This is the total of state and county sales tax rates. New sales and use tax rates operative april 1, 2021.

Opinion Contra Costa Herald

Tax rates include state, county, and city (special districts) rates:

Contra costa sales tax increase 2021. 1/2 cent sales tax, exempting food sales. 2021 california sales tax changes. The minimum combined 2021 sales tax rate for contra costa county, california is.

Contra costa county, ca sales tax rate. The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%. The markup rate will hold through at least june.

The contra costa county board of supervisors decided tuesday to allow 95 percent of future revenue from a sales tax passed by voters in. From april through june of this year, california businesses reported a record high $216.8 billion in taxable sales — a 38.8% increase over the same. By tony hicks / bay city news service.

The california state sales tax rate is currently %. Provide timely fire and emergency response; Playa del rey (los angeles) 9.500%:

(cntu) in addition to the contra costa countywide increase of 0.50 percent listed in the countywide table. Sales tax projected to generate $81 million annually over 20 years. 7 the city approved a new 1.00 percent (sbnt) to replace the existing 0.25.

And for other essential county services, shall the contra costa county measure levying a ½ cent sales tax, exempting food sales,. Contra costa county appoints new board to guide measure x money. The local sales tax rate in contra costa county is 0.25%, and the maximum rate (including california and city sales taxes) is 10.25% as of november 2021.

2 the city increased its existing tax of 0.50 percent (gzgt) to 1.00 percent (gztu) and extended the expiration date to march 31, 2044. The ballot language read, “to keep contra costa’s regional hospital open and staffed; Livingston’s proposal that a portion of $54 million in federal coronavirus aid, relief and economic security act (cares) funds be diverted to.

Invest in early childhood services; For the following special districts. Over the past year, there have been 122 local sales tax rate changes in california.

The measure adopts a 0.5% sales tax for 20 years beginning april 2021. Method to calculate contra costa county sales tax in 2021. The contra costa county sales tax rate is %.

The 2018 united states supreme court decision in south dakota v. 5 the city approved a new 1.50 percent. To the contra costa countywide increase of 0.50 percent listed in the countywide table).

Now the agency plans to increase cultivation taxes 4.5% at the start of 2022. Uninc this quarter* 13% fuel 24% pools 6% restaurants 7% autos/trans. , ca sales tax rate.

The average sales tax rate in california is 8.551% Concord's overall sales and use tax rate will rise from 8.75 percent to 9.25 percent. Increase appropriations limit to $1.75 million and adjust for cost of living.

The december 2020 total local sales tax rate was 8.250%. Change general plan within sand creek focus area. Thu, feb 4, 2021, 12:05 pm.

This table lists each changed tax jurisdiction, the amount of the change, and the towns and cities in which the modified tax rates apply. Food sales are exempt, and the county estimates the tax would raise $81 million a year for the general fund. As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate.

Extend 1 cent sales tax until ended by voters. The current total local sales tax rate in contra costa county, ca is 8.750%.

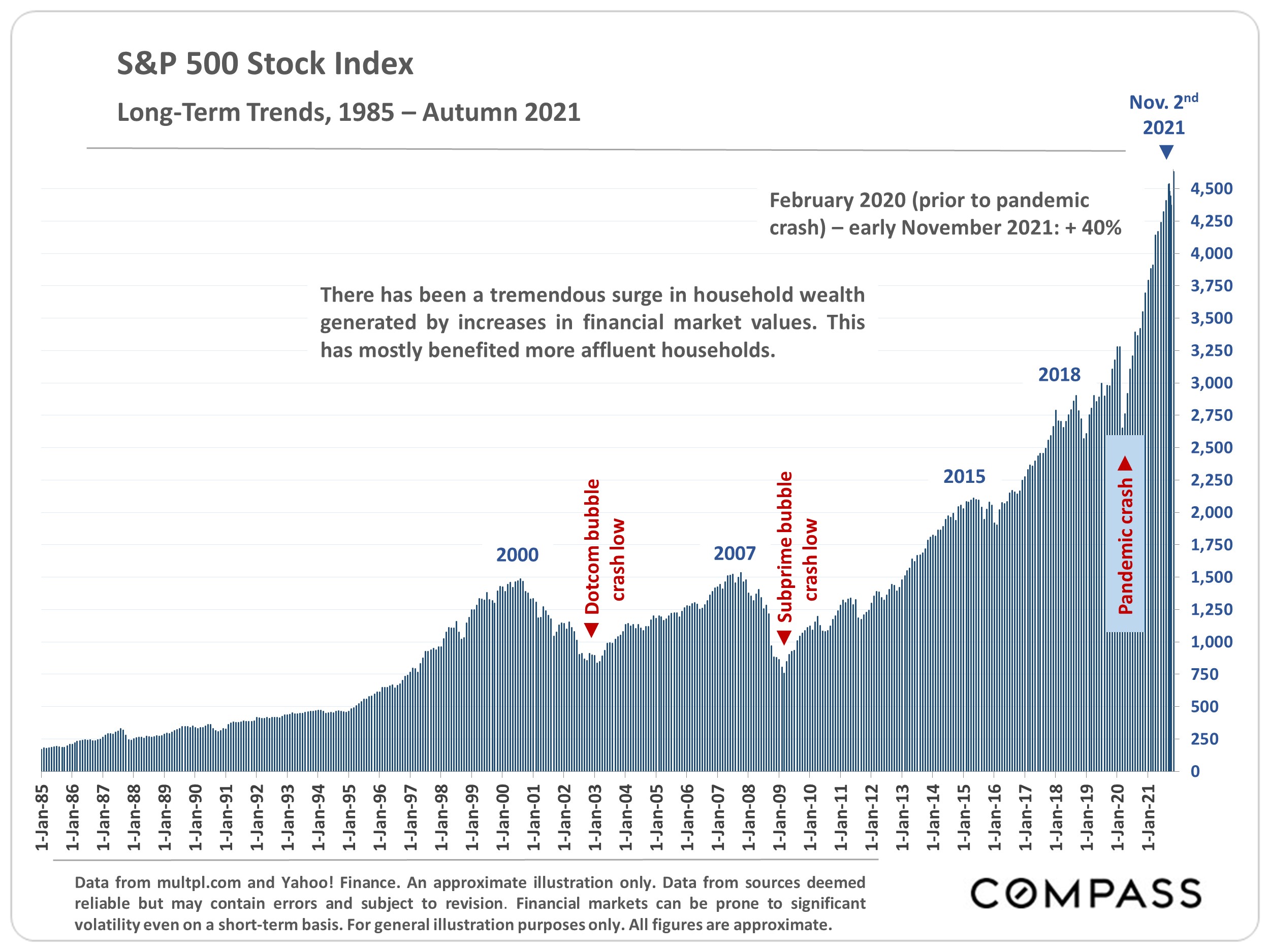

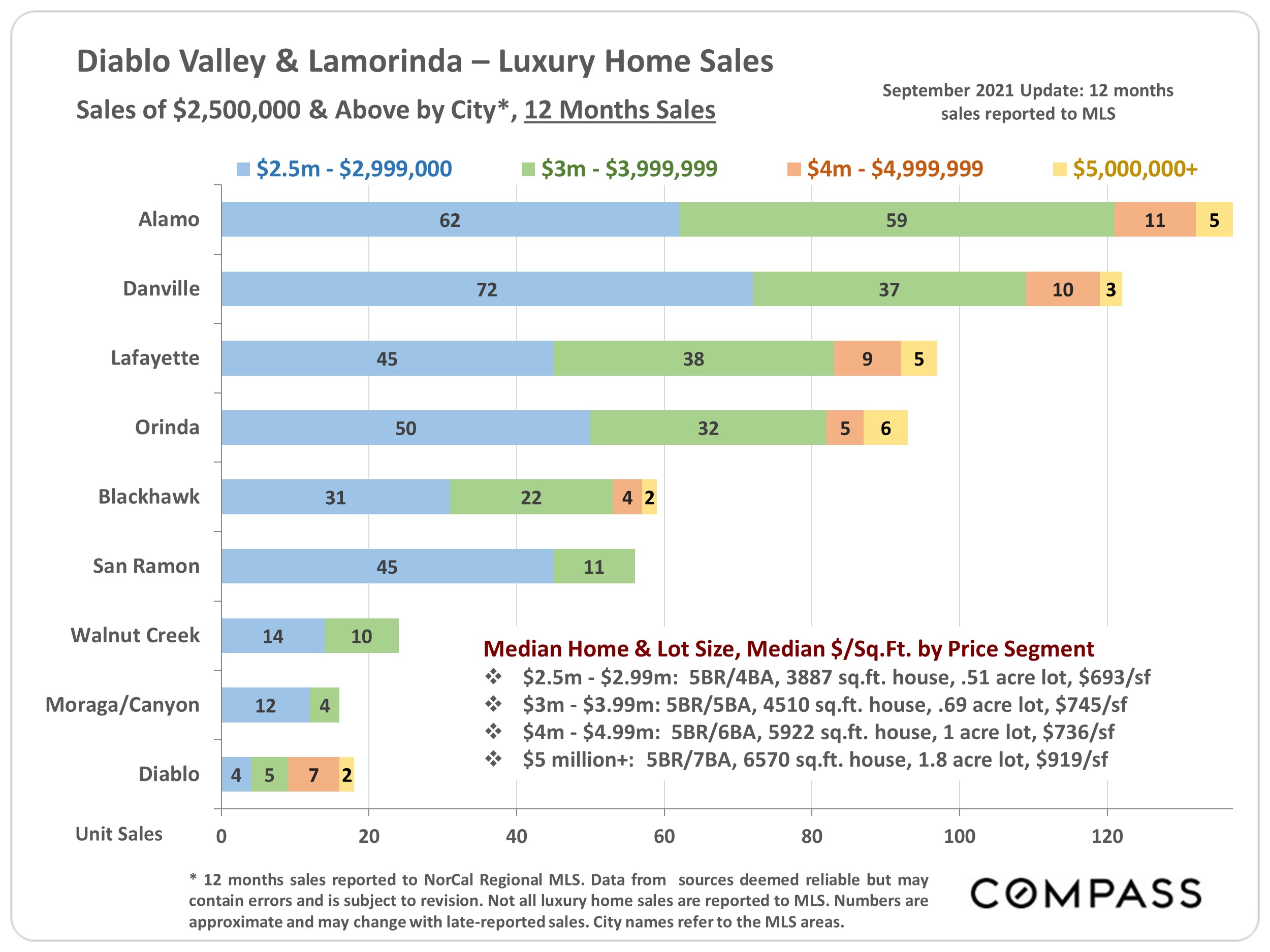

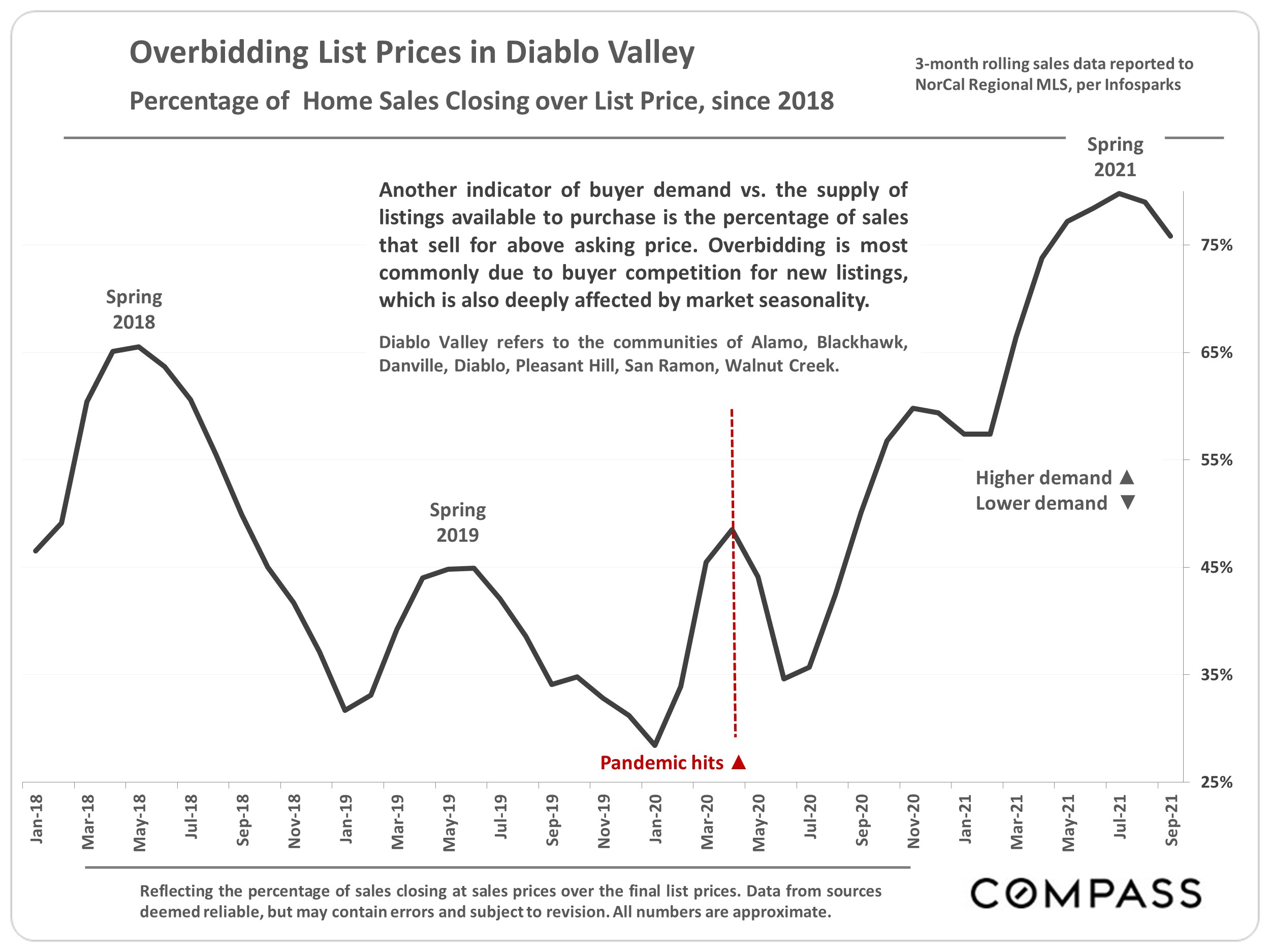

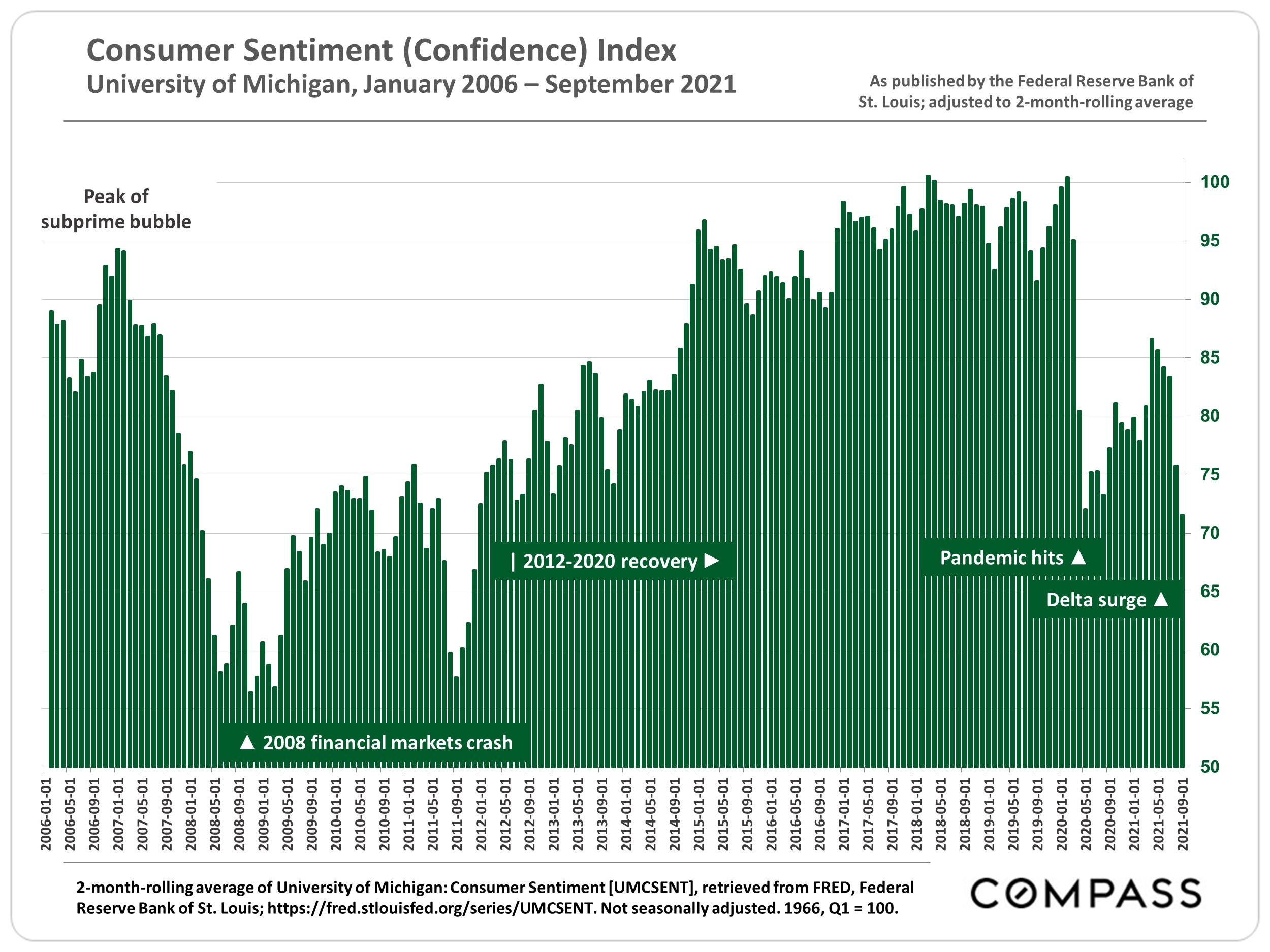

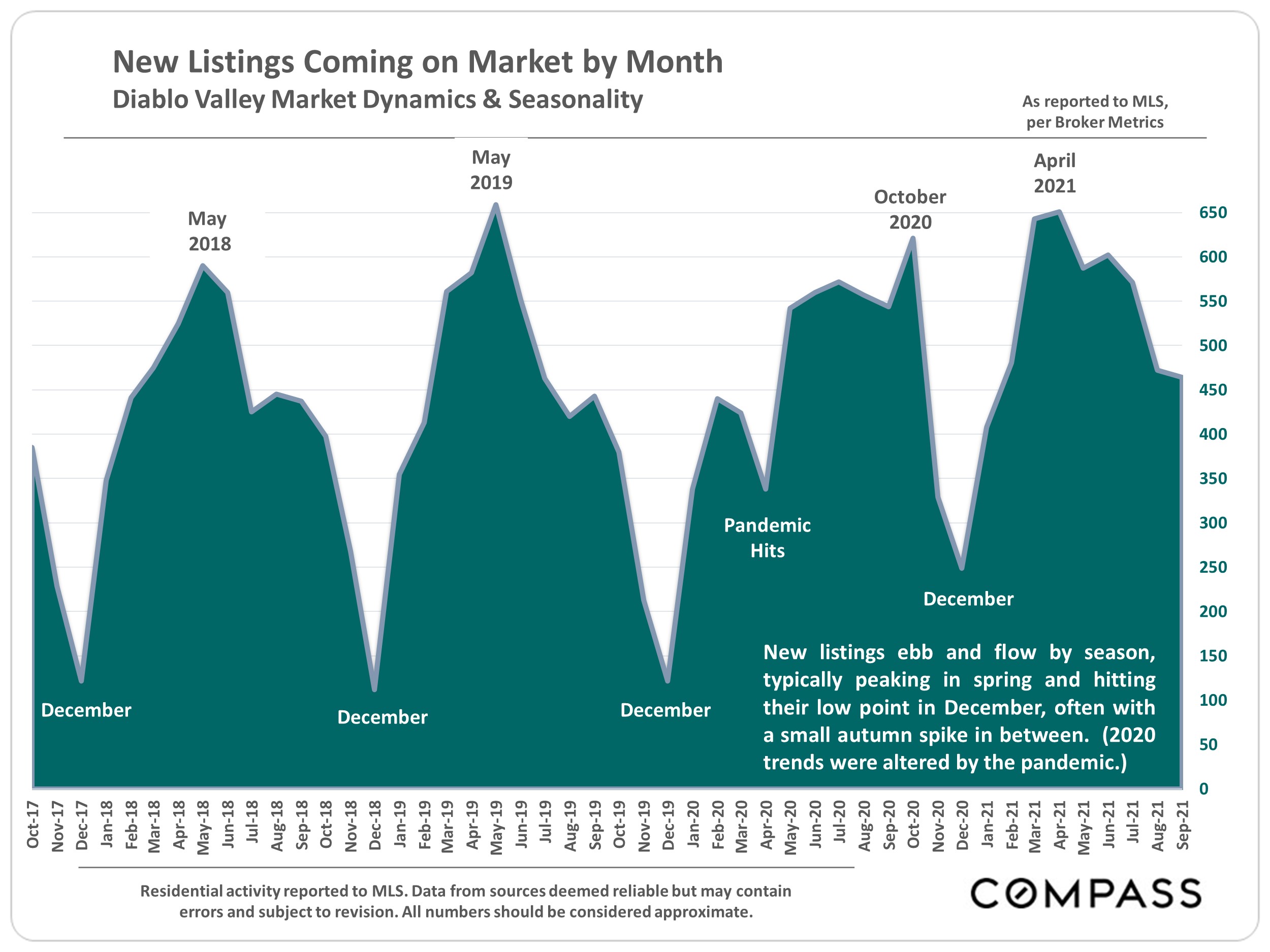

Diablo Valley Home Prices Market Trends Conditions - Compass

Proposition 60 In Contra Costa - Transfer Your Tax Base

Diablo Valley Home Prices Market Trends Conditions - Compass

Buckle Up Pandemic East Bay Real Estate Rollercoaster Is Ascending

Opinion Contra Costa Herald

366000 Jobs 152 Billion For Californias Economy Thanks To Oil And Gas - Aera Energy

Contra Costa County Election Results Offer Few Surprises Sfbay

2

![]()

Solano County California Sales Tax Increase Measure H June 2016 - Ballotpedia

San Mateo County California Ballot Measures - Ballotpedia

2

Diablo Valley Home Prices Market Trends Conditions - Compass

Diablo Valley Home Prices Market Trends Conditions - Compass

2

2

366000 Jobs 152 Billion For Californias Economy Thanks To Oil And Gas - Aera Energy

Diablo Valley Home Prices Market Trends Conditions - Compass

Solano County California Sales Tax Increase Measure H June 2016 - Ballotpedia

Brentwood California Ca 94513 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Comments

Post a Comment