It's entirely possible that a capital gains tax hike could be passed retroactive to january 1, 2021. Increase the top income tax rate. The current tax preference for capital gains costs upwards of $15 billion annually.

Tax increases in 2022 if you’re selling your privately held company, a key consideration may be closing the transaction before january 1, 2022 when new tax increases are likely to take effect. Washington's legislature passed a new capital gains tax in april (engrossed substitute s.b. Additionally, there has been a proposed increase to the capital gains tax, from 29% to almost 49% if including top state and federal tax.

To address wealth inequality and to improve functioning of our tax system, tax rates on capital gains income should be increased. In this case, it might be. The income tax act will take effect on the 15th at the earliest december 6, 2021 the capital gains tax of a single home owner with a market profit of 800 million won is expected to decrease by 40 million won from the current 120 million won to 80 million won after the new income tax law is enforced.

The new law will take effect january 1, 2022. President biden’s capital gains tax increase would take effect as of april 28, 2021, but must see how the legislative process unfolds. If a change to the capital gain inclusion rate is announced in the upcoming budget, it is not known whether it would be

This may be why the white house is seeking an april 2021 effective date for the retroactive capital gains tax increase, as president biden announced the proposal on april 28, 2021, although it was not widely publicized at the time and investors are still becoming aware of. In the latest development, the president has proposed raising the top tax rate on capital gains from 20% to 39.6% on families with income over $1 million. It’s time to increase taxes on capital gains.

Under the proposed build back better act, the top marginal tax rates will jump from 20% to 39.6% that is. To ensure future growth and progress, it is imperative that we create and maintain an environment that allows angel investors to operate and thrive. The new tax plan proposes a tax hike for the top income tax bracket, increasing it from 37% to 39.6%.

A capital gains tax increase would come as a huge blow to angel investors who fund the new technologies and ideas that we often take for granted. Biden proposed raising the top capital gains tax from 20% to 39.6% before a joint session of congress on april 28. Increasing the capital gain inclusion rate may be one tax change the canadian government could consider in order to boost tax revenues.

Posted on january 7, 2021 by michael smart.

What You Need To Know About Capital Gains Tax

Capital Gains Yield Cgy - Formula Calculation Example And Guide

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times

What You Need To Know About Capital Gains Tax

3 Ways To Calculate Capital Gains - Wikihow

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Whats In Bidens Capital Gains Tax Plan - Smartasset

Capital Gains Tax 101

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Whats Your Tax Rate For Crypto Capital Gains

Double Taxation Definition Taxedu Tax Foundation

Capital Gains Tax Reporting And Record-keeping Low Incomes Tax Reform Group

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Capital Gains Taxes Explained Short-term Capital Gains Vs Long-term Capital Gains - Youtube

Whats In Bidens Capital Gains Tax Plan - Smartasset

Understanding The Tax Implications Of Stock Trading Ally

How To Calculate Capital Gains Tax Hr Block

Comments

Post a Comment