In maine, the excise tax is based on the msrp (manufacturer’s suggested retail price) of the vehicle when it was sold new. Portland maine excise tax calculator real estate.homes details:

Excise Tax Calculator - Custom Communications

Like all states, maine sets its own excise tax.

Bangor maine excise tax calculator. If you purchased the vehicle from a maine licensed dealer, then you will need the window sticker (if the car is brand new), a title application form (usually blue), a dealer certificate (usually green), proof of insurance and the current mileage. You can also call the dealership that the vehicle was purchased from. Bangor maine excise tax calculator real estate.

You can print a 5.5% sales tax table here. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. The sales tax jurisdiction name is maine, which may refer to a local government division.

Check the maine bureau of motor vehicles for office locations and hours of operation. The april 1st date is set by state law and is used by all communities. The excise tax due will be $610.80.

How to register a passenger vehicle dealer sale (maine licensed dealer): $2.20 7 hours ago maine real estate transfer tax calculator. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax.

Total = state fee + excise tax + agent fee ($3.00). A registration fee of $35.00 and an agent fee of $6.00 for new vehicles will also be. (each spending category below corresponds to a town budget category).

The current method of calculating motor vehicle excise tax has been in place since 1929, and the rates used then are still in use. For tax rates in other cities, see maine sales taxes by city and county. In maine, the excise tax is based on the msrp (manufacturer’s suggested retail price) of the vehicle when it was sold new.

The minimum combined 2021 sales tax rate for bangor, maine is. Overview of maine taxes maine has a progressive income tax system that features rates that range from 5.80% to 7.15%. There is no applicable county tax, city tax or special tax.

The county sales tax rate is %. Houses (1 days ago) (22 days ago) maine real estate transfer taxes: This is the total of state, county and city sales tax rates.

Pay excise tax at your town office. Excise tax is a municipal tax. For the privilege of operating a motor vehicle or camper trailer on the public ways, each motor vehicle, other than a stock race car, or each camper trailer to be so operated is subject to excise tax as follows, except as specified in subparagraph (3), (4) or (5):

Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Excise tax maine calculator real estate. The rates used then are still in use today.

The 5.5% sales tax rate in bangor consists of 5.5% maine state sales tax. Please contact your local municipal office for additional information. Municipal property tax rate calculation 2018 and 2019.

A sum equal to 24 mills on each dollar of the maker's list price for the first or current year of. In maine, the excise tax is based on the msrp (manufacturer’s suggested retail price) of. Maine residents that own a vehicle must pay an excise tax for every year of ownership.

The bangor sales tax rate is %. Motor vehicle excise tax and registration fees. Excise tax is an annual tax that must be paid prior to registering your vehicle.

The bangor sales tax is collected by the merchant on all qualifying sales made within bangor The maine sales tax rate is currently %. Conservation (loon), university of maine (black bear and um system), agriculture, support your troops, breast cancer awareness.

Most home furnishings are exempt from personal property taxes, therefore the property tax bill for most maine homeowners is based on the value of the land and buildings (house and outbuildings). 41110000 auto excise tax 5,470,000 5,910,000 41115000 boat excise tax 14,500 14,500. And over registered weight) $20/$40.

If the vehicle is brand new, the tax collector will require that you provide the manufacturers suggested retail price sticker (also known as the monroney label) or a copy of. If you need to update the name or contact information on your account, please fill out and mail in the tax and sewer information change request form. The current method of calculating motor vehicle excise tax has been in place since 1929.

While many other states allow counties and other localities to collect a local option sales tax, maine does not permit local sales taxes to be collected. The bangor, maine sales tax is 5.50%, the same as the maine state sales tax. Bring all of these items to the treasury office to pay the excise tax.

Trailers with a declared gross weight of 9,000 pounds or less are charged a flat rate vehicle excise tax of $8.00. Although the city's tax year runs from july 1st to june 30th the taxes are assessed against the owner of record on april 1st. Title 36, §1482 excise tax.

Once you have obtained your vehicle's msrp and manufacture date you may proceed to the calculator below to give you an idea of what it will cost to renew the current registration on your. Trailer (up to 2,000 lbs registered weight) $10.50/$21. The following specialty plates are an additional $20.00 for the first year and $15.00 for each subsequent year:

Maine real estate transfer tax calculator. the amounts shown are based on percentages derived from the approved fy19 town of hampden budget. Since books are taxable in the state of hawaii, mary charges her.

Maine excise tax on vehicles real estate.homes details: The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various town expenses. Online calculators are available, but those wanting to figure their excise tax in maine can do so easily using a manual calculator or paper and pen.

Welcome To The City Of Bangor Maine - Excise Tax Calculator

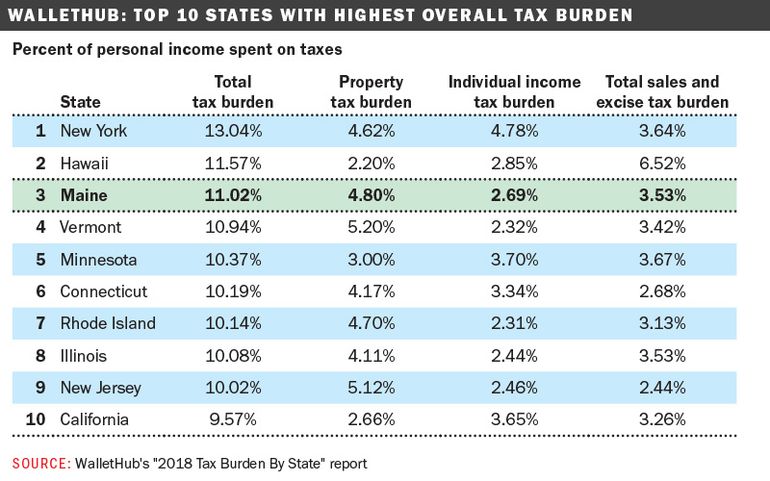

Maine Makes Top 5 In States With Highest Tax Burden Mainebizbiz

Digicombpllibmeus

Mainegov

Core

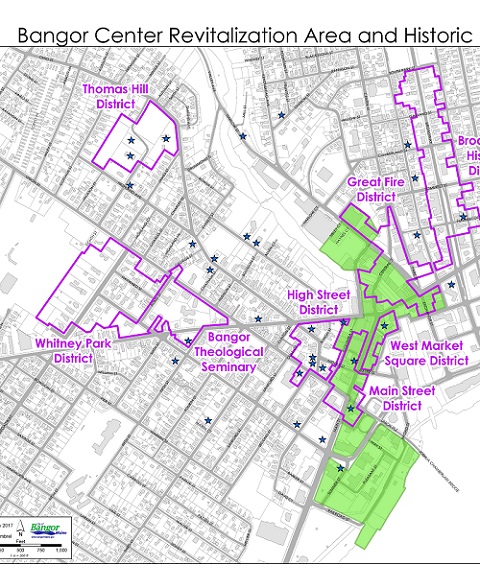

Welcome To The City Of Bangor Maine - Gis

Bangor Public Library Digital Commons

Maine Income Tax Calculator - Smartasset

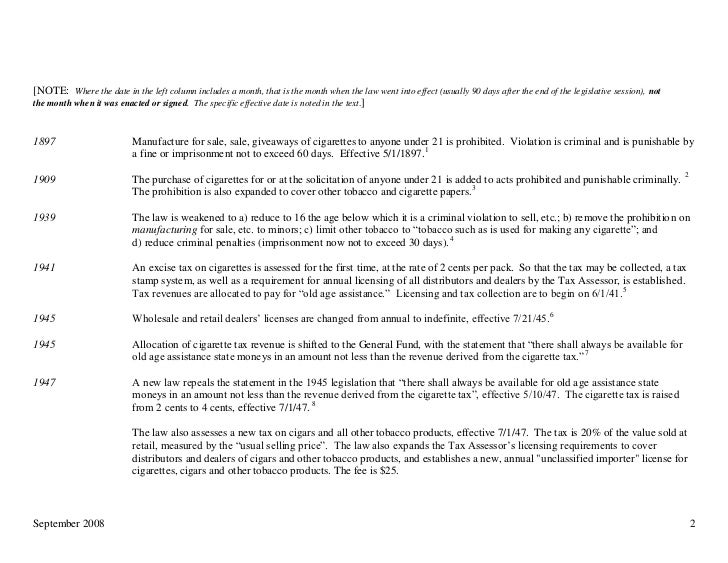

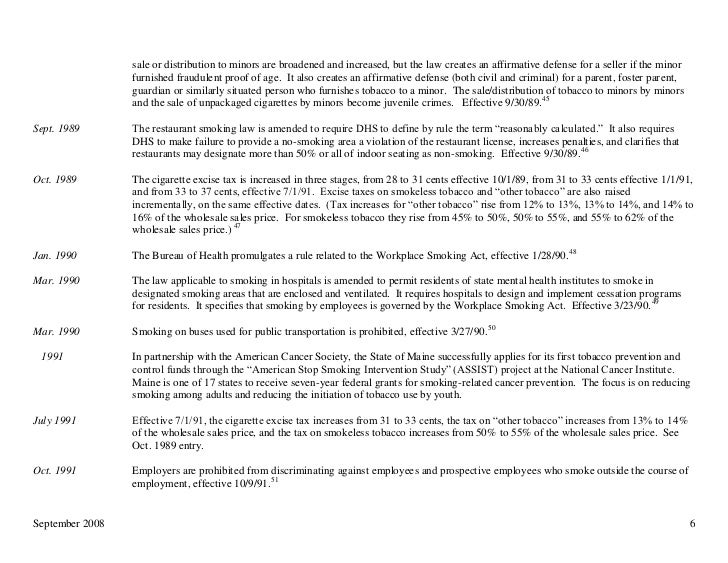

Maine Tobacco Control Timeline 1897-2008

Digicombpllibmeus

Welcome To The City Of Bangor Maine - Gis

Coreacuk

Maine Tobacco Control Timeline 1897-2008

Want To Lower Maines Tax Burden Dont Forget To Consider Raising Incomes

Welcome To The City Of Bangor Maine - Excise Tax Calculator

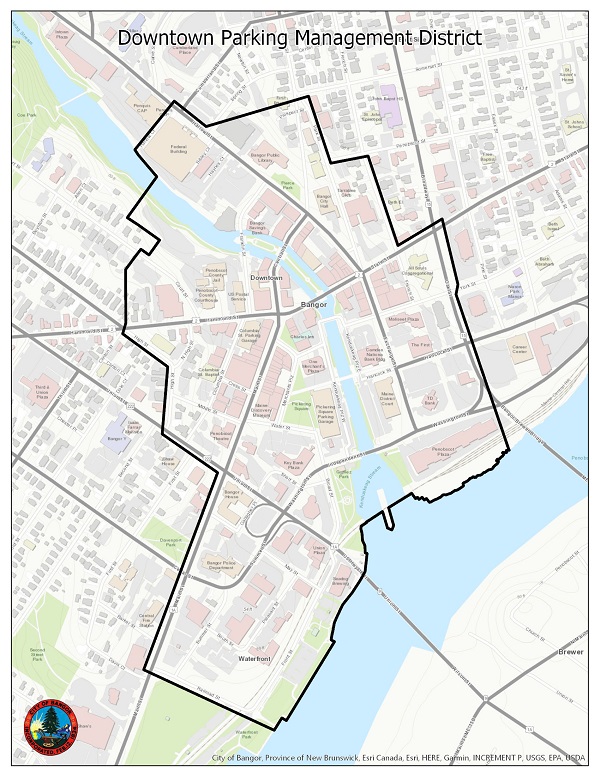

Welcome To The City Of Bangor Maine - Winter Parking Regulations

Welcome To The City Of Bangor Maine - Excise Tax Calculator

Maine Income Tax Calculator - Smartasset

Welcome To The City Of Bangor Maine - Capehart Brook

Comments

Post a Comment