The fiscal year runs from july 1st through the following june 30th. Maine is a beautiful state and lewiston/auburn (twin cites) are a nice area.

Auburnmainegov

The maine state statutes regarding excise tax can be found in title 36, section 1482.

Auburn maine excise tax calculator. Excise tax receipt (provided at the town office). Maine residents that own a vehicle must pay an excise tax for every year of ownership. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

4 seasons, clean air, best water in the world. Other fees charged when purchasing a new vehicle you need to pay additional fees when you purchase a vehicle in maine. City of auburn is a locality in androscoggin county, maine.while many other municipalities assess property taxes on a county basis, city of auburn has its own tax assessor's office.

The sales tax jurisdiction name is maine, which may refer to a local government division. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year basis. Dump stickers may also be purchased at the tax.

Tax rates for auburn, me. State of maine vehicle registration online. Augusta maine real estate tax.

While many other states allow counties and other localities to collect a local option sales tax, maine does not permit local sales taxes to be collected. Please note the state of maine property tax division only provides quotes to the municipal excise tax collector and not to individuals. You can print a 5.5% sales tax table here.

There is the ocean, small theme parks. On june 30 of each year, preliminary tax bills are mailed to taxpayers. Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

After making this calculation, you know that you'll pay $58.18 in excise tax. Auburn collects the maximum legal local sales tax. Remember to have your property's tax id number or parcel number available when you call!

That is literally impossible, because i tried the excise tax calculators of 4 different townships on my car to experiment and every town was slightly different. The tax office is committed to providing the best possible customer service. Payment for the registration fees based upon license plate.

The msrp is the 'sticker price' and not necessarily what you paid for the vehicle. The excise tax rate is $24.00 per thousand dollars of value the first year, $17.50 the second year, $13.50 the third year, $10.00 the fourth year, $6.50 the fifth year and $4.00. If your property is located in a different androscoggin county city or town, see that page to find your local tax assessor.

The msrp is the manufacturer's suggested retail price of your vehicle. There is no applicable county tax, city tax or special tax. Maine revenue services property tax.

60 court street auburn, maine 04210 phone: Will the first owner listed on the registration be a corporation, trust or individual? 5.00% [the total of all sales taxes for an area, including state, county and local taxes.income taxes:

Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. Use our sales tax calculator or download a free maine sales tax rate table by zip code. 60 court street, auburn, maine 04210

To calculate your estimated registration renewal cost, you will need the following information: This information will be used to determine the month in which the vehicle will be due for renewal each year. Online calculators are available, but those wanting to figure their excise tax in maine can do so easily using a manual calculator or paper and pen.

This department is responsible for registering motor vehicles and recreational vehicles, collecting real estate and personal property taxes, as well as water and sewer payments. Tax collection / vehicle registration. The auburn sales tax is collected by the merchant on all qualifying sales made within auburn.

Excise tax is an annual tax that must be paid prior to registering your vehicle. $18.67 [the property tax rate shown here is the rate per $1,000 of home value. The excise tax calculation is based on the original value of the motor vehicle.

I've lived in maine 28 years. $500 x.06 = $30, which is. Like all states, maine sets its own excise tax.

The town of auburn collects taxes quarterly. The maine sales tax rate is currently 5.5%. Overview of maine taxes maine has a progressive income tax system that features rates that range from 5.80% to 7.15%.

For example, passenger vehicle calculations are based on the original sticker price. 8.50% [the total of all income taxes for an area, including state, county and local taxes.federal income taxes are not included.] property tax rate: The auburn, maine sales tax is 5.50% , the same as the maine state sales tax.

From l/a area, every type of lifestyle is accessible within an hour of travel. The 5.5% sales tax rate in auburn consists of 5.5% maine state sales tax. The county sales tax rate is 0%.

Payment for the $33 title application fee for vehicles 1995 or newer.

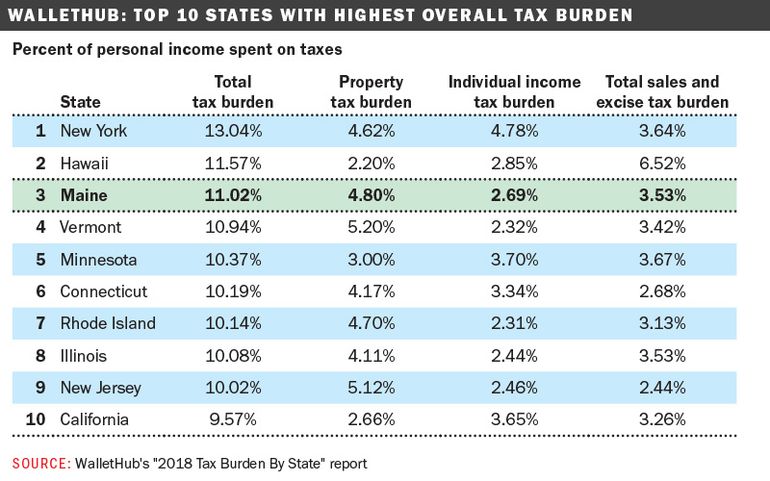

Maine Makes Top 5 In States With Highest Tax Burden Mainebizbiz

Calculating Excise Tax - Help With Closing Statments - Youtube

I-team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Excise Tax Information Cumberland Me

Welcome To The City Of Bangor Maine - Excise Tax Calculator

Maine Car Registration A Helpful Illustrative Guide

2

2

How Do I Turn Off Automated Sales Tax I Unchecked Taxable On Our Products And Cleared The Taxes On The Invoices But It Is Still Saying We Collected Taxes Wont Close

Auburnmainegov

Biddeford Man Wants To Change Maine Excise Tax With Citizen Initiative On Ballot Wgme

Welcome To The City Of Bangor Maine - Excise Tax Calculator

Maine Car Registration A Helpful Illustrative Guide

Mpraubuni-muenchende

Auburnmainegov

Maine Sales Tax Rates By City County 2021

City Of Auburn Fy 13 Proposed Budget As Presented 031912 - Draft Pdf Fiscal Year Property Tax

Auburnmainegov

Maine Sales Tax Calculator And Local Rates 2021 - Wise

Comments

Post a Comment