If you succeed in getting tax debt forgiven with what’s known as an “offer in compromise,” you won’t face a tax bill for the forgiven debt. These specific exclusions will be discussed later.

Tax Debt Relief Things You Need To Know Tax Relief Center Tax Debt Tax Debt Relief Debt Relief

This is called the 10 year statute of limitations.

Will the irs forgive my debt. If it can’t collect tax debt in that time, the irs will write it off. Once you receive a notice of deficiency (a bill for your outstanding balance with the irs), and fail to act on it, the irs will begin its collection process. The irs considers the collectability of the debt.

Any debt owed upon death resolves is the same as if they were alive. What if my debt is forgiven? You may often find yourself thinking, “can’t the irs forgive me, just this one time?” good news:

It rarely forgives all of your back taxes, though, but it offers a tax debt relief program that can help debt settlement be more manageable. The irs generally has 10 years to collect on a tax debt before it expires. That’s exactly what they can do!

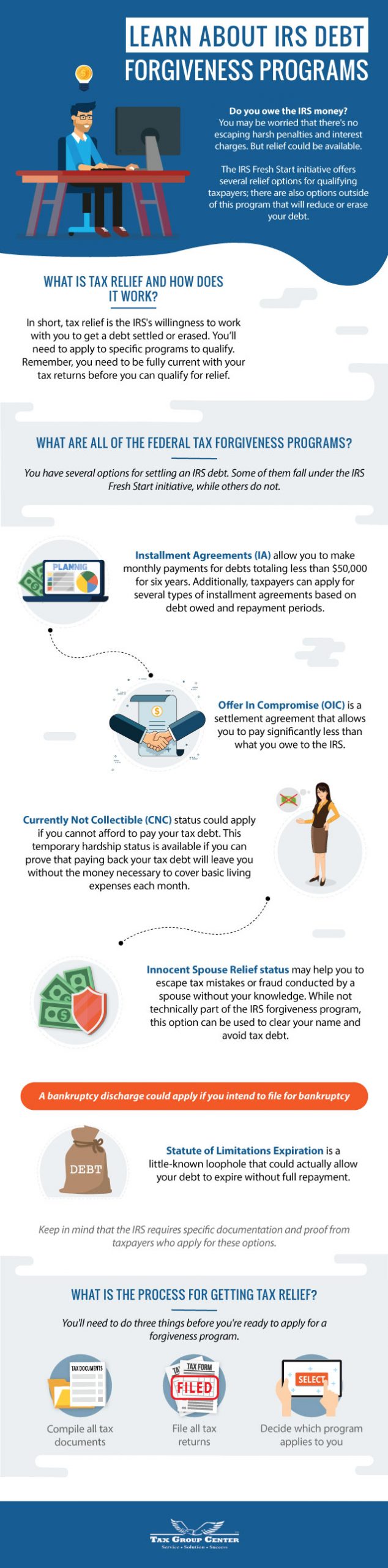

Take a look at what every taxpayer needs to know about the irs debt forgiveness program. Irs debt forgiveness is basically paying less than you owe to the irs, getting part of the debt forgiven. The short answer is yes , but it’s best to enlist professional assistance to obtain that forgiveness.

After that, the debt is wiped clean from its books and the irs writes it off. But if you owe the irs they can hold on to your refund, take a chunk of your pay, put a lien on your bank account, seize and sell your property and even revoke your passport. The irs may forgive tax debt for taxpayers who are unable to pay in full or make monthly payments.

If you owe money, the irs will make serious efforts to collect the debt. It must be noted that the irs rarely forgive tax debts. The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances.

Here’s a little bit of good news: This means the irs should forgive tax debt after 10 years. For example, i have a client who’s husband died.

Making an offer in compromise can enable you to pay off your tax debt for a fraction of what you owe. If you owe money to the irs due to unpaid taxes, you won’t have to pay it after the collection period has passed. The canceled debt isn't taxable, however, if the law specifically allows you to exclude it from gross income.

In some situations, the irs may forgive part of your outstanding tax debt. Does the irs forgive tax debt? If you can prove financial hardship based on the agency’s standards, your debt may be forgiven in full.

Generally, if you owe more money than you can reasonably pay based on your present financial circumstances, you may qualify for irs tax debt forgiveness. While these options aren’t available to. It’s not exactly forgiveness, but similar.

Many of these incredibly hig. Generally, if you borrow money from a commercial lender and the lender later cancels or forgives the debt, you may have to include the cancelled amount in income for tax purposes. But that 10 year period may be longer than you expect, given lengthy suspensions, the irs’s date of tax assessment versus your last return, and whether or not you have been keeping up to date with your tax returns since the debt period began.

First time penalty abatement based on prior compliance; In general, the internal revenue service (irs) has 10 years to collect unpaid tax debt. Every one of the other answers are telling you, “not very often.” these folks are correct, but i ask, “is the debt all tax, or is some penalty and interest?” that penalty is often forgiven if you will just file the correct (or corrected) tax returns.

However, the rules can be somewhat different on how the collectability formula is applied. The irs can quickly and easily place a levy on your social security payments and on any bank accounts you might have, freezing the account so that you have no access to the funds. Does the irs forgive debt after 10 years?

Yes, your irs debt will be forgiven after ten years. The most common types of tax debt forgiveness are: While uncommon, if approved, taxpayers may find the irs will forgive debt within the hopes of receiving as a lot of the overall invoice as potential.

It’s really more of expiration than forgiveness. It is not in the financial interest of. The day the tax debt expires is often referred to as the collection statute expiration date, or csed.

The irs can stop you from receiving any current and future refunds until the debt is satisfied. Yes, the irs forgives tax debt in partial. Under certain circumstances, the irs will forgive tax debt after 10 years.

Only when they take a look at your financial conditions and find out that they can’t collect taxes more than you can possibly pay, they will give you a partial forgiveness, which is after your application of the irs debt forgiveness program. Put simply, the statute of limitations on federal tax debt is 10 years from the date of tax assessment. When you comply with pay the total quantity, you could also be able to cut back the curiosity owed and another fees.

Are you wondering if irs debt forgiveness is possible? As previously mentioned, the statute of limitations on a tax debt is ten years. The debt falling off after the statute of limitation expires (not really forgiveness, but similar)

Some tax debts will expire 10 years after assessment.

Pdf Download How To Get Tax Amnesty By Daniel J Pilla Free Epub Free Ebooks Download Pdf Download Tax Debt

The Proven Way To Settle Your Tax Debt With The Irs - Debtcom

How Do I Get My Irs Tax Debt Forgiven Fortress Tax Relief

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven - Debtcom

Flat Fee Irs Tax Relief - Affordable Irs Levy Help Florida Irs Income Tax Help - Stop An Irs Levy - Settle With Th Tax Debt Relief Tax Relief Help Debt Relief

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

Does Irs Debt Show On Your Credit Report Hr Block

7015 - Optima Tax Relief Lettering Take You Home Relief

Different Types Of Irs Tax Installment Agreements Irs Taxes Irs Payment Plan Tax Debt

What Is The Irs Tax Debt Forgiveness Program Irs Debt Forgiveness Help

How To Request For An Irs Hardship Payment Extension Irs Credit Card Statement Tax Deadline

Tax Debt Forgiveness Frequently Asked Questions Tax Relief Center Debt Forgiveness Tax Debt This Or That Questions

Irs Tax Debt Forgiveness Tax Debt Debt Forgiveness Tax Debt Relief

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

What If I Cant Pay My Taxes By April 15 Tax Relief Center Tax Prep Checklist Tax Prep Small Business Bookkeeping

Will The Irs Forgive My Debt Tax Debt Tax Debt Relief Debt

Tax Debt What To Do If You Owe Back Taxes To The Irs Tax Debt Debt Irs Taxes

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Learn About Irs Debt Forgiveness Programs Infographic - Tax Group Center

Comments

Post a Comment