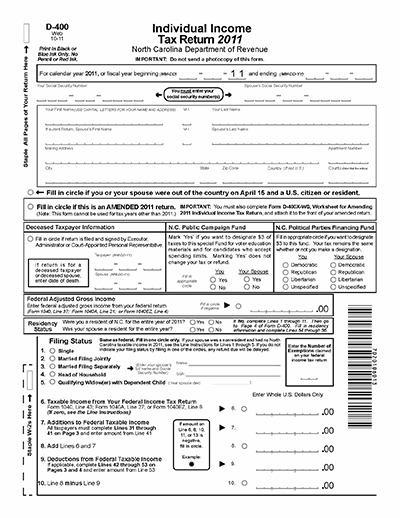

North carolina does not collect an inheritance tax or an estate tax. While 2010 has an unlimited exemption with the tax repealed, you will only be able to have a $1,000,000 exemption starting in 2011 with a 55 percent maximum estate tax on values over this amount.

State Estate And Inheritance Taxes Itep

Questions answered every 9 seconds.

Do you pay taxes on inheritance in north carolina. However there are sometimes taxes for other reasons. These are some of the taxes you may have to think about as an heir. Children in north carolina inheritance law.

For example, let's say a family member passes away in an area with a. North carolina does not collect an inheritance tax or an estate tax. There is no inheritance tax in north carolina.

There’s no inheritance tax at the federal. Spouses and certain other heirs are typically excluded by states from paying inheritance taxes. However, state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than $11.18 million.

I just inherited money, do i have to pay taxes on it? Ad a tax advisor will answer you now! However, state residents should remember to take into account the federal estate tax if.

If you inherit property in kentucky, for example, that state’s inheritance tax will apply even if you live in a different state. There is no inheritance tax in nc. The inheritance tax of another state may come into play for those living in north carolina who inherit money.

However, the federal government still collects these taxes, and you must pay them if you are liable. Put another way, that means that you have a 99.8% chance of never having to worry about estate taxes. Spouses and certain other heirs are typically excluded by states from paying inheritance taxes.

Class a beneficiaries pay no taxes on their inheritances. North carolina inheritance tax and gift tax. 6 hours ago capital gain tax rates by state 2020 & 2021 calculate.

However, if you inherit an estate worth over $11.18 million in standard assets such as bank accounts, you may be required to pay taxes (federal estate tax). If you own real estate in another state, your estate may need to file and pay an estate or inheritance tax in that state. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive.

The class c group can end up paying tax rates anywhere from 6% to 16%. There is no inheritance tax in north carolina. Nc capital gains tax on real estate.

The inheritance tax of another state may come into play for those living in north carolina who inherit money. I just inherited money, do i have to pay taxes on it? You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000.

Class b beneficiaries pay a tax rate that can vary from 4% to 16%. Neither north carolina nor the u.s. If you live in a state that does have an estate tax, you may be expected to pay the death tax on the money you inherit from a death in nc.

Children in north carolina inheritance law. This should include the federal estate transfer tax as well as state inheritance taxes. Calculate how much tax will be owed on your estate upon your death.

Many states do not collect inheritance taxes from spouses or children. Do you have to pay taxes on inheritance in north carolina. One of the first questions many people ask is whether the inheritance will result in income tax to them.

Does north carolina have an inheritance or estate tax? 1 hours ago the capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Calculate the capital gains tax on a sale of real estate.

Even though estate taxes are the subject of much debate, and many people don’t like the idea of the estate tax, estate taxes affected less than 1/4 of 1% (0.18% if you are keeping score) of all decedents in 2015. However, if you inherit an estate worth over $11.18 million in standard assets such as bank accounts, you may be required to pay taxes (federal estate tax). Like most other states that impose this tax, the kentucky inheritance tax rates are straightforward and easy to understand.

Questions answered every 9 seconds. When a loved one or benefactor dies and leaves property or money to you, you might have to pay inheritance and estate taxes on it. The answer is probably not.

The answer is probably not. When you are receiving an inheritance, you may wonder if you are required to pay a tax on the inheritance. The recipient of an inheritance is not going to be paying transfer taxes on the inheritance unless there is an inheritance tax in the state within which the recipient resides.

In some states the executor may be required to obtain an inheritance tax waiver from the state tax authorities before the assets in the deceased’s. Ad a tax advisor will answer you now! South carolina does not tax inheritance gains and eliminated its estate tax in 2005.

Inheritance taxes are levied on heirs after they have received money from the deceased. An inheritance tax is a state levy that americans pay when they inherit an asset from someone who’s died.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Taxes State Ncpedia

States With No Estate Tax Or Inheritance Tax Plan Where You Die

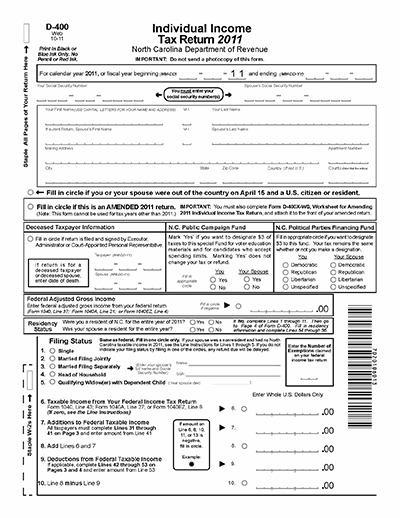

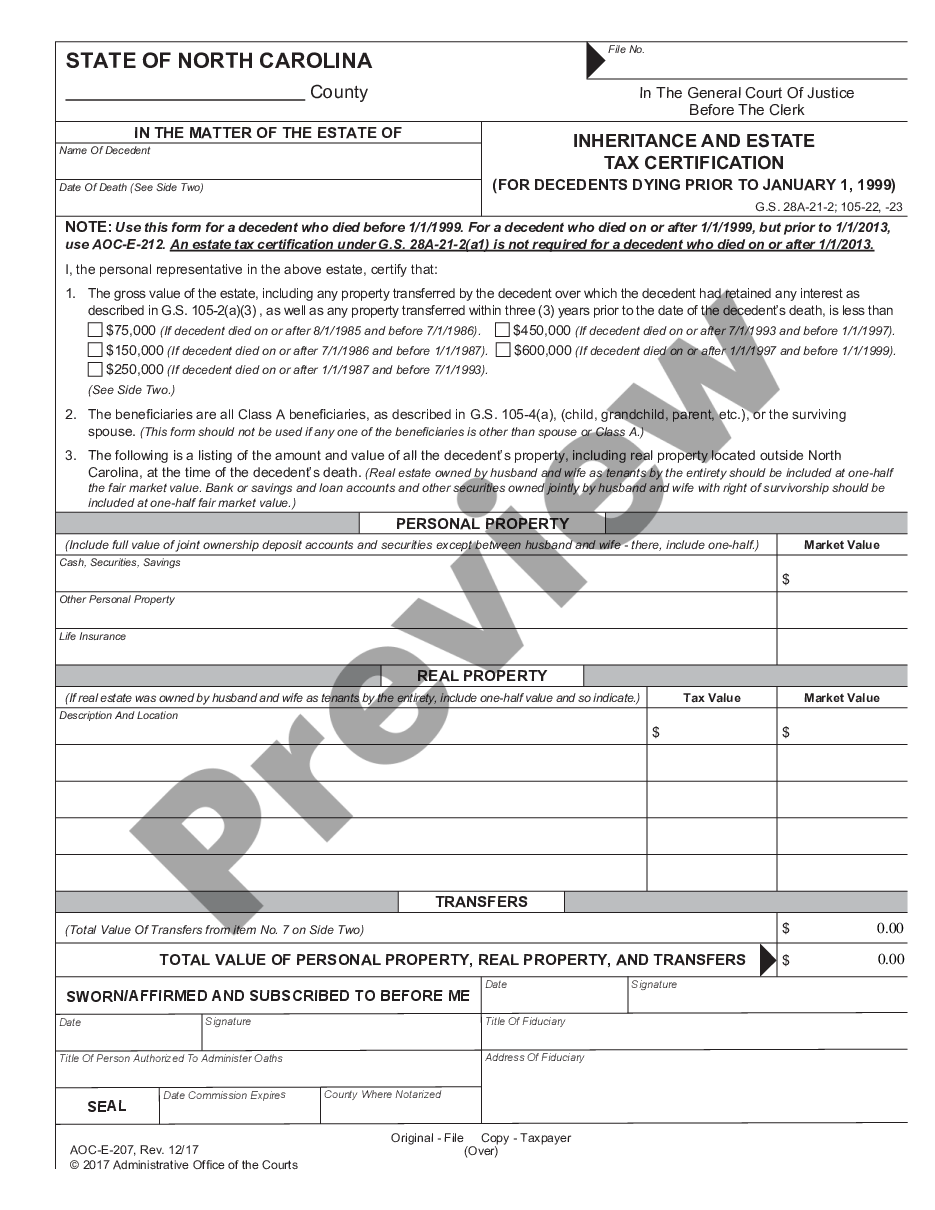

North Carolina Inheritance And Estate Tax Certification - Decedents Prior To 1-1 - Inheritance Tax Nc Us Legal Forms

Heres Which States Collect Zero Estate Or Inheritance Taxes

Does North Carolina Collect Estate Or Inheritance Tax

State Estate And Inheritance Taxes

Is There An Inheritance Tax In Nc An In-depth Inheritance Qa

Tax Concerns For North Carolina Inheritances - North Carolina Estate Planning Blog

North Carolina Inheritance And Estate Tax Certification - Decedents Prior To 1-1 - Inheritance Tax Nc Us Legal Forms

Guide To Nc Inheritance And Estate Tax Laws - Hopler Wilms Hanna

Guide To Nc Inheritance And Estate Tax Laws - Hopler Wilms Hanna

State Estate And Inheritance Taxes Itep

What To Do When You Inherit A House - Complete Guide To Selling Fast

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What North Carolina Residents Need To Know About Federal Capital Gains Taxes

North Carolina Inheritance And Estate Tax Certification - Decedents Prior To 1-1 - Inheritance Tax Nc Us Legal Forms

States With An Inheritance Tax Recently Updated For 2020

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Comments

Post a Comment